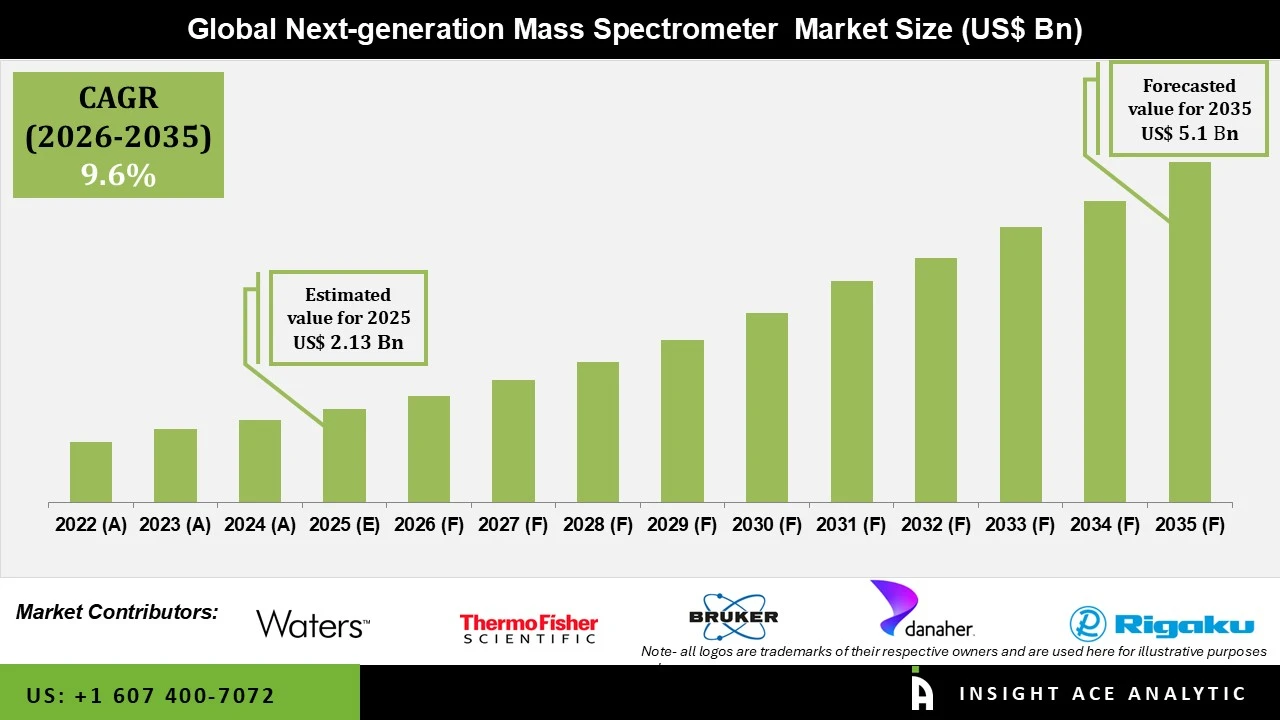

Next-generation Mass Spectrometer Market Size is valued at USD 2.13 billion in 2025 and is predicted to reach USD 5.1 billion by the year 2035 at a 9.6% CAGR during the forecast period for 2026 to 2035.

