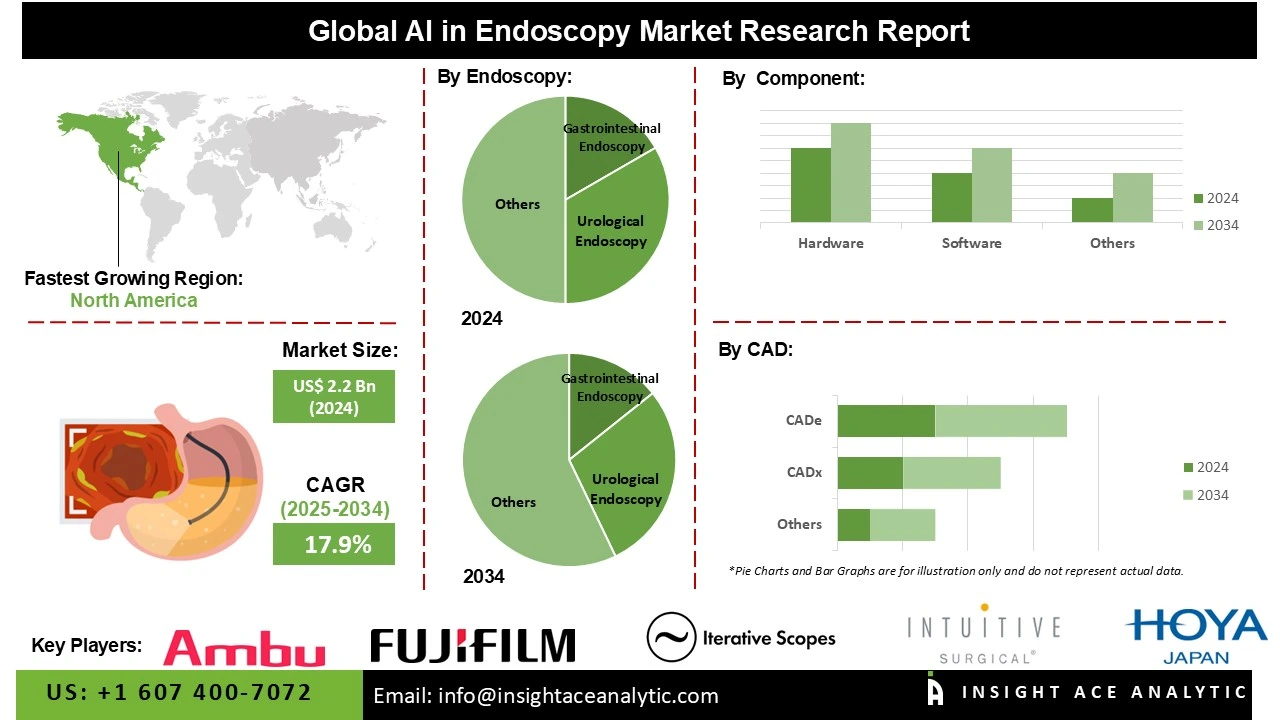

Global AI in Endoscopy Market Size is valued at US$ 2.2 Bn in 2024 and is predicted to reach US$ 10.9 Bn by the year 2034 at an 17.9% CAGR during the forecast period for 2025-2034.

AI in endoscopy refers to the use of artificial intelligence technologies, including machine learning and computer vision, to help in endoscopic procedures by expanding detection, diagnosis, and characterization of gastrointestinal and other internal abnormalities. The AI in endoscopy market is extending rapidly owing to significant technological advancements, including real-time image analysis, deep learning algorithms, and enhanced computer-aided detection systems.

These innovations permits AI to accurately identify polyps, lesions, and early-stage cancers during endoscopic procedures, improving diagnostic precision and reducing human error. A major driver is the rising prevalence of gastrointestinal diseases and colorectal cancer, which fuels need for early and accurate detection. Additionally, hospitals and clinics are adopting AI-enabled endoscopy systems to optimize workflow efficiency, decrease procedure times, and expand patient outcomes. Rising investments in AI research and integration with minimally invasive procedures further accelerate market expansion worldwide.

