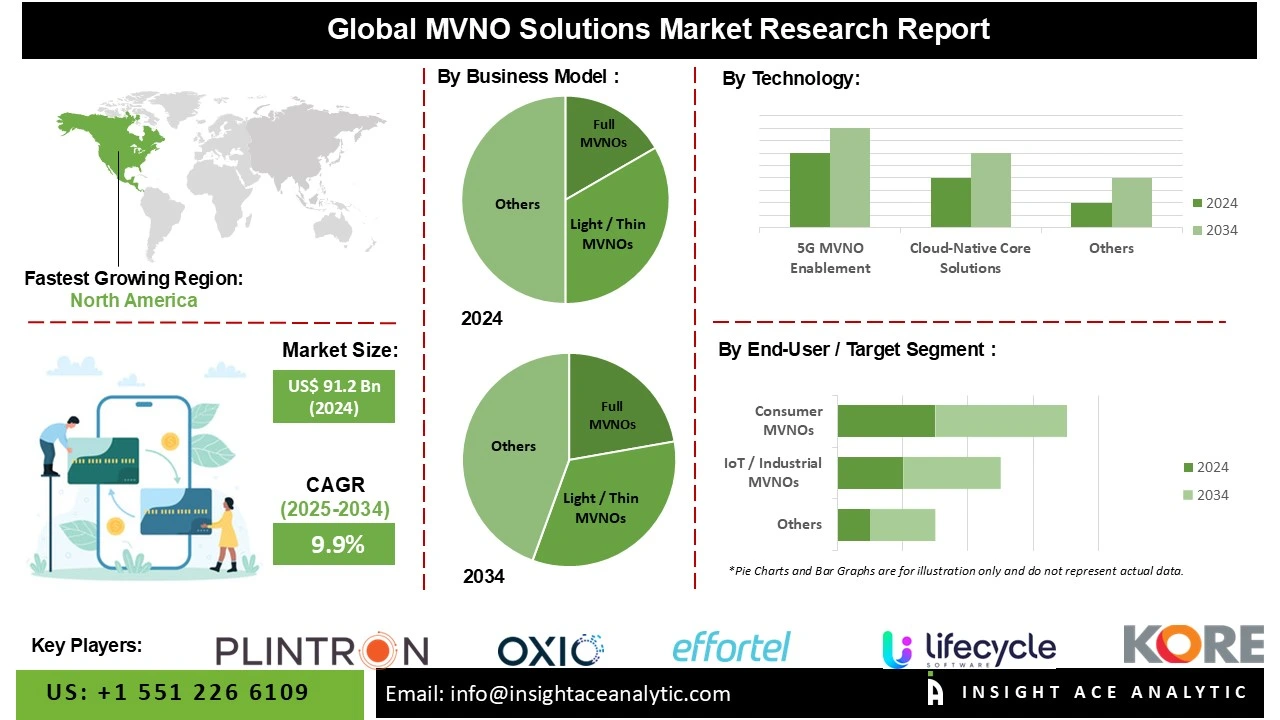

Global MVNO Solutions Market Size is valued at USD 91.2 Bn in 2024 and is predicted to reach USD 227.1 Mn by the year 2034 at a 9.9% CAGR during the forecast period for 2025 to 2034.

