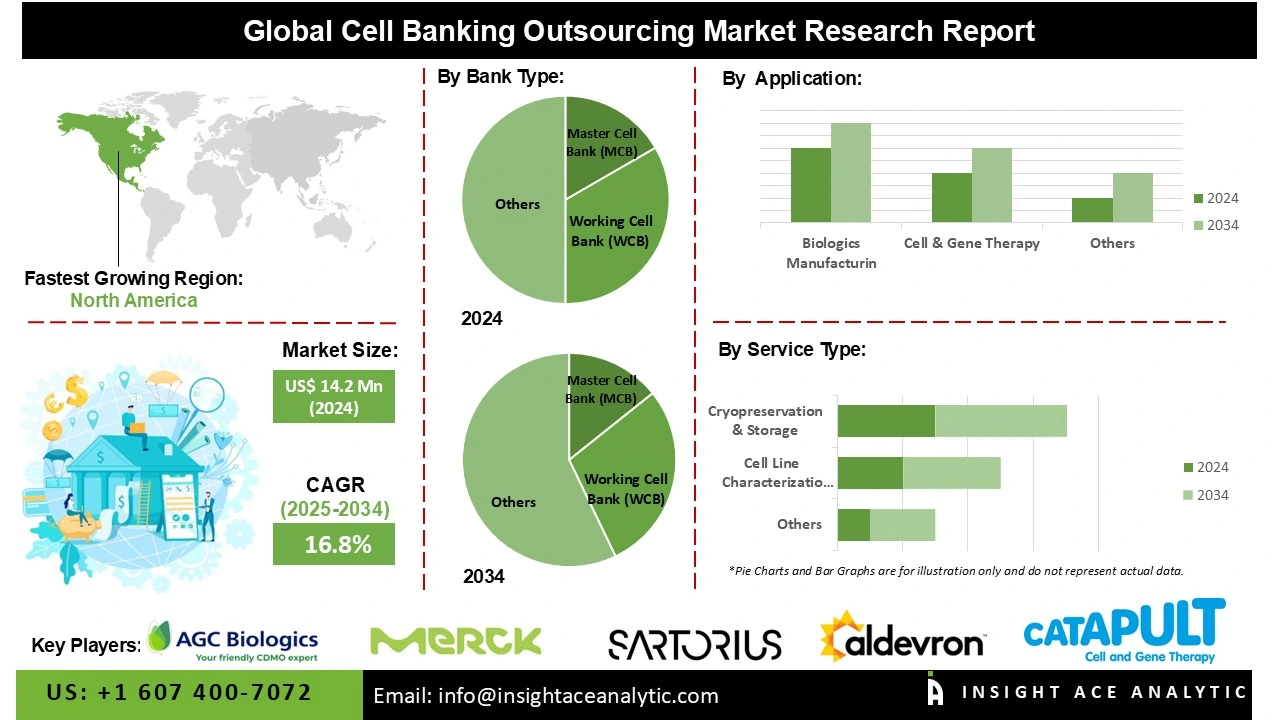

Cell Banking Outsourcing Market Size is valued at US$ 14.2 Bn in 2024 and is predicted to reach US$ 65.5 Bn by the year 2034 at an 16.8% CAGR during the forecast period for 2025-2034.

A cell bank is a facility that keeps cells that have been taken from different body fluids and organ tissue in order to meet future demands. The ability to preserve cells with a specific genome for later use is known as cell banking outsourcing. In addition to reducing cross-contamination of a cell line, it can be utilized to generate comprehensive characterizations of cell lines. The main factors propelling the cell banking outsourcing market's growth are the growing need for monoclonal antibodies and efficient biopharmaceuticals, the expanding use of stem cell therapies, and the increasing advancement of cryopreservation and cell bank preparation techniques.

Additionally, large-scale investments in R&D to improve disease treatment, increased stem cell application research, the creation of sophisticated preservation methods, and the adoption of acquisition and collaboration strategies are all anticipated to have an impact on the cell banking outsourcing market growth in the years to come. However, the global market for cell banking outsourcing may be constrained in its expansion over the projected period by the high operating costs of stem cell therapies, the availability of suitable donors, strict regulatory requirements, the risk involved in cell line banking, and ethical considerations.

