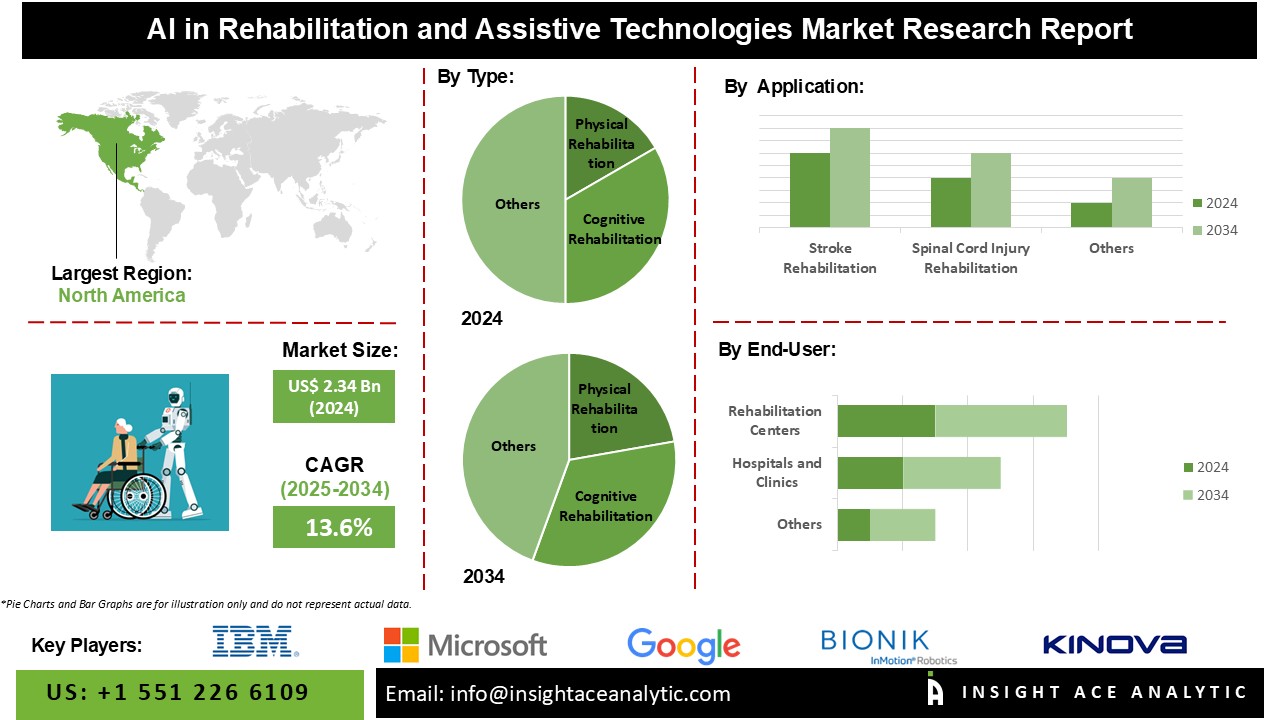

AI in Rehabilitation and Assistive Technologies Market Size was valued at USD 2.34 Bn in 2024 and is predicted to reach USD 8.29 Bn by 2034 at a 13.6% CAGR during the forecast period for 2025-2034.

AI in rehabilitation and assistive technologies has emerged as a game-changer in the healthcare sector, and its transformative potential in rehabilitation and assistive technologies is becoming increasingly evident. Machine learning algorithms, natural language processing, computer vision, and robotics are among the Al technologies powering innovations that cater to personalized patient care, real-time monitoring, and data-driven decision-making. Rehabilitation and assistive technologies encompass various devices and interventions to support individuals with disabilities or impairments to enhance their functional abilities and overall well-being. These technologies play a crucial role in restoring independence and autonomy, providing access to opportunities that may otherwise be limited.

However, the global market is expected to increase during the forecast period due to the surge in adoption of rehabilitation and assistive robotics during the COVID-19 pandemic. The assistive and rehabilitation robotics market offers significant opportunities for manufacturers of robotic rehabilitation and assistive technology. Government initiatives aimed at promoting healthcare accessibility and technological innovation have infused significant momentum into the market. Funding support for research and development projects, coupled with favorable reimbursement policies for assistive devices, has propelled market growth and fostered collaboration within the industry. Embracing a patient-centric approach, these technologies enable personalized treatment plans, real-time monitoring, and remote rehabilitation services, empowering patients to actively engage in their recovery journey and attain optimal outcomes.

