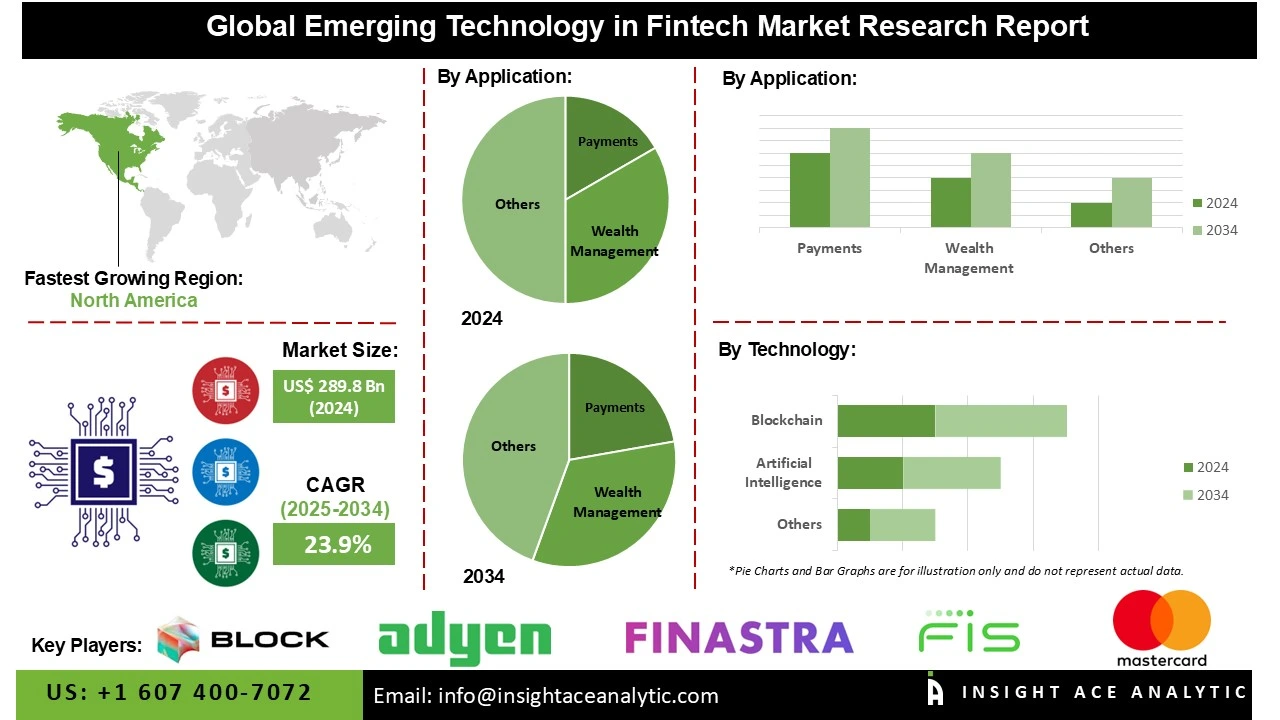

Global Emerging Technology in Fintech Market Size is valued at US$ 289.8 Bn in 2024 and is predicted to reach US$ 2,369.8 Bn by the year 2034 at an 23.9% CAGR during the forecast period for 2025-2034.

Emerging technology in fintech refers to innovative digital tools, such as blockchain, AI, machine learning, big data, and biometrics, that transform financial services by enhancing efficiency, security, accessibility, personalization, and automation across banking, payments, lending, and investment sectors. The new technology within the fintech space is being driven by the accelerating adoption of digital solutions aimed at improving financial accessibility, security, and efficiency.

Significantly contributing to this trend is the growing demand for digital financial services, where customers and enterprises seek quicker, more secure, and more convenient alternatives to conventional banking. Mobile wallets, payment systems utilising blockchain technology, robo-advisors, AI-based credit scoring, and biometric authentication are transforming the delivery of financial services.