Some of the Key Players in Cell Banking Outsourcing Market:

· Lonza Group

· AGC Biologics

· BioReliance (Merck KGaA)

· Aldevron

· QTP Labs

· Sino Biological

· BioOutsource (Sartorius)

· Thermo Fisher Scientific (Patheon)

· Vibalogics

· Charles River Laboratories

· Eurofins Scientifi

· Fujifilm Diosynth Biotechnologies

· Cell and Gene Therapy Catapult

· Rentschler Biopharma

· Samsung Biologics

· Novartis Contract Manufacturing

· Paragon Bioservices (Catalent)

· Porton Advanced

· Syngene International

· WuXi Advanced Therapies (WuXi AppTec)

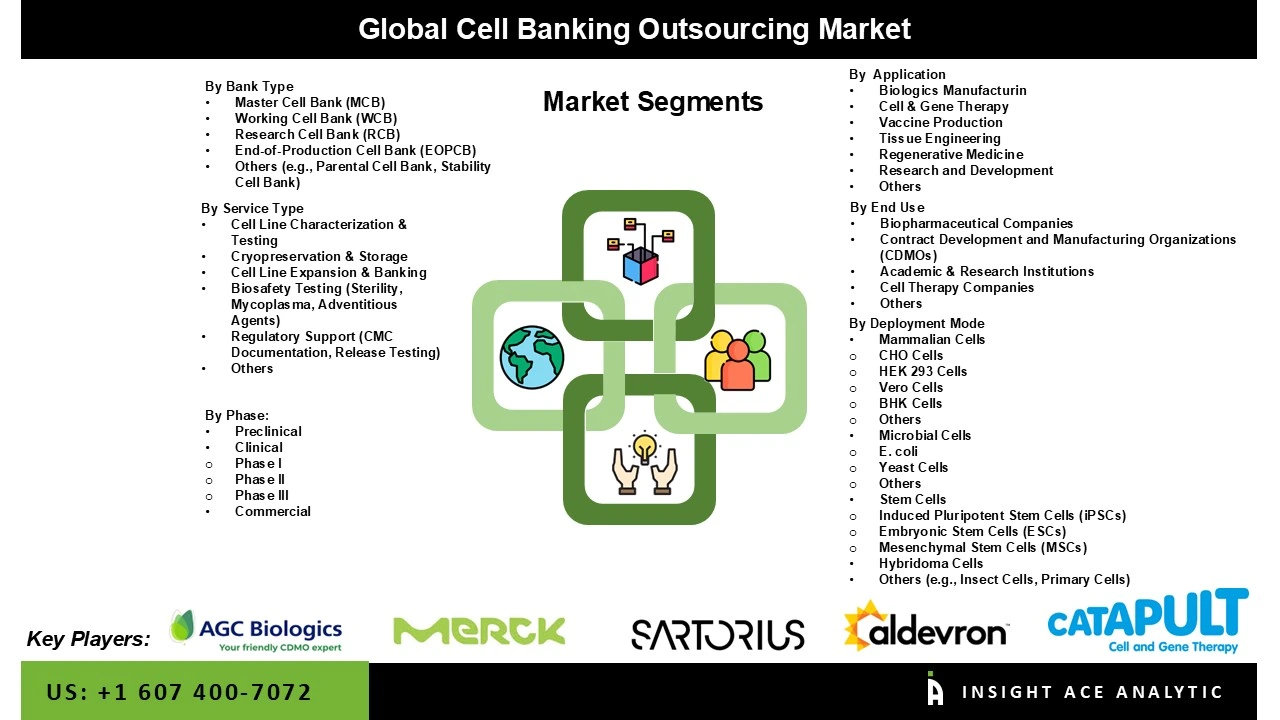

The Cell banking outsourcing market is segmented by service type, cell type, bank type, application, phase, and end-use. By service type, the market is segmented into cell line expansion & banking, cell line characterization & testing, cryopreservation & storage, regulatory support (CMC documentation, release testing), biosafety testing (sterility, mycoplasma, adventitious agents), and others. by cell type, the market is segmented into mammalian cells (CHO cells, BHK cells, VERO cells, HEK 293 cells, others), stem cells (induced pluripotent stem cells (iPSCs), mesenchymal stem cells (MSCs), embryonic stem cells (ESCs)), microbial cells (yeast cells, E. coli, others), hybridoma cells, and others (e.g., insect cells, primary cells).

By bank type, the market is segmented into research cell bank (RCB), master cell bank (MCB), end-of-production cell bank (EOPCB), working cell bank (WCB), and others (e.g., parental cell bank, stability cell bank). By application, the market is segmented into vaccine production, cell & gene therapy, tissue engineering, biologics manufacturing, regenerative medicine, research and development, and others. By phase, the market is segmented into preclinical, clinical (phase I, phase II, phase III), and commercial. By end-use, the market is segmented into biopharmaceutical companies, contract development and manufacturing organizations (CDMOs), cell therapy companies, academic & research institutions, and others.