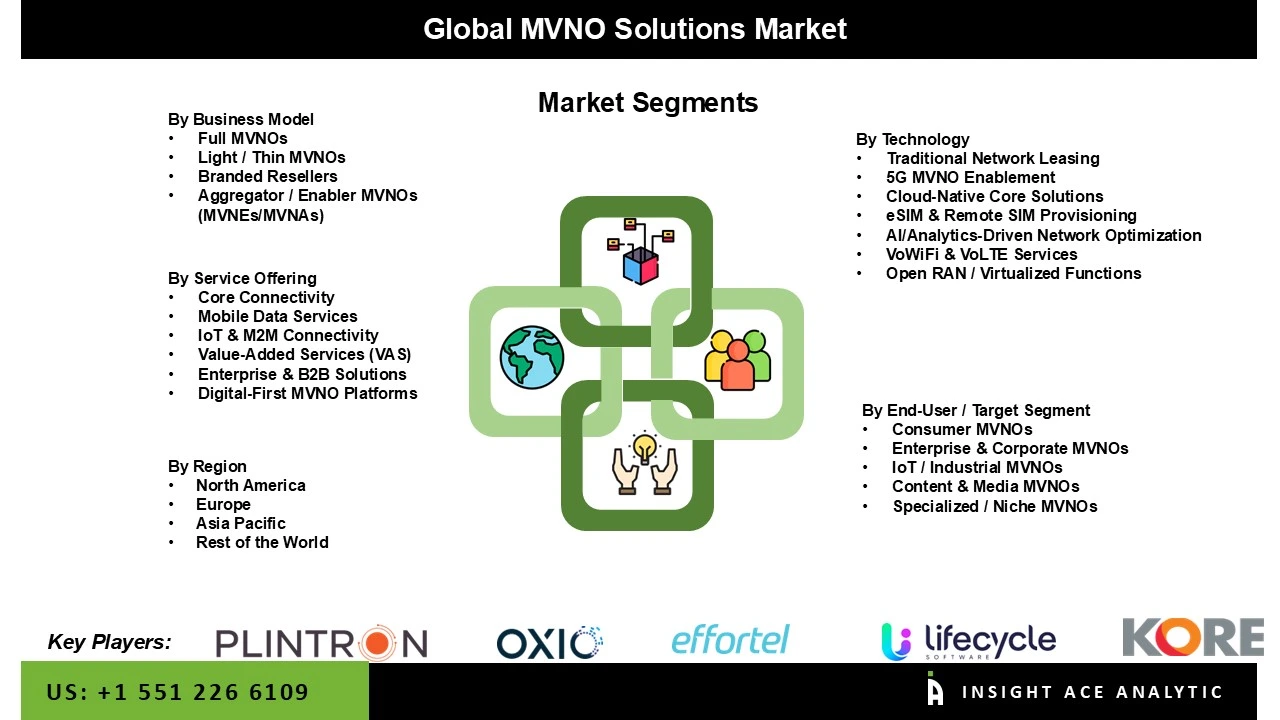

MVNO Solutions Market, Share & Trends Analysis Report, By Business Model (Full MVNOs, Light / Thin MVNOs, Branded Resellers, Aggregator / Enabler MVNOs (MVNEs/MVNAs)), By Service Offering (Core Connectivity, Mobile Data Services, IoT & M2M Connectivity, Value-Added Services (VAS), Enterprise & B2B Solutions, Digital-First MVNO Platforms), By Technology, By End-User / Target Segment, By Region, and Segment Forecasts, 2025 to 2034.

An extensive suite of services, technology, and support systems that allow companies to provide mobile services without investing in actual wireless infrastructure is known as an MVNO (mobile virtual network operator) solution. MVNOs lease network capacity from well-known mobile network operators (MNOs) like AT&T, verizon, or T-mobile rather than investing in radio spectrum, cell towers, or base stations. They then resell these services under their own brand with unique plans, prices, and offerings.

Cloud-based platforms that offer scalability and flexibility and support cutting-edge capabilities such as eSIM provisioning, IoT connectivity, and 5G readiness are often included in these solutions. MVNOs frequently depend on mobile virtual network enablers (MVNEs) to manage the technical and operational aspects. MVNEs perform vital tasks such as policy control, billing, provisioning, and customer administration, freeing MVNOs to focus on marketing, branding, and customer interaction.

The MVNO solutions market is growing significantly due to IoT-enabled MVNOs, which facilitate cross-border connectivity by forming alliances with multiple MNOs to support global IoT deployments across industries such as connected cars, smart cities, and logistics. To protect against threats such as signaling attacks, these operators need sophisticated solutions with roaming control, real-time analytics, and robust security capabilities. IoT MVNOs stimulate innovation, attract new competitors, and intensify rivalry by combining value-added services such as cybersecurity and AI-driven analytics. This increases demand for end-to-end platforms from mobile virtual network enablers (MVNEs) that enable quick, scalable deployment. These providers increase negotiating power, reduce MNO dependency, and improve compliance and scalability by utilizing independent core networks in full MVNO arrangements. For example, eSIM Go and Vodafone UK teamed up in december 2024 to streamline MVNO launches for IoT-focused companies. This partnership provides rapid access to Vodafone's network for sectors such as linked cars and fintech, reducing barriers to entry and accelerating market growth. Overall, by meeting the increasing demand for specialized, effective, and secure connectivity in a future where devices are connected and by promoting innovation in 5G, eSIM, and industry-tailored services, the IoT MVNO segment is driving the adoption of advanced MVNO solutions.

