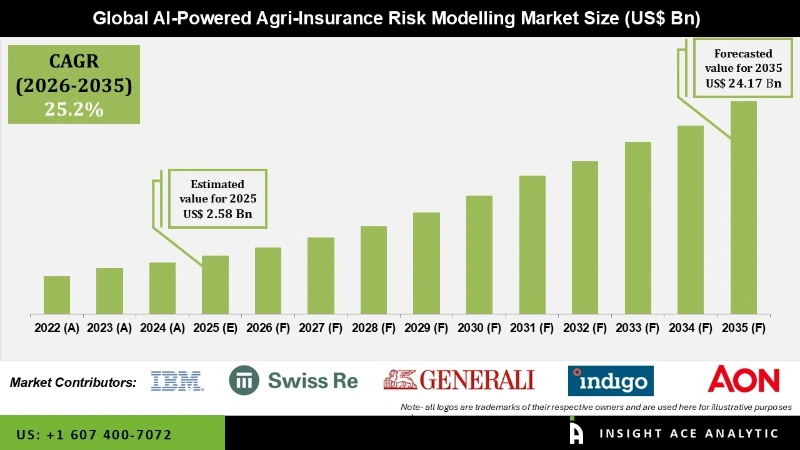

Global AI-Powered Agri-Insurance Risk Modelling Market Size is valued at US$ 2.58 Bn in 2025 and is predicted to reach US$ 24.17 Bn by the year 2035 at an 25.2% CAGR during the forecast period for 2026-2035.

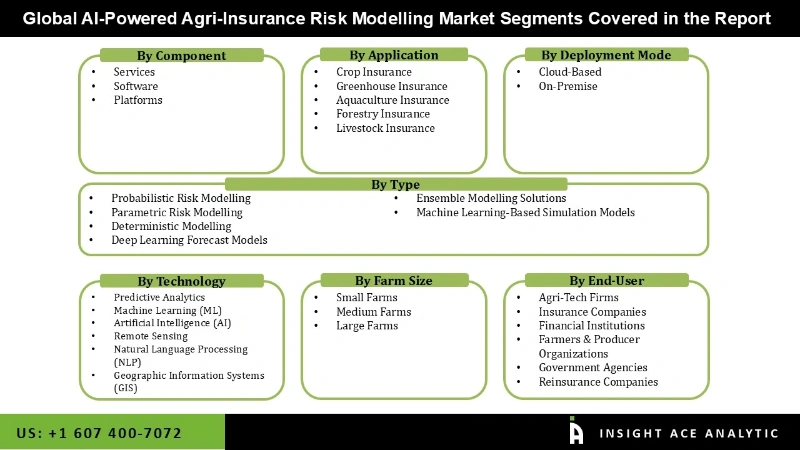

AI-Powered Agri-Insurance Risk Modelling Market Size, Share & Trends Analysis Distribution by Component (Services, Software, and Platforms), Type (Probabilistic Risk Modelling, Parametric Risk Modelling, Deterministic Modelling, Deep Learning Forecast Models, Ensemble Modelling Solutions, and Machine Learning-Based Simulation Models), Deployment Mode (Cloud-Based and On-Premise), Application, Technology, End-use, and Segment Forecasts, 2026 to 2035.

AI-Powered Agri-Insurance Risk Modelling Market Key Takeaways:

|

AI-powered agri-insurance risk modeling uses machine learning, satellite data, IoT sensors, and climate analytics to assess and predict farming risks (droughts, floods, pests, yield losses). These models help insurers price policies accurately, automate claims, and reduce fraud by analyzing real-time field data. The growing use of real-time data integration from satellite imaging, climate monitoring systems, and loT sensors is driving the need for Al-powered agri-insurance risk modelling. The use of dynamic pricing algorithms by insurers that adjust to environmental conditions has given farmers flexible protection. The Al-powered agri-insurance risk modelling market will expand as a result of this.

Furthermore, parametric insurance supported by Al is gaining popularity as a way to guarantee quick, data-driven payouts in the event of floods, droughts, and other emergencies. With the expansion of digital policy delivery channels, particularly through mobile platforms in remote farming regions, this change enables insurers to decrease claim disputes and enhance customer satisfaction. Nonetheless, the Al-powered agri-insurance risk modelling market has certain difficulties. While farmers' lack of knowledge about available products limits market expansion, regulatory barriers can impede the adoption of innovative insurance schemes.

Some of the Key Players in AI-Powered Agri-Insurance Risk Modelling Market are:

The ai-powered agri-insurance risk modelling market is segmented by component, type, deployment mode, application, technology, farm size, and end-use. The component segment comprises services, software, and platforms. By type, the market is segmented into probabilistic risk modelling, parametric risk modelling, deterministic modelling, deep learning forecast models, ensemble modelling solutions, and machine learning-based simulation models. As per the deployment mode, the market is segmented into cloud-based and on-premise. Based on the application, segment consists of crop insurance, greenhouse insurance, aquaculture insurance, forestry insurance, and livestock insurance. By technology, the market is segmented into predictive analytics, machine learning (ML), artificial intelligence (AI), remote sensing, natural language processing (NLP), and geographic information systems (GIS). As per the farm size, the market is segmented into small farms, medium farms, and large farms. By end-use, the market is segmented into agri-tech firms, insurance companies, financial institutions, farmers & producer organizations, government agencies, and reinsurance companies.

