The Global Syngas Market Size is recorded at 3,07,131.63 MWth in 2023 and is predicted to reach 7,56,189.38 MWth by the year 2031 at a 12.20% CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

Hydrogen, carbon monoxide, and carbon dioxide are all components of syngas. Gasification is typically how the Syngas is created. Its primary use is for electricity production, and it has some heating benefits. It serves as a versatile intermediary in manufacturing methanol, methanol, and SNG. In between generating petroleum to use as a lubricator and to make other chemicals, there is Syngas. The constantly rising demand for syngas from the global chemical industry is one of the main factors boosting the market for syngas.

Additionally, the advancement of the underground mine gasification (UGC) method is enhancing the market outlook. It makes it easier to finish the in-situ gasification process, which turns coal into Syngas. Since less feedstock needs to be transported to combustion plants, considerable cost savings drive the market's expansion. Increasing environmental awareness and strict government rules surrounding the use of clean fuels are other major drivers of industry expansion. Due to the existence of significant companies on a global scale, the syngas business is predicted to expand quickly.

The market is anticipated to increase due to rising environmental consciousness and government laws regarding the use of bioethanol, as well as rising hydrogen demand for fertilizers and the expanding requirement for Syngas from the electrical and chemical industries. On the other hand, setting up a syngas production plant involves significant finance and capital. The market's expansion is anticipated to be hampered by this aspect.

The syngas market is segmented based on production technology, feedstock, gasifier type and application. Based on production technology, the market is segmented as steam reforming, partial oxidation, auto-thermal reforming, two-step reforming and biomass gasification. Based on gasifier type market is segmented as moving bed gasifier, fluidized bed gasifier, entrained flow gasifier and others. By feedstock, the market is segmented into coal, natural gas, petroleum byproducts and biomass. Based on Application, the market is segmented into chemicals, fuel, electricity and others.

The fluidized bed gasifier category held a major share of the global syngas market in 2021. A fluidized bed gasifier is frequently used to increase turbulence for more thorough combustion of low-responsiveness feedstocks. Additionally, compared to pressurized gasifiers, it has superior cold gas efficiency. Furthermore, the fluidized bed gasifier is one of the most important designs for biomass gasification, largely because it can be used for intermediate processes. Additionally, crucial benefits, including high efficiency, adaptable feedstock, and reduced pollution, are anticipated to boost demand for fluidized bed gasifiers.

The coal segment is projected to grow rapidly in the global Syngas market. This rise can be attributed mostly to the natural abundance of coal for the generation of electricity as well as to its outstanding compatibility as a source of cutting-edge technology for the manufacture of synthetic gas. The production of coal-based Syngas is also significantly influenced by important markets like China and India. This may help the coal segment's global industrial growth during the forecast year.

The North America syngas market is expected to register the highest market share in revenue shortly. This can be attributed to the region's strong focus on the environment, with the increasing adoption of Syngas in different industries, including food & beverages, personal care, packaging, automotive, and others. In addition, the chemical industry in the region is focusing on the production of Syngas to develop sustainable and environmental-friendly solutions.

Growing demand for bio-based components across industries and widespread adoption of Syngas in the production of intermediate chemicals in the region are factors increasing the growth of the target market in the region. In addition, the Asia Pacific region is projected to grow rapidly in the global Syngas market. The Asia-Pacific area is anticipated to expand quickly over the forecast period due to the growing market for Syngas across numerous industries, including fuel, chemicals, and power. Additionally, the expanding industrialization in Asian countries like Japan and Australia would help expand the Asia Pacific synthesis gas market.

|

Report Attribute |

Specifications |

|

Market size value in 2023 |

3,07,131.63 MWth |

|

Volume forecast in 2031 |

7,56,189.38 MWth |

|

Growth rate CAGR |

CAGR of 12.20% from 2024 to 2031 |

|

Quantitative units |

Representation of Volume in MWth, and CAGR from 2024 to 2031 |

|

Historic Year |

2019 to 2023 |

|

Forecast Year |

2024-2031 |

|

Report coverage |

The forecast of Volume, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments covered |

Production Technology, Feedstock, Gasifier Type And Application |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

|

Competitive Landscape |

Air Products Inc., KBC Inc., Siemers, Haldor Topsoe A/S, Air Liquide, BASF S, Synthesis Energy Systems, Inc., Dow Inc. andSasol Limited |

|

Customization scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and available payment methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Syngas Market Snapshot

Chapter 4. Global Syngas Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Production Technology Estimates & Trend Analysis

5.1. by Production Technology & Market Share, 2019 & 2031

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2019 to 2031 for the following by Production Technology:

5.2.1. Steam Reforming

5.2.2. Partial Oxidation

5.2.3. Auto-Thermal Reforming

5.2.4. Two-step Reforming

5.2.5. Biomass Gasification

Chapter 6. Market Segmentation 2: by Gasifier Type Estimates & Trend Analysis

6.1. by Gasifier Type & Market Share, 2019 & 2031

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2019 to 2031 for the following by Gasifier Type:

6.2.1. Moving Bed Gasifier

6.2.2. Fluidized Bed Gasifier

6.2.3. Entrained Flow Gasifier

6.2.4. Others

Chapter 7. Market Segmentation 3: by Feedstock Estimates & Trend Analysis

7.1. by Feedstock & Market Share, 2019 & 2031

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2019 to 2031 for the following by Feedstock:

