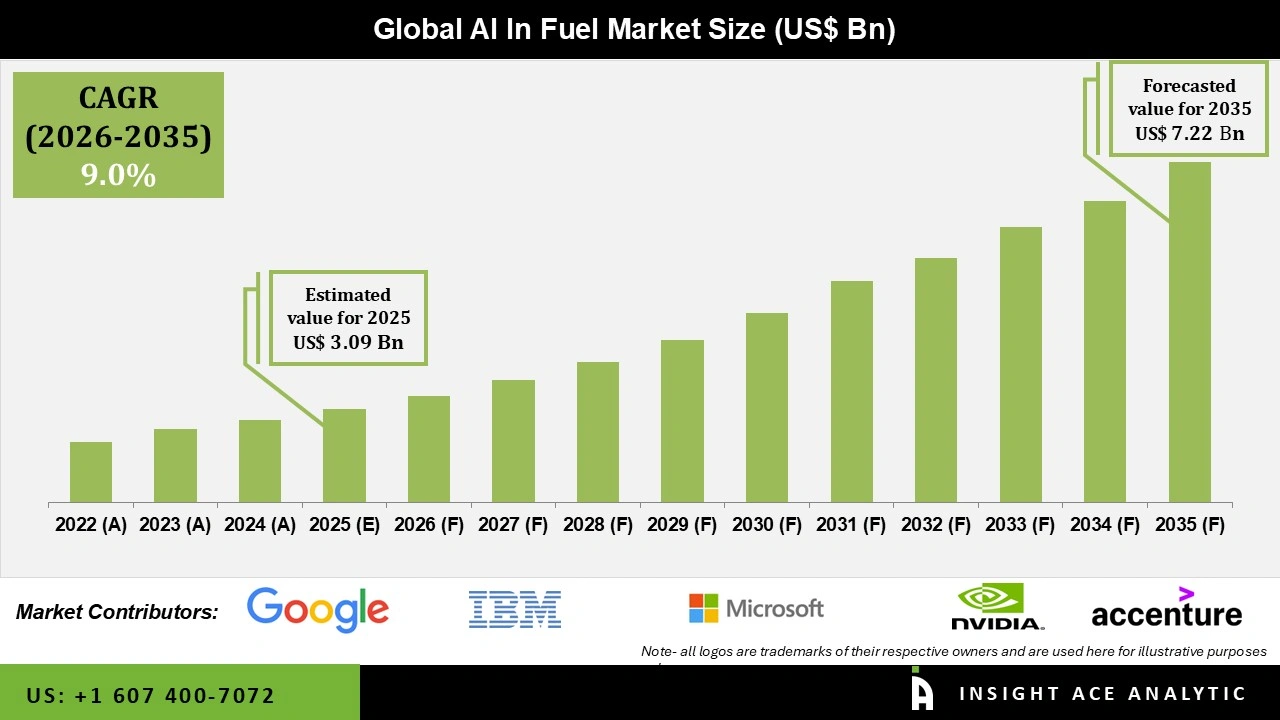

Global AI In Fuel Market Size is valued at USD 3,09 Bn in 2025 and is predicted to reach USD 7.22 Bn by the year 2035 at a 9.0% CAGR during the forecast period for 2026 to 2035.

