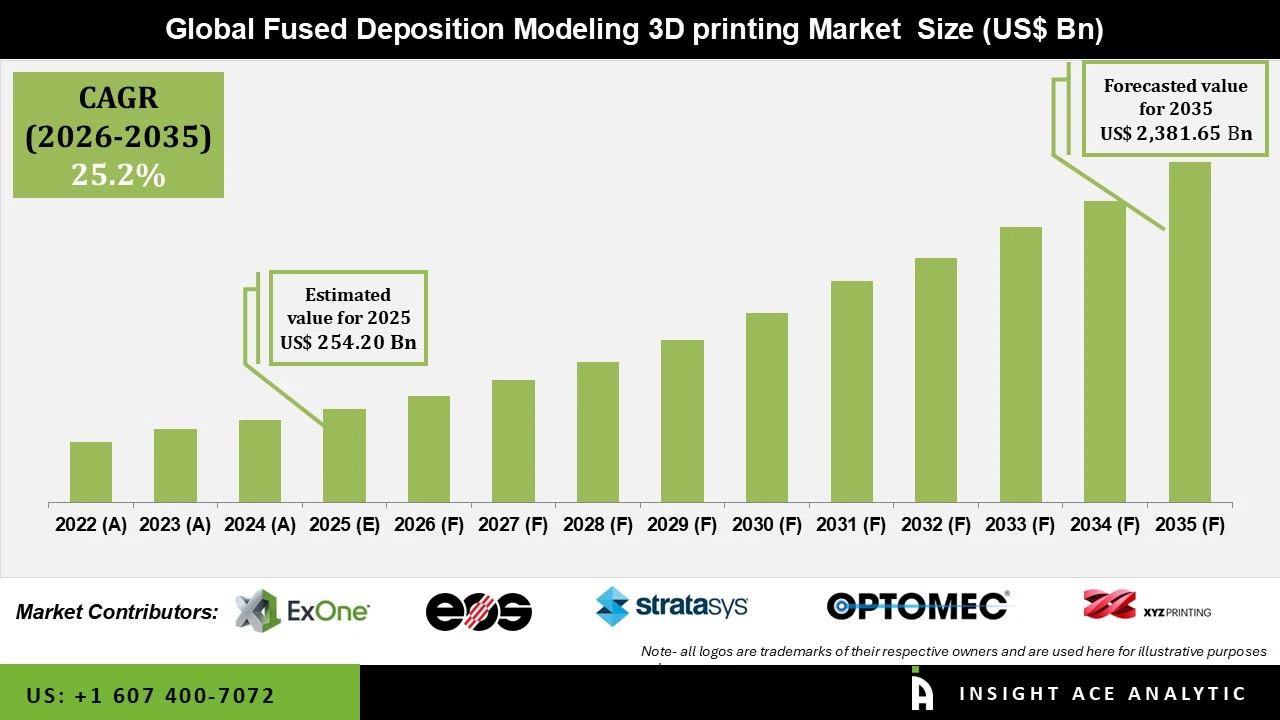

Fused Deposition Modeling 3D printing Market Size is valued at USD 254.20 Bn in 2025 and is predicted to reach USD 2381.65 Bn by the year 2035 at a 25.2% CAGR during the forecast period for 2026 to 2035.