7.2.1. Coal

7.2.2. Natural Gas

7.2.3. Petroleum Byproducts

7.2.4. Biomass

Chapter 8. Market Segmentation 4: by Application Estimates & Trend Analysis

8.1. by Application & Market Share, 2019 & 2031

8.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2019 to 2031 for the following by Application:

8.2.1. Chemicals

8.2.2. Fuel

8.2.3. Electricity

8.2.4. Others

Chapter 9. Syngas Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. North America

9.1.1. North America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Production Technology, 2024-2031

9.1.2. North America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Gasifier Type, 2024-2031

9.1.3. North America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Feedstock, 2024-2031

9.1.4. North America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Application, 2024-2031

9.1.5. North America Syngas Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

9.2. Europe

9.2.1. Europe Syngas Market Revenue (US$ Million) Estimates and Forecasts by Production Technology, 2024-2031

9.2.2. Europe Syngas Market Revenue (US$ Million) Estimates and Forecasts by Gasifier Type, 2024-2031

9.2.3. Europe Syngas Market Revenue (US$ Million) Estimates and Forecasts by Feedstock, 2024-2031

9.2.4. Europe Syngas Market Revenue (US$ Million) Estimates and Forecasts by Application, 2024-2031

9.2.5. Europe Syngas Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

9.3. Asia Pacific

9.3.1. Asia Pacific Syngas Market Revenue (US$ Million) Estimates and Forecasts by Production Technology, 2024-2031

9.3.2. Asia Pacific Syngas Market Revenue (US$ Million) Estimates and Forecasts by Gasifier Type, 2024-2031

9.3.3. Asia-Pacific Syngas Market Revenue (US$ Million) Estimates and Forecasts by Feedstock, 2024-2031

9.3.4. Asia-Pacific Syngas Market Revenue (US$ Million) Estimates and Forecasts by Application, 2024-2031

9.3.5. Asia Pacific Syngas Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

9.4. Latin America

9.4.1. Latin America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Production Technology, 2024-2031

9.4.2. Latin America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Gasifier Type, 2024-2031

9.4.3. Latin America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Feedstock, 2024-2031

9.4.4. Latin America Syngas Market Revenue (US$ Million) Estimates and Forecasts by Application, 2024-2031

9.4.5. Latin America Syngas Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

9.5. Middle East & Africa

9.5.1. Middle East & Africa Syngas Market Revenue (US$ Million) Estimates and Forecasts by Production Technology, 2024-2031

9.5.2. Middle East & Africa Syngas Market Revenue (US$ Million) Estimates and Forecasts by Gasifier Type, 2024-2031

9.5.3. Middle East & Africa Syngas Market Revenue (US$ Million) Estimates and Forecasts by Feedstock, 2024-2031

9.5.4. Middle East & Africa Syngas Market Revenue (US$ Million) Estimates and Forecasts by Application, 2024-2031

9.5.5. Middle East & Africa Syngas Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

Chapter 10. Competitive Landscape:

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. Air Liquide

10.2.2. Air Products Inc.

10.2.3. BASF SE

10.2.4. Dow Inc.

10.2.5. Haldor Topsoe A/S

10.2.6. KBR Inc.

10.2.7. Sasol Limited

10.2.8. Syngas Energy Holdings

10.2.9. SynGas Technology LLC

10.2.10. Synthesis Energy Systems, Inc.

10.2.11. The Linde Group

10.2.12. Other Prominent Players

Syngas Market By Production Technology

Syngas Market By Gasifier Type

Syngas Market By Feedstock

Syngas Market By Application

Syngas Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

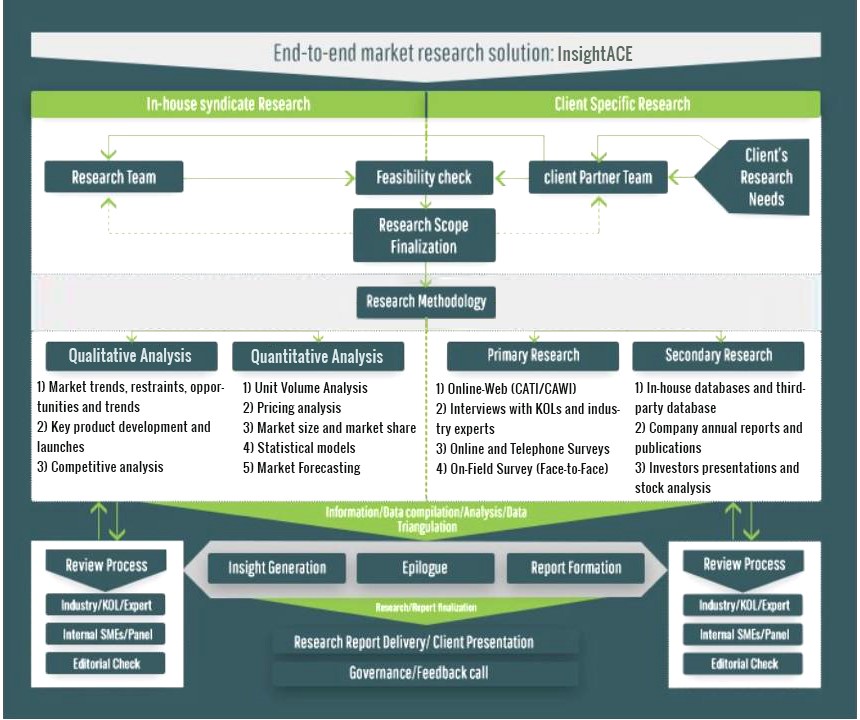

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.