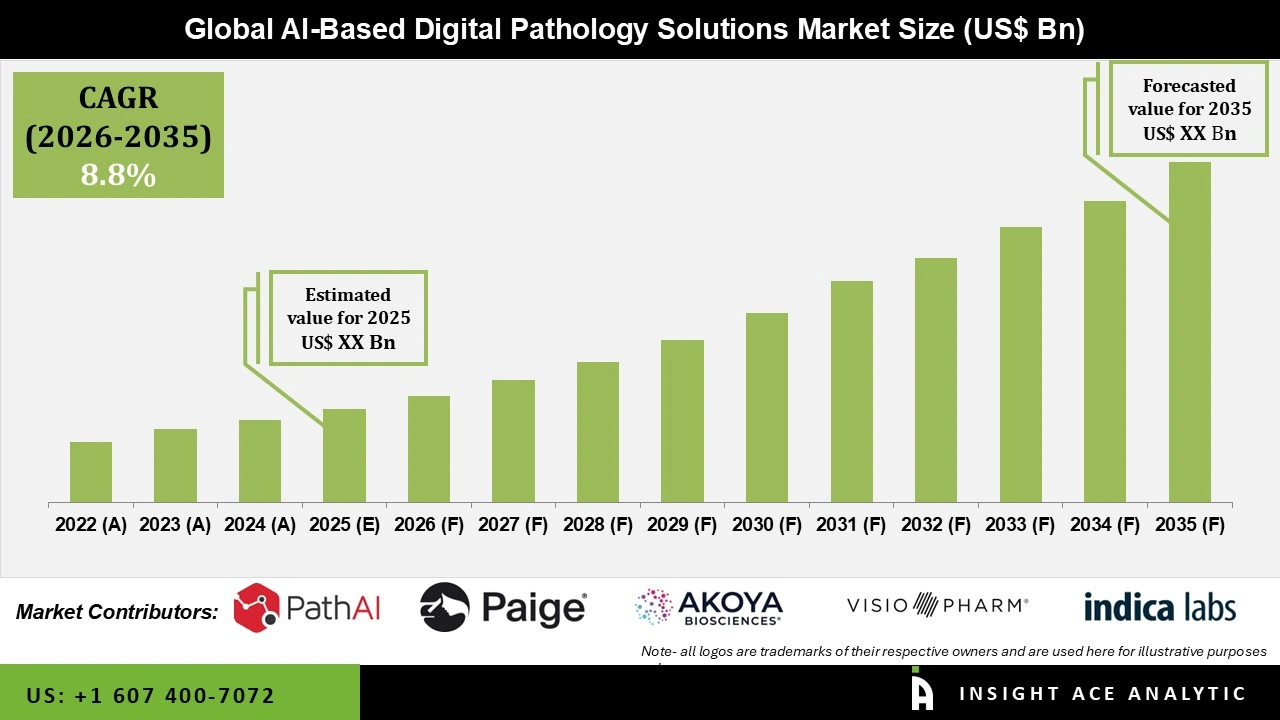

Global AI-Based Digital Pathology Solutions Market is predicted to grow at an 8.8% CAGR during the forecast period for 2026 to 2035.

AI-Based Digital Pathology Solutions Market Size, Share & Trends Analysis Report By Type of Neural Network, Type Of Assay, Type Of Target Disease Indication, By Application, By End-User, By Region, And Segment Forecasts, 2026 to 2035.

AI-Based Digital Pathology Solutions Market Key Takeaways:

|

Key Industry Insights & Findings from the Report:

Artificial Intelligence (AI) has been proven to be a faster and more effective approach to identifying and assessing pathological characteristics in samples than previous techniques. The drug discovery process is made more efficient and effective by implementing AI, and the diagnosis process can be accelerated and strengthened. In addition, AI aids pathologists in making accurate diagnoses by using data to verify their findings. It can alert them when their conclusions are contrary to what is expected based on the algorithms. As a result, AI-based pathology solutions may become increasingly popular.

By combining Artificial Intelligence (AI) with digital pathology, pathologists can now perform image analytics on a more significant number of slides in a shorter period by combining AI and digital pathology as a validation tool. Pathologists can improve outcomes by focusing on specific regions and improving efficiency accordingly. Digital pathology is enhancing patient engagement with the use of artificial intelligence, with devices and apps providing access to electronic health records, radiology images, etc.

