The Perovskite Solar Cell Market Size is valued at USD 124.3 Mn in 2023 and is predicted to reach USD 3,509.2 Mn by the year 2031 at an 52.3% CAGR during the forecast period for 2024-2031.

Perovskites, a class of materials with a distinctive crystalline structure, exhibit a remarkable array of properties, including magnetoresistance and superconductivity, which make them valuable across multiple advanced technology applications. These easily produced materials are widely considered the future of solar cells due to their unique structure, which supports the development of affordable, efficient photovoltaics. Perovskites are also anticipated to play roles in next-generation electric vehicle applications such as sensors, lasers, and batteries. Falling under the category of third-generation photovoltaics (PVs), perovskite PVs join quantum dot (QD) PVs, organic photovoltaics (OPVs), and dye-sensitized solar cells (DSSCs), all of which are based on novel materials and have the potential to break through existing limits of performance and efficiency.

Perovskite solar cells are designed to make solar energy more cost-effective and efficient. With the capability to respond to multiple light wavelengths, perovskite PVs can convert a broader portion of sunlight into electricity, giving them a significant advantage over conventional solar technology. This combined potential for high efficiency, low material costs, and reduced processing expenses further strengthens their appeal as a transformative solution in renewable energy.

Government policies and incentives, such as feed-in tariffs and tax credits, play a significant role in accelerating the adoption of perovskite solar technology. The market for perovskite solar cells is rapidly expanding as the global demand for solar energy rises. These cells are highly valued for their versatility and portability, making them ideal for a wide range of applications across different industries. The pressing need for sustainable energy sources and the exceptional efficiency of perovskite materials in converting sunlight into electrical power drive this demand.

Additionally, priorities like energy stability and economic growth are supporting the market's expansion, as efficient energy use becomes crucial for reducing poverty and improving living standards in growing economies. This emphasis on energy stability has led to increased investments and advancements in solar technologies, with perovskite cells recognized as vital for enhancing energy accessibility.

A major factor driving the market is the surge in solar installations, which aligns with rising urbanization and evolving consumer preferences. As a cost-effective alternative to traditional solar panels, perovskite solar cells attract consumers seeking innovative solar solutions. Their popularity is fueled by their high-power conversion efficiency, affordability, and ease of production, making them more accessible and appealing than conventional solar options. These qualities not only enhance their appeal but also position perovskite solar cells as a strong catalyst for market growth by delivering high performance at a lower cost.

The Perovskite Solar Cell market is segmented based on structure, product type, and end user. Based on the structure, the market is divided into planar perovskite solar cells and mesoporous perovskite solar cells. Based on the product type, the market is divided into rigid and flexible. Based on the end user, the market is divided into aerospace, industrial automation, consumer electronics, energy, and others.

Based on the structure, the market is divided into planar perovskite solar cells and mesoporous perovskite solar cells. Among these, the planar perovskite solar cells segment is expected to have the highest growth rate during the forecast period. Planar perovskite solar cells have a straightforward, layer-by-layer structure without the need for a mesoporous scaffold. This simplicity reduces the number of fabrications steps and allows for quicker, more cost-effective production. Manufacturers favor this because it facilitates scalability, which is critical for commercialization. Planar cells can achieve high power conversion efficiencies with relatively simpler architectures. Advances in materials and deposition techniques have improved the quality of perovskite films in planar configurations, enhancing efficiency and performance. The research community and industry investors have primarily focused on planar structures for large-scale applications. With more research efforts concentrated here, advances in stability, performance, and manufacturing for planar cells have progressed rapidly, further solidifying their market dominance.

Based on the end user, the market is divided into aerospace, industrial automation, consumer electronics, energy, and others. Among these, the energy segment dominates the market. Perovskite materials are less costly and require simpler manufacturing processes than traditional silicon cells. The potential for low-cost, high-volume manufacturing makes them attractive for large-scale energy applications, as they can be deployed more affordably compared to conventional solar technologies.

Many governments worldwide have introduced incentives, subsidies, and policies promoting renewable energy adoption. These initiatives encourage investment in solar technologies, and perovskite cells, with their potential for higher efficiency and lower cost, stand out as a promising solution in the energy segment. The energy sector benefits from the development of tandem solar cells, where perovskites are layered with silicon or other materials to achieve efficiencies beyond those possible with single-material cells. This application supports higher energy output, which is essential for utility-scale solar installations and helps meet rising energy demands.

