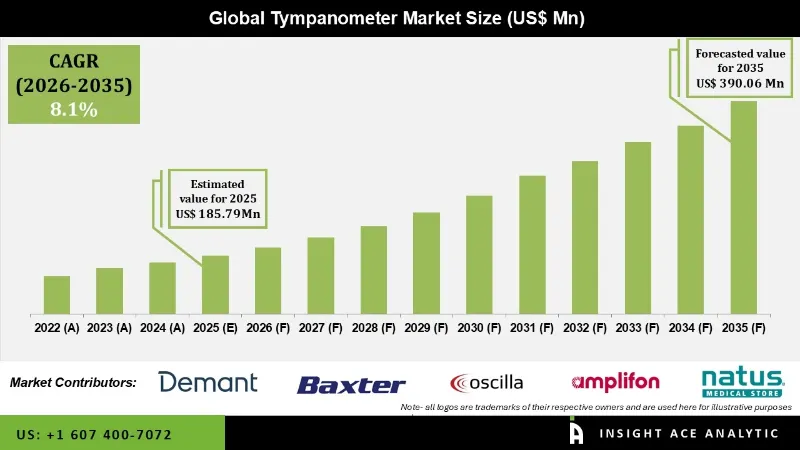

Tympanometer Market Size was valued at USD 185.79 Mn in 2025 and is predicted to reach USD 390.06 Mn by 2035 at a 8.1% CAGR during the forecast period for 2026 to 2035.

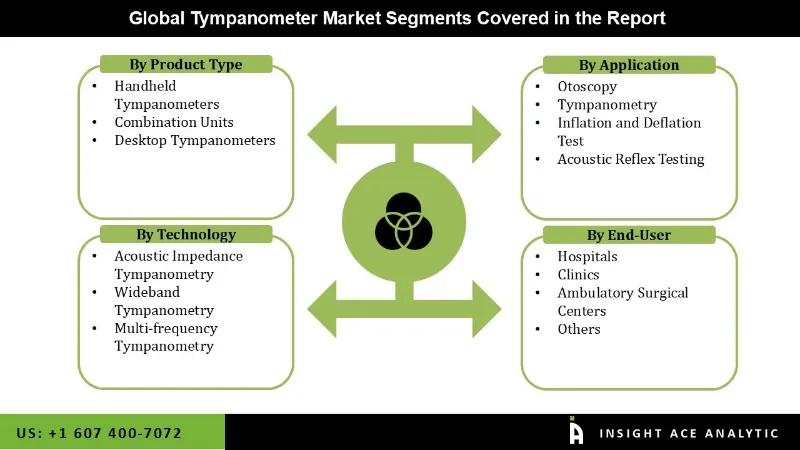

Tympanometer Market Size, Share & Trends Analysis Report, By Product Type (Handheld Tympanometers, Combination Units and Desktop Tympanometers), By Application (Otoscopy, Tympanometry, Inflation, Deflation Test and Acoustic Reflex Testing), By Technology (Acoustic Impedance Tympanometry, Wideband Tympanometry and Multi-Frequency Tympanometry), By End-user (Hospitals, Clinics, Ambulatory Surgical Centers, And Others), By Region, Forecasts, 2026 to 2035

The market for tympanometers is propelled by a variety of factors highlighting the necessity for advanced diagnostic tools in audiology and otolaryngology. Increased awareness of hearing health, the prevalence of ear disorders like otitis media, and the growing emphasis on neonatal and pediatric screening significantly drive the demand for tympanometers. Advances in healthcare infrastructure, alongside technological innovations in Tympanometry, improve the accessibility and effectiveness of these diagnostic devices. With the global population aging and becoming more susceptible to hearing-related issues, the market is experiencing further growth. Furthermore, the shift towards point-of-care testing and the rising preference for decentralized diagnostics encourage the adoption of portable and sophisticated tympanometers. Initiatives such as awareness campaigns, screening programs, and regulatory support that highlight the importance of hearing health also contribute to the widespread utilization of tympanometers in healthcare settings. As healthcare spending increases and the need for precise and efficient diagnostic solutions persists, the tympanometers market is positioned for expansion, with ongoing technological advancements shaping its trajectory.

