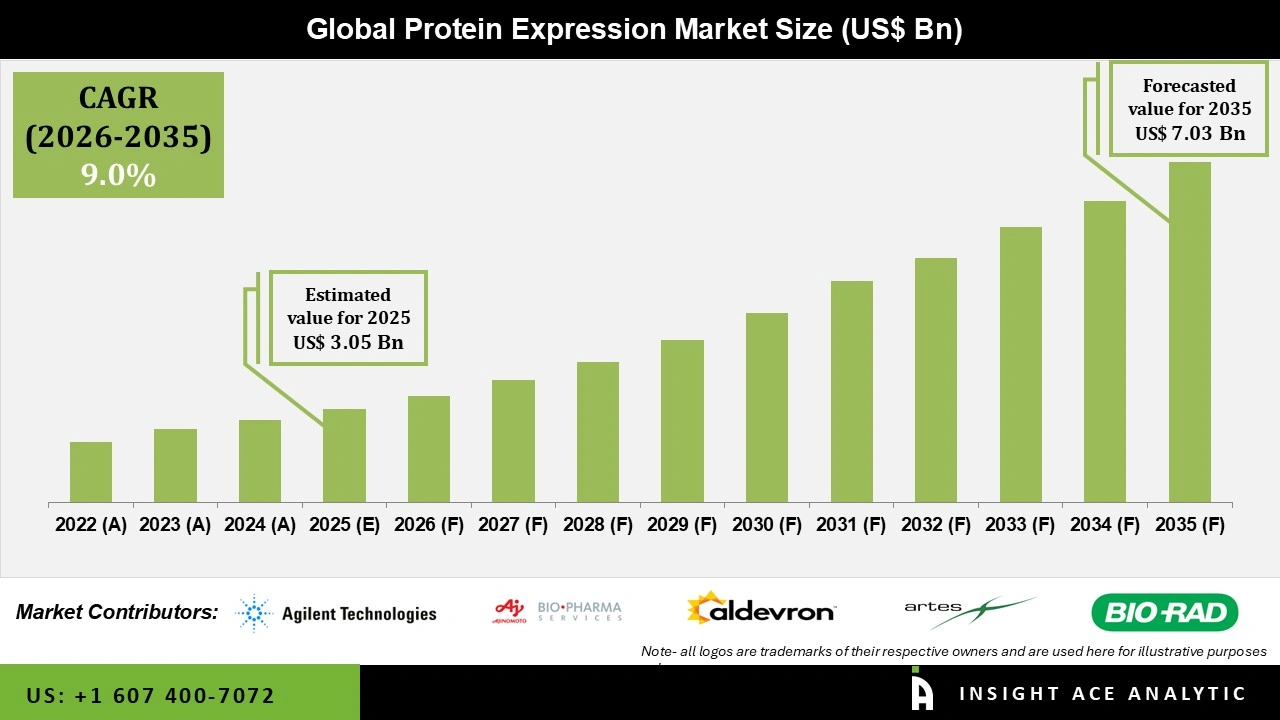

Global Protein Expression Market Size is valued at USD 3.05 Bn in 2025 and is predicted to reach USD 7.03 Bn by the year 2035 at an 9.0% CAGR during the forecast period for 2026 to 2035.

