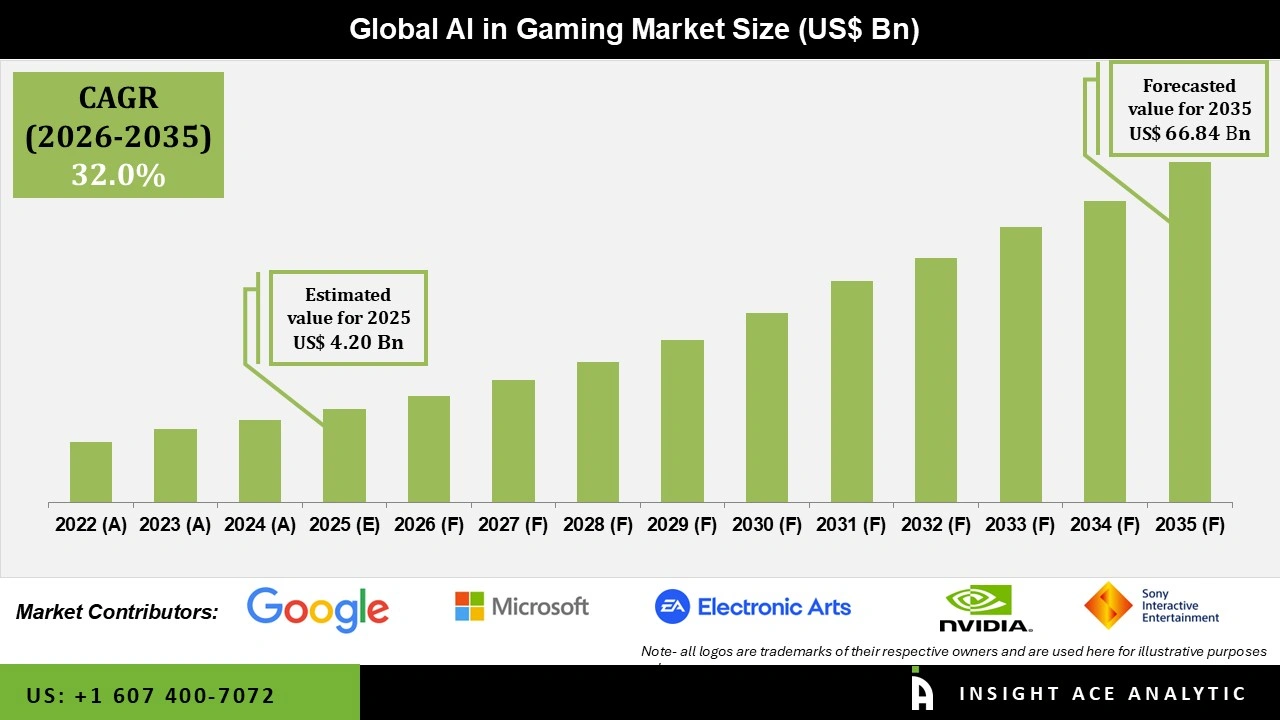

Global AI in Gaming Market Size is valued at USD 4.20 Bn in 2025 and is predicted to reach USD 66.84 Bn by the year 2035 at a 32.00% CAGR during the forecast period for 2026 to 2035.

