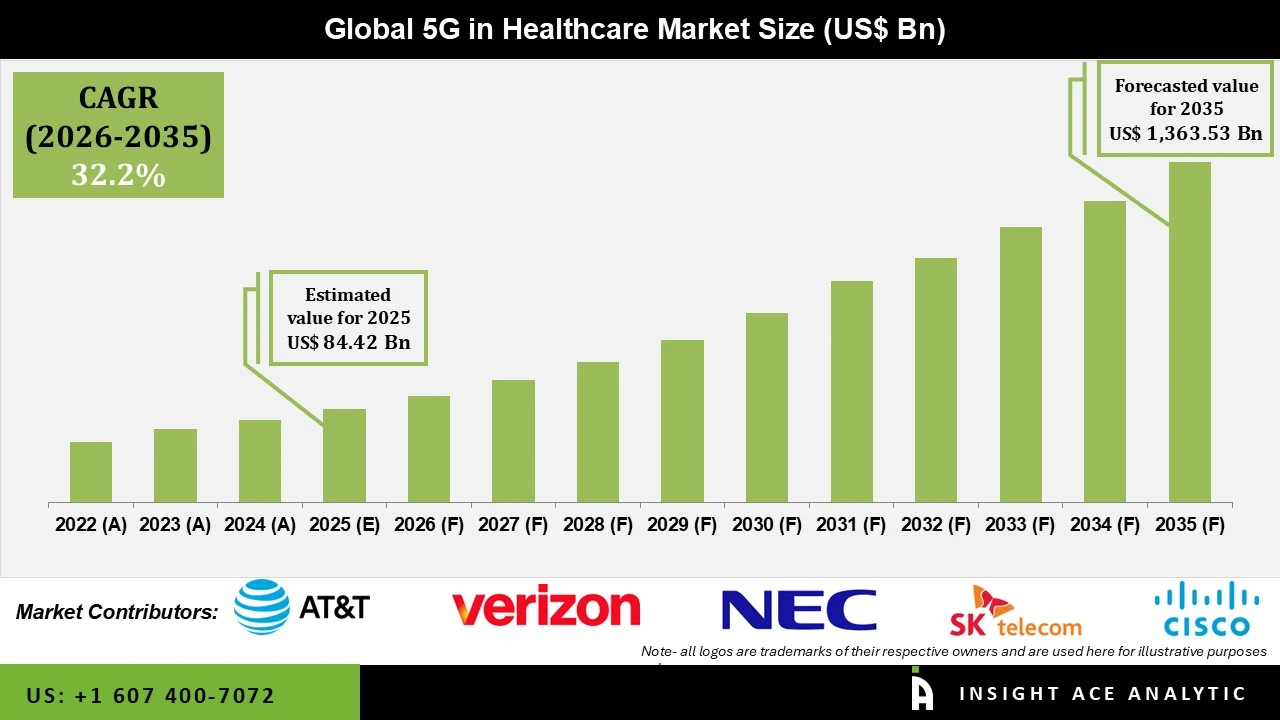

5G in Healthcare Market Size is valued at USD 84.42 Billion in 2025 and is predicted to reach USD 1363.53 Billion by the year 2035 at a 32.2% CAGR during the forecast period for 2026 to 2035

