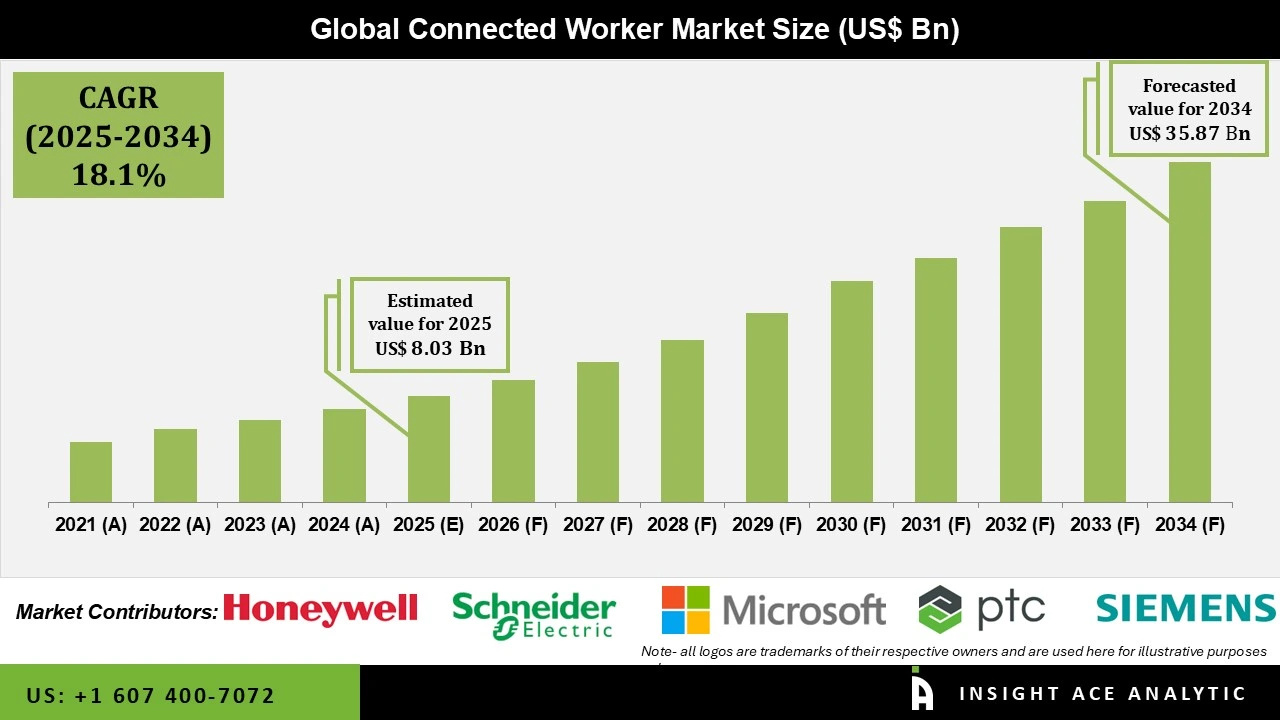

Global Connected Worker Market is valued at US$ 8.03 Bn in 2025 and it is expected to reach US$ 35.87 Bn by 2034, with a CAGR of 18.1% during the forecast period of 2025-2034.

Connected worker solutions use wearables and mobile devices to help frontline workers do their jobs faster and safer. They provide real-time instructions, checklists, and expert help through smart glasses, tablets, or wrist devices. These tools track safety compliance, monitor equipment, and reduce downtime in factories, oil & gas, construction, and warehouses. Supervisors use them to spot problems, assign tasks quickly, and keep remote teams connected. For workers, they improve communication, increase accuracy, and reduce errors. The global connected worker market is growing rapidly due to industrial digitization, IoT, AI, and 5G networks.

The market is expanding because companies want more efficient operations. Connected worker platforms now integrate with collaborative robots (cobots) and exoskeleton suits that reduce physical strain. For example, HeroWear's soft exosuits eliminated back injuries across 280,000+ warehouse work hours by reducing worker fatigue. Safety-focused wearables with embedded sensors track posture, vital signs, and hazardous conditions in real time. These technologies help companies improve productivity while protecting workers from injuries.

High upfront costs and complex integration remain major barriers for many companies. Smaller manufacturers often struggle with the technical setup and training required. However, next-generation wearables with built-in AI, longer battery life, and simpler interfaces are solving these problems. Edge computing reduces data delays, while cloud platforms make deployment easier. As costs drop 15-20% annually and solutions become plug-and-play, connected worker technology will become standard across industries, driving market growth through 2030.