In 2024, the market for cell banking outsourcing was dominated by the cryopreservation & storage segment because cell cryopreservation preserves product efficacy and quality, reduces transportation difficulties, and shields the product from unforeseen shipment delays. Due to inadequate planning or product shelf life it helps save expenses and material waste. By preserving cell viability and functionality until the cells are needed, this procedure increases the product's shelf life and consistency. However, the cell line characterisation and biosafety testing segment is expected to grow at the quickest rate because characterization of cell lines reduces misidentification issues by confirming which are well-defined and appropriate for the planned study.

The master cell banking segment dominated the cell banking outsourcing market in 2024 and is predicted to continue to do so in the years to come due to a number of factors, including the increasing need for cell-based treatments, biologics, and vaccines that depend on a reliable and well-characterized cell line as the starting material, as well as regulatory requirements for cell line authentication, quality control, and traceability that call for the creation of strong master cell banks. The master cell banking category is also expanding at a rapid pace because of the time and money savings that come with outsourcing MCB services, which frees up businesses to concentrate on their core R&D.

In 2024, North America held the largest market share due to the region's significant R&D facilities and the growing number of metabolic diseases like Parkinson's and Alzheimer's, as well as other cancers that can be treated with gene therapy. Another factor contributing to the organizational diversity in the North American healthcare system is the sharp rise in the development of financial services, which is an indication of swift change. Furthermore, North America is a center for cutting-edge research and development in fields including drug discovery, cell therapy, and regenerative medicine, which increases demand for specialist cell banking outsourcing services.

The rapidly growing biotechnology sector and rising investments in healthcare infrastructure are likely to propel the cell banking outsourcing market's growth rate in Asia Pacific over the forecast period. The leading nations in this expansion are China, India, and Japan, which have made notable strides in the study and development of biotechnology. Furthermore, the cell banking outsourcing market expansion in Asia Pacific is being driven by the rising incidence of chronic illnesses, rising demand for biologics, and encouraging government programs that encourage R&D.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 14.2 Bn |

| Revenue Forecast In 2034 | USD 65.5 Bn |

| Growth Rate CAGR | CAGR of 16.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Service Type, By Cell Type, By Bank Type, By Application, By Phase, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Lonza Group, AGC Biologics, BioReliance (Merck KGaA), Aldevron, QTP Labs, Sino Biological, BioOutsource (Sartorius), Thermo Fisher Scientific (Patheon), Vibalogics, Charles River Laboratories, Eurofins Scientifi, Fujifilm Diosynth Biotechnologies, Cell and Gene Therapy Catapult, Rentschler Biopharma, Samsung Biologics, Novartis Contract Manufacturing, Paragon Bioservices (Catalent), Porton Advanced, Syngene International, and WuXi Advanced Therapies (WuXi AppTec) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cell Banking Outsourcing Market by Service Type

· Cell Line Expansion & Banking

· Cell Line Characterization & Testing

· Cryopreservation & Storage

· Regulatory Support

o CMC Documentation

o Release Testing

· Biosafety Testing

o Sterility

o Mycoplasma

o Adventitious Agents

· Others

Cell Banking Outsourcing Market by Cell Type

· Mammalian Cells

o CHO Cells

o BHK Cells

o Vero Cells

o HEK 293 Cells

o Others

· Stem Cells

o Induced Pluripotent Stem Cells (iPSCs)

o Mesenchymal Stem Cells (MSCs)

o Embryonic Stem Cells (ESCs)

· Microbial Cells

o Yeast Cells

o E. coli

o Others

· Hybridoma Cells

· Others (e.g., Insect Cells, Primary Cells)

Cell Banking Outsourcing Market by Bank Type

· Research Cell Bank (RCB)

· Master Cell Bank (MCB)

· End-of-Production Cell Bank (EOPCB)

· Working Cell Bank (WCB)

· Others (e.g., Parental Cell Bank, Stability Cell Bank)

Cell Banking Outsourcing Market by Application

· Vaccine Production

· Cell & Gene Therapy

· Tissue Engineering

· Biologics Manufacturing

· Regenerative Medicine

· Research and Development

· Others

Cell Banking Outsourcing Market by Phase

· Preclinical

· Clinical

o Phase I

o Phase II

o Phase III

· Commercial

Cell Banking Outsourcing Market by End-use

· Biopharmaceutical Companies

· Contract Development and Manufacturing Organizations (CDMOs)

· Cell Therapy Companies

· Academic & Research Institutions

· Others

Cell Banking Outsourcing Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.