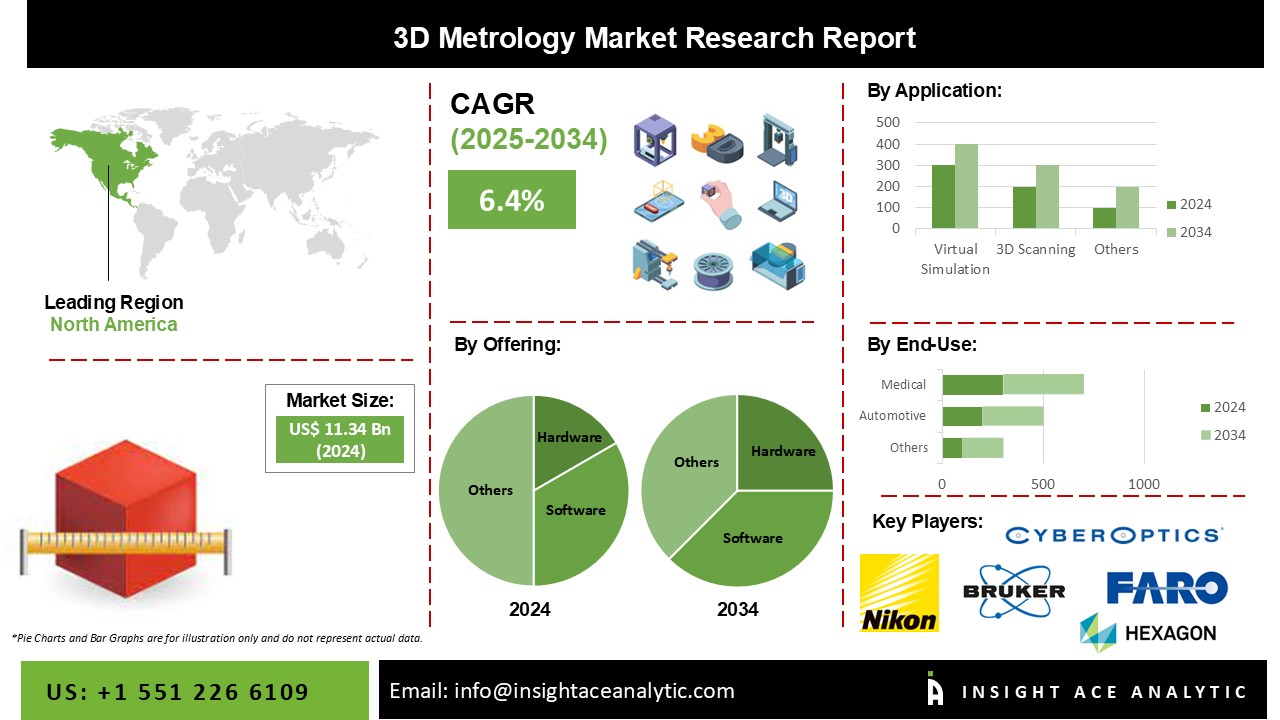

3D Metrology Market Size is valued at 11.34 billion in 2024 and is predicted to reach 20.93 billion by the year 2034 at a 6.4% CAGR during the forecast period for 2025-2034

3D metrology is an innovative 3D scanning and modeling solution for engineering and manufacturing. It was created to assist engineers and designers in easily obtaining high-quality data for their products with no manual labor. It has one of the fastest measurement speeds in the business because of the power of cloud computing.

The global 3D metrology market expansion is anticipated to increase due to factors such as global automotive industry growth and a focus on quality control while manufacturing items. Furthermore, an increase in demand for improved productivity by electronics manufacturing firms increases total industry growth. Significant advancements in software-driven process automation and user-friendly metrology equipment for modified services have also contributed to market expansion.

However, the global 3D metrology sector is hampered by a lack of streamlined software solutions. On the contrary, the 3D metrology business is predicted to benefit from a surge in demand for Industry 4.0 and strong expansion in the aviation industry.

