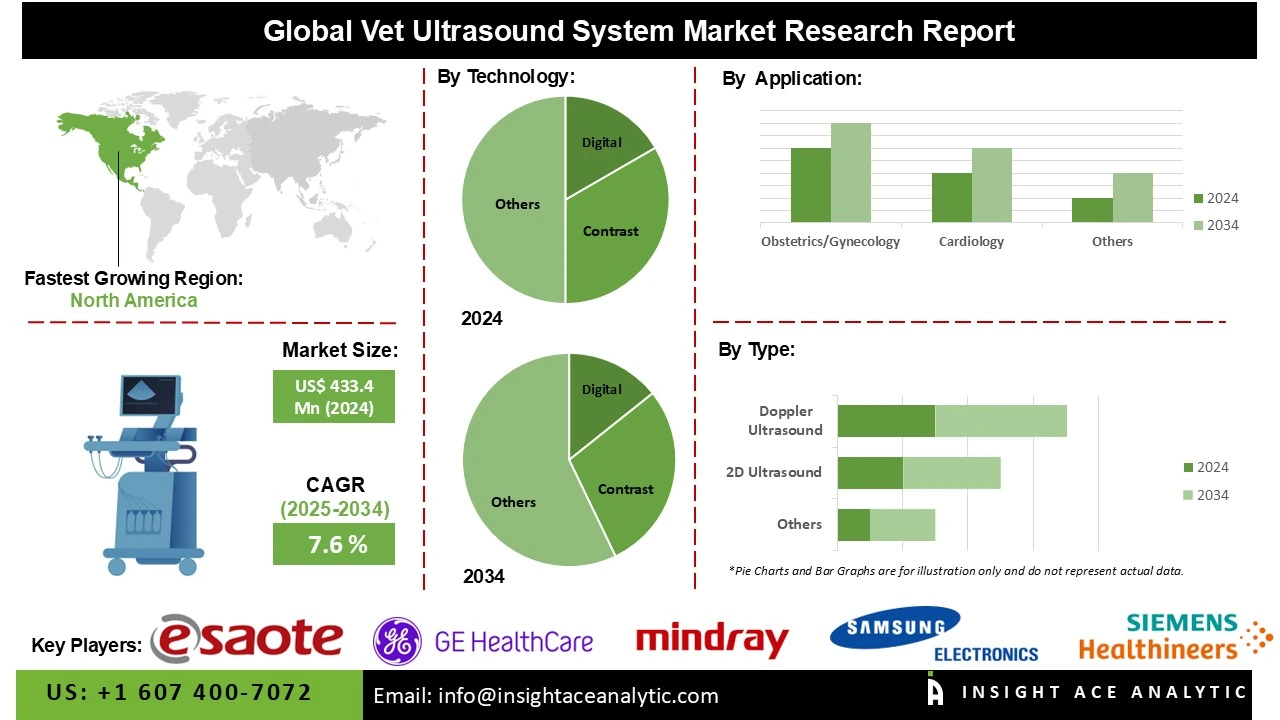

Global Vet Ultrasound System Market Size is valued at US$ 433.4 Mn in 2024 and is predicted to reach US$ 864.6 Mn by the year 2034 at an 7.6% CAGR during the forecast period for 2025-2034.

A veterinary ultrasound system is a vital diagnostic tool that utilizes sound waves to create real-time images of an animal's internal organs and structures. It is non-invasive and safe, commonly used for abdominal exams, heart scans (echocardiography), and pregnancy monitoring. Systems range from portable units for general practice to advanced consoles for specialists, allowing vets to diagnose conditions, guide procedures, and provide a higher standard of care without surgery.

Growing pet adoption, combined with pet humanization, has made owners look for sophisticated diagnostic technologies to identify diseases at an early stage and treat them more efficiently. Increasing livestock health issues, prompted by the requirement to enhance productivity and avoid zoonotic diseases, are further driving demand. Public awareness campaigns by veterinary associations, animal welfare societies, and governments are making consumers aware of preventive care and frequent check-ups. This trend underpins market expansion as veterinary hospitals and clinics advance to high-tech imaging equipment.

The market for veterinary ultrasound systems is growing with the increasing number of animal shelters. More awareness of animal welfare, improved animal protection legislation, and volunteer-run rescue operations are contributing to the establishment of shelters in every part of the world. The shelters shelter rescued, stray, and abandoned animals and need to provide medical evaluations for wounds, diseases, or reproductive disorders. Veterinary ultrasound machines play a vital role in such environments for internal organ condition diagnosis without surgery, detecting pregnancy, and tracking recovery. With efforts towards enhancing care quality in shelters, the need for low-cost, portable, and user-friendly ultrasound machines increases. This is also driven by increasing funding and donations, allowing shelters to invest in high-tech veterinary diagnostic tools.

