Global Quicklime Market is valued at USD 6.3 Billion in 2024 and is predicted to reach USD 9.8 Billion by the year 2034 at a 4.7% CAGR during the forecast period for 2025-2034.

Quicklime, also known as burnt lime or calcium oxide (CaO), is a white, caustic, alkaline chemical compound generated by heating limestone (calcium carbonate, CaCO?) in a kiln at approximately 900–1,000°C, a process known as calcination. uicklime has a high melting point of 2600 degrees Celsius and is a white, amorphous solid. When it comes into contact with water, it produces slaked lime. Quicklime is a common flux used to cleanse steel since it is high in calcium and dolomitic. It stabilizes the soil and offers long-lasting plaster and mortar. Additionally, it enhances the quality of water, particularly by removing arsenic and softening it.

Quicklime is used in many different industries, such as mining, metallurgy, paper and pulp production, building and construction materials, and chemicals. The market is growing at a rapid pace because to increased demand from various end-use sectors, particularly the construction and steel industries. Another main factor propelling the quicklime market's expansion is the resurgence of construction activity following COVID-19, as well as the growing infrastructure developments in emerging nations. Furthermore, quicklime's growing use in environmental applications, including wastewater treatment and flue gas desulfurization, is fueling the market's growth.

However, the environmental issues of quicklime manufacture, which requires high energy usage and CO2 emissions, are one major obstacle. Producers have difficulty as a result of strict environmental rules designed to reduce carbon footprints, which force them to invest in cleaner and more sustainable production technology. On the other hand, the quicklime industry offers a number of prospects, such as growing mining activity and the need for iron and steel from various sectors. Certain companies are increasing their production capacity and getting into agreements across multiple locations in order to meet the increasing demand for quicklime products in the building construction and water treatment industries.

The Quicklime market is segmented by application, product, end-use industry and form. Based on indication, it is divided into steel manufacturing, construction, water treatment, chemical manufacturing, and glass production. By product type, the market is classified into high-calcium quicklime, dead-burned magnesite, hydrated lime, and quicklime powder. Based on the end-use industry, the market is categorized into metallurgy, environmental, construction, chemical, and paper. Based on form, the market is segmented into granular, powder, and lump.

In 2024, the global quicklime treatment market was dominated by high-calcium quicklime. Due to its better chemical performance than other kinds of quicklime products, the demand for quicklime is expanding. High calcium performs wonderfully in sludge stabilization, SO2 absorption, acid neutralization, and other alkali-based industrial applications. Additionally, the segment serves as the best alkaline substance for treating odours and disinfecting surfaces. A high calcium content maintains the environment clean and the workers safe. Furthermore, the product filters the sugar juice from sugarcane and beet operations without captive lime kilns. Moreover, flue gas desulfurization (FGD), steel production, nonferrous metal processing, paper production, municipal sanitation, water treatment, and soil stability for building and highway construction are some of the main uses of high calcium.

Quicklime is essential to the production of steel because it refines and eliminates impurities from the metal. The increase in the quicklime market is mostly due to the steel industry's constant growth, which is fueled by the automotive and infrastructure sectors. The need for quicklime in this sector is anticipated to continue to be strong as steel production rises globally, especially in developing nations. Another important quicklime application is water treatment plants. It is essential for maintaining water quality and safety since it may be used to soften water, change pH levels, and remove contaminants. The need for quicklime in this industry is expected to rise as stricter water quality regulations and increased awareness of water conservation and treatment are put into place.

The Asia Pacific quicklime market is expected to register the highest market share in revenue in the near future propelled by swift advancements in infrastructure, urbanization, and industry. The main sectors that use quicklime are steel and construction, which are produced in nations like China and India. Additionally, the market is growing as a result of the region's strong economic growth and increasing environmental activities for pollution control. Moreover, China's quicklime market is growing quickly due to extensive industrial activity, especially in the steel and construction sectors. Government rules that attempt to reduce environmental impacts have caused market dynamics to shift toward the adoption of cleaner production technology. In addition, North America is projected to grow rapidly in the global quicklime market driven by the building and environmental industries. Particularly in the US, quicklime is in high demand in air pollution control systems because of strict environmental restrictions. Quicklime is also in high demand for soil stabilization and building material manufacturing due to the region's developed construction industry. Notwithstanding its relative maturity, North America still has development prospects due to improvements in technology and a greater emphasis on environmentally friendly business practices.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 6.3 Billion |