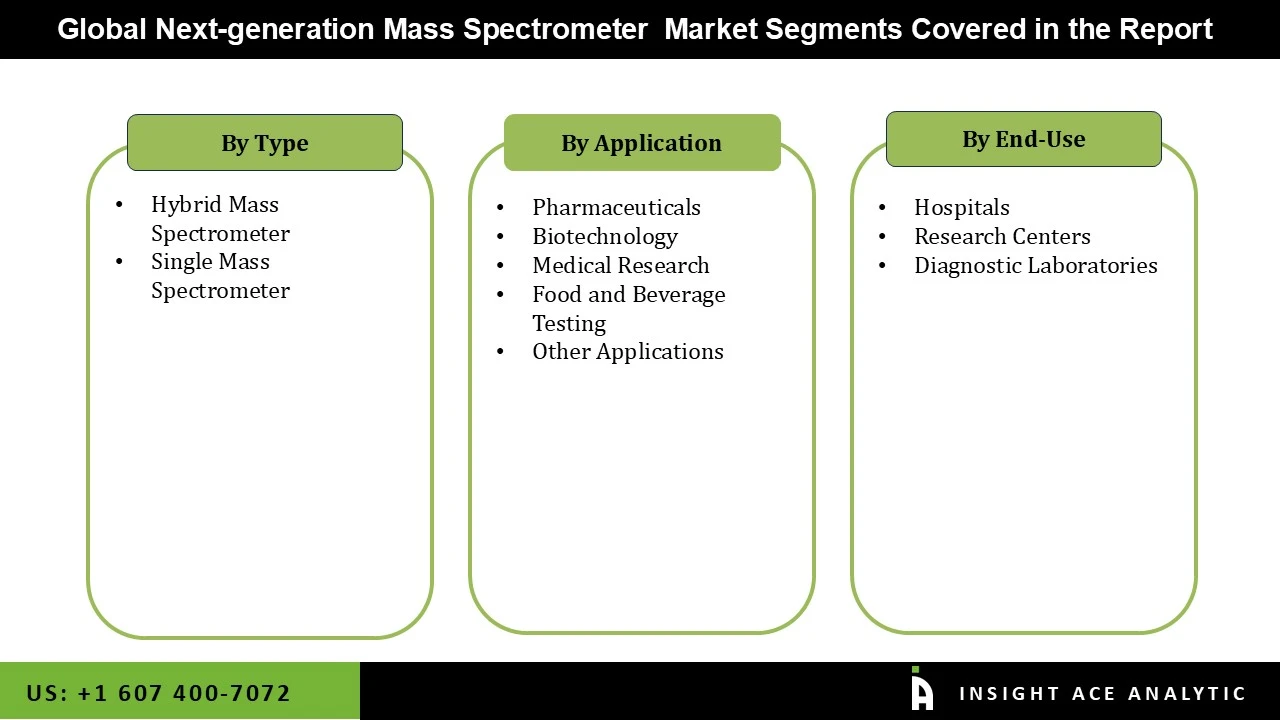

Next Generation Mass Spectrometer Market Size, Share & Trends Analysis Report By Type (Hybrid & Single Mass Spectrometer), By Application (Pharmaceuticals, Biotechnology, Medical Research, Food and Beverage Testing), By End-User (Hospitals, Research Centers, Diagnostic Laboratories), By Region, And By Segment Forecasts, 2026 to 2035

Next-generation mass spectrometers are state-of-the-art analytical devices that provide enhanced sensitivity, resolution, speed, and versatility in comparison to earlier versions. They provide meticulous examination of intricate samples in disciplines like as proteomics, metabolomics, medicines, and environmental science. These devices include advancements such as enhanced ionization processes, accelerated scan speeds, hybrid mass analyzers, and advanced data processing software. They improve the ability to analyze data, assist in handling large workloads, and play a crucial role in developing scientific research, diagnostics, and industrial applications that require in-depth molecular analysis.

Next-generation mass spectrometers are developing at an astonishing rate, both in terms of resolution and speed, due to the development of new instruments and software. The primary gowth driver of the market expansion for next-generation mass spectrometers is the increase in government expenditure on pharmaceutical and life sciences research and development.

In addition, there has been a surge in the use of next-generation mass spectrometers due to growing food concerns, demands in agricultural and medical research, the ability to facilitate creative diagnosis and novel medication development for illnesses, and competitive post-sale and technical support. Moreover, growth in market revenue is also primarily driven by the spectrometry industry's rapid technological breakthroughs, such as the creation of smaller spectrometers.

The next-generation mass spectrometer market is segmented based on type, application and end-user. Type segment includes hybrid and mass mass spectrometer. The application segment is categorized into Pharmaceuticals, Biotechnology, Medical Research, Food and Beverage Testing, and Other Applications. As per the end-user, the market is divided into Hospitals, Research Centers, and Diagnostic Laboratories.

Biotechnology is expected to hold a major global market share in 2023. In biotechnology, next-generation mass spectrometer plays a crucial role in protein analysis, biomarker identification, and biopharmaceutical characterization, allowing scientists to decipher molecular structures and explore biological processes at the molecular level. Personalized medicine and precision healthcare are made possible by the contributions made by next-generation mass spectrometers to illness biomarker identification, pharmacokinetics investigations, and clinical diagnostics. On the other hand, because of the growing number of cases of contaminated food, drug safety, and the development of novel medications for illnesses, pharmaceutical companies, for instance, have a wide range of applications for the next-generation mass spectrometer.

Next-generation mass spectrometers are found to be extensively used in hospitals, where they are employed for a range of clinical purposes, such as biomarker identification, therapeutic medication monitoring, and illness diagnosis. In hospital settings, next-generation mass spectrometers are vital to improve patient care outcomes and diagnostic capacities. However, research centres, which include universities, government research institutes, and private research groups, make up another important end-user segment. In these environments, next-generation mass spectrometers are used in a variety of disciplines, comprising biology, chemistry, physics, and materials science, for basic science, applied science, and technological development.

