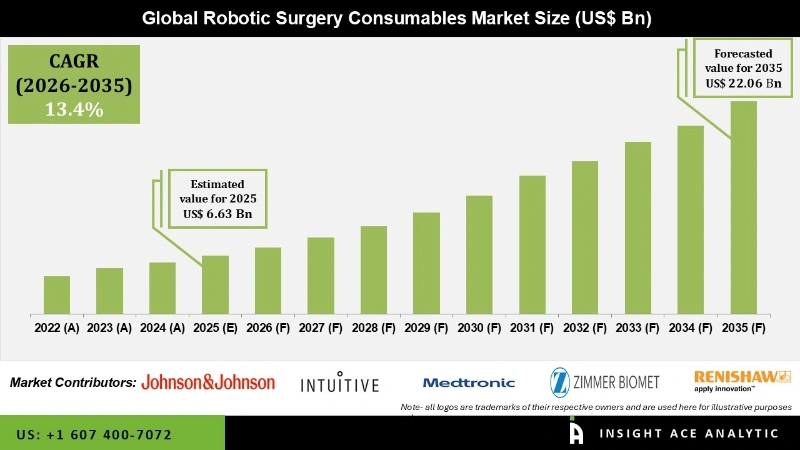

Robotic Surgery Consumables Market Size was valued at USD 6.63 Bn in 2025 and is predicted to reach USD 22.06 Bn by 2035 at a 13.4% CAGR during the forecast period for 2026 to 2035.

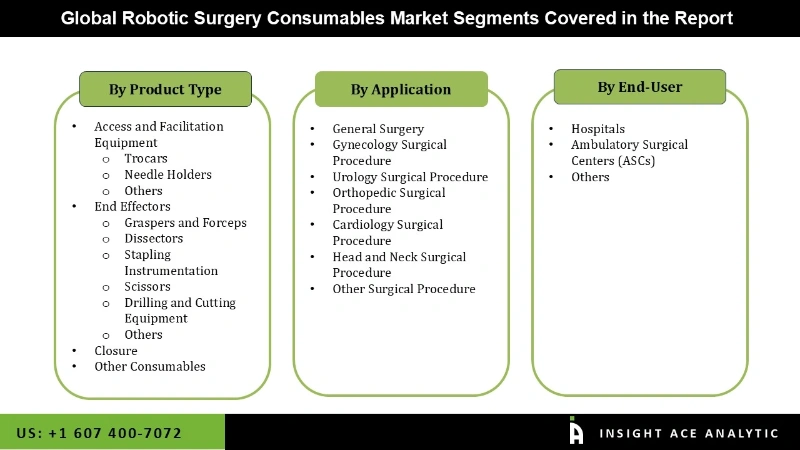

Robotic Surgery Consumables Market Size, Share & Trends Analysis Report, By Product Type (Access and Facilitation Equipment, End Effectors, Closure and Others), By Application (General Surgery, Gynecology Surgical Procedure, Urology Surgical Procedure, Orthopedic Surgical Procedure, Cardiology Surgical Procedure, Head and Neck Surgical Procedure and Others), By End-user (Hospitals, Ambulatory Surgical Centers (ASCs), Others)), By Region, Forecasts, 2026 to 2035.

The integration of robotic surgery consumables into the healthcare sector has instigated transformative shifts, offering manifold advantages. These consumables have significantly elevated surgical precision, expanding the repertoire of procedures achievable with enhanced accuracy and efficacy. Patients reap the benefits of improved outcomes and expedited recovery periods, courtesy of the minimally invasive nature of robotic-assisted surgeries, reducing hospital stays and post-operative discomfort. Furthermore, the adoption of robotic systems has bolstered operating rooms' overall efficiency and productivity, empowering healthcare providers to cater to a larger patient population efficiently.

Moreover, the emergence of cost-effective robotic surgery platforms presents a lucrative opportunity for the consumer market. These platforms widen access to advanced surgical procedures, particularly in emerging markets, driving escalated demand for associated consumables. Additionally, intensified competition stimulates innovation in manufacturing processes, potentially leading to more accessible consumables. Overall, this trend not only amplifies the adoption of robotic surgery but also catalyzes growth and innovation within the consumer market.