|

Revenue Forecast In 2034 |

USD 9.8 Billion |

|

Growth Rate CAGR |

CAGR of 4.7% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Application, Product, End-Use Industry And Form |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

|

Competitive Landscape |

Nordkalk, Mississippi Lime Company, Carmeuse, ARA Chemie, Cornelissen Group, Lhoist Group, Nirma Limited, Omya AG, Matsusaka Limestone Co., United States Lime and Minerals, Illinois Lime Company, PPC Ltd., and Graymont. |

|

Customization Scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

|

Pricing and Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Quicklime Market Snapshot

Chapter 4. Global Quicklime Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Porter's Five Forces Analysis

4.7. Incremental Opportunity Analysis (US$ MN), 2024-2034

4.8. Competitive Landscape & Market Share Analysis, By Key Player (2023)

4.9. Use/impact of AI on Quicklime Market Industry Trends

4.10. Global Quicklime Market Penetration & Growth Prospect Mapping (US$ Mn), 2021-2034

Chapter 5. Quicklime Market Segmentation 1: By Application, Estimates & Trend Analysis

5.1. Market Share by Application, 2024 & 2034

5.2. Market Size Revenue (US$ Million) & Forecasts and Trend Analyses, 2021 to 2034 for the following Application:

5.2.1. Steel Manufacturing

5.2.2. Construction

5.2.3. Water Treatment

5.2.4. Chemical Manufacturing

5.2.5. Glass Production

Chapter 6. Quicklime Market Segmentation 2: By Product Type, Estimates & Trend Analysis

6.1. Market Share by Product Type, 2024 & 2034

6.2. Market Size Revenue (US$ Million) & Forecasts and Trend Analyses, 2021 to 2034 for the following Product Type:

6.2.1. High Calcium Quicklime

6.2.2. Dead-burned Magnesite

6.2.3. Hydrated Lime

6.2.4. Quicklime Powder

Chapter 7. Quicklime Market Segmentation 3: By End Use, Estimates & Trend Analysis

7.1. Market Share by End Use, 2024 & 2034

7.2. Market Size Revenue (US$ Million) & Forecasts and Trend Analyses, 2021 to 2034 for the following End Use:

7.2.1. Metallurgy

7.2.2. Environmental

7.2.3. Construction

7.2.4. Chemical

7.2.5. Paper

Chapter 8. Quicklime Market Segmentation 4: By Form, Estimates & Trend Analysis

8.1. Market Share by Form, 2024 & 2034

8.2. Market Size Revenue (US$ Million) & Forecasts and Trend Analyses, 2021 to 2034 for the following Form:

8.2.1. Granular

8.2.2. Powder

8.2.3. Lump

Chapter 9. Quicklime Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. Global Quicklime Market, Regional Snapshot 2024 & 2034

9.2. North America

9.2.1. North America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.2.1.1. US

9.2.1.2. Canada

9.2.2. North America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.2.3. North America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.2.4. North America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by End Use, 2021-2034

9.2.5. North America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Form, 2021-2034

9.3. Europe

9.3.1. Europe Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.3.1.1. Germany

9.3.1.2. U.K.

9.3.1.3. France

9.3.1.4. Italy

9.3.1.5. Spain

9.3.1.6. Rest of Europe

9.3.2. Europe Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.3.3. Europe Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.3.4. Europe Quicklime Market Revenue (US$ Million) Estimates and Forecasts by End Use, 2021-2034

9.3.5. Europe Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Form, 2021-2034

9.4. Asia Pacific

9.4.1. Asia Pacific Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.4.1.1. India

9.4.1.2. China

9.4.1.3. Japan

9.4.1.4. Australia

9.4.1.5. South Korea

9.4.1.6. Hong Kong

9.4.1.7. Southeast Asia

9.4.1.8. Rest of Asia Pacific

9.4.2. Asia Pacific Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.4.3. Asia Pacific Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.4.4. Asia Pacific Quicklime Market Revenue (US$ Million) Estimates and Forecasts by End Use, 2021-2034