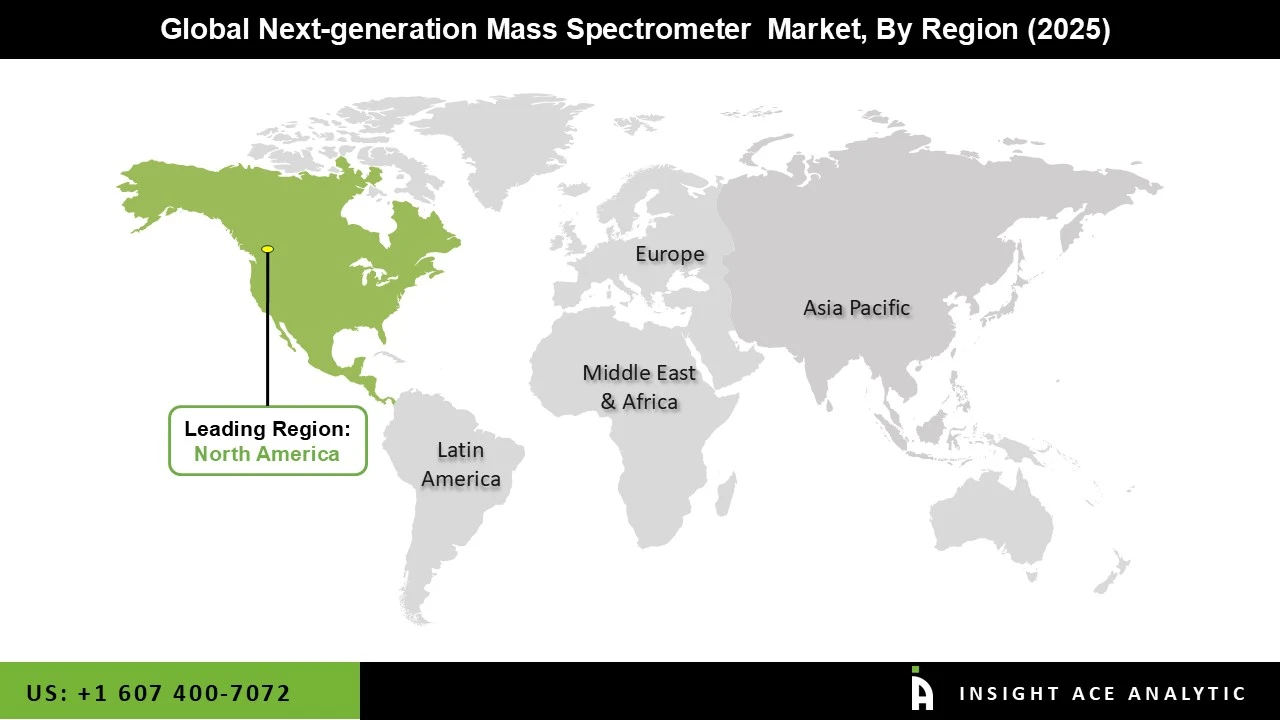

The North American next-generation mass spectrometer market is expected to report the maximum market share in revenue in the near future, propelled by the existence of top mass spectrometry producers, a firmly established research network, and substantial investments in the life sciences and healthcare. Over the course of the projection period, the next-generation mass spectrometer market in North America is expected to rise thanks in part to the increased focus on medication research and development by a number of pharmaceutical companies. In addition, Asia Pacific is predicted to grow rapidly in the global next-generation mass spectrometer market.

The growth of next-generation mass spectrometers worldwide in the region is being aided by increased research in the medical and pharmaceutical fields. The next-generation mass spectrometer market is anticipated to develop at a rapid rate throughout the course of the forecast period due in part to the vast number of conferences, production facilities, and research facilities of companies in the Asia-Pacific region, excluding the Japanese market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.13 Bn |

| Revenue Forecast In 2035 | USD 5.1 Bn |

| Growth Rate CAGR | CAGR of 9.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2036 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Shimadzu Corporation, Waters Corporation, Thermo Fisher Scientific, Inc., Bruker Corporation, AB Sciex Pte. Ltd., Danaher Corporation, Rigaku, PerkinElmer, Bio-Rad Laboratories, Jeol Ltd, and Agilent Technologies. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Next-generation Mass Spectrometer Market By Type -

Next-generation Mass Spectrometer Market By Application-

Next-generation Mass Spectrometer Market By End-User-

Next-generation Mass Spectrometer Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.