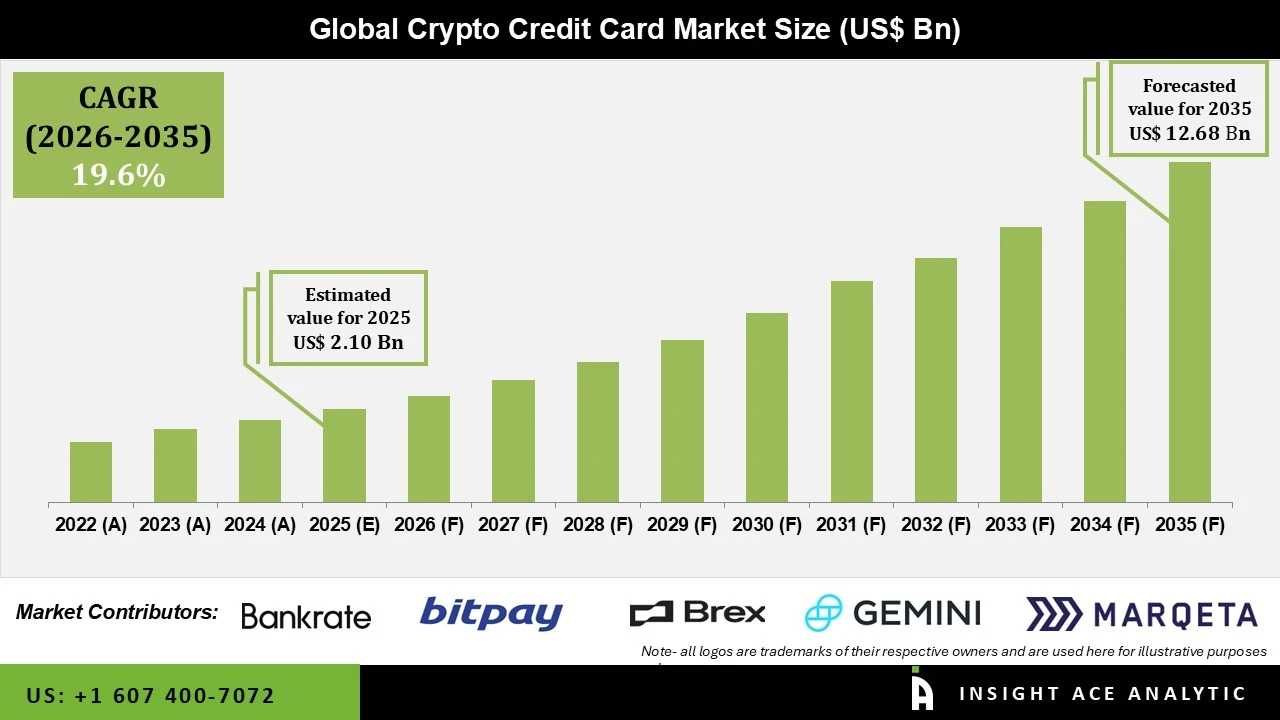

Crypto Credit Card Market Size is valued at USD 2.10 billion in 2025 and is predicted to reach USD 12.68 billion by the year 2035 at a 19.68% CAGR during the forecast period for 2026 to 2035.