9.4.5. Asia Pacific Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Form, 2021-2034

9.5. Latin America

9.5.1. Latin America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.5.1.1. Brazil

9.5.1.2. Mexico

9.5.1.3. Rest of Latin America

9.5.2. Latin America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.5.3. Latin America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.5.4. Latin America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by End Use, 2021-2034

9.5.5. Latin America Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Form, 2021-2034

9.6. Middle East & Africa

9.6.1. Middle East & Africa Wind Turbine Rotor Blade Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.6.1.1. GCC Countries

9.6.1.2. Israel

9.6.1.3. South Africa

9.6.1.4. Rest of Middle East and Africa

9.6.2. Middle East & Africa Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.6.3. Middle East & Africa Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.6.4. Middle East & Africa Quicklime Market Revenue (US$ Million) Estimates and Forecasts by End Use, 2021-2034

9.6.5. Middle East & Africa Quicklime Market Revenue (US$ Million) Estimates and Forecasts by Form, 2021-2034

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. Nordkalk

10.2.1.1. Business Overview

10.2.1.2. Key Type/Service Overview

10.2.1.3. Financial Performance

10.2.1.4. Geographical Presence

10.2.1.5. Recent Developments with Business Strategy

10.2.2. Mississippi Lime Company

10.2.3. Carmeuse

10.2.4. ARA Chemie

10.2.5. Cornelissen Group

10.2.6. Lhoist Group

10.2.7. Nirma Limited

10.2.8. Omya AG

10.2.9. Matsusaka Limestone Co.

10.2.10. United States Lime and Minerals

10.2.11. Illinois Lime Company

10.2.12. PPC Ltd.

10.2.13. Graymont

Segmentation of Quicklime Market-

Quicklime Market By Application-

Quicklime Market By Product Type-

Quicklime Market By End-use Industry

Quicklime Market By Form

Quicklime Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

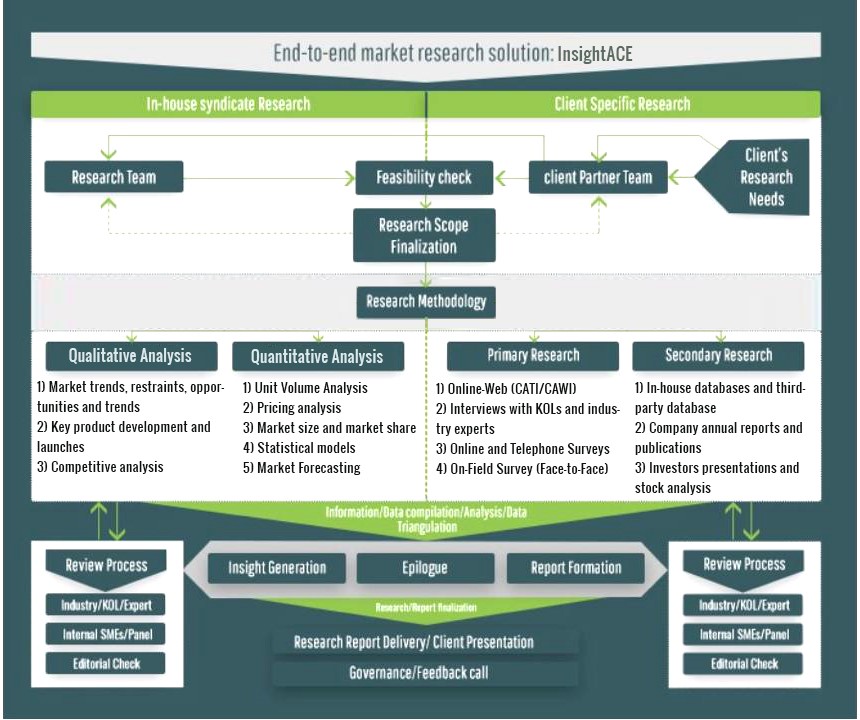

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.