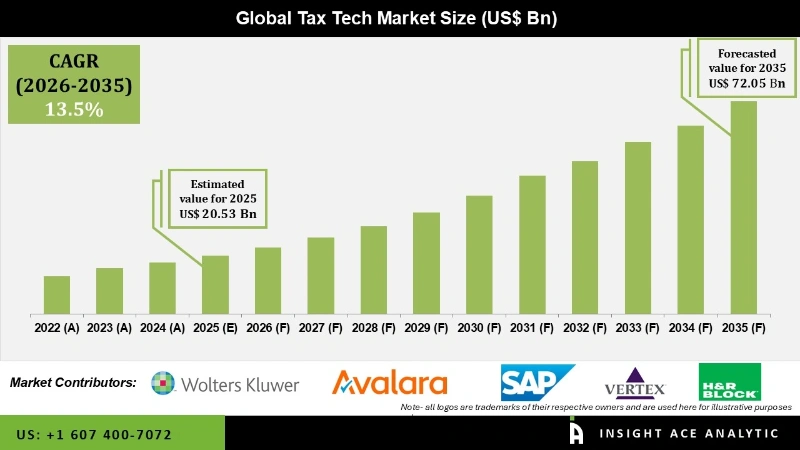

Tax Tech Market Size is valued at USD 20.53 Bn in 2025 and is predicted to reach USD 72.05 Bn by the year 2035 at a 13.50% CAGR during the forecast period for 2026 to 2035.

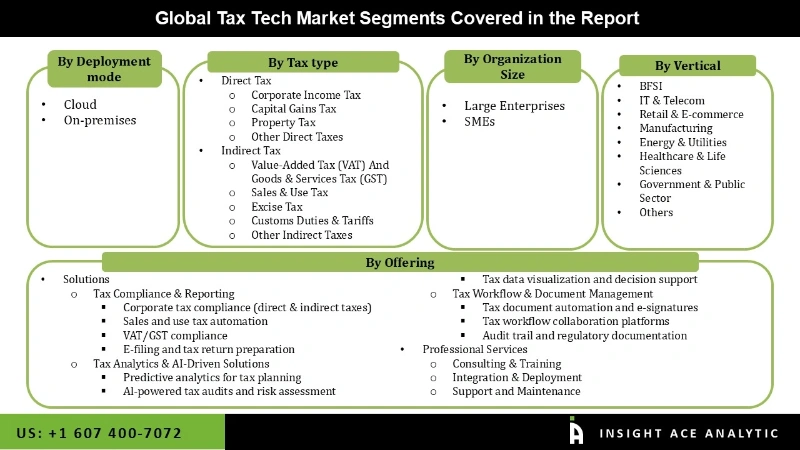

Tax Tech Market Size, Share & Trends Analysis Report By Offering (Solutions (Tax Compliance & Reporting (Corporate tax compliance (direct & indirect taxes), Sales and use tax automation, VAT/GST compliance, E-filing and tax return preparation), Tax Analytics & AI-Driven Solutions), Tax Workflow & Document Management), Professional Services), By Deployment Mode, By Tax Type, By Organization Size, By Vertical, by Region, And by Segment Forecasts, 2026 to 2035.

Tax technology, or tax tech, refers to the use of software, automation, and digital tools to streamline and enhance tax-related processes. It encompasses solutions like tax preparation software, compliance platforms, and data analytics tools that help individuals, businesses, and tax professionals manage tax calculations, filings, and reporting efficiently. By using technologies such as AI, cloud computing, and blockchain, tax tech reduces errors, improves accuracy, and ensures compliance with complex, ever-changing tax regulations, saving time and resources. Due to the growing need for efficient tax technology solutions across various industries, comprising financial services, retail & eCommerce, and IT & telecom, the tax tech industry is expanding. The complexity and regional variations in tax laws present restraints for businesses in terms of compliance and reporting. By offering automation, precision, and real-time updates, the tax tech solution makes it easier for businesses to manage intricate tax laws. The market is expected to rise as a result of this trend, which has raised demand for tax technology solutions as businesses look to streamline tax-related procedures, reduce errors, and ensure adherence to changing tax laws.

However, the growth of businesses in emerging nations is impeded by their ignorance of tax technology. Companies find it difficult to comprehend the advantages of automation and prefer the traditional methods of processing taxes since employees lack digital skills and implementing new technology presents challenges. On the other hand, new opportunities for tax technology are created by the rise of digital currencies and shifting tax laws. Governments desire more transparency, and tax technology assists companies in maintaining compliance by streamlining reporting, automating tax procedures, and precisely handling taxes on digital assets.