The robotic surgery consumables market is segmented on the basis of product type, application and end-user. Based on product type, the market is segmented as end effectors, access and facilitation equipment, closures, and other consumables. By application, the market is segmented into general surgery, gynecology surgical procedure, urology surgical procedure, orthopedics surgical procedure, cardiology surgical procedure, head and neck surgical procedure, and other surgical procedures. By end-user, the market is segmented into hospitals, ambulatory surgical centers (ASCs) and others.

The global robotic surgery consumables market saw the general surgery segment holding the largest share. Notably, the landscape of healthcare robotics has witnessed significant technological advancements, profoundly influencing disease diagnosis and treatment methods. Integrating robotic assistance in general surgeries empowers surgeons to perform intricate procedures with heightened precision and flexibility. Robotic systems offer superior control over consumables used in robotic surgery, attributed to the remarkable talent of the instruments. Despite the generally shorter duration of conventional manual general surgeries than robotic procedures, empirical evidence suggests that robotic-assisted general surgery could lead to reduced blood loss and superior short-term outcomes. The da Vinci Xi, Senhance Robotic System, and Versius Robotic Systems are examples of robotic-assisted systems utilising robotic surgery consumables for general surgery.

The hospital segment emerged as the dominant end-user in the global robotic surgery consumables market. Hospitals notably lead in the acquisition of robotic surgery systems, consequently driving substantial consumption of related consumables. The surge in the adoption of robotic surgery systems can be attributed to significant factors like the escalating prevalence of chronic ailments and the expanding elderly demographic, resulting in a higher volume of annual procedures. A prominent industry trend involves collaborations among major manufacturers of robotic surgery systems and consumables, as well as hospitals.

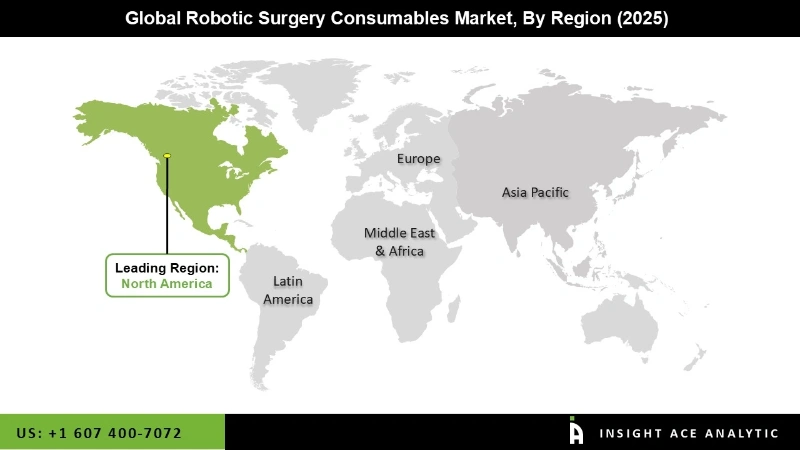

The North American region presents significant market appeal for manufacturers of robotic surgery systems and consumables, owing to the widespread acceptance of advanced surgical technologies among patients and the presence of a robust and expansive healthcare industry. Within North America, the United States is anticipated to emerge as the primary revenue-generating country. The increasing prevalence of chronic diseases and the need for advanced surgical procedures are contributing to the growth of the robotic surgery consumables market in APAC. Additionally, supportive government initiatives, favorable reimbursement policies, and collaborations between healthcare providers and technology companies are further driving regional market expansion.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 6.63 Bn |

| Revenue Forecast In 2035 | USD 22.06 Bn |

| Growth Rate CAGR | CAGR of 13.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Application, By End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Johnson & Johnson (Auris Health, Inc.), Intuitive Surgical, Inc., Medtronic plc. (Mazor Robotics), Zimmer Biomet Holdings (Medtech SA), Renishaw plc., Venus Concept (Restoration Robotics, Inc.), Smith & Nephew plc., Stereotaxis, Inc., Stryker Corporation (Mako Surgical Corporation), THINK Surgical, Inc., CMR Surgical Ltd., Meerecompany, Inc., Virtual Incision Corporation, and Asensus Surgical US, Inc. (Transenterix, Inc.). |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Robotic Surgery Consumables Market- By Product Type

Global Robotic Surgery Consumables Market- By Application

Global Robotic Surgery Consumables Market- By End-User

Global Robotic Surgery Consumables Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.