North America is home to leading research institutions, universities, and private companies focused on renewable energy and photovoltaic innovation. With dedicated funding and a robust ecosystem for technological advancement, the region has become a hub for perovskite solar research, helping accelerate commercialization. The U.S. and Canadian governments have introduced a range of policies and incentives to encourage renewable energy adoption, including solar energy. Subsidies, tax credits, grants, and research funding have fueled the development and deployment of solar technologies like perovskite cells, making North America a leading market.

|

Report Attribute |

Specifications |

|

Market Size Value In 2023 |

USD 124.3 Mn |

|

Revenue Forecast In 2031 |

USD 3,509.2 Mn |

|

Growth Rate CAGR |

CAGR of 52.3% from 2024 to 2031 |

|

Quantitative Units |

Representation of revenue in US$ Mn and CAGR from 2024 to 2031 |

|

Historic Year |

2019 to 2023 |

|

Forecast Year |

2024-2031 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Structure, Product Type, and End User. |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

|

Competitive Landscape |

Saule Technologies, FrontMaterials Co. Ltd., Xiamen Weihua Solar Co. Ltd., Fraunhofer ISE, Polyera Corporation, Solaronix SA, Dyesol, FlexLink Systems Inc., New Energy Technologies Inc, Oxford Photovoltaics, Hanwha Q CELLS, CubicPV, EneCoat Technologies, Microquanta Semiconductor, Greatcell Energy, P3C, Perovskia Solar AG, Panasonic Corporation, ALFA CHEMISTRY MATERIALS, SOLRA PV, Dyenamo AB, FrontMaterials Co. Ltd., G24 Power Ltd., SWIFT SOLAR, Energy Materials Corp, TOSHIBA CORPORATION, EVOLAR |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Perovskite Solar Cell Market Snapshot

Chapter 4. Global Perovskite Solar Cell Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Porter's Five Forces Analysis

4.7. Incremental Opportunity Analysis (US$ MN), 2024-2031

4.8. Global Perovskite Solar Cell Market Penetration & Growth Prospect Mapping (US$ Mn), 2023-2031

4.9. Competitive Landscape & Market Share Analysis, By Key Player (2023)

4.10. Use/impact of AI on Perovskite Solar Cell Industry Trends

Chapter 5. Perovskite Solar Cell Market Segmentation 1: By Structure, Estimates & Trend Analysis

5.1. Market Share by Structure, 2023 & 2031

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2019 to 2031 for the following Structure:

5.2.1. Planar perovskite solar cells

5.2.2. Mesoporous perovskite solar cells

Chapter 6. Perovskite Solar Cell Market Segmentation 2: By Product Type, Estimates & Trend Analysis

6.1. Market Share by Product Type, 2023 & 2031

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2019 to 2031 for the following Product Types:

6.2.1. Rigid

6.2.2. Flexible

Chapter 7. Perovskite Solar Cell Market Segmentation 3: By End user, Estimates & Trend Analysis

7.1. Market Share by End user, 2023 & 2031

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2019 to 2031 for the following End users:

7.2.1. Aerospace

7.2.2. Industrial automation

7.2.3. Consumer Electronics

7.2.4. Energy

7.2.5. Others

Chapter 8. Perovskite Solar Cell Market Segmentation 6: Regional Estimates & Trend Analysis

