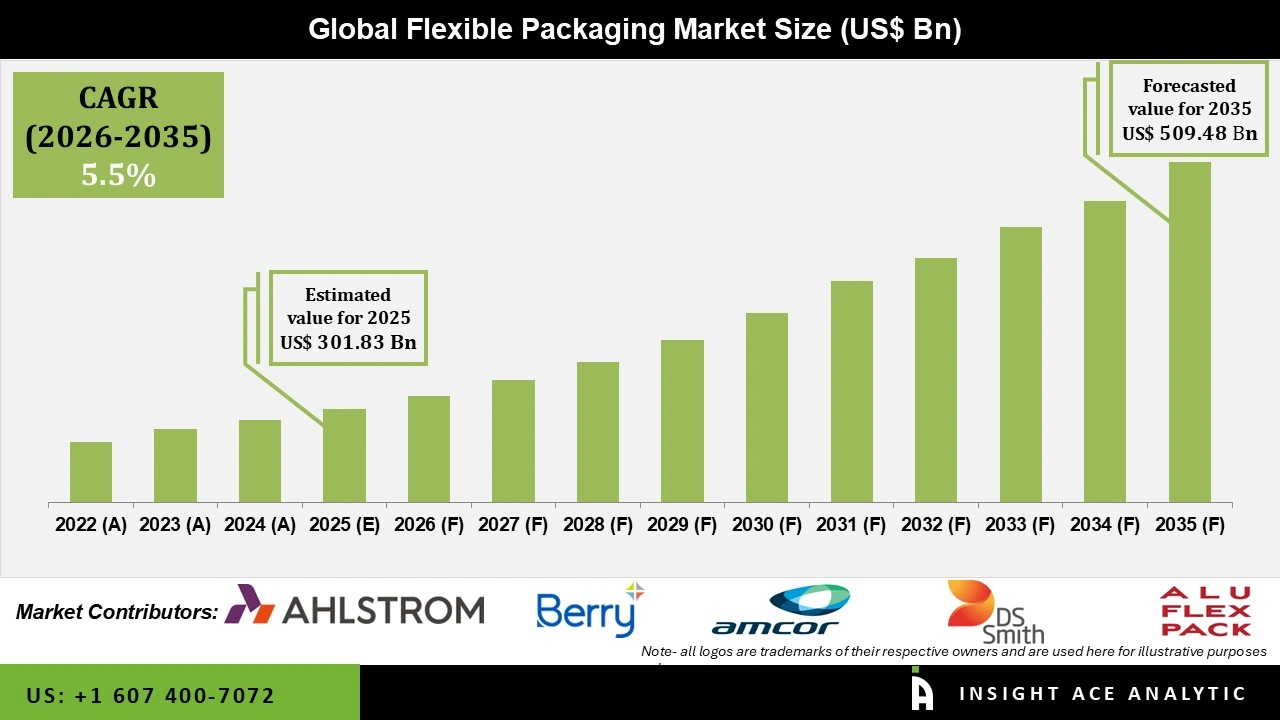

Global Flexible Packaging Market Size is valued at USD 301.83 billion in 2025 and is predicted to reach USD 509.48 billion by the year 2035 at a 5.5% CAGR during the forecast period for 2026 to 2035.

