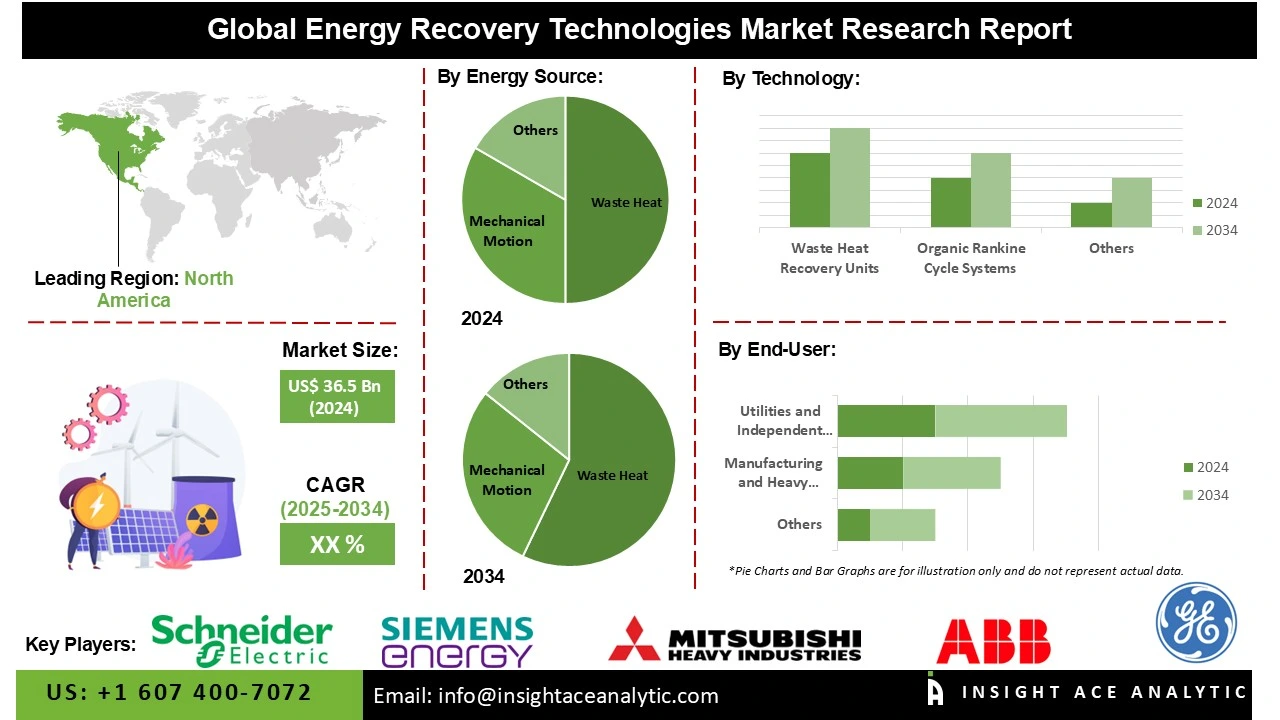

Energy Recovery Technologies Market Size is valued at US$ 36.5 Bn in 2024 and is predicted to reach US$ 71.5 Bn by the year 2034 at an 7.2% CAGR during the forecast period for 2025-2034.

Energy recovery technologies encompass a broad set of systems and processes designed to capture and reuse energy that would otherwise be lost during industrial, commercial, or municipal operations. These technologies play a critical role in improving efficiency, reducing operational costs, and minimizing environmental impact across sectors such as manufacturing, power generation, oil & gas, water treatment, transportation, and construction.

The growing demand for energy efficiency across sectors worldwide is driving considerable growth in the energy recovery technologies market. Energy recovery technologies provide an appealing answer by capturing and reusing energy that would otherwise be squandered, especially as energy costs continue to climb and enterprises face increasing demand to minimize operating expenses.

The global focus on cutting energy waste is in line with more general sustainability objectives, making energy recovery technology an essential part of contemporary industrial plans. The market for energy recovery technologies is expected to increase as a result of the increasing use of renewable energy sources, which frequently call for effective energy management systems to optimize production and reduce losses.