It is becoming increasingly common to use artificial intelligence in healthcare, particularly in pathological diagnosis, to improve patient care. For example, a clinical decision support system is an AI-based tool designed to streamline workflow processes and enhance hospital patient care. The Roche Group announced in October 2021 that it had agreed with PathAI, an artificial intelligence-based pathology technology leader. The agreement outlines the development and distribution of an embedded image analysis workflow to be used by pathologists under this development and distribution contract. An AI-based medical device will be developed as a result of this partnership, which will include a scanner, an assay, a management system, and an algorithm.

Research collaborations and the growth of digital documentation are driving an increase in adoption across all scientific disciplines. The increasing penetration of healthcare IT solutions has boosted the demand for digital pathology solutions. In recent years, many organizations have adopted resolutions to decrease costs, reduce resource bottlenecks, automate processes, and effectively share content. Advancements in technologies, such as microarrays and predictive models, including hybrid models and API algorithms, will also fuel the demand for digital image analysis.

Several factors contribute to the restraints on the market, including the requirement for high capital, which hinders the company's global reach expansion, and a lack of tools necessary to conduct a computational analysis. Also, many factors could limit the market's growth, including a shortage of experienced professionals and a lack of awareness of modern spatial-based technology.

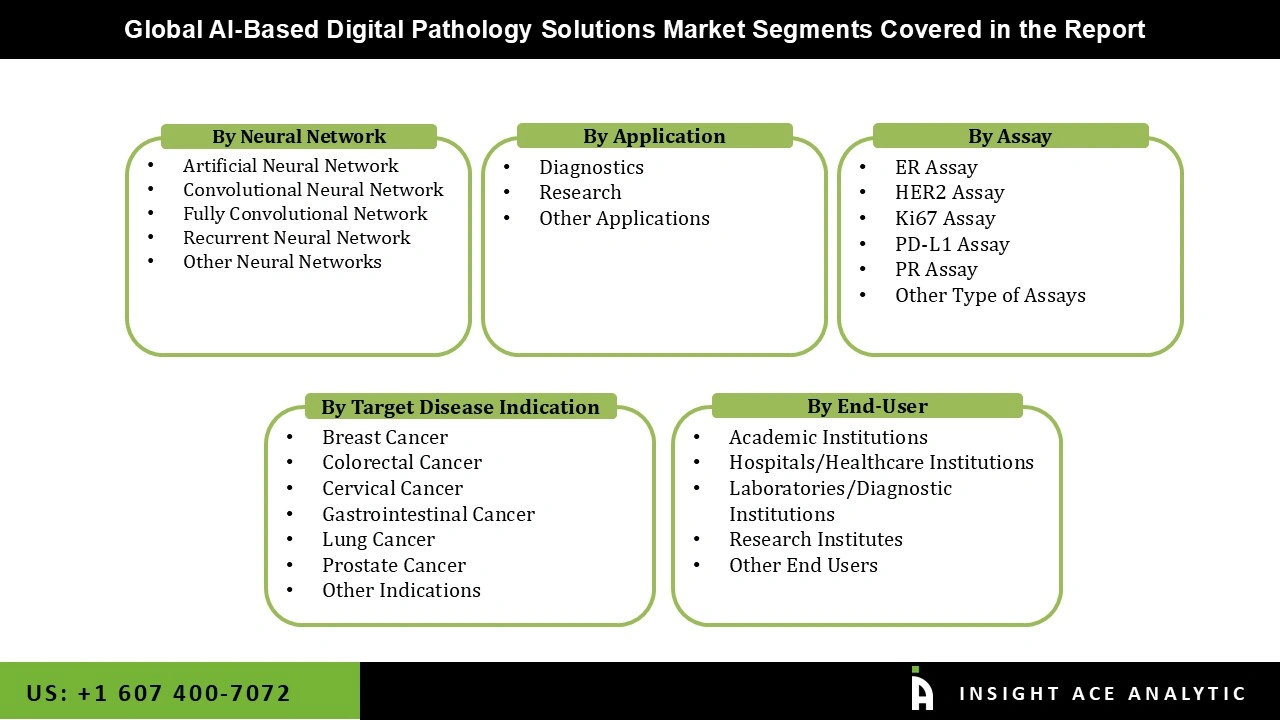

The AI-Based Digital Pathology market is segmented by type of neural network, assay type, type of target disease indication, application, and end-user. All of these segments are subdivided into respective segments. The type of neural network segment has artificial, convolutional, fully convolutional, recurrent neural, and others, respectively. The type of assay category comprises ER assay, HER2 assay, Ki67 assay, PD-L1 assay, PR assay, and other assays. The target disease indication segment includes breast cancer, colorectal cancer, cervical cancer, gastrointestinal cancer, lung cancer, prostate cancer, and other indications. Also, the application segment includes diagnosis, research, and other applications. The last segment is the end-user segment which contains academic institutions, hospitals/healthcare institutions, laboratories/diagnostic institutions, research institutes and other end-users.