The emerging technology in the fintech market is being propelled by rapid digital transformation, growing demand for secure transactions, and customer preference for seamless financial services. Artificial intelligence, machine learning, and big data analytics are powering real-time fraud detection, personalized banking, and automated advisory services. Cloud computing allows scalability and cost savings, while open banking regulations foster collaboration between legacy banks and fintech developers.

Among the key drivers of this change is the evolution of blockchain technology, which offers decentralized, transparent, and tamper-evident transaction records at significantly lower costs and settlement times. North America and Europe are at the forefront of regulatory environments that promote blockchain usage, while the Asia-Pacific region is leading the way in mass adoption, thereby establishing blockchain as the cornerstone of secure digital transactions, cross-border transactions, and smart contracts.

Some of the Key Players in the Emerging Technology in Fintech Market:

· PayPal

· Block, Inc.

· Stripe, Inc.

· Ant Group CO., Ltd.

· FIS

· Adyen

· Finastra

· Mastercard

· Revolut Ltd

· Robinhood

· Goldman Sachs

· N26 SE

· Zelle

· Visa

· Chime Financial, Inc.

The emerging technology in fintech market is segmented by application, technology and By Region. By application, the market is segmented into lending, payments, wealth management, insurance, and others. By technology, the market is segmented into artificial intelligence, blockchain, cloud & edge computing, quantum computing, and others.

In 2024, the payments sector held the major market share due to increasing consumer expectations for smooth, real-time experiences. Biometric authentication, contactless payments, and mobile wallets are revolutionising customer interactions, while blockchain and distributed ledger technologies are growing transparency and minimising fraud in cross-border payments. Open banking rules in most regions are promoting interoperability and innovation, enabling third-party providers to offer personalised payment services. Also, the growth in e-commerce, peer-to-peer transactions, and buy-now-pay-later facilities brings with it an intense desire for scalable, secure, and cost-effective payment infrastructures that facilitate global financial inclusion.

The emerging technology in the fintech market is dominated by cybersecurity, driven by augmented digital transactions, open banking models, and decentralised finance models. European and international markets are exposed to increased threats of fraud, identity theft, and cyberattacks. Banks and other financial institutions are increasingly combining cutting-edge security technologies, such as AI-powered threat identification, biometric verification, and blockchain-based checks, to protect data and maintain strict regulatory compliance, including the GDPR and PSD2. Growing consumer demand for trust, coupled with regulatory mandates, fuels investment in cybersecurity-focused fintech innovation, ensuring secure digital finance ecosystems.

North America dominates the market for emerging technology in fintech due to region’s rapid digital transformation, high adoption of mobile banking, and increasing demand for secure, frictionless financial services. Technologies such as AI, blockchain, open banking APIs, and cloud-based solutions are reshaping payment systems, lending platforms, and wealth management tools. Rising cybersecurity concerns further encourage adoption of advanced biometric authentication and fraud detection tools. Significant venture capital investment and regulatory backing of innovation, in the form of sandboxes and digital-first banking models, facilitate growth. Additionally, the proliferation of embedded finance and real-time payments underscores the growing role of financial technology in industries beyond traditional banking.

Moreover, Europe's emerging technology in the fintech market is also fueled by the region’s rapid digital transformation, strong regulatory support, and widespread consumer adoption of innovative financial solutions. PSD2 and geography-specific open banking regulations enable secure data sharing, allowing fintechs to develop personalised banking, lending, and payments solutions. Increasing demand for contactless payments, AI-driven fraud detection, and blockchain-driven cross-border payments drives market growth. Moreover, Europe's vibrant startup ecosystem, supported by accelerators and venture capital, drives innovation in digital wallets, robo-advisory, and RegTech. Increased collaboration among incumbent banks and fintech firms drives confidence and drives the adoption of innovative financial technologies across industries.