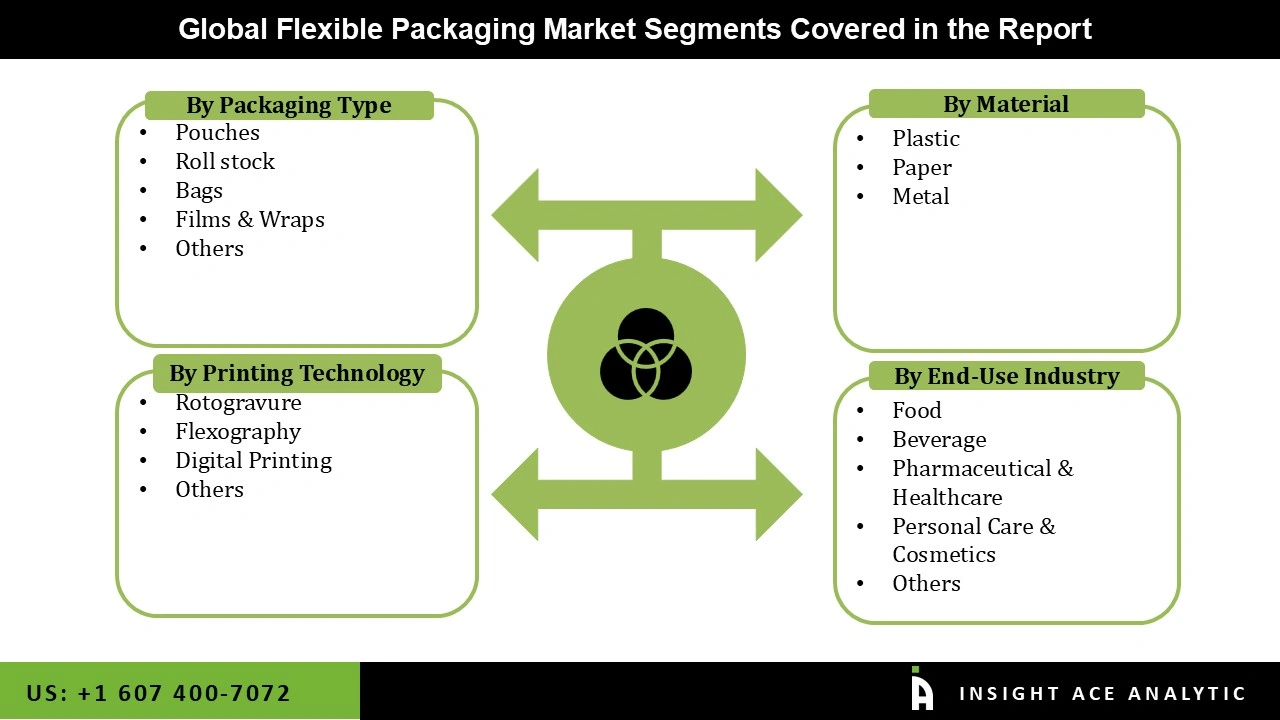

Flexible packaging Market Size, Share & Trends Analysis Report By Packaging Type (Pouches, Bags, Roll Stock, Films & Wraps), Printing Technology (Flexography, Rotogravure, Digital Printing), Material (Paper, Plastic, Metal), By End-user Industry, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Flexible packaging has gained substantial demand over the past few years as innovation in the packaging industry has seen a significant impetus owing to changing consumer preferences and requirements in multiple end-use applications. Flexible packaging has emerged as a popular choice due to its cost-effectiveness and longer shelf life than other packaging options.

Furthermore, the rising use of biodegradable plastics due to increased awareness about eco-friendly products among consumers; and transcultural eating habits have led to the growing demand for packaged fast foods, therefore driving the adoption of plastic in the packaging of food products. Besides that, the changing demand for more elegant and delicate packaging in an affordable manner has fostered the demand for Flexible packaging products during the forecast period.

However, recycling plastic packaging waste is a complex process requiring state-of-the-art infrastructure. It is a time-consuming process that needs personnel expertise which hampers the market's growth.

The flexible packaging market is divided into packaging type, material, printing technology, and end user. Based on packaging type, the flexible packaging market is segmented as pouches, roll stock, bags, films & wraps and others. The flexible packaging market is segmented by material: plastic, paper and metal. By printing technology, the market is segmented into rotogravure, flexography, digital printing and others. By end users, the flexible packaging market is segmented into food, beverage, pharmaceutical & healthcare, personal care & cosmetics and others.

The plastic category will hold a major global market share. The need for plastic packaging in food and beverage applications is anticipated to rise in response to the rising demand for novel products such as flex tanks and retort pouches for bulk transportation and storage of beverages and semi-solid food goods. Plastic is an excellent packing material for perishable goods like fruits, meat, and dairy products because it offers better pressure relief, greater structural and thermal integrity, and can act as an insulator. Globally high product consumption levels help the product have a large market share.

The food segment is projected to grow rapidly in the global flexible packaging market. Food can be transported more easily and successfully with proper packing. The expansion of advanced packaging in the food industry is also fueled by rising demand in emerging countries due to the rising consumption of packaged food items and raised awareness about nutrition and well-being. Additionally, the increasing prevalence of automated food manufacturing facilities necessitates employing cutting-edge packaging techniques for barrier-free packaging of completed goods, which spurs market expansion.