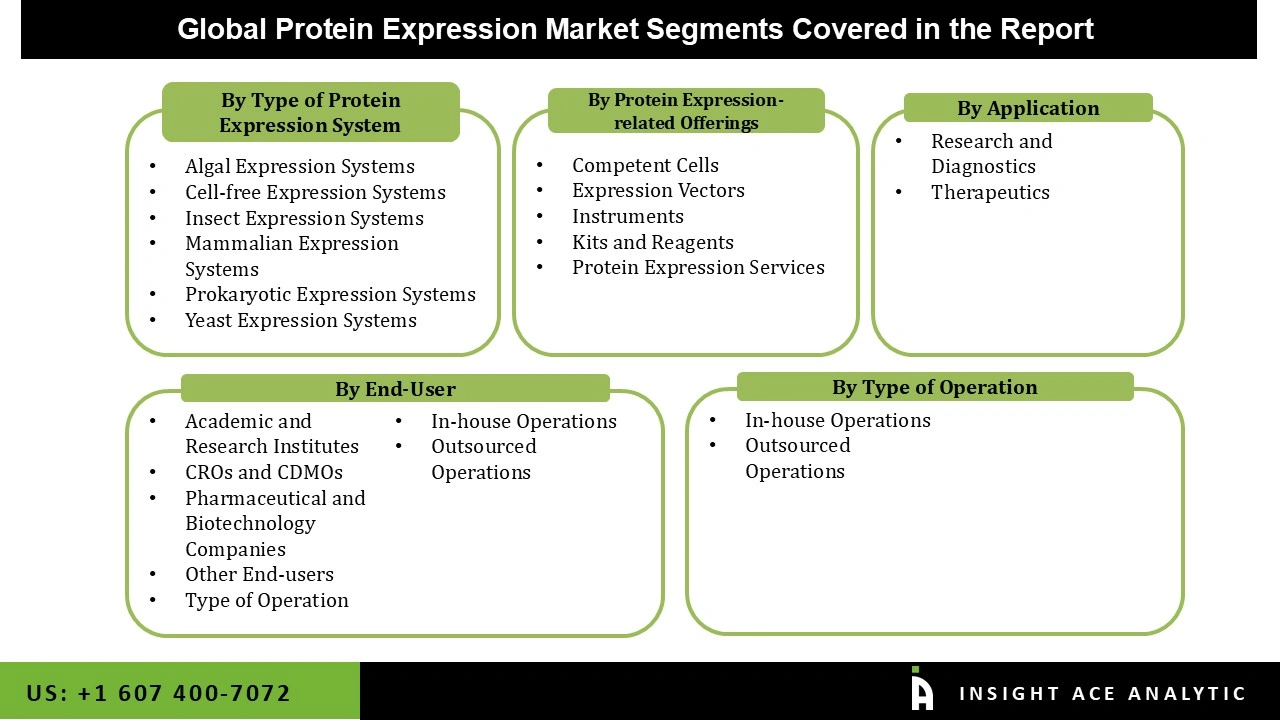

Protein Expression Market, Share & Trends Analysis Report, By Type of Protein Expression System (Algal, Cell-free, Insect, Mammalian, Prokaryotic and Yeast), Protein Expression-related Offerings (Competent Cells, Expression Vectors, Instruments, Kits and Reagents, and Protein Expression Services), Application Aera, End-Users, Type of Operation, By Region and Segment Forecasts, 2026 to 2035.

The technique of creating an artificial protein, known as a heterologous protein, involves introducing recombinant DNA into a host cell, a process that exemplifies the essential biological function of protein expression. This fundamental process is so critical that even the simplest prokaryotic organisms dedicate nearly 80% of their energy and over half of their dry weight to it. Cells, as the basic building blocks of life, must synthesize proteins using the instructions encoded in their DNA, as these proteins determine their unique shapes and structures. According to the fundamental dogma of molecular biology, genetic information flows from DNA to RNA through transcription and is then translated into proteins, highlighting the intricate connection between genetics and cellular function.

In June 2024, the Broad Institute unveiled a groundbreaking epigenetic editing method capable of permanently silencing the gene responsible for producing prion proteins in the brain using molecular tools. This innovative approach, which involves a single intravenous injection of a modified adeno-associated virus (AAV), has shown promising results in animal studies, reducing prion protein levels by over 80%, and potentially paving the way for new treatments for prion diseases. In a related development, the FDA approved fifty new medications in 2021, including fourteen biologics—such as monoclonal antibodies, pegylated proteins, hormones, and enzymes—all of which require protein expression. Notably, the approval of upheld, a co-packaged preventive treatment, and various monoclonal antibodies like tocilizumab and sotrovimab for COVID-19 further highlighted the importance of protein biologics. As the FDA was expected to approve several additional medications in 2022, the growing demand for these products has significantly increased the need for protein expression goods and services, driving market expansion.

The Protein Expression Market is segmented based on the type of protein expression system, protein expression-related offerings, application area, end-users, and type of operation. Based on the type of protein expression system, the market is divided into algal, cell-free, insect, mammalian, prokaryotic, and yeast. Based on the Protein Expression-related Offerings, the market is divided into competent cells, expression vectors, instruments, kits and reagents, and protein expression services. The market is categorized into academic and research institutes, CROS and CDMOS, pharmaceutical/biotechnology companies, and other end-users based on the end user. Based on the application area, the market is categorized into research and diagnostics, and therapeutics. Based on the type of operation, the market is categorized into In-house and outsourced operations.

Based on the type of protein expression system, the market is divided into algal, cell-free, insect, mammalian, prokaryotic, and yeast. Among these, prokaryotic expression systems (particularly Escherichia coli) typically drive and hold the largest share of the protein expression market. his is due to their simplicity, cost-effectiveness, high yield, and rapid production rates. Prokaryotic systems are widely used in research and industrial applications to produce recombinant proteins. However, as the demand for more complex proteins grows, other systems like mammalian and yeast expression systems are also gaining significance for their ability to produce proteins with proper post-translational modifications. The ease of scaling up production in prokaryotic systems enables industrial-level protein manufacturing, making them ideal for large-scale applications like enzyme production, research, and biopharmaceuticals.