The AI in endoscopy market is witnessing significant growth, driven primarily by the rapid development of healthcare infrastructure across Europe. Cutting-edge hospitals and diagnostic centers are increasingly adopting AI-powered endoscopy systems for expanded accuracy in detecting gastrointestinal disorders, early cancer diagnosis, and procedural efficiency. AI algorithms helps clinicians by expanding image analysis, reducing human problems, and allowing real-time decision-making. Growing investments in modern healthcare facilities, along with increasing awareness about early disease detection, are accelerating adoption. Moreover, integration of AI with robotic endoscopy and telemedicine platforms is expanding clinical capabilities, further driving the market. This trend is reinforced by supportive government initiatives and research funding.

Some of the Key Players in the AI in Endoscopy Market:

· Ambu

· Fujifilm

· Hoya

· Intuitive Surgical

· Iterative Scopes

· Magentiq Eye

· Medtronic

· NEC

· Olympus

· PENTAX Medical

· Wision Al

· Wuhan EndoAngel Medical Technology

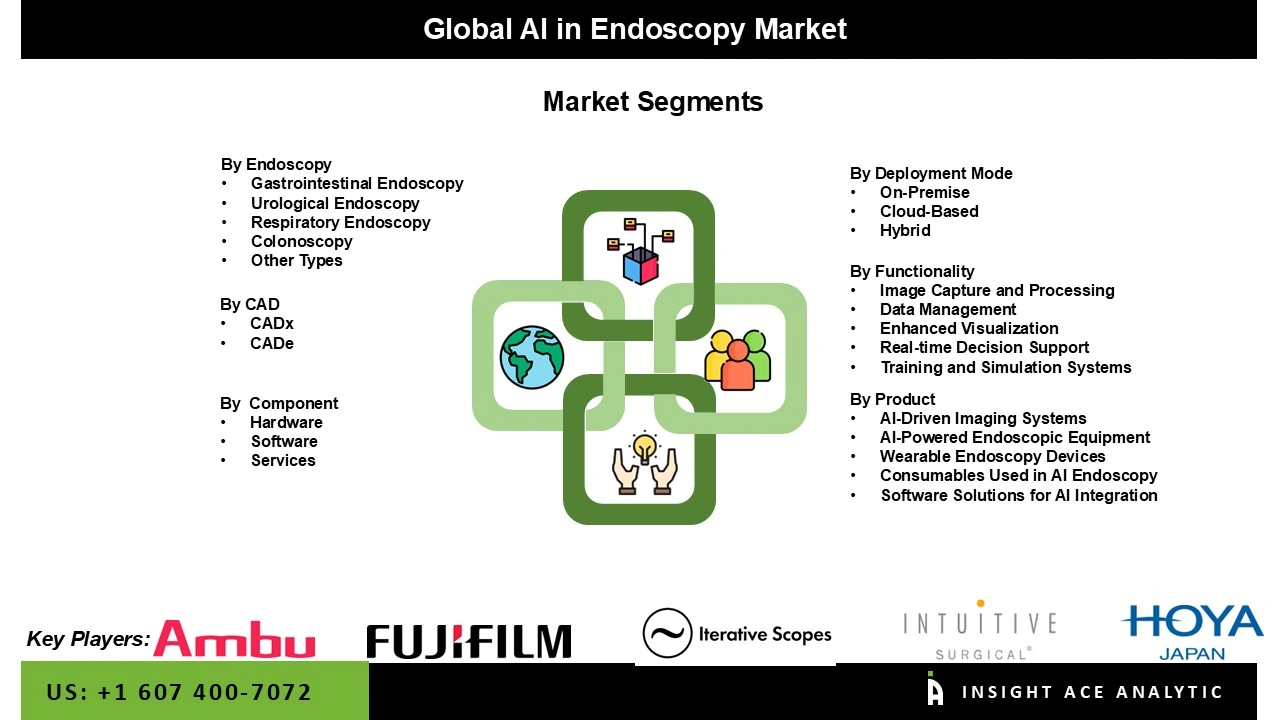

The AI in endoscopy market is segmented by type of endoscopy, type of component, type of CAD, type of technology, type of functionality, type of product and by region. By type of endoscopy, the market is segmented into gastrointestinal endoscopy, urological endoscopy, respiratory endoscopy, colonoscopy, and other types. By type of component, the market is segmented into hardware, software and services. By type of CAD, the market is segmented into CADx, and CADe. By type of technology, the market is segmented into cloud, hybrid, and on-premises. By type of functionality, the market is segmented into image capture & processing, data management, enhanced visualization, real-time decision support, and training & simulation systems. By type of product, the market is segmented into AI-driven imaging systems, AI-powered endoscopic equipment, wearable endoscopy devices, consumables used in AI endoscopy, and software solutions for AI integration.

In 2024, the gastrointestinal endoscopy held the major market share over the projected period due to the growing need for early detection and accurate diagnosis of gastrointestinal disorders such as colorectal cancer, ulcers, and polyps. A key driver is the integration of artificial intelligence algorithms that enhance image analysis, identify abnormalities in exact time, and decrease human issues during endoscopic procedures. AI-powered systems help clinicians in expanding diagnostic accuracy, workflow efficiency, and procedure outcomes.