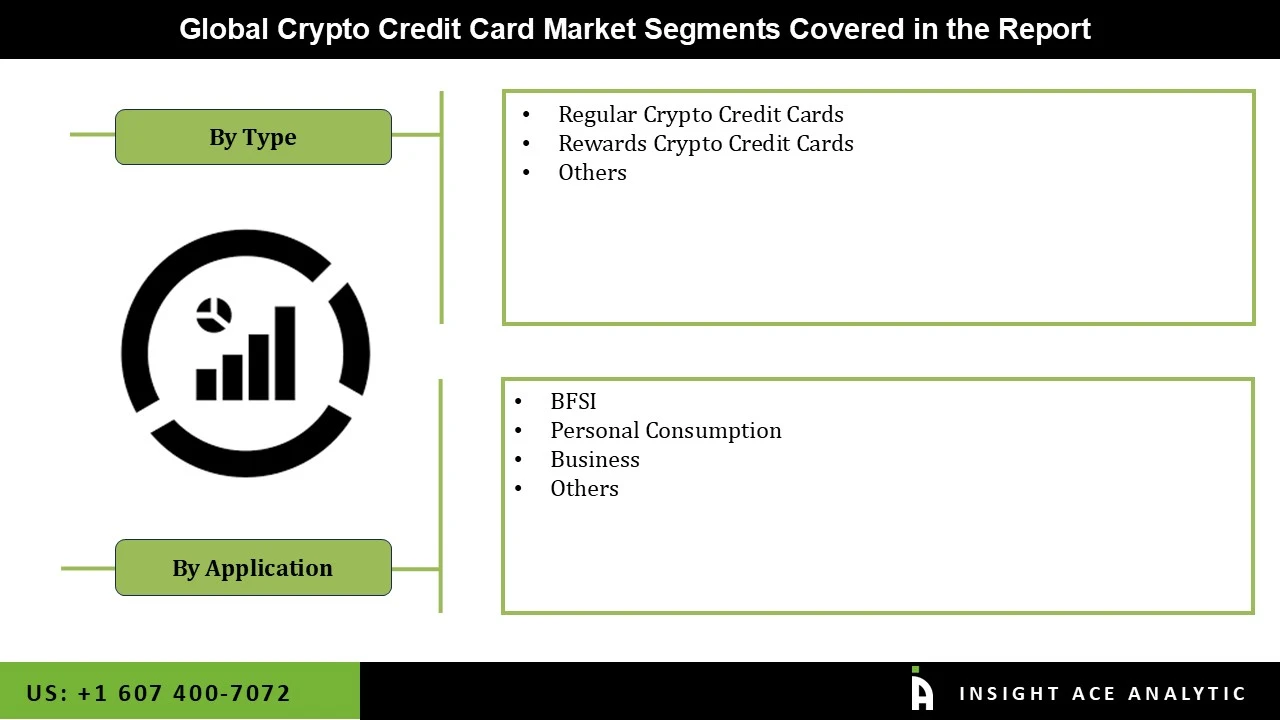

Crypto Credit Card Market Size, Share & Trends Analysis Report By type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others), By Region, And By Segment Forecasts, 2026 to 2035

A crypto credit card is a class of credit card that offers incentives in the form of cryptocurrency instead of conventional rewards such as points or cash back. These cards function in a similar manner to regular credit cards, except they provide users with digital assets, such as Bitcoin, as incentives. Additionally, certain cards facilitate the direct utilization of cryptocurrency for transactions. Usually, they are linked to cryptocurrency wallets or exchanges, and they involve fees, conversion rates, and interest charges that are similar to those of traditional credit cards.

However, the volatility of cryptocurrency markets presents challenges for both cardholders and issuers. Fluctuations in crypto prices can impact the value of users' digital assets and introduce uncertainty into transactions, posing difficulties in managing credit assessments and liquidity risks for card issuers. Despite advancements in security measures, concerns about risks inherent to cryptocurrencies, such as hacking, fraud, and theft, remain prominent among crypto credit card users. Strategic collaborations between fintech firms, cryptocurrency exchanges, and traditional financial institutions have been pivotal in expanding the market. These partnerships aim to enhance card functionalities, ensure regulatory compliance, and broaden market penetration, thereby fostering greater consumer trust and adoption. In summary, the Crypto Credit Card market is driven by the convergence of financial technology, supportive regulatory frameworks for cryptocurrency adoption, and rising consumer demand for secure and convenient ways to utilize digital assets in everyday transactions.

The Crypto Credit Card market is segmented on the basis of product and application. The product segment includes regular crypto credit cards, rewards crypto credit cards, and others. By application, the market is segmented into BSFI, personal, consumption, business, and others.

Regular Crypto Credit Cards currently hold the largest market share, largely due to their widespread adoption in gambling and their robust capability to convert digital assets into fiat currency. This trend underscores their dominance and expanding role in financial transactions. Conversely, Rewards Crypto Credit Cards are anticipated to experience significant growth driven by technological innovations within the Crypto Credit Card market. These advancements are expected to enhance their appeal by offering compelling benefits and rewards, positioning them as a promising segment for future market expansion.

The dominance of the Banking, Financial Services, Insurance (BFSI) sector in the Crypto Credit Card market underscores its pivotal role in driving adoption and facilitating seamless monetary transactions globally. BFSI institutions have increasingly recognized the potential of Crypto Credit Cards to enhance financial services, offering customers the ability to transact in cryptocurrencies alongside traditional fiat currencies. This integration aligns with the industry's focus on digital transformation and innovation, aiming to meet evolving consumer preferences for flexible and efficient payment solutions.