The Tax Tech market is segmented based on offering, deployment mode, tax type, organization size, and vertical. The offering, segment includes solutions [tax compliance & reporting (corporate tax compliance (direct & indirect taxes), sales and use tax automation, VAT/GST compliance, e-filing and tax return preparation), tax analytics & AI-driven solutions (predictive analytics for tax planning, al-powered tax audits and risk assessment, tax data visualization and decision support), tax workflow & document management (tax document automation and e-signatures, tax workflow collaboration platforms, audit trail and regulatory documentation)] and professional services [consulting & training, integration & deployment, support and maintenance]. As per the deployment mode, the market is further segmented into cloud and on-premises. By tax type, the market is segmented into direct tax [corporate income tax, capital gains tax, property tax, other direct taxes] and indirect tax [value-added tax (VAT) and goods & services tax (GST), sales & use tax, excise tax, customs duties & tariffs, other indirect taxes]. The organization size segment includes large enterprises and SMEs. The vertical segment comprises BFSI, IT & telecom, retail & e-commerce, manufacturing, energy & utilities, healthcare & life sciences, government & public sector, and others.

The solutions category is expected to hold a major global market share in 2024 as a result of the industry's increasing need for automation, compliance, and real-time tax reporting. More and more businesses are putting tax software into place to handle regulatory upgrades, automate tax computations, and lower human error rates. These solutions enable business houses to improve the accuracy and efficiency of tax processes by offering sophisticated features, including e-filing, audit support, analytics, and system integration with enterprises. As governments around the world implement intricate and ever-changing tax laws, businesses are looking for reliable digital solutions to guarantee timely compliance and reduce financial risk. The popularity of cloud-based tax solutions, which provide cost savings, scalability, and security, encourages wider usage.

The BFSI industry is expected to dominate the tax tech market due to its ability to manage complex financial procedures and stringent regulatory regulations. Since banks and other financial organizations deal with a large number of transactions every day, frequently spanning several nations, they must use effective, automated tax systems. These companies profit from tax technology solutions that lower personnel costs, keep them abreast of constantly evolving tax regulations, and help them remain out of trouble or in compliance. Due to increasing digitization, the majority of BFSI organizations are utilizing automation, cloud-based solutions, and AI-enabled analytics to increase the effectiveness of their tax processes.

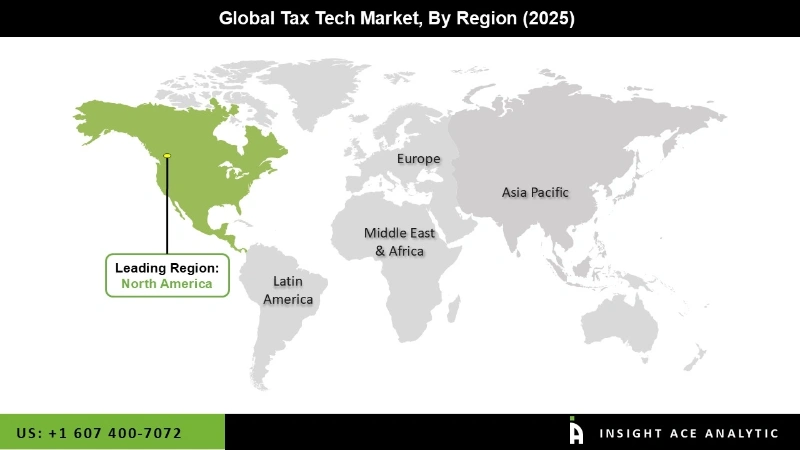

The North American Tax Tech market is expected to register the highest market share in revenue in the near future due to its highly automated tax system, e-filing initiatives supported by the government, and pressing demand for artificial intelligence-driven automation. In response to increasingly stringent regulatory requirements and businesses seeking effective tax compliance, the region is well-positioned to continue its leadership position by offering state-of-the-art cloud-based, AI-driven, and blockchain-based tax solutions. With consistent investments in digital tax innovation and security enhancements, North America will set the standard for tax technology developments that will increase accuracy, compliance, and efficiency for taxpayers and companies. In addition, Asia Pacific is projected to grow rapidly in the global Tax Tech market, driven by an increase in regulatory requirements and a faster pace of digital change. The region's tax environment is being transformed by initiatives such as the European Commission's VAT in the Digital Age (ViDA) package, which makes e-invoicing mandatory, improves digital reporting, and streamlines cross-border VAT procedures.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 20.53 Bn |

| Revenue Forecast In 2035 | USD 72.05 Bn |

| Growth Rate CAGR | CAGR of 13.50% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Offering, Deployment Mode, Tax Type, Organization Size, And Vertical |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Wolters Kluwer, H&R Block, Avalara, Vertex, Thomson Reuters, SAP, ADP, SOVOS, Intuit, Xero, TaxBit, Ryan, TaxAct, Anrok, Corvee, TaxSlayer, Fonoa, Token Tax, Drake Software, TaxJar, Picnic Tax |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Tax Tech Market By Offering-

Tax Tech Market By Deployment mode-

Tax Tech Market By Tax type-

Tax Tech Market By Organization Size-

Tax Tech Market By Vertical-

Tax Tech Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.