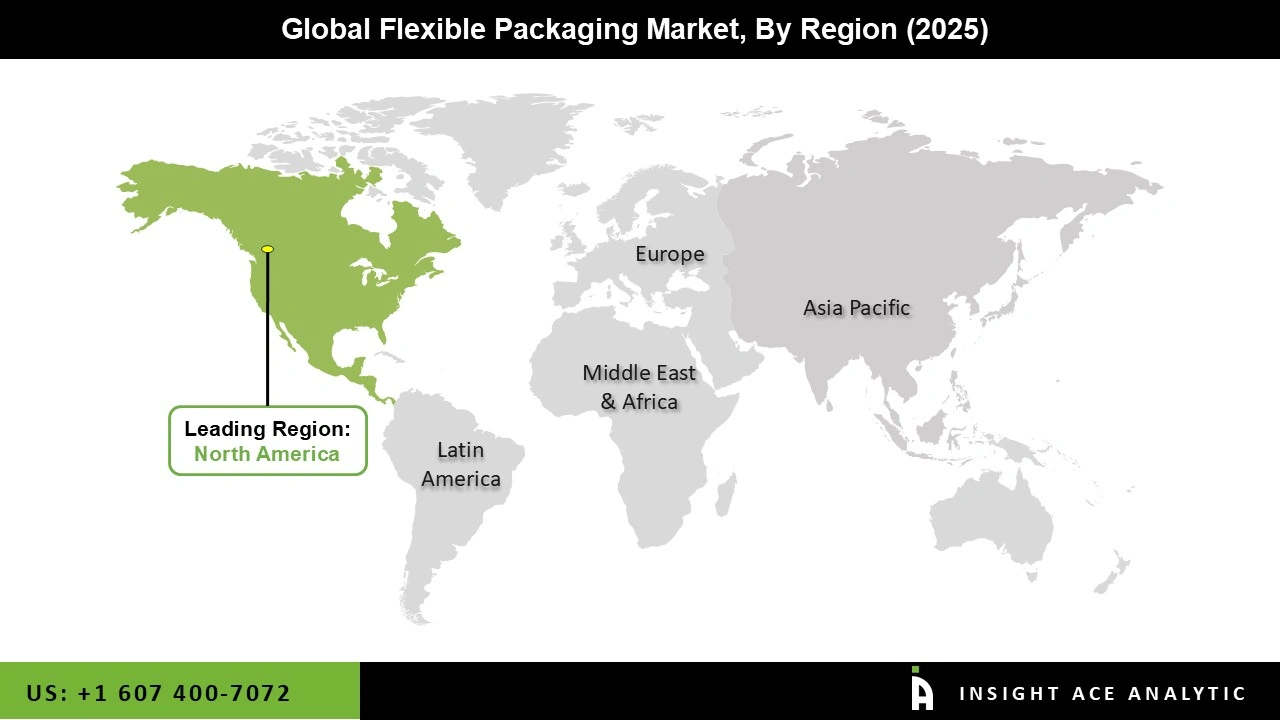

The North American region's flexible packaging market is expected to record the highest market share in revenue soon. This is majorly due to population growth, urbanization, changes in lifestyles, rise in income levels, increase in internet penetration and surge in development of the economy. In Addition, rising sales of products, increasing e-commerce activity, the presence of key flexible packaging manufacturers, and rapid industrialization are some of the major factors that govern the flexible packaging market in this region.

Besides, the Asia-Pacific region will hold the most noteworthy market share in the upcoming years. The market will have better prospects for expansion thanks to the existence of the organized retail sector and the growing e-commerce sectors. The availability of inexpensive labor and readily accessible raw materials in this area will fuel market expansion. In the upcoming year, rising demand for snacks and drinks in developing countries in the Asia Pacific region will fuel market expansion.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 301.83 billion |

| Revenue forecast in 2035 | USD 509.48 billion |

| Growth rate CAGR | CAGR of 5.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, Volume (KT) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Packaging Type, Material, Printing Technology, And End User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Sealed Air, Corporation (US), Coveris (Austria), Transcontinental Inc. (Canada), Amcor (Australia), Sonoco (US), Huhtamaki (Finland), Berry Global Inc. (US), Mondi (South Africa) and Clondalkin Group. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.