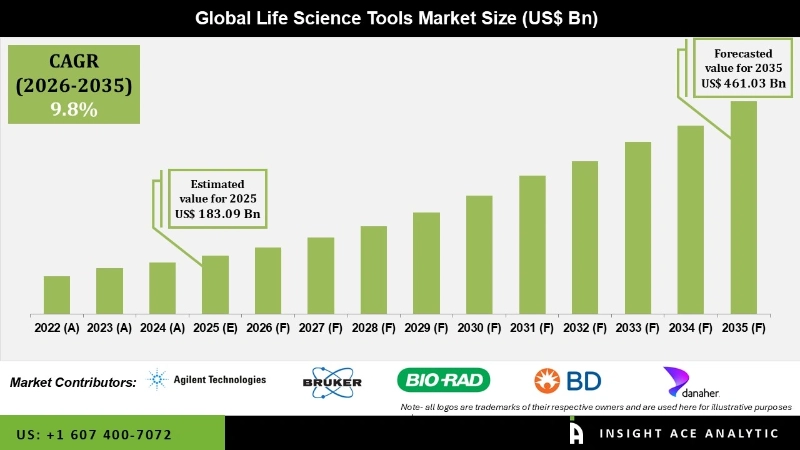

Global Life Science Tools Market Size is valued at USD 183.09 billion in 2025 and is predicted to reach USD 461.03 billion by the year 2035 at a 9.8% CAGR during the forecast period for 2026 to 2035.

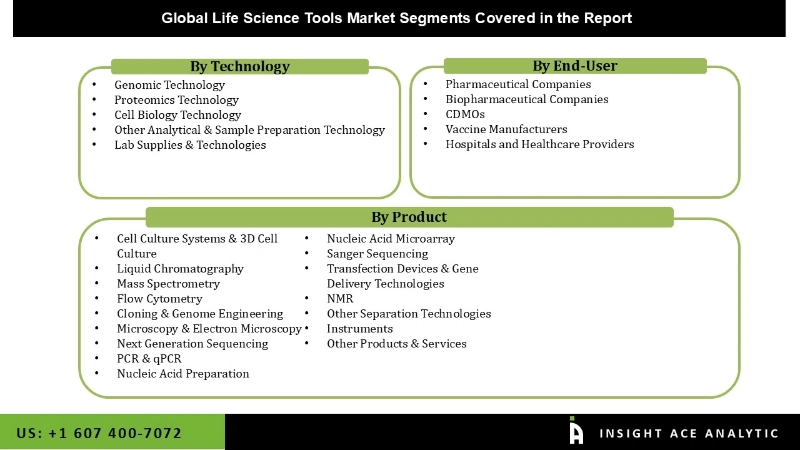

Life Science Tools Market Size, Share & Trends Analysis Report By By Technology (Cell Biology, Proteomics), By Product (Cell Culture Systems & 3D Cell Culture, Liquid Chromatography, Mass Spectrometry, Flow Cytometry, Microscopy & Electron Microscopy, Next Generation Sequencing), By End-use (Government & Academic, Healthcare), By Region, And Segment Forecasts, 2026 to 2035.

Life Science Tools Market Size, Share & Trends Analysis Report By By Technology (Cell Biology, Proteomics), By Product (Cell Culture Systems & 3D Cell Culture, Liquid Chromatography, Mass Spectrometry, Flow Cytometry, Microscopy & Electron Microscopy, Next Generation Sequencing), By End-use (Government & Academic, Healthcare), By Region, And Segment Forecasts, 2023 to 2031

Over the projection period, market growth is anticipated to pick up due to the biopharmaceutical industry's consistent commercial success, which includes novel product categories, including Nanobodies, rDNA, synthetic vaccines, fusion proteins, soluble receptors, immunoconjugates, and immunotherapeutics. The market is expected to be driven by the increase in funding for R&D linked to academics and life sciences tools research by government and non-government organisations. The development of life science instruments for diagnosing the target population will also be stimulated by the increased need for diagnostic tests for numerous infectious diseases, driving market growth overall throughout the projection period.

In addition, mass spectrometry, chromatography techniques, sequencing technologies, and other items have seen increased use in medical facilities, academic research facilities, and diagnostic labs. The market development of life science tools is expected to be boosted by rapid innovation in scientific tools and technical advancement in the healthcare industry. The elevation of instruments used in life science, such as NMR, sequencing advances, chromatography methods, and tools for rapid diagnostics, is a priority of businesses like Bio-Rad Research Centers.

