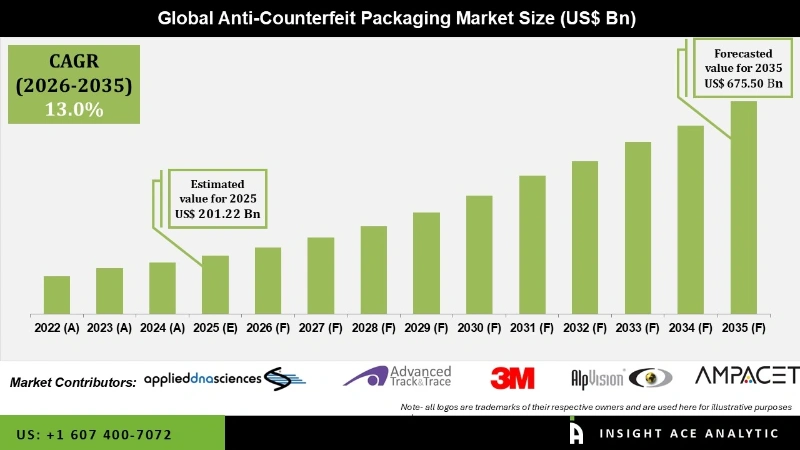

Global Anti-Counterfeit Packaging Market Size is valued at USD 201.22 Billion in 2025 and is predicted to reach USD 675.50 Billion by the year 2035 at a 13.0% CAGR during the forecast period for 2026 to 2035.

Anti-Counterfeit Packaging Market Size, Share & Trends Analysis Report By Authentication Packaging Technology (Ink And Dyes, Security Inks, Holograms, Watermarks, Taggants), Track and Trace Packaging Technology (Barcode Technology, RFID Technology) and Application (Food Packaging, Pharmaceutical Packaging), By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Anti-counterfeit packaging is the process of giving the goods secure packaging to reduce theft or counterfeiting. Anti-counterfeiting packaging is the practice of safe packaging that ensures product safety and thwarts imitation. Companies use anti-counterfeit measures, which aid them in minimizing loss from counterfeiting in terms of income and customer loyalty.

The economic harm to the business and the health hazards to consumers are the two main elements encouraging the adoption of anti-counterfeit packaging. In 2012, losses at pharmaceutical businesses were estimated to be $514 billion. The main cause of this loss of revenue is drug counterfeiting for over-the-counter use. Thus, cutting-edge technologies for product tracking would reduce economic harm and further encourage anti-counterfeit packaging market growth. Additionally, favorable government rules for food and pharmaceutical packaging, which are a major driving force in this industry, encourage anti-counterfeit solutions.

However, the anti-counterfeit packaging market expansion is hindered by consumers' lack of knowledge regarding the need to authenticate food and pharmaceutical items. An additional obstacle to the market's expansion is the growing impact on the process of product distribution, the rising expense of infrastructure, and the growing lack of knowledge, which together represent the main reasons limiting anti-counterfeit packaging market growth.

The anti-counterfeit packaging market is segmented on technologies and application. Based on technologies, the market is segmented into authentication packaging technology (ink and dyes, security inks, holograms, overt holograms, covert hologram, watermarks, physical paper watermark, digital watermark, taggants, detection taggants, identification taggants) and track and trace packaging technology (barcode technology ((bar code labels, paper barcode labels, aluminum barcode labels, polyester barcode labels and ceramic barcode labels)), and RFID technology (low-frequency RFID, Ultra-high frequency RFID, high-frequency RFID)).

On the basis of application, the market is categorized into food packaging (canned food packaging, convenience food packaging, baby food, packaged bakery products, confectionery, packaged dairy products, packaged meat products, packaged seafood) and pharmaceutical packaging (over-the-counter drugs, prescription based drugs).

The pharmaceutical packaging category grabbed the highest revenue share, and it is anticipated that it will continue to maintain that position during the anticipated time. Under the label of the packaged good is where the RFID microchip is located. Utilizing tracking and authentication, RFID technology is utilized in the production process to secure and manage product movement. RFID technologies have been implemented due to the increased demand for technology in governmental and medical institutions to maintain structured records of goods and guard against counterfeiting. These elements are responsible for RFID's market domination.

The pharmaceutical packaging category is anticipated to grow significantly over the forecast period. Anti-counterfeiting is mostly used in the healthcare and pharmaceutical industries because using fake medications can result in drug recalls, legal action, harm to consumers' safety, and reduced brand loyalty. The obvious preventive action done to guarantee that medications in the supply chain are real is the adoption of anti-counterfeit technologies. The expansion of this market would be supported by the increased demand from the pharmaceutical industry for providing and offering genuine pharmaceuticals to consumers.

North America anti-counterfeit packaging market is expected to register the highest market share in revenue in the near future. This is mostly due to the large number of businesses that produce consumer goods, food, and medicine and have used anti-counterfeit packaging. With a projected $65.4 billion in revenue in 2023, the U.S. is predicted to dominate the North American anti-counterfeit packaging market.

In addition, the Asia Pacific is projected to grow rapidly in the global anti-counterfeit packaging market mainly because manufacturers are becoming more conscious of dishonest counterfeiting practices. The market is expected to grow due to the region's expanding population and rising disposable income, which are driving up demand for packaged foods in the area.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 201.22 Billion |

| Revenue forecast in 2035 | USD 675.50 Billion |

| Growth rate CAGR | CAGR of 13.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (Unit)and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Technologies And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | 3D AG (Switzerland), 3M Company (US), Advanced Track and Trace (France), AlpVision S.A. (Switzerland), Ampacet Corporation (US), Applied DNA Sciences Inc (US), Atlantic Zeiser GmBH (Germany), Authentix, Inc., Avery Dennison Corporation (US), CCL Industries (US), Du Pont De Nemours and Company, Impinj Inc. (US), and Intelligent Label Solutions |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Anti-Counterfeit Packaging Market By Technologies

Anti-Counterfeit Packaging Market By Application

Anti-Counterfeit Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.