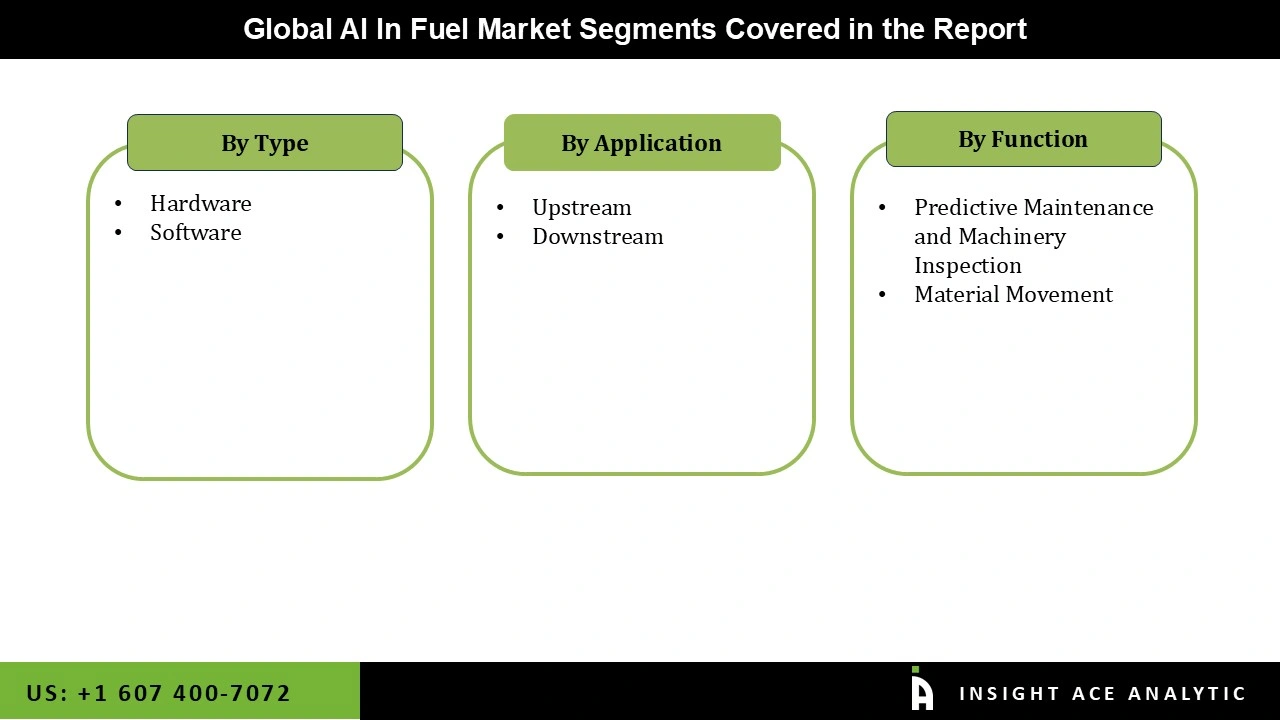

AI in Fuel Market Size, Share & Trends Analysis Report By Type(Hardware, Software), By Function(Predictive Maintenance and Machinery Inspection, Material Movement), By Application(Upstream, Downstream), By Region and Segment Forecasts, 2026 to 2035.

AI in Fuel Market Key Takeaways:

|

Artificial intelligence (AI) has substantial potential for developing and innovating all general-purpose technologies in the modern period. The gasoline supply chain is being optimized with AI, which can help create inventory control, minimize waste, and increase delivery efficiency. The petroleum business is pressured to keep up with the rising global energy demand. Companies in the petroleum sector can benefit from AI by streamlining their operations, cutting costs, and meeting demand while remaining profitable. This is expected to fuel market expansion. Furthermore, escalating demand for cutting-edge solutions in drilling, boiler diagnostics, quality control, planning, and predictive maintenance across various operations is fueling market expansion.

The global AI in fuel market is progressing due to the quick development of new technologies, including natural language processing, machine learning, and computer vision. These technologies are helping the petroleum business by automating processes, enhancing decision-making, and lowering human error. Yet, implementing AI technology in the gasoline industry can be expensive, especially for small & medium-sized enterprises. The high implementation costs of AI technology could discourage some businesses from implementing it, which would restrict industry growth.

The AI in fuel market is segmented on the basis of type, function and application. Based on type, the market is segregated as Hardware and Software. By function, the market is segmented into Predictive Maintenance and Machinery Inspection and Material Movement. Based on application, the market is segmented as Upstream and Downstream.

The predictive maintenance and machinery inspection category is expected to hold a major share in the global AI in fuel market in 2024. Predictive maintenance makes use of Al to monitor machinery and systems, spotting possible difficulties before they develop into major concerns and enabling proactive maintenance planning. Fuel companies may cut down on expensive equipment failures and unforeseen maintenance that can disrupt operations and affect profitability by implementing Al-powered predictive maintenance. As a result, the equipment operates more effectively, has less downtime, and lasts longer.

The downstream segment is projected to grow at a rapid rate in the global AI in fuel market. Through the use of Al technology, refiners may spot chances for cost savings and improve safety protocols by spotting abnormalities and potential risks during the refining process. By monitoring emissions and implementing sustainable processes, Al can also help refiners follow environmental standards. The downstream refining segment is expected to significantly boost the adoption of Al technology in the fuel market as the demand for high-quality fuel products rises and the necessity for more environmentally friendly refining procedures grows.