Some of the Key Players in the Vet Ultrasound System Market:

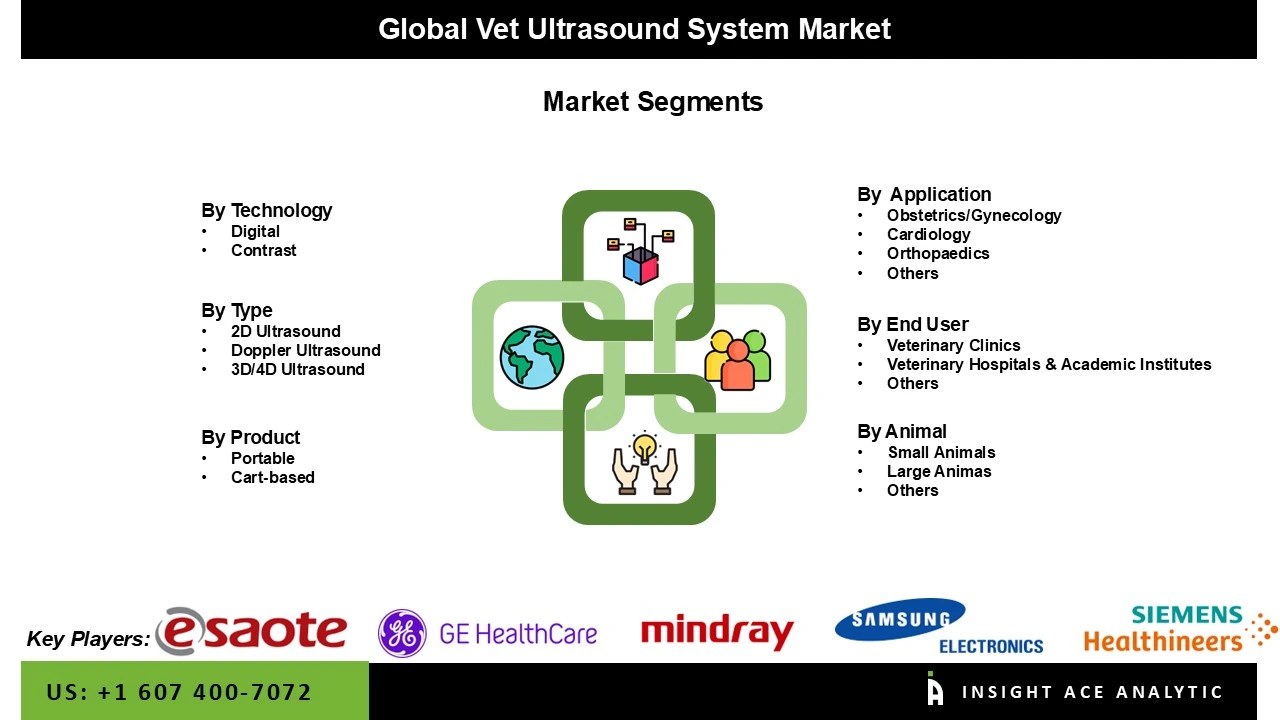

The vet ultrasound system market is segmented by type, product, technology, application, animal, and end-user. By type, the market is segmented into 2D ultrasound, doppler ultrasound, and 3D/4D ultrasound. By product, the market is segmented into portable and cart-based. By technology, the market is segmented into digital, and contrast. By application, the market is segmented into obstetrics/gynaecology, cardiology, orthopaedics, and others. By animal, the market is segmented into small animals, large animals, and others. By end-user, the market is segmented into veterinary clinics, veterinary hospitals & academic institutes, and others.

In 2024, cost-effectiveness, ease of use, and ability to provide real-time, high-resolution imaging for diagnosing animal health issues drive market growth. Its wide applicability in routine veterinary examinations, reproductive monitoring, and internal organ assessment boosts demand. Its universal use in standard veterinary checks, reproductive surveillance, and assessment of internal organs enhances demand. Increased pet ownership, the need to manage livestock health, and technology advances in hand-held ultrasound equipment enhance market growth, particularly in clinics and field veterinary practice.

The vet ultrasound system market is dominated by obstetrics/gynaecology due to the rising demand for advanced reproductive care in animals, particularly in livestock and companion animals. Increasing recognition of early pregnancy diagnosis, fetal health tracking, and breeding management optimisation increases take-up. Emerging technologies like compact and high-resolution imaging devices increase diagnostic precision and on-the-spot care effectiveness, enabling enhanced reproductive outcomes and lowering economic losses associated with failed pregnancies in veterinary medicine.

North America dominates the market for vet ultrasound systems due to rising pet ownership, growing expenditure on animal healthcare, and increasing awareness of early disease detection in companion and livestock animals. Advances in technology, including portable and 3D/4D imaging technologies, improve diagnostic accuracy and convenience for veterinary professionals. The increase in veterinary service coverage, positive government-run animal welfare programs, and the growth of equine and livestock management activity fuel market expansion, promoting adoption in clinics, hospitals, and research centres.

Moreover, Europe is the second-largest region in the market for vet ultrasound systems. This is attributed to growing demand for sophisticated diagnostic equipment in animal health, spurred by rising pet ownership and concern for animal welfare. Increased companion animal adoption, growth in livestock rearing, and the requirement for early identification of diseases are driving demand. Advances in technology, including hand-held and wireless ultrasound scanners, improve diagnostic precision and ease of use for veterinarians. Favourable government policies and rising investment in veterinary infrastructure further fuel market growth in the region.

Vet Ultrasound System Market by Type-

· 2D Ultrasound

· Doppler Ultrasound

· 3D/4D Ultrasound

Vet Ultrasound System Market by Product-

· Portable

· Cart-based

Vet Ultrasound System Market by Application-

· Obstetrics/Gynecology

· Cardiology

· Orthopaedics

· Others

Vet Ultrasound System Market by Animal-

· Small Animals

· Large Animas

· Others

Vet Ultrasound System Market by End-User-

· Veterinary Clinics

· Veterinary Hospitals & Academic Institutes

· Others

Vet Ultrasound System Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.