The tympanometry market is segmented on the basis of technology, application, end users, and technology. Based on technology, the market is segmented as acoustic impedance tympanometry, wideband tympanometry and multi-frequency tympanometry. By application, the market is segmented into otoscopy, tympanometry, inflation, deflation test, and acoustic reflex testing. By end users, the market is segmented into hospitals, clinics, ambulatory surgical centers, and others. By product, the market is segmented into handheld tympanometers, combination units, and desktop tympanometers.

The acoustic impedance tympanometry category is expected to hold a major share of the global tympanometer market in 2022. Acoustic impedance tympanometry is a diagnostic procedure used in the assessment of middle ear function. This variant of tympanometry involves measuring the acoustic impedance of the middle ear. Acoustic impedance refers to the resistance of the middle ear to the transmission of sound waves it signifies a rising trend or prominence of this particular method within the industry. The increasing prominence of this diagnostic approach within the industry is likely driven by advancements in technology and the recognition of its diagnostic value by healthcare professionals.

The hospital segment is projected to grow at a rapid rate in the global tympanometer market. A rise in hospitals engaging in tympanometry indicates an increasing demand for diagnostic services related to middle ear function assessment. This could be attributed to various factors such as a higher prevalence of ear-related disorders, increased awareness among patients and healthcare providers about the importance of early diagnosis, or advancements in tympanometric technology, making it more accessible and reliable.

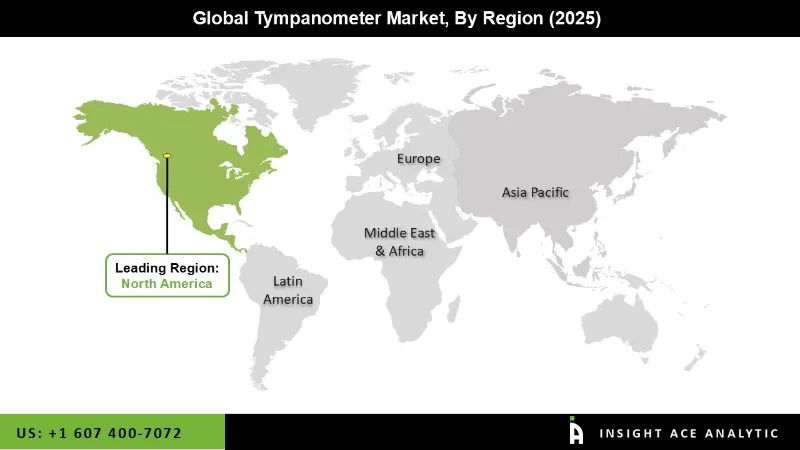

The North American tympanometer market is expected to register the highest market share. Consumers in North America are increasingly aware of the environmental impact of their choices. There is a growing preference for sustainable products, including tympanometers, which are derived from plant or animal waste. This heightened consumer awareness drives market demand in the region. In addition, Asia Pacific is projected to grow at a rapid rate in the global tympanometer market. Major players in the tympanometer market are expanding their presence in the Asia-Pacific region through investments, partnerships, and strategic collaborations. This influx of investments contributes to market growth and stimulates innovation in the region. The Asia-Pacific region offers diverse applications for tympanometers across industries such as automotive, packaging, personal care, and agriculture. The versatility of tympanometers makes them suitable for various applications, driving market demand in the region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 185.79 Mn |

| Revenue Forecast In 2035 | USD 390.06 Mn |

| Growth Rate CAGR | CAGR of 8.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn, Volume (Units) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Application, By Technology, By End-user and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Demant Group, Baxter International, Oscilla Hearing, Amplifon SpA, Natus Medical Incorporated, MedRx Inc., Happersberger Otopront GmbH, Grason-Stadler, MAICO Diagnostic GmbH and INVENTIS s.r.l. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Tympanometer Market- By Product Type

Tympanometer Market- By Application

Tympanometer Market- By Technology

Tympanometer Market- By End User

Tympanometer Market- By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.