8.1. Global Perovskite Solar Cell Market, Regional Snapshot 2023 & 2031

8.2. North America

8.2.1. North America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Country, 2024-2031

8.2.1.1. US

8.2.1.2. Canada

8.2.2. North America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Structure, 2024-2031

8.2.3. North America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

8.2.4. North America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by End user, 2024-2031

8.3. Europe

8.3.1. Europe Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Country, 2024-2031

8.3.1.1. Germany

8.3.1.2. U.K.

8.3.1.3. France

8.3.1.4. Italy

8.3.1.5. Spain

8.3.1.6. Rest of Europe

8.3.2. Europe Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Structure, 2024-2031

8.3.3. Europe Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

8.3.4. Europe Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by End user, 2024-2031

8.4. Asia Pacific

8.4.1. Asia Pacific Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Country, 2024-2031

8.4.1.1. India

8.4.1.2. China

8.4.1.3. Japan

8.4.1.4. Australia

8.4.1.5. South Korea

8.4.1.6. Hong Kong

8.4.1.7. Southeast Asia

8.4.1.8. Rest of Asia Pacific

8.4.2. Asia Pacific Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Structure, 2024-2031

8.4.3. Asia Pacific Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

8.4.4. Asia Pacific Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts By End user, 2024-2031

8.5. Latin America

8.5.1. Latin America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Country, 2024-2031

8.5.1.1. Brazil

8.5.1.2. Mexico

8.5.1.3. Rest of Latin America

8.5.2. Latin America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Structure, 2024-2031

8.5.3. Latin America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

8.5.4. Latin America Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by End user, 2024-2031

8.6. Middle East & Africa

8.6.1. Middle East & Africa Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

8.6.1.1. GCC Countries

8.6.1.2. Israel

8.6.1.3. South Africa

8.6.1.4. Rest of Middle East and Africa

8.6.2. Middle East & Africa Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Structure, 2024-2031

8.6.3. Middle East & Africa Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

8.6.4. Middle East & Africa Perovskite Solar Cell Market Revenue (US$ Million) Estimates and Forecasts by End user, 2024-2031

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Saule Technologies

9.2.1.1. Business Overview

9.2.1.2. Key Product/Service Offerings

9.2.1.3. Financial Performance

9.2.1.4. Geographical Presence

9.2.1.5. Recent Developments with Business Strategy

9.2.2. FrontMaterials Co. Ltd.

9.2.3. Xiamen Weihua Solar Co. Ltd.

9.2.4. Fraunhofer ISE

9.2.5. Polyera Corporation

9.2.6. Solaronix SA

9.2.7. Dyesol

9.2.8. FlexLink Systems Inc.

9.2.9. New Energy Technologies Inc

9.2.10. Oxford Photovoltaics

9.2.11. Hanwha Q CELLS

9.2.12. CubicPV

9.2.13. EneCoat Technologies

9.2.14. Microquanta Semiconductor

9.2.15. Greatcell Energy

9.2.16. P3C

9.2.17. Perovskia Solar AG

9.2.18. Panasonic Corporation

9.2.19. ALFA CHEMISTRY MATERIALS

9.2.20. SOLRA PV

9.2.21. Dyenamo AB

9.2.22. FrontMaterials Co. Ltd.

9.2.23. G24 Power Ltd.

9.2.24. SWIFT SOLAR

9.2.25. Energy Materials Corp

9.2.26. TOSHIBA CORPORATION

9.2.27. EVOLAR

9.2.28. Other Market Players

Global Perovskite Solar Cell Market- By Structure

Global Perovskite Solar Cell Market – By Product Type

Global Perovskite Solar Cell Market – By End User

Global Perovskite Solar Cell Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

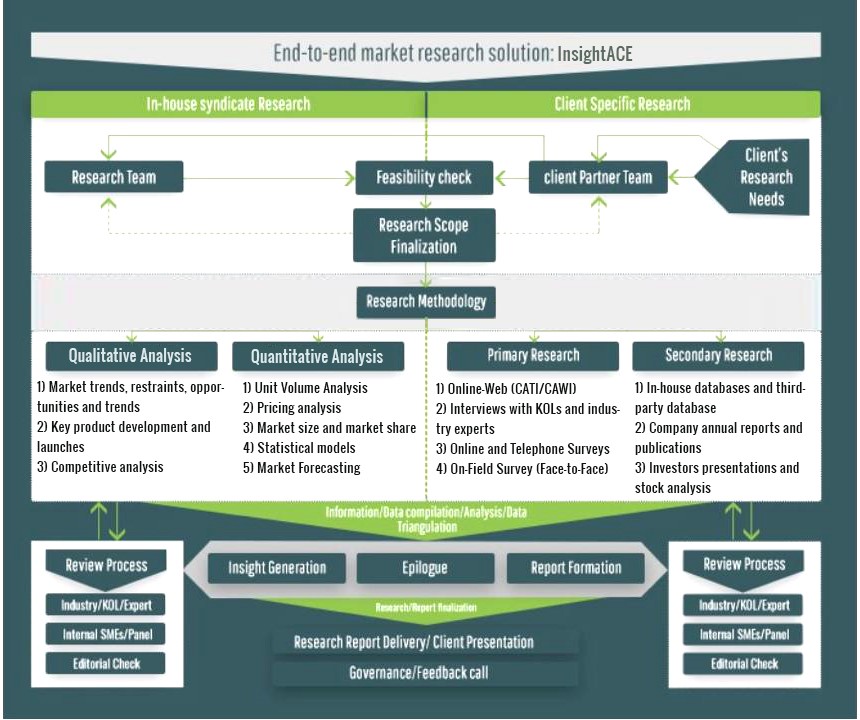

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.