The Life Science Tools market is segmented on the basis of technology, product, and end-user. Based on technology, the market is segmented as Genomic Technology, Proteomics Technology, Cell Biology Technology, Other Analytical & Sample Preparation Technology, and Lab Supplies & Technologies. By product, the market is segmented into Cell Culture Systems & 3D Cell Culture, Liquid Chromatography, Mass Spectrometry, Flow Cytometry, Microscopy & Electron Microscopy, Next Generation Sequencing, PCR & qPCR, Nucleic Acid Preparation, Nucleic Acid Microarray, Sanger Sequencing, Transfection Devices & Gene Delivery Technologies, Other Separation Technologies, and Other Products & Services. By end user, the market is segmented into Government & Academic, Biopharmaceutical Companies, Healthcare, Industrial Applications, and Others.

The biggest portion was attributed to cell biology technologies. The segment is expanding as a result of the increasing NIH funding for cell biology and the application of cell biology technology in drug discovery. Likewise, the use of cell-based assays for drug discovery has increased as a result of advancements in flow cytometry and liquid handling. Important market participants have also collaborated on research projects to convert blood and umbilical cord tissue stem cells from newborns into induced pluripotent stem cells (iPSCs). For instance, EdiGene and Haihe Laboratory declared a strategic partnership to create platform technologies and stem regenerative cell treatments in January 2022. The cooperation intends to investigate cutting-edge biomarkers to improve stem cell production quality control. These partnerships are anticipated to boost industry growth.

From 2023 to 2030, next-generation sequencing is expected to grow at the fastest rate, 21.2%. Massively parallel genome sample sequencing is possible with next-generation sequencing (NGS) equipment. The systems are effective at simultaneously analysing a lot of sequencing reactions. The usage of this life science technology is also projected to increase due to the NGS workflow's simplification and ongoing instrument and reagent cost decreases. Moreover, with enhancement in bioinformatics, the adoption of NGS is likely to grow in high- and even low-throughput research. For example, in February 2022, Beckman Coulter Life Sciences signed an application development agreement with Illumina, Inc. for the Biomek NGeniuS Next Generation Library Preparation System.

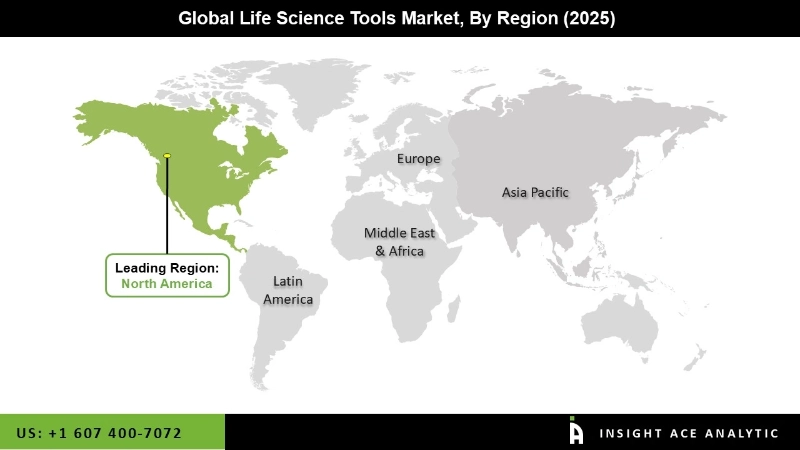

Due to the region's rapid adoption of genomics, proteomics, oncology, and diagnostic screening, North America accounted for the lion's share of the revenue. The U.S. and Canada are driving market expansion in the area with the increased use of genetic medicine, biopharmaceuticals, diagnostic techniques, and inventive technologies for diagnosing and treating clinical illnesses. Numerous market participants consistently working to provide cutting-edge equipment for life science research is another advantage the region enjoys. Also, a well-regulated environment for the approval and use of genomic and tissue diagnostic tests is anticipated to fuel the market's expansion throughout the course of the projected period.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 183.09 Bn |

| Revenue forecast in 2035 | USD 461.03 Bn |

| Growth rate CAGR | CAGR of 9.8 % from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Technology, Product, And End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Agilent Technologies, Inc.; Becton; Dickinson and Company; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc; QIAGEN N.V.; Merck KGaA; Shimadzu Corporation; Hitachi Ltd.; Bruker Corporation; Oxford Instruments plc; Zeiss International. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Life Science Tools Market By Technology-

Life Science Tools Market By Product-

Life Science Tools Market By End Use-

Life Science Tools Market By Region-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.