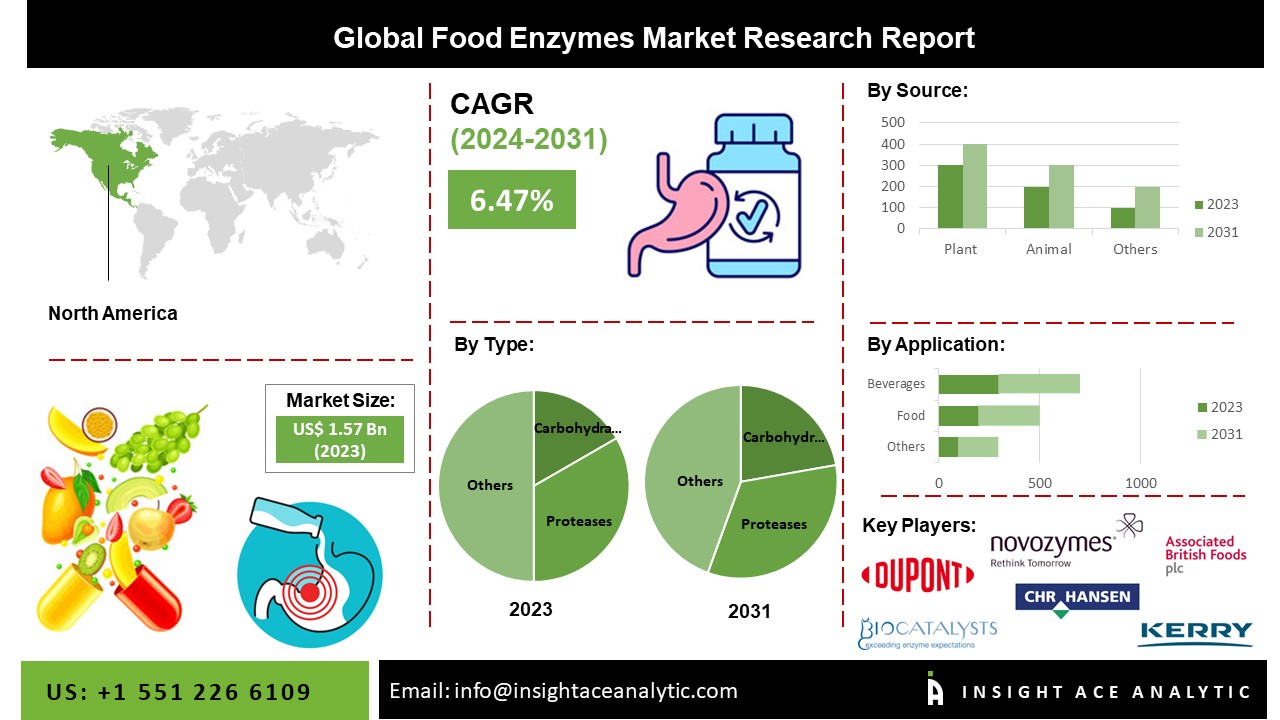

The Food Enzymes Market Size is valued at 1.57 Billion in 2023 and is predicted to reach 2.57 Billion by the year 2031 at a 6.47 % CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

Food enzymes are intricate substances that act as catalysts and are frequently used in the food processing sector to promote complexity, variety and quality. Food enzymes are extensively used in food processing for their many advantages, such as improving smell, texture, and flavour and coagulating, preserving, and tenderizing food. The global market for food enzymes is driven by the consumer's increasing awareness of wholesome and safe foods. Additionally, macroeconomic factors such as rising processed food competition and consumer desire for environmentally friendly manufacturing methods positively impact the global market for food enzymes. Other factors, such as the high enzyme response specificity and improvements in food quality, will moderate the market's development rate. The food enzyme market will expand faster due to waste reduction and energy savings in the food processing process.

The main factors that will accelerate the growth rate of the food enzymes market also include the rise in demand for nutraceutical products, increased consumption of alcoholic and non-alcoholic drinks, and replacement of old chemicals in various sectors. Additionally, as there are more cutting-edge technology platforms and emerging applications, there will be more potential for the market for food enzymes to expand.

The food enzymes market is segmented by type, source, application and form. Based on type, the market is segmented into carbohydrase (amylase, cellulase, lactase, pectinase and other carbohydrases), proteases, lipases, polymerase & nuclease and other types. Based on the source, the market is segmented into microorganisms, plants and animals. Based on the application, the market is segmented into food (meat products, bakery & confectionery products, dairy products, nutraceuticals and other food products) and beverages (juices, brewing and other beverages). Based on the form, the market is segmented into lyophilized powder, liquid and other formulations.

The carbohydrase category dominated the market in 2021 due to its application in animal feed enzymes, food, and beverages. Enzyme demand in food has expanded as consumer wants and benefits are becoming more widely known. Additionally, it is anticipated that growing consumer demand for products with added value and expanding adoption of new technologies would offer significant industry potential. Due to their low toxicity, cost-effectiveness, high tolerance, and increased demand from the dairy industry, carbohydrases have benefits for use in food applications.

The microorganism category dominated the market in 2021. The advantages of employing microorganisms include lower production costs, a more comprehensive range of industrial fermentation, easier manufacturing processes, and quicker culture development. Cheddar cheese production benefits from the use of the microbial enzyme lipase. Manufacturers can benefit from microbial proteases in brewing, meat tenderization, milk coagulation, and bread quality improvement.

The North American food enzymes market is expected to register the highest market share in revenue, shortly ascribed to the growing popularity of using components that are naturally derived. The ever rising belief is driving consumers' demand for food enzymes in the region that natural additives are secure & nutritious. The widespread use of enzymes in food systems has developed due to the growing demand for high-quality processed foods free of chemical additives. The region's market is expanding due to the increasing investments made by major corporations in creating cutting-edge products such as enzymes with high specificity. In addition, Asia Pacific is projected to boost in the global food enzymes market because the food and beverage sector is flourishing. The adoption of Western diets, related to the rising demand for bakery goods, dairy goods, and beverages, keeps developing in the area. As worries about sustainability and food safety increase, these products are anticipated to use food enzymes rather than synthetic chemicals.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 1.57 Billion |

| Revenue Forecast In 2031 | USD 2.57 Billion |

| Growth Rate CAGR | CAGR of 6.47 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Source, Form, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | DuPont, Associated British Foods plc., DSM, Novozymes, Chr. Hansen, Kerry Group, Jiangsu Boli Bioproducts Co., Ltd., Biocatalysts Ltd., Puratos Group, Advanced Enzyme Technologies Ltd., Amano Enzyme Inc., Enzyme Development Corporation, ENMEX, S.A. de C.V., Enzyme Bioscience Private Limited, Aumgene Biosciences, Creative Enzymes, SUNSON Industry Group Co., Ltd., AUM Enzymes, Xike Biotechnology Co. Ltd. and Antozyme Biotech Pvt Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Type

By Source

By Application

By Form

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.