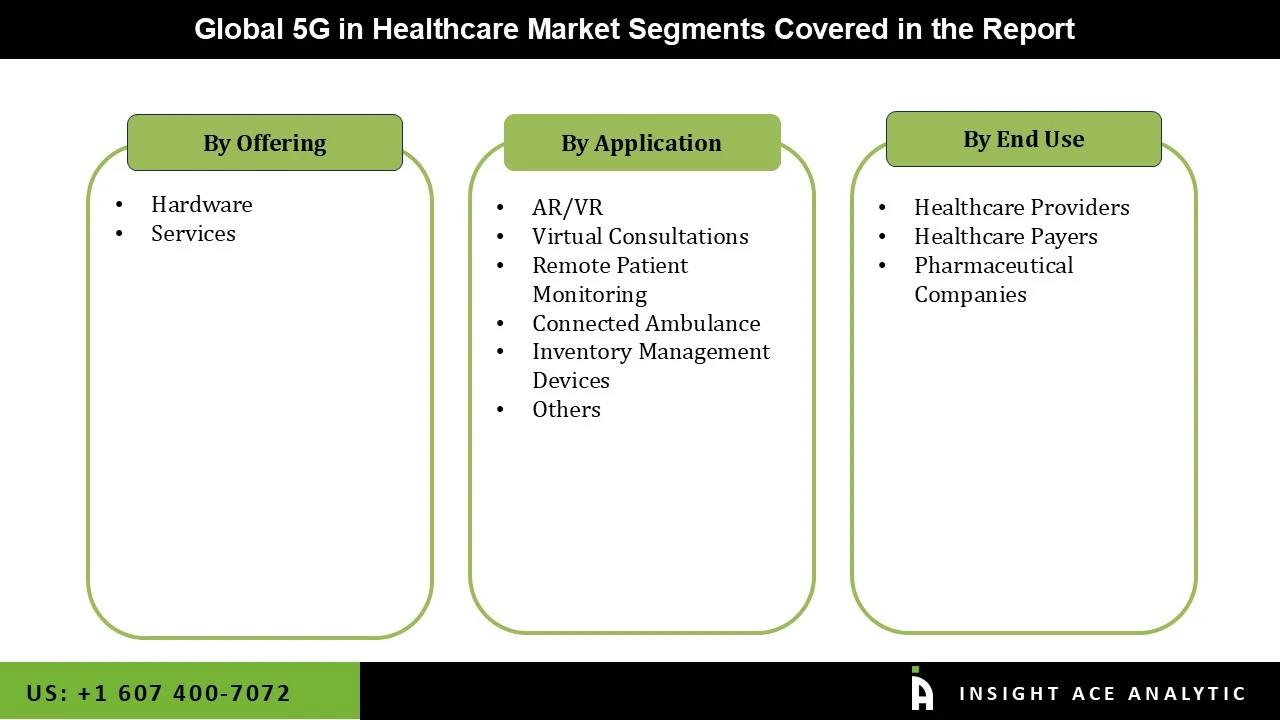

5G in Healthcare Market Size, Share & Trends Analysis Report By Offering (Hardware, Services), By Application, By End-Use (Healthcare Providers, Healthcare Payers, Pharmaceutical Companies), By Region, And by Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

5G promises a significant advancement in the healthcare sector by enabling a new health ecosystem that can effectively, economically, quickly, and broadly address patients' needs. The utilization of 5G networks in the healthcare sector has increased recently. Innovations in robotics, IoT, and AI will turn the health system into a newly connected ecosystem, boosting 5G networks.

The global market is driven by the rising usage of telehealth and robotic surgery. The market is growing due to expanding telecommunications innovation, the adoption of wearable medical devices driven by 5G technology, the capacity of 5G technology to download massive patient data files at light speed, and the accessibility of inexpensive sensors. Additionally, the government and major industry players are increasing their efforts in implementing 5G in healthcare, accelerating market growth.

Cellular technology is anticipated to increase significantly wireless network speed, coverage, and responsiveness in the healthcare sector. As a result, the demand for quicker and more reliable data transfer in the healthcare sector will continue to grow. Furthermore, the healthcare sector's growing need for faster and more dependable data transmission will fuel market expansion in the years to come.

The 5G in the healthcare market is segmented on the offering, application and end use. Based on offering, the market is segmented into hardware and services. Based on application, the 5G in the healthcare market is segmented into AR/VR, virtual consultations, remote patient monitoring, connected ambulance, inventory management devices and others. Based on end use, the 5G in the healthcare market is segmented into healthcare providers, healthcare payers and pharmaceutical companies.

Based on application, the 5G in the healthcare market is segmented into AR/VR, virtual consultations, remote patient monitoring, connected ambulance, inventory management devices and others. The connected ambulance category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time ascribed to the expansion of the telehealth industry and the rising popularity of home healthcare. The market for a connected ambulance in the 5G in healthcare is further being driven by the high burden of COVID-19, rising healthcare expenses, strong government backing and initiatives, and the increased focus on the quality of care and safety of the patient.

Based on end use, the 5G in the healthcare market is segmented into healthcare providers, healthcare payers and pharmaceutical companies. The healthcare providers category is anticipated to grow at a significant rate over the forecast period, ascribed to the growing demand for better technologies that facilitate the quick transfer of huge data files, the expanding patient volume, the growing number of hospitals and ambulatory care facilities, the rise of telehealth, and the rising usage of 5G-enabled wearable medical devices.