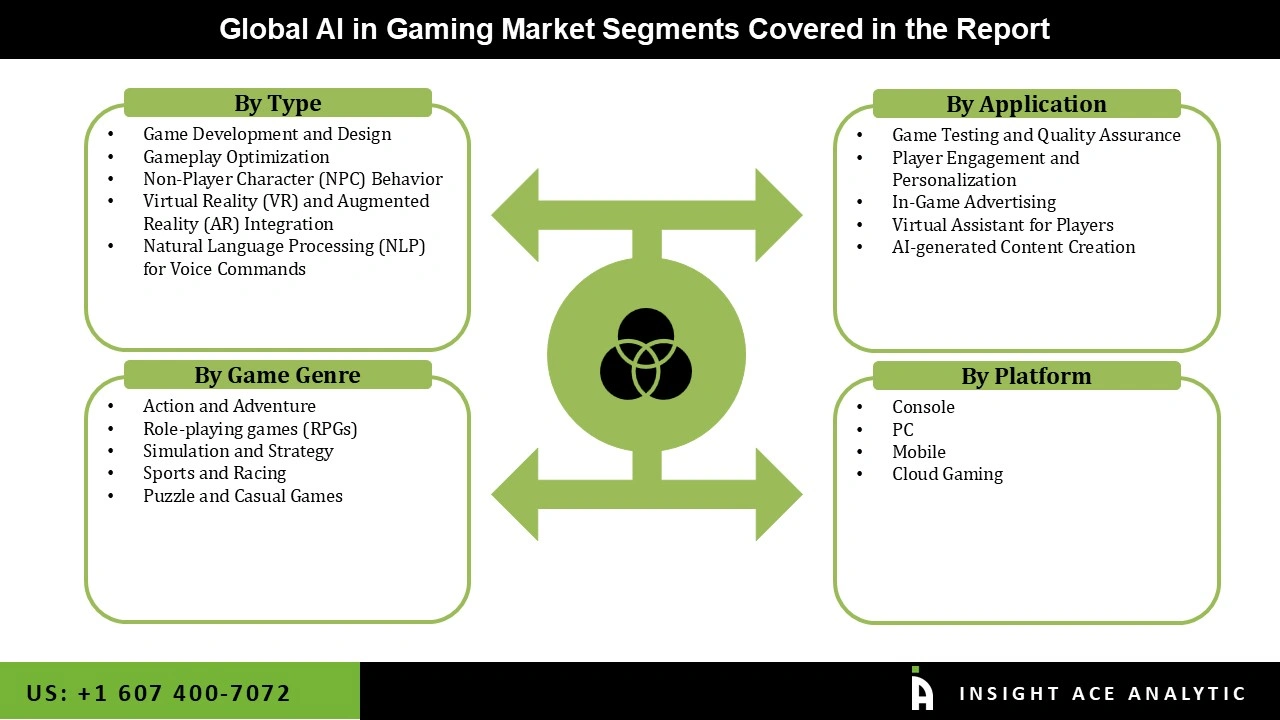

AI in Gaming Market Size, Share & Trends Analysis Report By Type (Game Development and Design, Gameplay Optimization. Non-Player Character (NPC) Behavior, Virtual Reality (VR) and Augmented Reality (AR) Integration, Natural Language Processing (NLP) for Voice Commands), By Application, By Game Genre, By Platform, By Region, And By Segment Forecasts, 2026 to 2035.

AI in Gaming Market Key Takeaways:

|

Artificial Intelligence in gaming has transformed the business by improving gameplay, fostering more immersive experiences, and facilitating more intelligent in-game settings. Artificial intelligence technologies like machine learning, neural networks, and procedural content generation, are being incorporated into multiple facets of game production and user engagement.

With the help of AI, non-player characters are becoming smarter and more lifelike, and players are able to enjoy procedurally generated content that keeps them engaged. AI is also being utilized to enhance gaming system performance, namely in the areas of graphical optimization and latency reduction. In addition, the market is anticipated to be propelled by increased investments in research and development to optimize better gaming processes. In addition, AI is expected to drive the market by automating testing and content development, which ultimately lowers costs in the gaming industry.

However, data privacy concerns, high implementation costs, and issues with regulation and compliance are limiting factors in the market’s expansion. Global markets expanded during the coming years due to market participants in artificial intelligence for games often working together directly through mergers and acquisitions to use cutting-edge AI gaming systems. In order to boost game creation, player experiences, and industry innovation, they collaborate with AI startups and tech companies. Further, because of the rise in demand for home entertainment, COVID-19 hastened the adoption of AI in gaming. Companies use AI to improve games, make experiences more personalized, and handle more player engagement efficiently.

The AI in the gaming market is segmented based on type, application, game genre, and platform. Based on type, the market is segmented into game development and design, gameplay optimization, non-player character (NPC) behavior, virtual reality (VR) and augmented reality (AR) integration, and natural language processing (NLP) for voice commands. By application, the market is segmented into game testing and quality assurance, player engagement and personalization, In-game advertising, virtual assistant for players, and AI-generated content creation. By game genre, the market is segmented into action and adventure, role-playing games (RPGs), simulation and strategy, sports and racing, and puzzle and casual games. By platform, the market is segmented into console, PC, mobile, and cloud gaming.

The non-player character (NPC) AI market in gaming is expected to hold a major global market share because it can make character interactions more realistic and interesting, which improves gameplay. Additionally, dynamic and surprising situations are created by NPCs that adjust to player actions due to advanced AI algorithms, enhancing immersion. Players looking for more immersive experiences are drawn to this innovation, which in turn drives demand for advanced AI systems and has a substantial impact on the expansion of the gaming industry’s market.

The cloud gaming category is projected to grow rapidly in the global AI gaming market because it can provide top-notch gaming experiences without breaking the bank on necessary equipment. In real-time, AI improves visuals, decreases latency, and optimizes game streaming. Another factor fueling the segment’s meteoric rise is the convenience of playing games on many devices and the prevalence of internet connectivity.