The AI in endoscopy market is dominated by CADx due to the growing need for accurate and early disease detection, especially in gastrointestinal disorders and cancers. AI-powered CADx systems enhance diagnostic precision by identifying subtle lesions and polyps that may be missed by human eyes. The rising adoption of minimally invasive procedures, advancements in deep learning algorithms, and increasing integration of real-time image analysis in hospitals and diagnostic centers further accelerate market growth and improve patient outcomes.

North America dominates the market for AI in endoscopy due to region’s growing demand for advanced diagnostic accuracy and early disease detection in gastrointestinal disorders and cancers. Artificial intelligence enhances image analysis, polyp detection, and real-time decision-making during endoscopic procedures. Increasing adoption of minimally invasive surgeries, strong presence of leading healthcare technology companies, and supportive regulatory frameworks further propel growth. Additionally, rising healthcare investments and integration of AI-powered systems in hospitals and clinics strengthen market expansion across the region.

Moreover, Europe's AI in endoscopy market is also fueled due to the region’s growing adoption of artificial intelligence for early and accurate disease detection, particularly in gastrointestinal disorders and cancer screening. A major driver is the increasing need to enhance diagnostic precision and reduce human error during endoscopic procedures. Additionally, advancements in image recognition, government support for healthcare digitization, and rising investments in AI-based medical technologies are accelerating adoption across hospitals and research institutions throughout Europe.

AI in Endoscopy Market by Type of Endoscopy-

· Gastrointestinal Endoscopy

· Urological Endoscopy

· Respiratory Endoscopy

· Colonoscopy

· Other Types

AI in Endoscopy Market by Type of Component-

· Hardware

· Software

· Services

AI in Endoscopy Market by Type of CAD-

· CADx

· CADe

AI in Endoscopy Market by Type of Technology-

· Cloud

· Hybrid

· On-Premises

AI in Endoscopy Market by Type of Functionality-

· Image Capture and Processing

· Data Management

· Enhanced Visualization

· Real-time Decision Support

· Training and Simulation Systems

AI in Endoscopy Market by Type of Product-

· AI-Driven Imaging Systems

· AI-Powered Endoscopic Equipment

· Wearable Endoscopy Devices

· Consumables Used in AI Endoscopy

· Software Solutions for AI Integration

AI in Endoscopy Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.