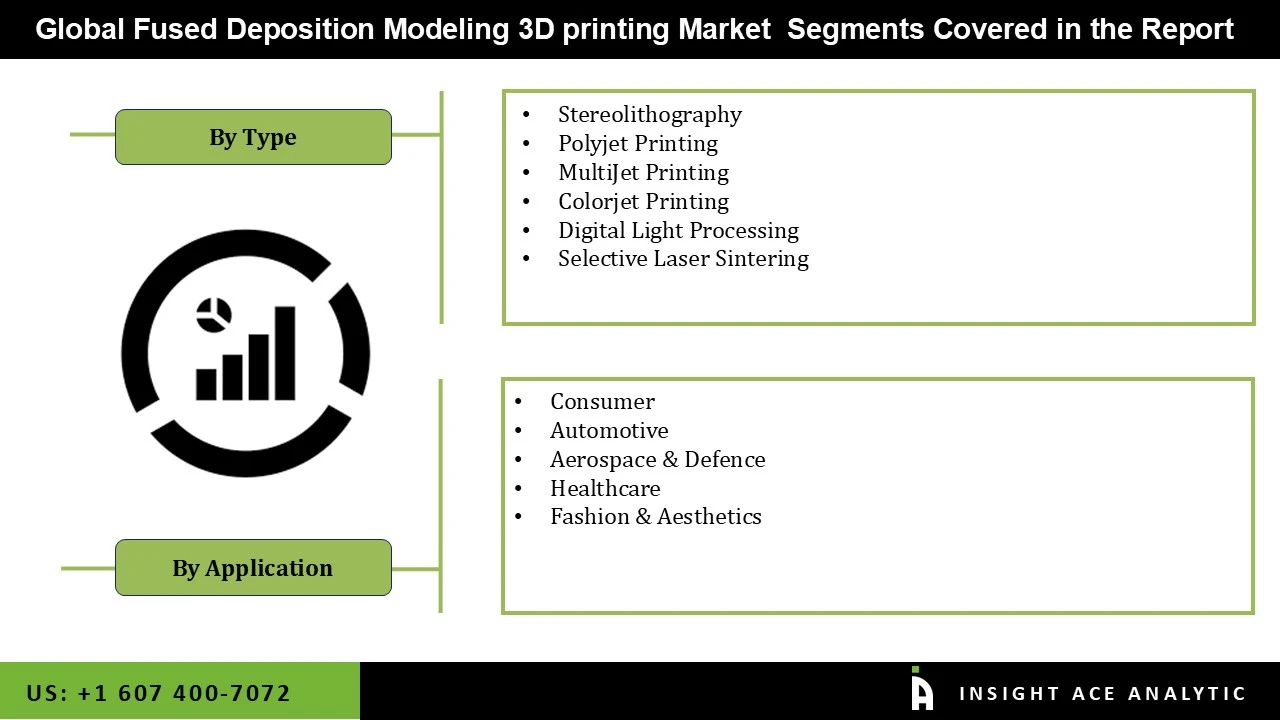

Fused Deposition Modeling 3D printing Market Size, Share & Trends Analysis Report By Type (Stereolithography, Polyjet Printing, MultiJet Printing, Colorjet Printing, Digital Light Processing, Selective Laser Sintering), By Application (Consumer, Automotive, Aerospace & Defence, Healthcare, Fashion & Aesthetics), By Region, And By Segment Forecasts, 2026 to 2035.

FDM is an additive production technology used for 3D printing. It operates by heating and extruding thermoplastic filament through a nozzle, which deposits layers of material according to a digital design or CAD (Computer-Aided Design) model. FDM 3D printing continues to evolve with advancements in materials and printer technology, expanding its capabilities and applications in manufacturing, prototyping, and creative fields. The market is expected to reach substantial growth in value due to the widespread adoption of fused deposition modelling technology in various industries.

In healthcare, these 3D printers are valued for their ability to produce affordable prosthetic devices. They are also extensively utilized in the aerospace and automotive sectors to enhance research and design efficiency. Moreover, the growth can be credited to ongoing advancements in FDM technology, which include enhancements in printing speeds, resolution, and the ability to work with a broader array of materials.

The expanding availability and evolution of diverse thermoplastic materials that are compatible with FDM printers have been pivotal in stimulating market expansion. Manufacturers now enjoy a broad spectrum of material options offering varied properties such as strength, flexibility, heat resistance, and biodegradability. This diversity empowers them to select materials that best fit their particular application needs.

The fused deposition modelling 3D printing market is segmented by type and application. Based on product segment, the market is divided into stereolithography, polyjet printing, multijet printing, colorjet printing, digital light processing, and selective laser sintering. By application, the global fused deposition modelling 3D printing market is categorized into consumer, automotive, aerospace and defence, healthcare, fashion, and aesthetics.

Digital Light Processing (DLP) technology commands a significant share of the 3D printing market due to its ability to produce high-resolution parts with intricate details. By using a digital light projector to cure photosensitive resin layer by layer, DLP enables rapid prototyping and manufacturing across various industries. It is particularly valued in sectors such as dental, jewellery, and small-scale manufacturing, where precision and superior surface finish are paramount. DLP's efficiency in creating complex geometries and fine features makes it a preferred choice for applications requiring high detail and accuracy. As a result, DLP is expanding its presence in the 3D printing market, offering advanced solutions to meet diverse industry needs for customized and precise components.

The automotive segment has established itself as the leading sector in the Fused Deposition Modeling (FDM) 3D printing market. This prominence is underpinned by several key advantages that FDM technology offers to automotive manufacturers. Primarily, FDM is extensively used for rapid prototyping of vehicle components and the production of tools, jigs, and fixtures used in assembly processes. This capability accelerates product development timelines and reduces the lead time for new vehicle models. Furthermore, FDM enables customization and optimization of automotive parts, facilitating the creation of lightweight components with intricate geometries that enhance vehicle performance and efficiency.