Additionally, strict environmental laws and international pledges to cut carbon emissions are driving the market for energy recovery technologies. Policies requiring industries to reduce their carbon footprints are being enforced by governments and international organizations, which is encouraging the development of energy recovery and reuse technology to reduce waste.

Some of the Key Players in Energy Recovery Technologies Market:

· Schneider Electric SE

· Siemens Energy AG

· Ormat Technologies Inc.

· Echogen Power Systems Inc.

· Mitsubishi Heavy Industries, Ltd.

· ABB Ltd.

· Dürr AG

· General Electric Company

· Alfa Laval AB

· Exergy International Srl

The energy recovery technologies market is segmented by energy source, technology, and end user. By energy source, the market is segmented into pressure differentials, waste heat, mechanical motion, exhaust gases, and renewable thermal sources. By technology, the market is segmented into organic rankine cycle systems, energy recovery ventilation systems, waste heat recovery units, flywheel energy storage, pressure energy recovery devices, regenerative braking systems, and thermoelectric generators. By end user, the market is segmented into transportation and logistics, food and beverage processing, manufacturing and heavy industry, utilities and independent power producer, chemical and petrochemical, construction and real estate.

The waste heat segment led the energy recovery technologies market in 2024 and is anticipated to continue to do so throughout the forecast period. In a variety of industrial applications, such as manufacturing, cement, steel, power generation, and chemical processing, this sector has become the most extensively used source of recoverable energy. When properly captured and repurposed, waste heat which is produced as a consequence of numerous thermal and mechanical processes offers a substantial opportunity for energy conservation.

The energy recovery technologies market was led by the Waste Heat Recovery Units segment in 2024 and is anticipated to continue to do so throughout the forecast period. Because it has been shown to improve energy efficiency and lower operating costs by capturing and reusing thermal energy that would otherwise be lost, this segment has gained significant traction across a variety of energy-intensive industries, including cement, steel, chemicals, oil and gas, and power generation. Waste heat recovery systems are widely used in both high- and low-temperature industrial processes, which makes them an essential part of energy management plans.

In 2024, the North American region dominated the energy recovery technologies market. Several energy-intensive businesses, including manufacturing, chemicals, and oil and gas, are present and are propelling market growth in the area. Because of the favorable regulatory environment and the rising need for energy-efficient solutions, the United States and Canada are the two biggest markets in North America. Additionally driving the energy recovery technologies market growth in the region are the growing emphasis on reducing greenhouse gas emissions and the growing use of renewable energy.

Over the course of the forecast period, the Asia Pacific region is expected to develop at the fastest rate in the energy recovery technologies market. Rapid industrialization, an expanding manufacturing base, and rising energy consumption in major economies like China, India, Japan, and South Korea are the main drivers of this regional leadership. Energy recovery technologies are being adopted by Asia Pacific industries, especially those in the cement, steel, oil and gas, chemical, and power generation sectors, in order to increase operational efficiency, lower energy costs, and adhere to more stringent environmental requirements.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 36.5 Bn |

| Revenue Forecast In 2034 | USD 71.5 Bn |

| Growth Rate CAGR | CAGR of 7.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Energy Source, By Technology, By End User, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Schneider Electric SE, Siemens Energy AG, Ormat Technologies Inc., Echogen Power Systems Inc., Mitsubishi Heavy Industries, Ltd., ABB Ltd., Dürr AG, General Electric Company, Alfa Laval AB, and Exergy International Srl |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Energy Recovery Technologies Market by Energy Source-

· Pressure Differentials

· Waste Heat

· Mechanical Motion

· Exhaust Gases

· Renewable Thermal Sources

Energy Recovery Technologies Market by Technology -

· Organic Rankine Cycle Systems

· Energy Recovery Ventilation Systems

· Waste Heat Recovery Units

· Flywheel Energy Storage

· Pressure Energy Recovery Devices

· Regenerative Braking Systems

· Thermoelectric Generators

Energy Recovery Technologies Market by End User-

· Transportation and Logistics

· Food and Beverage Processing

· Manufacturing and Heavy Industry

· Utilities and Independent Power Producer

· Chemical and Petrochemical

· Construction and Real Estate

Energy Recovery Technologies Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.