The AI in the rehabilitation and assistive technologies market is segmented by type, application, technology, and end user. Based on type, the market is segmented into physical rehabilitation, cognitive rehabilitation, sensory rehabilitation, mobility assistance, and communication assistance. The market is segmented by application into stroke rehabilitation, spinal cord injury rehabilitation, traumatic brain injury rehabilitation, musculoskeletal disorder rehabilitation, cognitive impairment assistance, visual impairment assistance, and hearing impairment assistance. The technology segments the market into machine learning algorithms, natural language processing (NLP), computer vision, robotics and exoskeletons, virtual reality (VR), and augmented reality. The market is segmented by end-user into hospitals and clinics, rehabilitation centers, home care settings, research institutions, and universities.

The AI in the rehabilitation and assistive technologies market is witnessing significant growth, particularly in the physical rehabilitation segment. AI-driven solutions are transforming traditional rehabilitation by enhancing the precision and personalization of treatments. These technologies employ machine learning algorithms and data analytics to develop tailored rehabilitation programs, monitor patient progress in real time, and adjust therapies accordingly. Robotic exoskeletons, AI-powered physiotherapy tools, and virtual reality systems are among the notable innovations that have improved patient outcomes and accelerated recovery times. The integration of AI in physical rehabilitation not only enhances efficiency but also ensures better patient engagement and adherence to rehabilitation protocols, driving the market's growth.

The AI in rehabilitation and assistive technologies market is witnessing significant growth, particularly driven by advancements in machine learning (ML) algorithms. These algorithms enhance the functionality of assistive devices and rehabilitation tools by enabling personalized, adaptive, and intelligent support for users. ML algorithms process large datasets from sensors and user interactions to create tailored rehabilitation programs, improve the accuracy of assistive devices like prosthetics and exoskeletons, and facilitate predictive maintenance. They also play a crucial role in speech recognition and natural language processing for communication aids, as well as in vision-based systems for the visually impaired. The continuous improvement in ML models, fueled by increased computational power and access to extensive training data, is leading to more efficient and effective assistive technologies.

The North American robotic rehabilitation and assistive technologies market, amongst the markets in all the other regions, is projected to hold the largest market share. The market's growth can be attributed majorly to the rising chronic disease prevalence coupled with the escalating geriatric population, and a strong healthcare industry is expected to drive the market's growth in North America during the forecast period. For instance, the U.S. has more than 54 million adults aged 65 and older, or roughly 16.5% of the population in 2022, according to the U.S. Census Bureau. Apart from that, the region's higher prevalence of cardiovascular diseases (CVDs), backed by the growth in robotic rehabilitation and assistive technologies owing to the ongoing development of robotics in North America, is projected to enlarge the market's size during the forecast period. As of 2019, nearly 40% of the population in the U.S.A. was diagnosed with cardiovascular diseases, and approximately 6 million people lost their lives owing to stroke in a similar year. Therefore, all these factors are expected to drive market growth in the region during the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 2.34 Bn |

| Revenue Forecast In 2031 | USD 8.29 Bn |

| Growth Rate CAGR | CAGR of 13.6% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By technology, By End-user and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | IBM Corporation, Microsoft Corporation, Intel Corporation, Google LLC, Apple Inc., Amazon Web Services (AWS), Bionik Laboratories Corp., Hocoma AG, Ekso Bionics Holdings, Inc., SWORD Health, ReWalk Robotics Ltd., Motus Nova, GaitTronics, Neofect, Myomo Inc., Onward Robotics, InMotion Robotics, Fourier Intelligence Co., Ltd., Cyberdyne Inc., Assistive Innovations Corp., RightHear, AiServe Technologies, Kinova Robotics, Gogoa Mobility Robots, NovuMind Inc., and others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

AI in Rehabilitation and Assistive Technologies Market- By Type

AI in Rehabilitation and Assistive Technologies Market- By Application

AI in Rehabilitation and Assistive Technologies Market- By Technology

AI in Rehabilitation and Assistive Technologies Market- By End-User

AI in Rehabilitation and Assistive Technologies Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.