Some of the Key Players in Connected Worker Market:

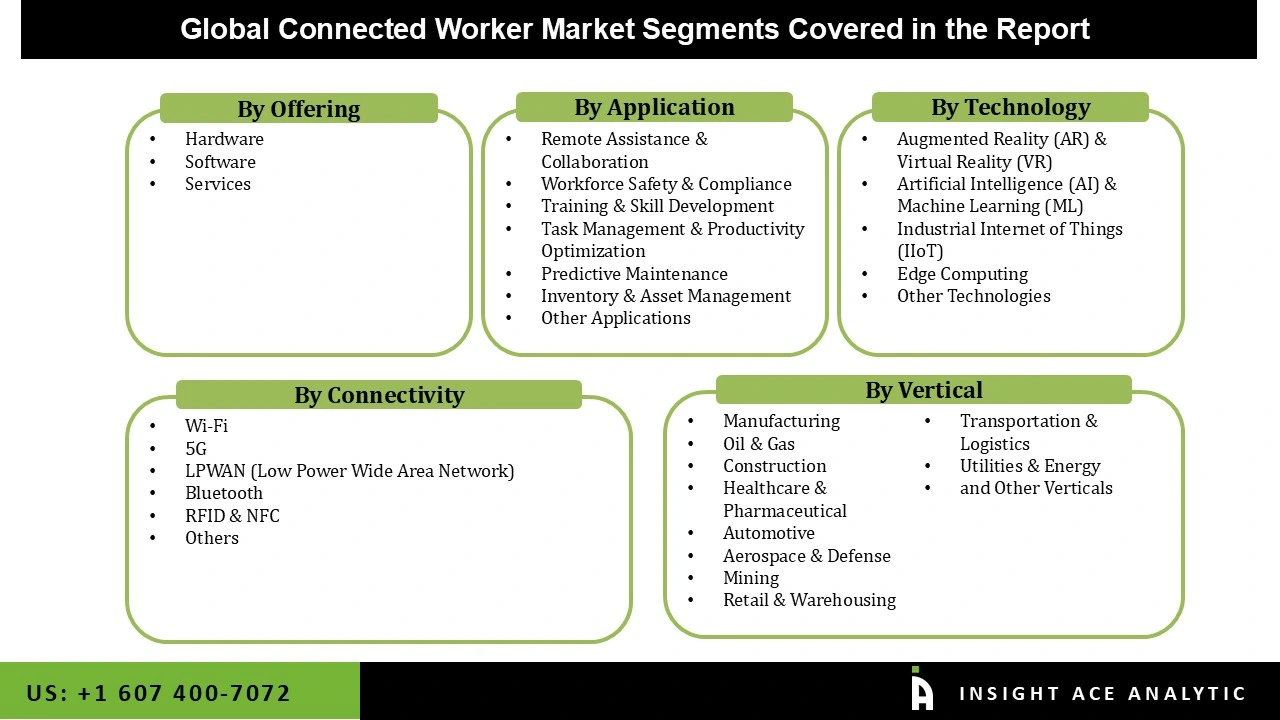

The connected worker market is divided into several categories. By offering, it includes hardware like wearables and smart glasses, software like platforms and analytics, and services like implementation and training. Technologically, it covers AR/VR for visual guidance, AI/ML for smart insights, IIoT for device connectivity, edge computing for real-time processing, and other emerging technologies. By connectivity, it includes Wi-Fi, 5G for high-speed data, LPWAN for long-range coverage, Bluetooth, RFID/NFC for tracking, and others.

By application, the market serves remote assistance and collaboration, workforce safety and compliance, training and skill development, task management and productivity, predictive maintenance, inventory and asset management, and other use cases. By vertical, it spans manufacturing, oil & gas, construction, healthcare, automotive, aerospace & defense, mining, retail & warehousing, transportation & logistics, utilities & energy, and other industries.

The Hardware category led the Connected Worker market in 2024. This convergence is fueled by mobile apps because every digital workflow ultimately depends on physical devices that workers use on the frontline. Industries like manufacturing, construction, and oil and gas rely heavily on durable, field-ready hardware to collect data, enable real-time guidance, and ensure worker safety. Hardware inherently makes up a bigger share of total market spending since it needs to be upgraded, replaced, and scaled as teams expand.

The largest and fastest-growing Technology is Artificial Intelligence (AI) & Machine Learning (ML), a trend because these technologies make frontline operations smarter, faster, and far more predictive. ML algorithms help refine workflows over time, improving accuracy and reducing errors. Businesses deploy AI-driven solutions to assess worker motions, spot safety risks, predict equipment problems, and give employees context-aware instructions.