Some of the Major Key Players in the MVNO Solutions Market are

· Plintron

· Transatel (NTT)

· Pareteum (Circles)

· OXIO

· Effortel

· Syniverse

· Lifecycle Software

· Reach

· Telefonica Tech

· KORE Wireless

· Amdocs

· MDS Global

· Digitalk

· Cerillion

· Tata Communications

· floLIVE

· BICS

· Telna

· Hologram

· i-New

The MVNO solutions market is segmented into business model, service offering, technology, and end-user / target segment. Based on the business model, the market is segmented into full MVNOs, light/thin MVNOs, branded resellers, and aggregator/enabler MVNOs (MVNEs/MVNAs). Based on the service offering, the market is divided into core connectivity, mobile data services, IoT & M2M connectivity, value-added services (VAS), enterprise & b2b solutions, and digital-first MVNO platforms. Based on the technology, the market is divided into traditional network leasing, 5G MVNO enablement, cloud-native core solutions, eSIM & remote SIM provisioning, AI/analytics-driven network optimization, VoWiFi & VoLTE services, open RAN / virtualized functions. Based on the end-user / target segment, the market is divided into consumer MVNOs, enterprise & corporate MVNOs, IoT / industrial MVNOs, content & media MVNOs, and specialized / niche MVNOs.

Full MVNOs (mobile virtual network operators) are the primary drivers of the MVNO solutions market because they have greater operational control, flexibility, and capacity for innovation compared to models such as branded resellers or light MVNOs. By owning and operating key network elements such as HLR/HSS, billing systems, and even their own SIM cards, Full MVNOs can design and deliver customized service offerings with minimal dependence on mobile network operators (MNOs) or mobile virtual network enablers (MVNEs). This deeper control across the value chain allows them to optimize pricing strategies, enhance customer experience, and achieve higher profit margins than lighter MVNO models. Moreover, their extensive infrastructure requirements drive demand for advanced MVNO solutions, including cloud-based OSS/BSS platforms, AI-driven analytics, and robust cybersecurity tools to safeguard against signaling attacks, positioning full MVNOs as leaders in shaping the future of the MVNO ecosystem.

A major factor propelling the MVNO solutions market's growth is the mobile data services segment, which is supported by the quick development of IoT applications in fields like industrial automation, smart cities, linked cars, and medical devices. Solutions that facilitate eSIM provisioning, global roaming, and real-time device management are in great demand as MVNOs increasingly offer customized data plans for IoT devices, which may require high-speed data for real-time analytics or low-bandwidth, low-power connectivity. Enterprise-grade services like secure VPNs, real-time analytics, and customized data plans are also necessary since enterprise-focused MVNOs are using secure, fast data connectivity to support private networks, cloud access, and remote work. This market is further improved by the increasing use of eSIM technology, which enables flexible plan management and fast activation. As a result, MVNO solutions with sophisticated provisioning and lifecycle management features are required. As a result of these trends, one of the MVNO solutions market's most innovative and dynamic segments is mobile data services.

Europe leads the world market for MVNO solutions because of its developed telecom infrastructure, high MVNO penetration, lenient laws, and robust demand for IoT and mobile data services. MVNOs that specialize in IoT connections, like Transatel and Onomondo, rely on solutions for global roaming, device management, and low-power connectivity. The region is a leader in IoT installations, especially in smart cities, automotive, and healthcare. MVNOs may now offer high-speed internet services due to the quick rollout of 5G networks, which is aided by operators like Vodafone and Orange. For instance, vodafone germany stated plans in march 2022 to reach nationwide 5G standalone coverage by 2025, opening up advanced MVNO use cases, while Telefónica Germany has already started offering 5G connectivity to MVNOs. Europe is at the forefront of the global market due to its leadership in 5G and IoT adoption, as well as its competitive and fragmented MVNO landscape. These factors drive strong demand for advanced solutions like cloud-based OSS/BSS platforms, eSIM provisioning, and IoT connectivity platforms.