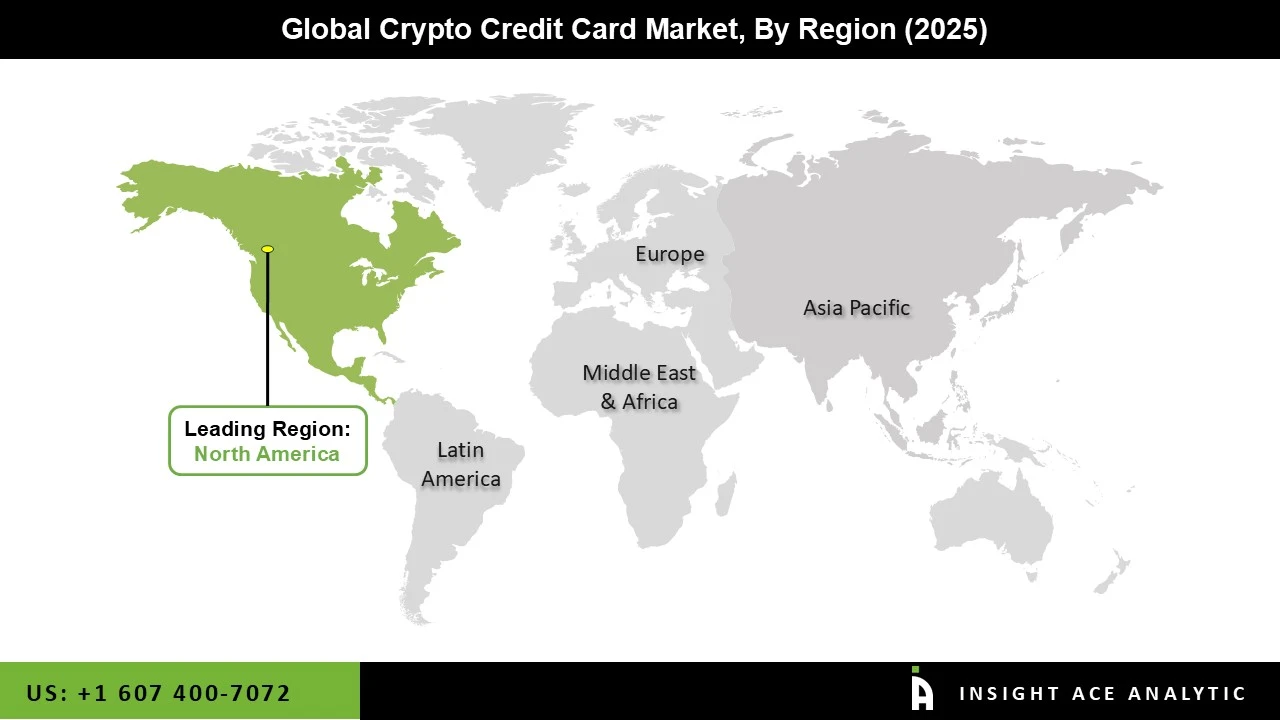

The North American crypto credit card market is expected to register at the highest market share. In the American region, including North America and South America, there is a strong presence of fintech innovation hubs and a growing acceptance of cryptocurrencies among consumers and businesses alike. North America, particularly the United States, leads in terms of market size and technological advancements, with a robust ecosystem supporting Crypto Credit Cards and related financial services. In addition, Asia Pacific (APAC) is projected to grow rapidly in the global Crypto Credit Card market. In APAC, countries like China, Japan, and South Korea are emerging as key markets due to their tech-savvy populations and increasing adoption of digital payment solutions.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.10 Bn |

| Revenue Forecast In 2035 | USD 12.68 Bn |

| Growth Rate CAGR | CAGR of 19.68% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type and Application. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Bankrate LLC, BitPay Inc., BlockFi Visa Card, Brex Inc., Club Swan Mastercard, Gemini Trust Company LLC, Marqeta Inc., MoonPay, Nexo, Paxful Inc., RedotPay, Revolut Bank UAB, Robinhood Markets Inc., Shakepay Visa, SoFi Credit Card, SpectroCoin, Uphold Inc., Wirex Visa, ZebPay, Zengo Ltd |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Crypto Credit Card Market By Type-

Crypto Credit Card Market By Application-

Crypto Credit Card Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.