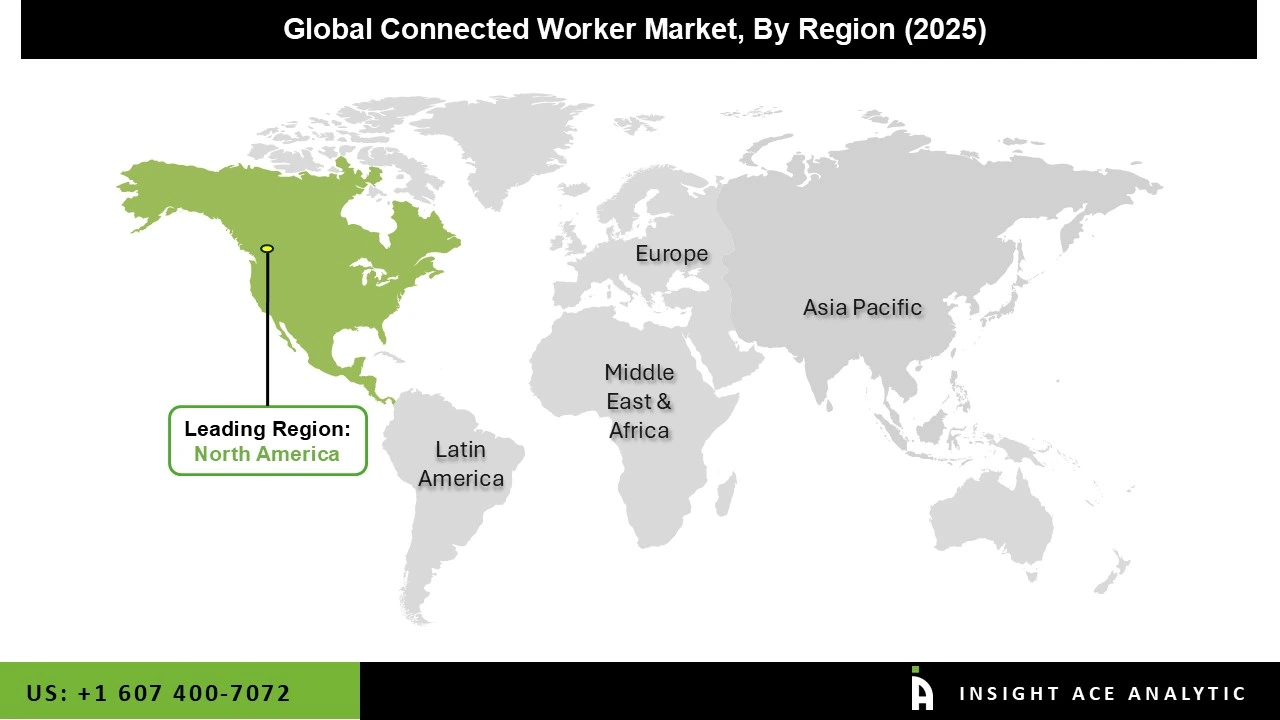

North America led the connected worker market in 2024, with the United States driving growth. Industries here adopt digital tools faster and invest heavily in workplace automation. Manufacturing plants, energy companies, and logistics firms use connected platforms to improve safety, address worker shortages, and streamline operations. Strong technology infrastructure, major solution providers, and advanced industrial IoT systems give the region a clear competitive edge.

Asia-Pacific is the fastest-growing connected worker market, fueled by rapid digital transformation. Manufacturing growth, large infrastructure projects, and stricter safety regulations push companies to adopt connected platforms. Rising investments in industrial IoT, widespread internet access, and affordable smartphones make it easier for businesses to equip frontline workers. This combination drives the region's explosive market expansion.

Connected Worker Market by Offering-

· Hardware

· Software

· Services

Connected Worker Market by Technology-

· Augmented Reality (AR) & Virtual Reality (VR)

· Artificial Intelligence (AI) & Machine Learning (ML)

· Industrial Internet of Things (IIoT)

· Edge Computing

· Other Technologies

Connected Worker Market by Connectivity-

· Wi-Fi

· 5G

· LPWAN (Low Power Wide Area Network)

· Bluetooth

· RFID & NFC

· Others

Connected Worker Market by Application-

· Remote Assistance & Collaboration

· Workforce Safety & Compliance

· Training & Skill Development

· Task Management & Productivity Optimization

· Predictive Maintenance

· Inventory & Asset Management

· Other Applications

Connected Worker Market by Vertical-

· Manufacturing

· Oil & Gas

· Construction

· Healthcare & Pharmaceutical

· Automotive

· Aerospace & Defense

· Mining

· Retail & Warehousing

· Transportation & Logistics

· Utilities & Energy

· Other Verticals

Connected Worker Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.