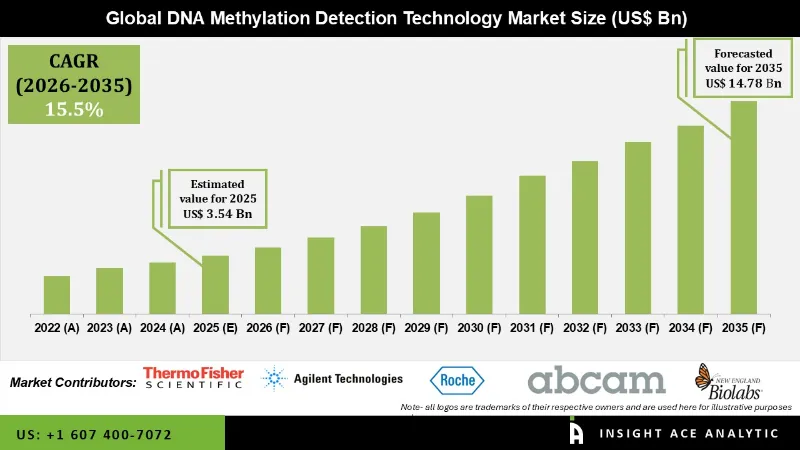

DNA Methylation Detection Technology Market Size was valued at USD 3.54 Bn in 2025 and is predicted to reach USD 14.78 Bn by 2035 at a 15.5% CAGR during the forecast period for 2026 to 2035.

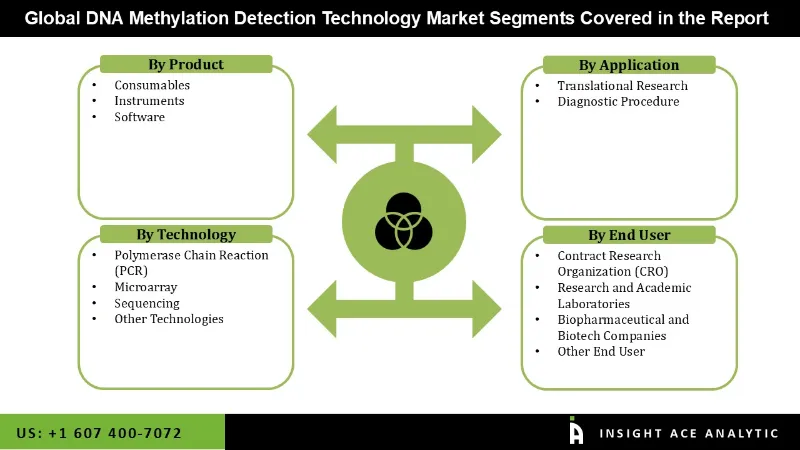

DNA Methylation Detection Technology Market Size, Share & Trends Analysis Report, By Product (Consumables, Instruments and Software), By Technology (Polymerase Chain Reaction (PCR), Microarray, Sequencing and Other Technologies), By Application (Translational Research and Diagnostic Procedure), By End-user (Contract Research Organization (CRO), Research & Academic Laboratories, Biopharmaceutical and Biotech Companies, And Other End User), By Region, Forecasts, 2026 to 2035

DNA Methylation Detection Technology Market Key Takeaways:

|

Key Industry Insights & Findings from the Report:

DNA methylation detection technology analysis provides researchers with a wealth of information about gene regulation and the identification of possible biomarkers. Cancer, obesity, and addiction are just a few of the many diseases that have been connected to aberrant DNA methylation. Healthcare, biotechnology, pharmaceuticals, and research have all been profoundly impacted by the worldwide DNA methylation detection technology industry. Precision medicine has advanced thanks to these technologies, which have made it possible to identify epigenetic biomarkers linked to disease susceptibility, progression, and treatment response. This has allowed for the development of individualized treatment plans that consider each patient's genetic and epigenetic profiles. To provide safer and more effective treatments, DNA methylation analysis speeds up the process of discovering new drug targets, biomarkers for patient stratification, and predictors of medication response. In addition, clinical diagnostics are making greater use of these technologies for early disease detection, diagnosis, and prognosis. They offer excellent sensitivity and specificity, leading to better medical results.