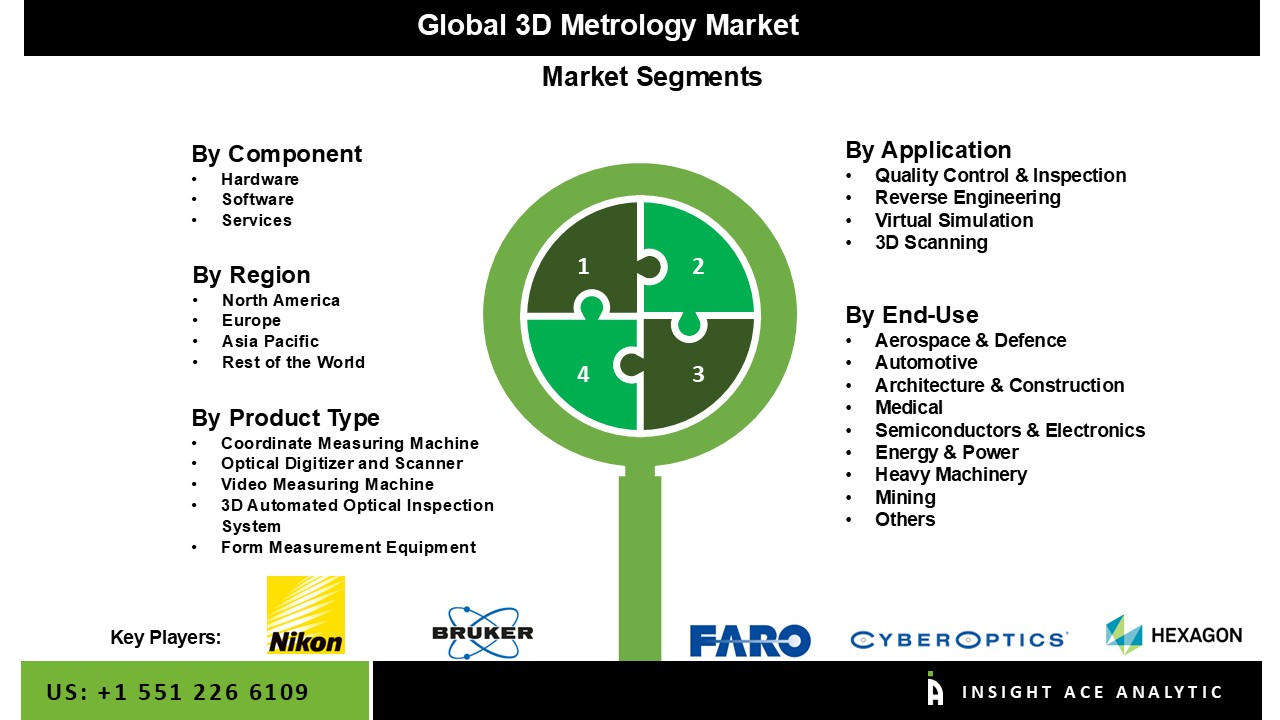

The 3D metrology market is segmented on the basis of offering, product type, application, and end-use. Based on offering, the market is segmented as hardware, software, and services. The 3D metrology market by product type includes Coordinate Measuring Machine (CMM) (Bridge CMM, Gantry CMM, Horizontal Arm CMM, Cantilever CMM, Articulated Arm CMM), Optical Digitizer and Scanner (ODS) (3D Laser Scanner, Structured Light Scanner, Laser Tracker), Video Measuring Machine (VMM) (Vision System, Measuring Microscope, Optical Comparator, Multi-sensor Measuring System), 3D Automated Optical Inspection (AOI) System, Form Measurement Equipment, X-ray and CT Equipment, and Other Product Types. By application, the market is segmented into quality control & inspection, reverse engineering, virtual simulation, and 3D Scanning. The end-user segment includes control cabinets, automotive, medical, construction & electronics, and others.

The software category is expected to hold a major share of the global 3D Metrology Market in 2024. The software allows for complete data collection and measurement from a variety of sources. As a result, it generates comprehensive and self-explanatory graphical and textual reports for identifying production trends and evaluating real-time variances. Furthermore, CAD/CAM software is used for design and manufacturing processes such as tooling, production engineering, sheet metal, metal fabrication, stone, and woodworking. It leads to increased manufacturing efficiencies and value addition to the operation, which drives up demand for software applications over the predicted period.

The reverse engineering segment is projected to grow at a rapid rate in the global 3D Metrology Market owing to the increased demand for intelligent reverse engineering solutions using CAD models or by comparing prototypes of CAD models, primarily in the automobile sector, which has also changed the metrology system's application mechanism.

The North American 3D Metrology Market is expected to register the highest market share in terms of revenue in the near future. The regional market growth is primarily driven by the presence of aerospace, automobile, and pharmaceutical equipment manufacturers in the United States. One of the major factors driving the demand for inline dimensional metrology solutions is the rapid automation of automotive manufacturing plants.

Inline metrology solutions may be used by certain powertrain and body-in-white (BIW) manufacturers in place of traditional measurement methods such as CMMs. Moreover, due to the existence of rising industrial economies such as China, India, and Japan, Asia Pacific is expected to grow significantly. Most industrial products are manufactured in the Asia Pacific area. China leads in the production of industrial output products such as steel, chemicals, iron, consumer goods, transportation, food processing, and equipment. As a result, 3D metrology is employed in a variety of industrial and power generation applications, including forging inspection, raw casting, die and mold design, and inspecting power generation components.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 11.34 Bn |

| Revenue forecast in 2031 | USD 20.93 Bn |

| Growth rate CAGR | CAGR of 6.4% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Offering, Product Types, Application and End Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Applied Materials, Inc., Automated Precision, Inc. (API), Baker Hughes Company, Bruker, Carmar Accuracy Co. Ltd., CyberOptics, FARO Technologies, Inc., GOM Metrology (Zeiss International), Hexagon AB, Keyence Corporation, KLA Corporation, Nikon Metrology NV, Novacam Technologies, Inc., Perceptron, Inc., Renishaw plc, Autodesk Inc., EDM Intelligent Solutions, Proto3000, CREAFORM, Intertek Group Plc, and SGS SA. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of 3D Metrology Market-

3D Metrology Market By Component-

3D Metrology Market, By Product Type

3D Metrology Market By Application-

3D Metrology Market By End-Use-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.