Based on the protein expression-related offerings, the market is divided into competent cells, expression vectors, instruments, kits and reagents, and protein expression services. Among these, kits and reagents dominate the protein expression market. This is because bio-experiments typically require a large volume of reagents for various steps in the protein production process. Reagents are crucial for every stage of protein expression, including cell preparation, vector transformation, and protein isolation. The high demand for these essential components, combined with their repeated use in experiments, makes them the largest revenue-generating segment in the protein expression market. Additionally, the growing need for reagents in both research and industrial applications further drives their dominance in the market.

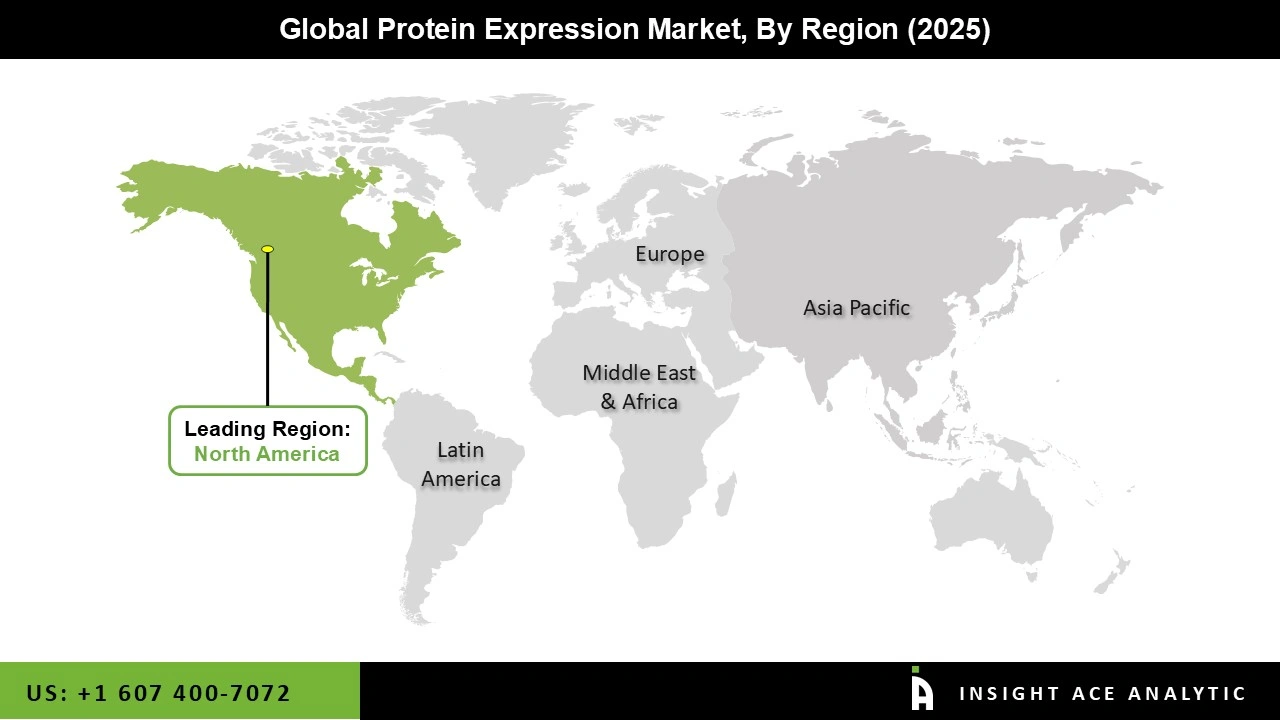

North America, particularly the United States, is home to a highly developed biotechnology and pharmaceutical sector. Leading companies and research institutions in these fields are driving demand for protein expression technologies for drug development, biologics, and biosimilars. The region benefits from substantial investment in R&D from both government bodies and private organizations.

This funding supports innovations in protein expression systems, enhancing productivity and fostering new therapeutic applications. The rising incidence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, in North America creates a high demand for protein-based therapeutics like monoclonal antibodies and vaccines, fueling the protein expression market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.05 Bn |

| Revenue Forecast In 2035 | USD 7.03 Bn |

| Growth Rate CAGR | CAGR of 9.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type Of Protein Expression System, Protein Expression-Related Offerings, Application Area, End-Users, And Type of Operation |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Agilent Technologies, Ajinomoto Bio-Pharma Services, Aldevron, Cayman Chemical, Charles River Laboratories, Domainex, Eurofins CALIXAR, GeNext Genomics, GenScript Biotech, Lonza , Merck KGaA, New England Biolabs, ProMab, Promega , ProteoGenix, QIAGEN, and other prominent players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.