However, the market growth is hampered by the lack of qualified professionals’ criteria for the safety and health of the DNA methylation detection technology market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or DNA methylation detection technology because of the absence of biotechnology specialists capable of conducting DNA methylation tests and research. The biotechnology industry shows encouraging signs with DNA methylation, but there is a severe shortage of trained lab staff to carry out these tests. Incorrect observations, faulty data interpretation, and incorrect conclusions could result from a lack of competence. Another factor that could slow the market's expansion is that DNA methylation is still not widely used as a diagnostic tool in the commercial sector. Restrictions on transportation caused by the COVID-19 outbreak hampered testing and research at academic institutions, which in turn had a detrimental effect on the market.

The DNA methylation detection technology market is segmented based on product, technology, application, and end user. Based on product, the market is segmented into consumables, instruments, and software. By technology, the market is segmented into polymerase chain reaction (PCR), microarray, sequencing, and other technologies. By application, the market is segmented into translational research and diagnostic procedures. By end user, the market is segmented into contract research organizations (CRO), research and academic laboratories, biopharmaceutical and biotech companies, and other end users.

The consumables segment is expected to hold a major global market share in 2022. Many consumables are needed to handle samples efficiently when using high-throughput technologies like microarray analysis and next-generation sequencing. In addition, the demand for consumables is anticipated to rise consistently, further establishing their market dominance as DNA methylation analysis continues to find more research and clinical applications.

The polymerase chain reaction (PCR)industry makes up the bulk of acrylic acid ester usage because it is reliable, flexible, and widely used. DNA methylation patterns can be detected with great sensitivity and specificity using PCR-based technologies like quantitative real-time PCR (qPCR) and methylation-specific PCR (MSP). These approaches are indispensable in epigenetics and clinical diagnostics, especially in countries like the US, Germany, the UK, China, and India.

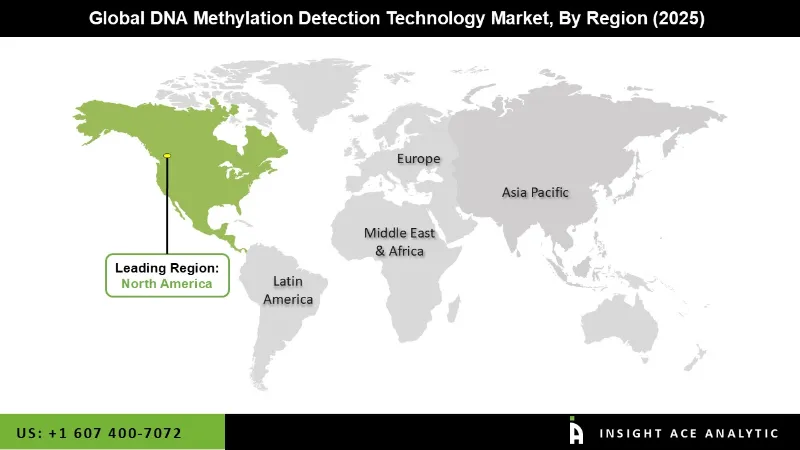

The North American DNA methylation detection technology market is expected to register the highest market share in revenue in the near future. It can be attributed to the proliferation of product releases and approvals and the extensive network of manufacturing and research and development facilities. In addition, the increasing need for systems that express proteins has played a major role in expanding this area.

In addition, Asia Pacific is projected to grow rapidly in the global DNA methylation detection technology market because the government is increasingly backing several programs. Additionally, a positive growth driver is the increasing attention of global businesses toward the expanding markets of the Asia Pacific region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.54 Bn |

| Revenue Forecast In 2035 | USD 14.78 Bn |

| Growth Rate CAGR | CAGR of 15.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2034 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Application, By Technology, By End-user and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | New England Biolabs, Abcam plc., F. Hoffmann-La Roche Ltd., Thermo-Fisher Scientific Inc., Agilent Technologies Inc., BioRad Laboratories Inc., Exact Sciences Corporation, QIAGEN N.V., Illumina Inc., Pacific Biosciences Inc., Merck KGaA, PerkinElmer Inc., Enzo Life Sciences, Inc., Takara Bio Inc. and Hologic, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

DNA Methylation Detection Technology Market- By Product

DNA Methylation Detection Technology Market- By Technology

DNA Methylation Detection Technology Market- By Application

DNA Methylation Detection Technology Market- By End User

DNA Methylation Detection Technology Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.