· In Nov 2023, NTT-owned IoT MVNO-enabler Transatel signed a wholesale agreement with O2 telefónica in germany to provide IoT applications and coverage for the automotive industry as well as the larger industrial market. The agreement provides "mid-term access" to O2 telefónica's 5G network for the france-based company, which has been providing local MVNO and MVNE services throughout Europe for 20 years and, more recently, a roaming extension for campus-based private cellular networks. In almost 200 countries, transatel provides IoT airtime. Its IoT business is divided into three divisions: industrial IoT, which offers worldwide airtime for maintenance and localization services; automotive IoT, which provides in-car connectivity for telematics and "infotainment"

· In May 2023, KORE declared the opening of its new retail solutions vertical offering. KORE has positioned its portfolio to provide high-bandwidth solutions in response to the retail industry's rapid digital transformation. High-bandwidth 5G cellular connectivity via fixed wireless access (FWA) is a feature of the KORE retail solution that offers high-speed internet access that is often only possible with landline solutions. A 5G network can provide more capacity to support these emerging and novel retail applications, many of which depend on faster and larger data volumes.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 91.2 Bn |

| Revenue Forecast In 2034 | USD 227.1 Bn |

| Growth Rate CAGR | CAGR of 9.9 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Business Model, Service Offering, Technology, End-User / Target Segment |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Plintron, Transatel (NTT), Pareteum (Circles), OXIO, Effortel, Syniverse, Lifecycle Software, Reach, Telefonica Tech, KORE Wireless, Amdocs, MDS Global, Digitalk, Cerillion, Tata Communications, floLIVE, BICS, Telna, Hologram, i-New |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global MVNO Solutions Market- By Business Model-

· Full MVNOs

o Own OSS/BSS (billing, CRM, customer care)

o Own Core Network (HLR/HSS, EPC/IMS, policy control)

o Independent service innovation (e.g., VoLTE, 5G SA)

· Light / Thin MVNOs;

o Host-dependent for the network core

o Partial OSS/BSS control

o Digital distribution & marketing focus

· Branded Resellers

o Distribution-only model

o Prepaid vs. Postpaid resellers

o Community/ethnic focus brands

· Aggregator / Enabler MVNOs (MVNEs/MVNAs)

Global MVNO Solutions Market – By Service Offering-

· Core Connectivity

o Voice

o Messaging

· Mobile Data Services

o 4G/LTE data bundles

o 5G fixed wireless & mobile broadband

· IoT & M2M Connectivity

o Consumer IoT

o Industrial IoT

o Automotive IoT

o Healthcare IoT

· Value-Added Services (VAS)

o Mobile Payments & Mobile Banking

o OTT & Entertainment Bundling

o Loyalty & Rewards integration

· Enterprise & B2B Solutions

o Unified Communications (UCaaS/CPaaS)

o Secure mobile services for enterprises

o Private LTE/5G MVNOs for corporate clients

· Digital-First MVNO Platforms

o App-based onboarding (KYC, digital SIM ordering)

o eSIM activation & management

o Digital self-care (chatbots, AI CX platforms)

Global MVNO Solutions Market – By Technology-

· Traditional Network Leasing

o 2G/3G MVNO hosting

o 4G/LTE hosting services

· 5G MVNO Enablement

o NSA (non-standalone) 5G MVNOs

o SA (Standalone) 5G MVNOs

o Network slicing for MVNOs

· Cloud-Native Core Solutions

o Virtual EPC/IMS

o Cloud-BSS / Cloud-OSS

· eSIM & Remote SIM Provisioning

o Consumer eSIM

o IoT eSIM

· AI/Analytics-Driven Network Optimization

o Predictive analytics for churn reduction

o QoS/QoE management

o AI-powered pricing & offers

· VoWiFi & VoLTE Services

o Wi-Fi Calling

o HD Voice & Rich Communication Services (RCS)

· Open RAN / Virtualized Functions

o NFV-based MVNO platforms

o Cloud RAN for MVNO enablement

Global MVNO Solutions Market- By End-User / Target Segment-

· Consumer MVNOs

· Enterprise & Corporate MVNOs

· IoT / Industrial MVNOs

· Content & Media MVNOs

· Specialized / Niche MVNOs

Global MVNO Solutions Market – By Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.