Cost efficiency is another significant driver, as FDM allows for the economical production of low-volume parts, spare components, and personalized accessories, thereby reducing inventory costs and minimizing waste. The flexibility of FDM in decentralized production also enhances supply chain agility, enabling manufacturers to produce parts closer to the point of use, thereby reducing logistics expenses and improving responsiveness to market demands. Additionally, ongoing advancements in FDM materials, such as high-performance thermoplastics and composites, ensure that automotive components meet stringent industry standards for durability, heat resistance, and mechanical properties.

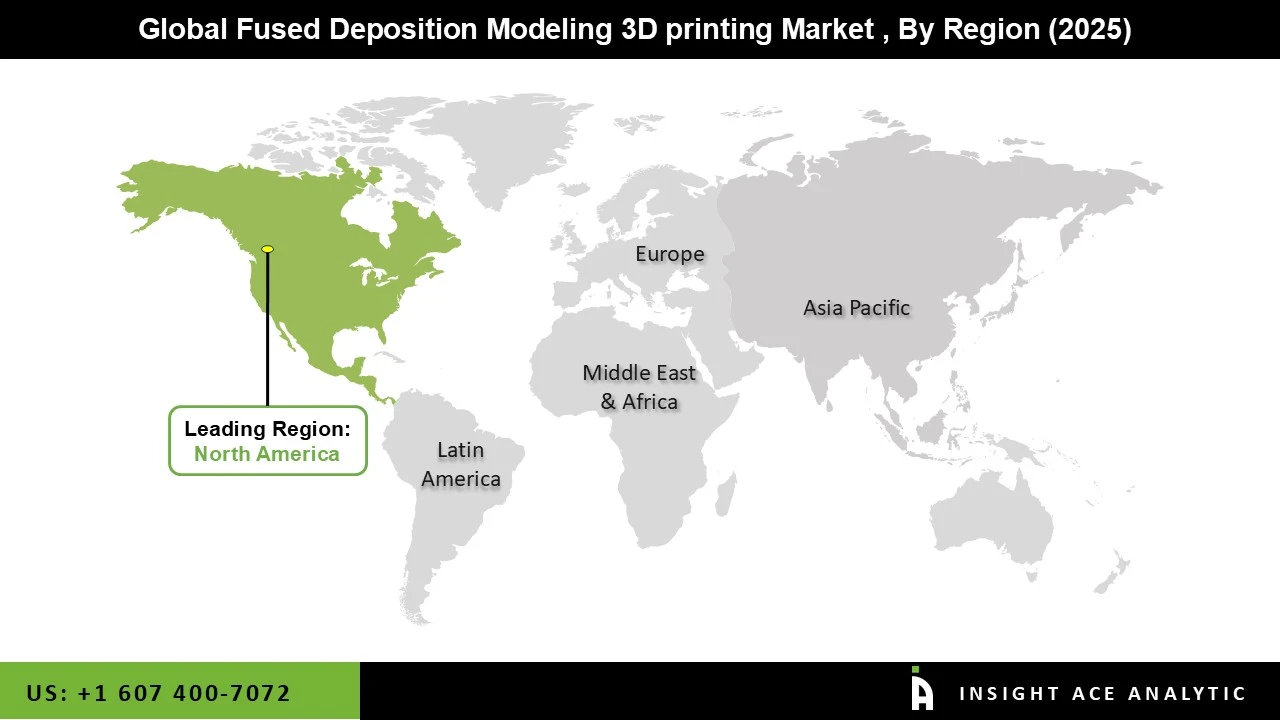

In the North American region, the Fused Deposition Modeling (FDM) 3D printing market commands a significant revenue share. This dominance is driven by a mature industrial base, strong technological advancements, and widespread adoption across diverse sectors, including aerospace, automotive, healthcare, and consumer goods. North America benefits from robust research and development initiatives, a supportive regulatory environment, and strategic investments in additive manufacturing technologies, all contributing to its prominent position in the global 3D printing market. Conversely, in the Asia-Pacific (APAC) region, the FDM 3D printing market is also witnessing substantial growth. Countries like China, South Korea, Japan and India are pivotal in this expansion, driven by rapid industrialization, increasing investments in advanced manufacturing technologies, and a burgeoning demand for customized production solutions.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 254.20 Bn |

| Revenue forecast in 2035 | USD 2381.65 Bn |

| Growth Rate CAGR | CAGR of 25.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Exone, EOS GmbH, Stratasys Ltd, XYZprinting, Inc., Optomec, Voxeljet AG, Organovo Holdings, Inc., EnvisionTEC, 3D Systems, and Ricoh Company, Ltd. and and Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Fused Deposition Modeling 3D printing Market By Type:

Fused Deposition Modeling 3D printing Market By Application:

Fused Deposition Modeling 3D printing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.