In 2024, the parametric risk modelling category dominated the Al-powered agri-insurance risk modelling market because it provided quicker claim settlements based on quantifiable factors like wind speed, temperature, or rainfall. Because of their efficiency and openness, insurers favor these models, particularly in areas that are regularly affected by climatic fluctuations. Increasingly, governments and insurers work together to extend parametric products in regions that are vulnerable to floods and drought, strengthening the financial resilience of rural communities. Furthermore, the adoption in emerging economies is strengthened by the ease of use of payments and weather station integration.

In order to improve underwriting, increase operational effectiveness, and provide new insurance products, insurance companies continue to be the principal consumers of Al models. These companies use modelling tools to automate processes and shorten response times by integrating them with basic insurance systems. Businesses spend on Al when the competition heats up in order to differentiate their products and improve client satisfaction. The agri-tech companies, on the other hand, integrate Al models into their service platforms as innovation partners. By converting unprocessed farm data into risk insights, these companies help insurers and farmers communicate.

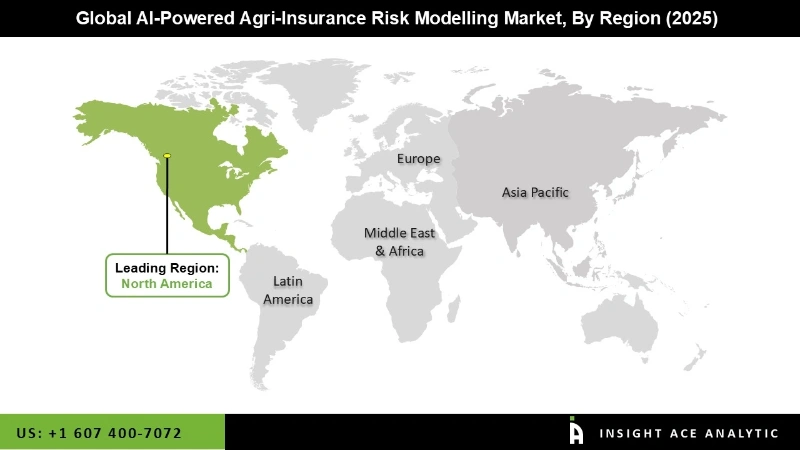

The market for Al-powered agri-insurance risk modelling was dominated by North America because of its robust regulatory support and high level of digital infrastructure. Insurers are using AI in the US and Canada more and more to support precision farming insurance, automate claims, and improve climate risk modelling. These areas are at the forefront of combining machine learning, remote sensing, and satellite analytics to evaluate agricultural damage and livestock health.

The Europe region is predicted to grow rapidly in the market due to rising climate unpredictability and a push for agricultural resilience. In this region, governments and non-governmental organizations also back Al-powered models to enhance disaster aid and subsidy targeting and reduce claim delays. Additionally, as mobile connectivity and digital literacy advance, insurers use Al-driven platforms that are customized to local farming systems and risk profiles to reach a wider audience, promoting inclusive and scalable growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.58 Bn |

| Revenue Forecast In 2035 | USD 24.17 Bn |

| Growth Rate CAGR | CAGR of 25.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, By Type, By Deployment Mode, By Application, By Technology, By Farm Size, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | IBM (Agri-focused Al Insurance Solutions), Swiss Re, Generali, Aon plc, Bayer's Climate Corp, Indigo Ag, AgroGuard, AgRisk Analytics, AgriShield, Lemonade (Agri-Insurance Al), Munich Re, AXA XL, Allianz, John Deere (Precision Agri-Insurance), Taranis, Descartes Labs (Agri-Risk Al), Syngenta (Al Risk Modelling), Swiss Re's Digital Ecosystem Partners, Blue River Technology (Al for Agri-Risk), and Munich Re's Al Agri-Insurance Ventures |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of AI-Powered Agri-Insurance Risk Modelling Market -

AI-Powered Agri-Insurance Risk Modelling Market by Component-

AI-Powered Agri-Insurance Risk Modelling Market by Type -

AI-Powered Agri-Insurance Risk Modelling Market by Deployment Mode-

AI-Powered Agri-Insurance Risk Modelling Market by Application-

AI-Powered Agri-Insurance Risk Modelling Market by Technology-

AI-Powered Agri-Insurance Risk Modelling Market by Farm Size-

AI-Powered Agri-Insurance Risk Modelling Market by End-user-

AI-Powered Agri-Insurance Risk Modelling Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.