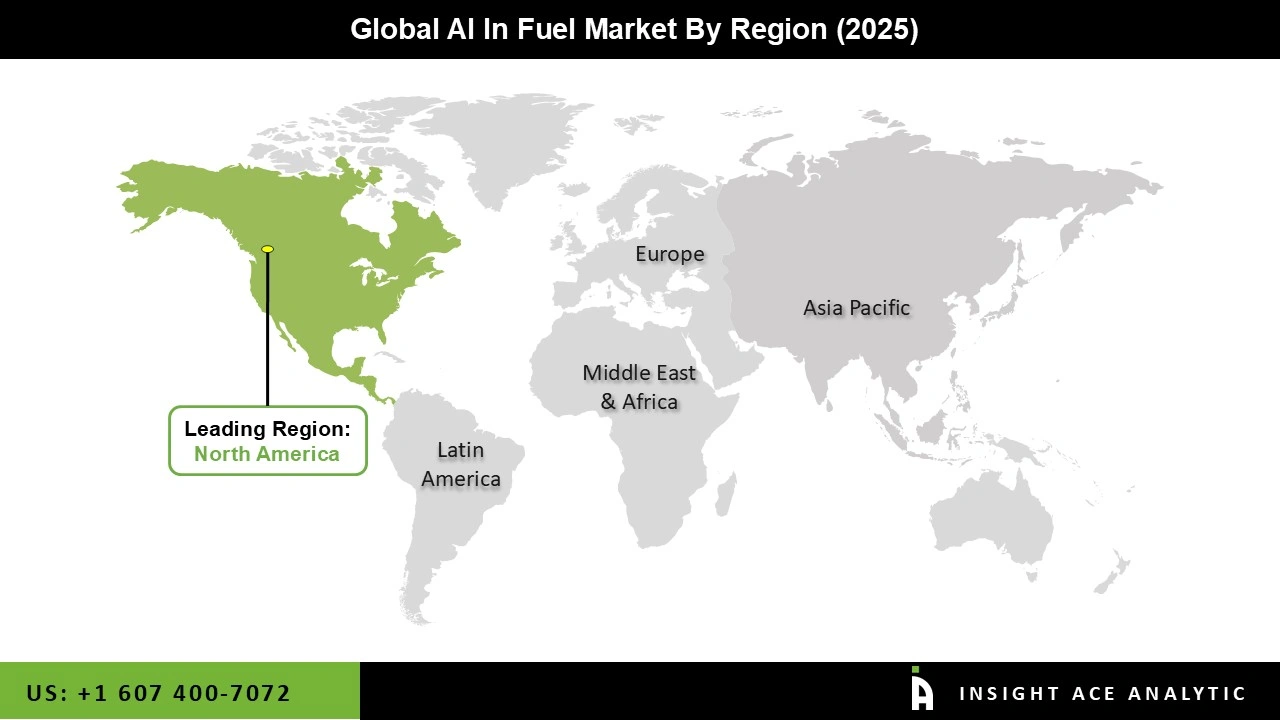

The North America AI in fuel market is expected to register highest market share in terms of revenue in the near future. The region's robust economy, the high rate of adoption of AI technologies by oilfield operators and service providers, the prominence of leading AI software and system providers, and joint R&D investments by public and private organizations are all anticipated to contribute to the demand for AI in the fuel industry.

In addition, Asia Pacific is projected to grow swiftly in the global AI in fuel market. The need for and usage of aluminum in the fuel industries is expanding in this region, which has a high degree of the gaseous and explosive chemical environment to monitor the tanks and gasoline business. The introduction of dependable technology in the fuel sector has led to an expansion of the market in this area.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3,09 Bn |

| Revenue forecast in 2035 | USD 7.22 Bn |

| Growth rate CAGR | CAGR of 9.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn , and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Function And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | IBM, AI, Google LLC, Microsoft Corporation, Oracle, FuGenX Technologies Pvt. Ltd, Cloudera, Cisco Systems, NVIDIA Corporation, Intel Corporation, Accenture plc, Huawei Technologies Co. Ltd, Infosys Limited, Intel Corporation, International Business Machines Corporation, Neudax and Shell plc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.