Emerging Technology in Fintech Market by Application-

· Lending

· Payments

· Wealth Management

· Insurance

· Others

Emerging Technology in Fintech Market by Technology-

· Artificial Intelligence

· Blockchain

· Cloud and Edge Computing

· Cybersecurity

· Quantum Computing

· Others

Emerging Technology in Fintech Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Emerging Technology in Fintech Market Snapshot

Chapter 4. Global Emerging Technology in Fintech Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Porter's Five Forces Analysis

4.7. Incremental Opportunity Analysis (US$ MN), 2025-2034

4.8. Global Emerging Technology in Fintech Market Penetration & Growth Prospect Mapping (US$ Mn), 2024-2034

4.9. Competitive Landscape & Market Share Analysis, By Key Player (2024)

4.10. Use/impact of AI on Emerging Technology in Fintech Market Industry Trends

Chapter 5. Emerging Technology in Fintech Market Segmentation 1: By Application, Estimates & Trend Analysis

5.1. Market Share by Application, 2024 & 2034

5.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Application:

5.2.1. Payments

5.2.2. Wealth Management

5.2.3. Insurance

5.2.4. Others

Chapter 6. Emerging Technology in Fintech Market Segmentation 2: By Technology, Estimates & Trend Analysis

6.1. Market Share by Technology, 2024 & 2034

6.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Technology:

6.2.1. Artificial Intelligence

6.2.2. Blockchain

6.2.3. Cloud and Edge Computing

6.2.4. Cybersecurity

6.2.5. Quantum Computing

6.2.6. Others

Chapter 7. Emerging Technology in Fintech Market Segmentation 3: Regional Estimates & Trend Analysis

7.1. Global Emerging Technology in Fintech Market, Regional Snapshot 2024 & 2034

7.2. North America

7.2.1. North America Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Country, 2021-2034

7.2.1.1. US

7.2.1.2. Canada

7.2.2. North America Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Application, 2021-2034

7.2.3. North America Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Technology, 2021-2034

7.3. Europe

7.3.1. Europe Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Country, 2021-2034

7.3.1.1. Germany

7.3.1.2. U.K.

7.3.1.3. France

7.3.1.4. Italy

7.3.1.5. Spain

7.3.1.6. Rest of Europe

7.3.2. Europe Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Application, 2021-2034

7.3.3. Europe Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Technology, 2021-2034

7.4. Asia Pacific

7.4.1. Asia Pacific Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Country, 2021-2034

7.4.1.1. India

7.4.1.2. China

7.4.1.3. Japan

7.4.1.4. Australia

7.4.1.5. South Korea

7.4.1.6. Hong Kong

7.4.1.7. Southeast Asia

7.4.1.8. Rest of Asia Pacific

7.4.2. Asia Pacific Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Application, 2021-2034

7.4.3. Asia Pacific Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Technology, 2021-2034

7.5. Latin America

7.5.1. Latin America Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Country, 2021-2034

7.5.1.1. Brazil

7.5.1.2. Mexico

7.5.1.3. Rest of Latin America

7.5.2. Latin America Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Application, 2021-2034

7.5.3. Latin America Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Technology, 2021-2034

7.6. Middle East & Africa

7.6.1. Middle East & Africa Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by country, 2021-2034

7.6.1.1. GCC Countries

7.6.1.2. Israel

7.6.1.3. South Africa

7.6.1.4. Rest of Middle East and Africa

7.6.2. Middle East & Africa Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Application, 2021-2034

7.6.3. Middle East & Africa Emerging Technology in Fintech Market Revenue (US$ Mn) Estimates and Forecasts by Technology, 2021-2034

Chapter 8. Competitive Landscape

8.1. Major Mergers and Acquisitions/Strategic Alliances

8.2. Company Profiles

8.2.1. Block, Inc.

8.2.1.1. Business Overview

8.2.1.2. Key Application/Service

8.2.1.3. Financial Performance

8.2.1.4. Geographical Presence

8.2.1.5. Recent Developments with Business Strategy

8.2.2. FIS

8.2.3. Adyen

8.2.4. Finastra

8.2.5. Mastercard

8.2.6. Revolut Ltd

8.2.7. Robinhood

8.2.8. Goldman Sachs

8.2.9. N26 SE

8.2.10. Zelle

8.2.11. Chime Financial, Inc.