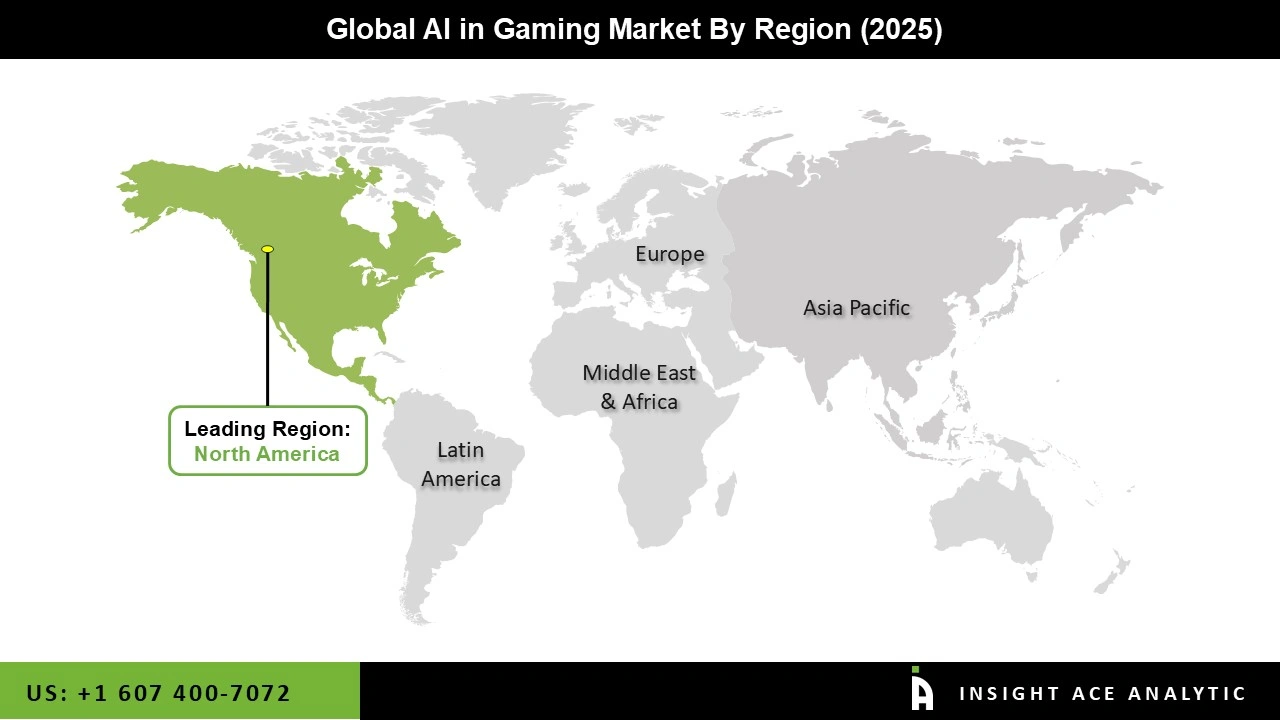

The North American AI in the gaming market is expected to report the largest market share in revenue in the near future. This can be because of the rapid adoption of AI technology in gaming, its robust technological infrastructure, thriving gaming sector, heavy investment in R&D, and innovation-loving culture.

In addition, Europe is likely to grow rapidly in the AI in the gaming market because of the region’s e-sports industry’s meteoric rise, its huge and tech-savvy populace, the proliferation of smartphones, and growing disposable expenditures. Also contributing to this rapid expansion are substantial expenditures on AI research and development, which will boost the market's growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 4.20 Bn |

| Revenue Forecast In 2035 | USD 66.84 Bn |

| Growth Rate CAGR | CAGR of 32.00% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, Game Genre, Platform |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | NVIDIA Corporation, Microsoft Corporation, Sony Interactive Entertainment LLC, Electronic Arts Inc., Activision Blizzard, Inc., Ubisoft Entertainment SA, Google LLC, Advanced Micro Devices, Inc., Unity Technologies, Tencent Holdings Limited, Epic Games, Inc., Take-Two Interactive Software, Inc., Intel Corporation, AMD (Advanced Micro Devices), Square Enix Holdings Co., Ltd., Konami Holdings Corporation, Bandai Namco Entertainment Inc., NetEase, Inc., Bungie, Inc., CD Projekt S.A., Konami Digital Entertainment Co., Ltd., EA Sports (Electronic Arts), 2K Games (Take-Two Interactive), Capcom Co., Ltd., Supercell Oy, Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.