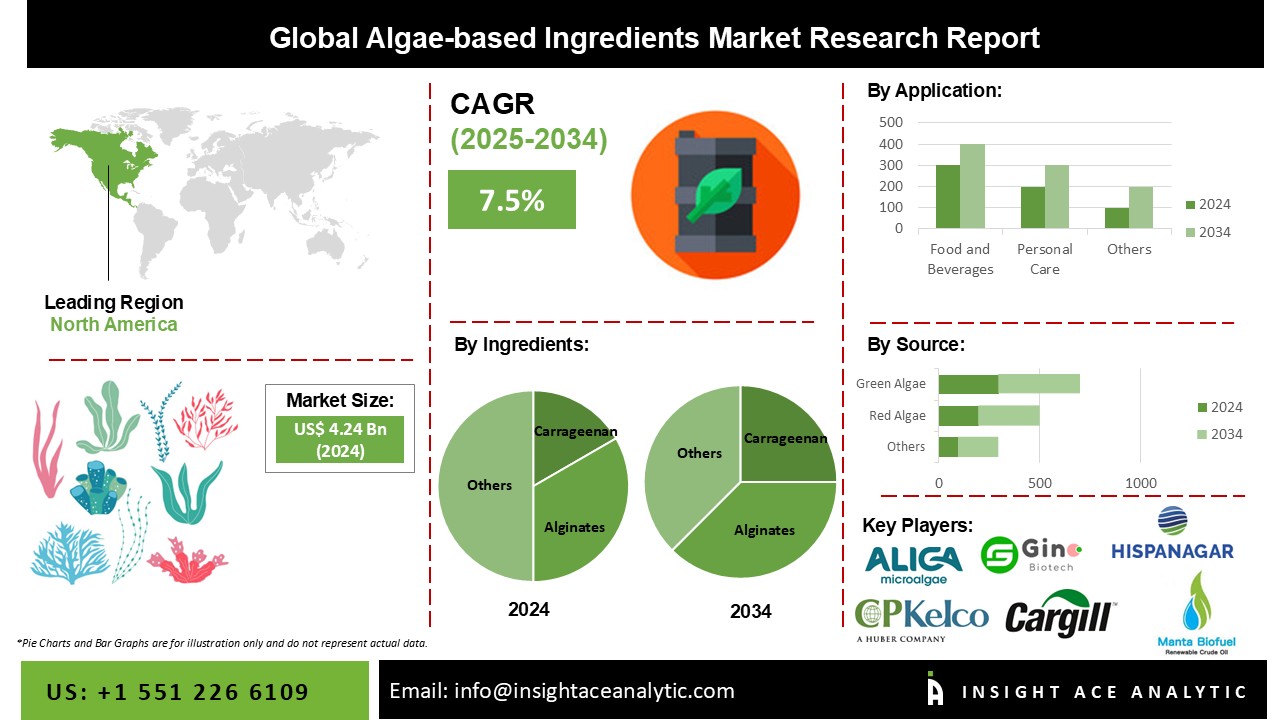

Algae-Based Ingredients Market Size is valued at USD 4.24 Billion in 2024 and is predicted to reach USD 8.64 Billion by the year 2034 at a 7.5% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

A range of finished products, including ice cream, anti-obesity, cakes, anti-diabetic medications, aquatic feed ingredients, toothpaste, and moisturizers, contain algae that have been grown using both agricultural and aquaculture techniques. While other items like alginate, agar, and hydrocolloids are used as gelling, suspending, thickening, and stabilizing agents, dietary components, including proteins, vitamins, carotenoids, and fatty acids, are isolated as primary and secondary metabolites from algae. Over the projected timeframe, increased consumer knowledge of the health benefits of products may present new opportunities for the sector to expand. In the upcoming years, market expansion may be supported by the rising demand for and consumption of nutraceutical products, which is supported by the prevalence of several metabolic and health issues.

In addition, the significant shift in eating patterns brought on by the growth in junk food intake has led to an increase in the occurrence of several diseases like diabetes, heart disease, obesity, chronic illnesses, etc., brought on by poor nutrition and a sedentary lifestyle. The International Diabetes Federation has estimated that 20–25% of adults worldwide suffer from metabolic syndrome. Compared to those without the syndrome, those with it are five times more likely to develop type 2 diabetes, three times likely to have a heart attack or stroke, and twice as likely to die. Shortly, due to their established health benefits, product demand will be boosted by the expanding use of algae-based ingredients in nutraceutical applications.

The algae-based ingredients market is segmented on the Ingredients, Source And Application. Based on ingredients, the market is segmented into carrageenan, alginates, algae protein, beta carotene, algae oil, agar and others. Based on source, the algae-based ingredients market is segmented into red algae, green algae, brown algae and others. Based on the application, the algae-based ingredients market is segmented into food and beverages, personal care, nutraceuticals (dietary supplements, functional foods, others), pharmaceuticals, animal feed (poultry, swine, cattle, aquaculture, pet food) and others.

Based on ingredients, the market is segmented into carrageenan, alginates, algae protein, beta carotene, algae oil, agar and others. The carrageenan category is anticipated to grow significantly over the forecast period. The substance is frequently known for being used as a thickening agent in foods with minimal nutritional value. It is well-known in the pharmaceutical industry to treat various illnesses, including the common cold, cough, bronchitis, tuberculosis, and other intestinal problems. Additionally, the rising use of carrageenan because of its antibacterial and antiviral qualities would boost product demand throughout the anticipated period.

Based on the application, the algae-based ingredients market is segmented into food and beverages, personal care, nutraceuticals (dietary supplements, functional foods, others), pharmaceuticals, animal feed (poultry, swine, cattle, aquaculture, pet food) and others. The food and beverages grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the expected time as algal products are used more frequently in beverages, functional foods, and food additives. However, the personal care segment is projected to develop at the quickest rate during the forecast period. During the projected period, the algal product market growth is anticipated to be driven by consumer desire to look young and the development of novel natural ingredients.

The North American algae-based ingredients market is expected to register the highest market share in revenue shortly, and the US will gain the most significant market share in North America. Food and beverage, nutraceuticals, medicines, and dietary supplements are all expanding industries that have significantly impacted the US market's expansion. The nation's expanding population is another factor that is projected to boost the market for products made from algae. Additionally, the Asia Pacific is anticipated to grow at a significant rate over the course of the forecast period. Due to more health-conscious consumers, lipids like omega-3 are used more frequently in nutraceutical and dietary supplement products, generating a market opportunity for algae-based omega-3 products.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 4.24 Billion |

| Revenue Forecast In 2034 | USD 8.64 Billion |

| Growth Rate CAGR | CAGR of 7.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Ingredients, Source, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Corbion, Aliga Microalgae, Triton, Cargill, Gino Biotech, CP Kelco U.S. Inc., AEP Colloids, KIMIA, Marine Hydrocolloids, AgarGel, Hispanagar SA, Taiwan Chlorella Manufacturing Company, Bioriginal Food & Science Corp, LUS Health Ingredients BV, Manta Biofuel, and Algenol Biotech. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Ingredients-

By Source-

By Application-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.