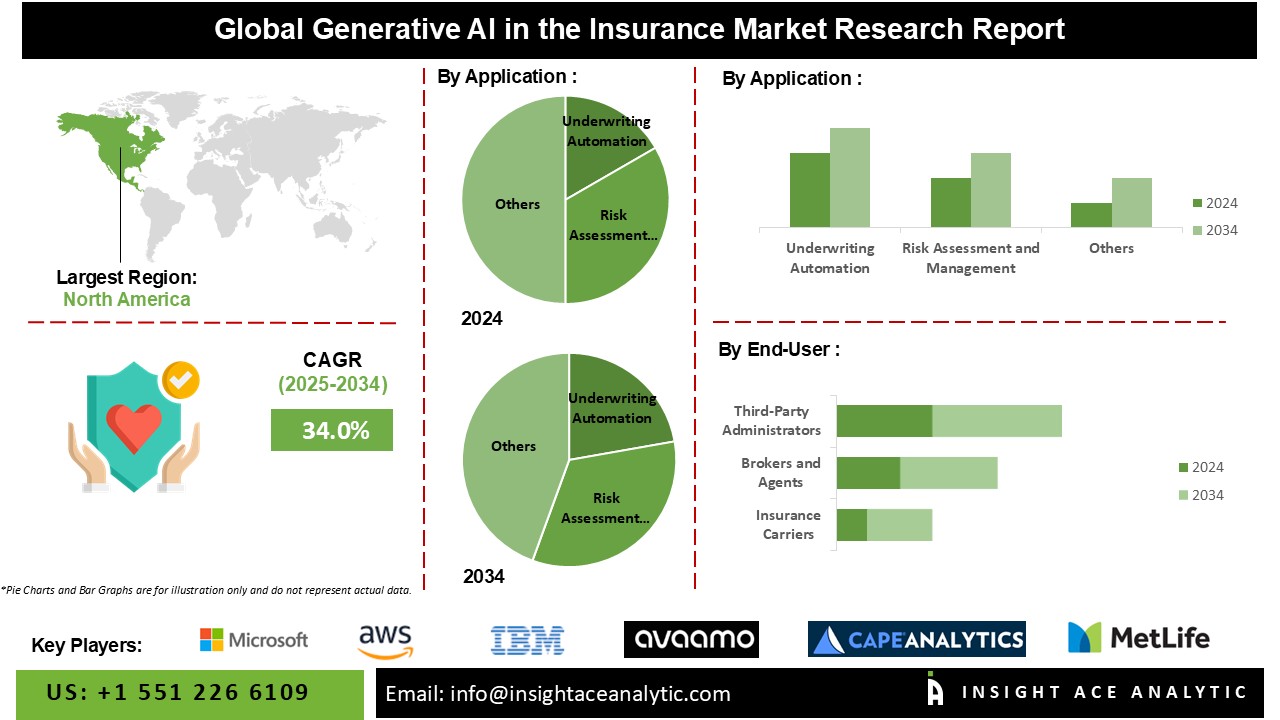

Generative AI in Insurance Market Size predicted to reach a 34.0% CAGR during the forecast period for 2025-2034.

A generative AI in the insurance sector is the application of powerful machine learning models to boost efficiency and accuracy in decision-making. This is essential for producing synthetic data, personalized products, and recommendations. Two key factors driving the industry ahead are the need for more efficient operations and the growing demand for personalized experiences. Responding to client demand for tailored insurance solutions, more and more insurers rely on AI technology to deliver specific suggestions and packages. Furthermore, modernization and international trade agreements might open new prospects for businesses worldwide, which can further promote market expansion. In addition, the market is anticipated to be propelled by increased government investments in research and development to optimize production & services processes.

However, the market growth is hindered by obstacles such as data privacy worries, expensive implementation expenses, a shortage of trained AI experts, problems with regulation and compliance, and the difficulty of incorporating AI into preexisting systems. Several variables can hinder adoption in this market. Global markets expanded during the coming years due to technological developments, widespread adoption of digital platforms, and the ever-increasing desire among consumers for novel goods and services.

The generative AI in the insurance market is segmented based on application and end-user. Based on application, the market is segmented into underwriting automation, risk assessment and management, fraud detection, customer service and engagement, and claim processing. By end-user, the market is segmented into insurance carriers, brokers and agents, and third-party administrators.

The underwriting automation generative AI in the insurance market is expected to hold a major global market share in 2023. Automating processes like risk evaluation, policy costs, and qualification decisions is made possible by generative AI, which allows insurers to make faster and more accurate decisions. Underwriting automation is the most lucrative market area because it allows insurers to optimize underwriting procedures, decrease human actions, and increase overall efficiency through sophisticated machine-learning models and the industry's overall market growth.

The insurance carriers segment is projected to grow rapidly in the global generative AI in the insurance market because better risk assessment models, faster claims processing, and customized insurance policies are becoming increasingly important. Carriers may improve their decision-making, fraud detection, and customer service by leveraging massive volumes of data with the help of generative AI. This boosts their efficiency and competitiveness in the market, especially in countries like the US, Germany, the UK, China, and India.

The North American generative AI in the insurance market is expected to register the highest market share in revenue in the near future. This can be attributed to the fact that for several reasons, including a highly developed healthcare IT infrastructure, increased spending by market participants, and supportive government programs. In addition, Asia Pacific is projected to grow rapidly in the insurance market's global artificial intelligence because of the growing funding for cutting-edge research and development in this area and growth in the middle class, which drives up demand for insurance. Insurance companies are increasingly turning to generative AI due to technological developments, and the trend toward digitalization will boost the market's growth.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 34.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By End-user, By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Microsoft Corporation, Amazon Web Services Inc., IBM Corporation, Avaamo Inc, Cape Analytics LLC, MetLife, Prudential Financial, Wipro Limited, ZhongAn, Acko General Insurance and Other Prominent Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Generative AI in the Insurance Market By Application

Generative AI in the Insurance Market By End-User

Generative AI in the Insurance Market By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.