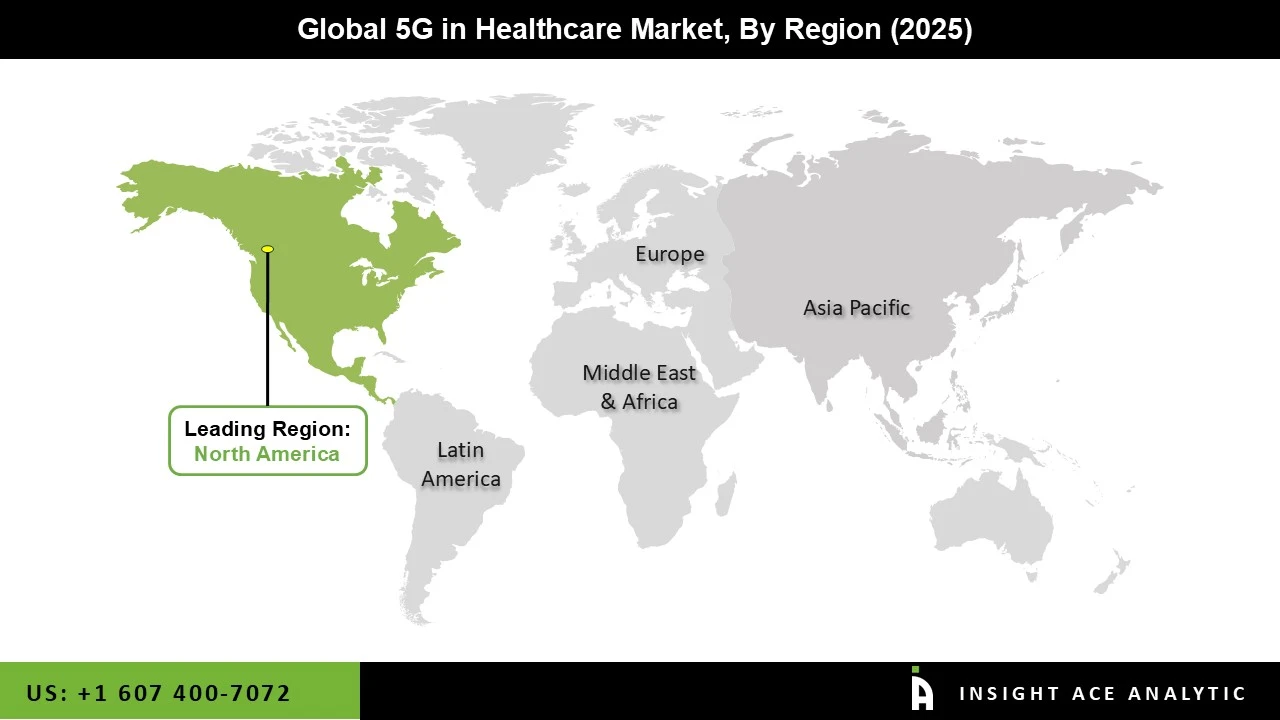

The North America 5G in the healthcare market is expected to register the highest market share in revenue shortly. The regional industry's expansion is influenced by several factors, including the increased frequency of coronary artery disorders (CAD), the rapidly aging population, and novel product introductions by major market competitors. The adoption of the technology will speed up as knowledge of the advantages of incorporating 5G technology into healthcare products and services grows. The CDC estimates that in 2020, about 20 million Americans had CAD. Additionally, it is projected that the Asia Pacific will expand significantly throughout the course of the forecast period. Other factors influencing the growth include a rise in 5G-capable medical devices and government intentions to integrate 5G in healthcare. This trend may also be a result of the widespread adoption of cutting-edge technology, the rise of medical equipment with loT capabilities, ongoing network connectivity improvements, and government initiatives for loT.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 84.42 Billion |

| Revenue forecast in 2035 | USD 1363.53 Billion |

| Growth rate CAGR | CAGR of 32.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Offering, Application, End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | AT&T Inc., Verizon Communications, NEC Corporation, Cisco Systems, Inc., SK Telecom Co., Ltd., Fibocom Wireless Inc., Qualcomm, Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., China Mobile Limited, Samsung Electronics Co., Ltd., BT Group, Deutsche Telekom AG, Vodafone, China Mobile Limited, China Unicom, Saudi Telecom Company (STC), and T-Mobile. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Offering-

By Application-

By End Use-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.