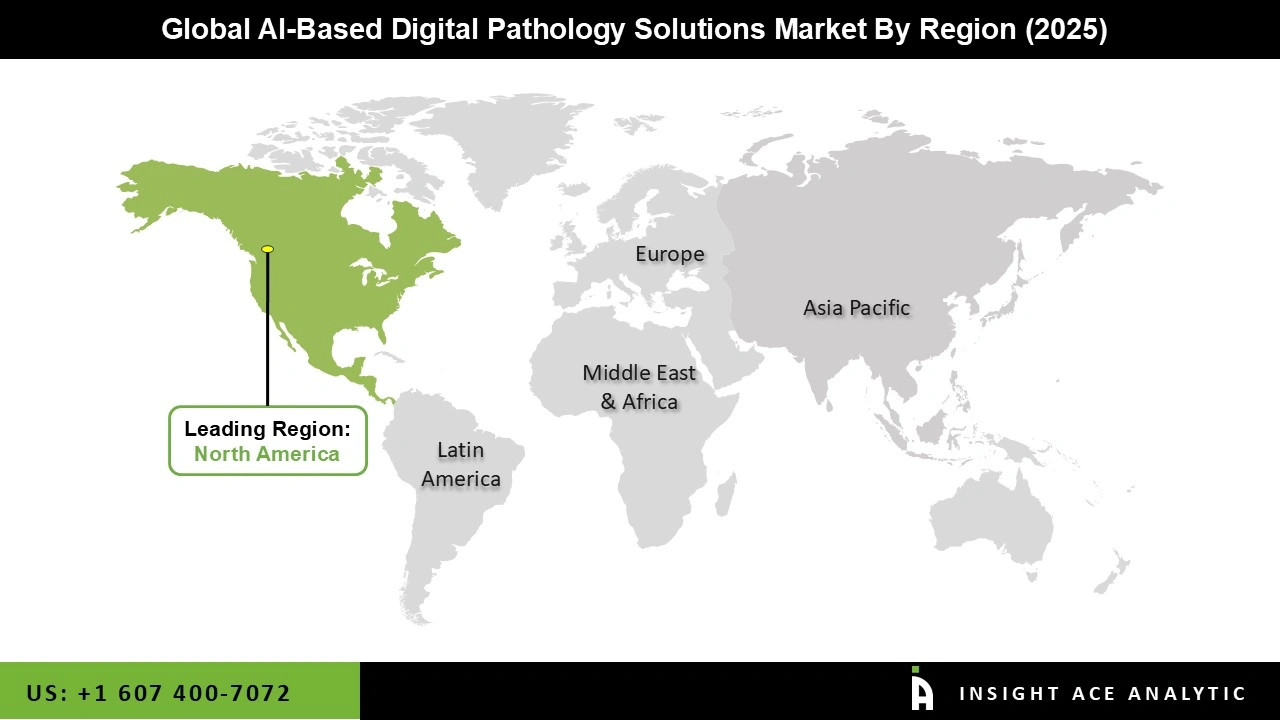

In 2021, North America dominated the market with a significant share. A major factor driving North America's share of the AI-based digital pathology market is improved healthcare infrastructure, increased per capita income, and the availability of state-of-the-art research laboratories and institutes. The FDA categorizes DP as a Class II device for primary diagnosis. Digital pathology is poised to become an increasingly vital tool to enhance disease diagnosis and improve the quality of pathology services. The market is expected to benefit from this development across the nation.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type of Neural Network, Type Of Assay, Type Of Target Disease Indication, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | PathAI, Paige.AI, Akoya Biosciences, Aiforia, aetherAI, CellCarta, Deep Bio Inc., DoMore Diagnostics, PROSCIA, Pramana, Inc., Visiopharm A/S, Roche Tissue Diagnostics, Indica Labs, Ibex Medical Analytics, LDPath, OracleBio Limited, Verily, Mindpeak GmbH, Proscia Inc., SamanTree Medical SA, Tempus AI, Techcyte, Inc., Tribun Health. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.