Global Industrial Internet of Things Market Size is valued at USD 192.9 Bn in 2024 and is predicted to reach USD 445.9 Bn by the year 2034 at a 9.0% CAGR during the forecast period for 2025-2034.

The implimentation of Internet of Things (IoT) technology into industrial and manufacturing processes is known as Industrial Internet of Things (IIoT), or Industrial IoT. The Industrial Internet of Things (IIoT) improves automation, efficiency, and production by allowing for the real-time monitoring and analysis of industrial operations. Essential elements include of intelligent devices, sophisticated connection, data analysis, and automation systems, facilitated by cloud and edge computing for data processing.

The advantages of Industrial Internet of Things (IIoT) encompass enhanced operational efficiency, less downtime, and energy conservation. This is a revolutionary technical notion. The desire to increase productivity and efficiency as well as government measures to promote industrial automation are major drivers driving the growth of this market. Investments in Industry 4.0 technologies are also developing. However the IIoT market's expansion is constrained by a lack of standardization and expensive capital and operating expenditure needs.

Additionally, it is anticipated that chances for market expansion will arise from the growing use of Industrial IoT for predictive maintenance and the expansion of data centers. But two big obstacles to business expansion are IoT device vulnerabilities and a shortage of qualified personnel.

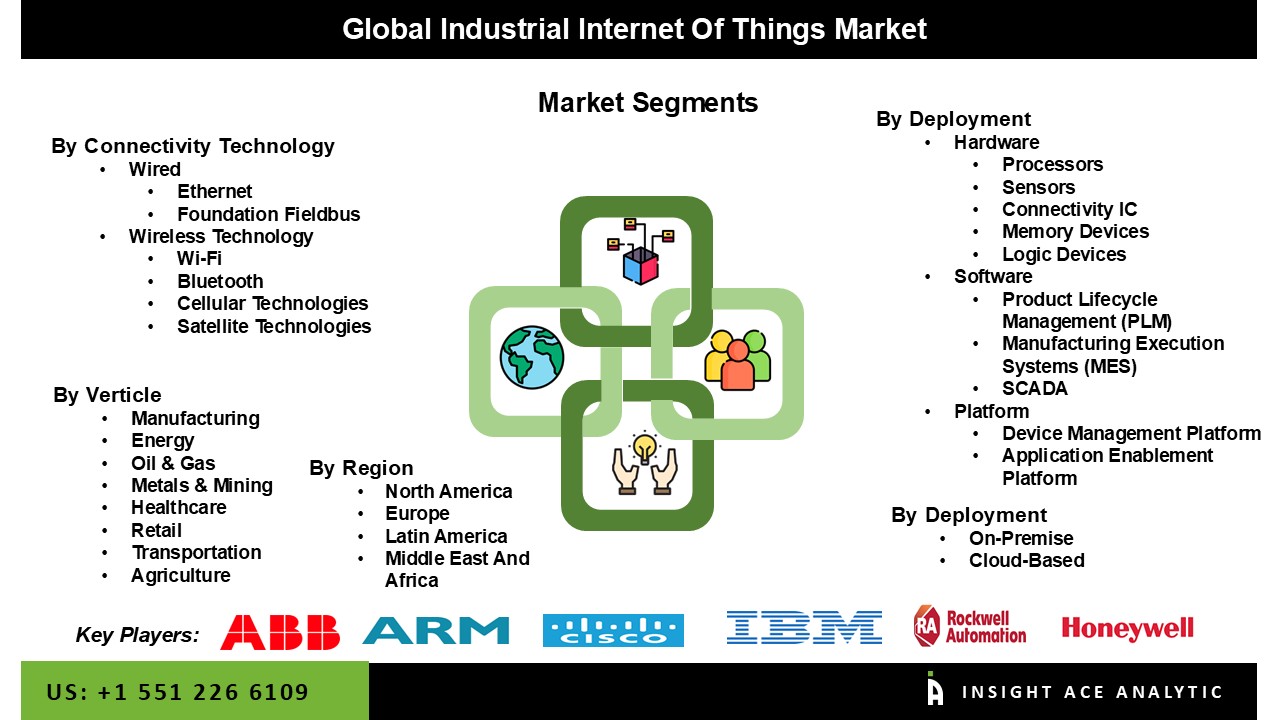

The industrial IoT market is segmented into deployment, offering, vertical, and connectivity technology. The deployment segment consists of on-premise and cloud-based. Based on the offering, the market comprises hardware, software, and platforms. The hardware segment is divided into processors, sensors, connectivity IC, memory devices, and logic devices. The software segment is divided into product lifecycle management (PLM), manufacturing execution systems (MES), SCADA, outage management systems (Oms), distribution management systems (DMS), remote patient monitoring, retail management software, visualization software, transit management systems, farm management systems. The platform segment is divided into device management platform, application enablement platform, connectivity management platform, and services. Based on the vertical, the market is divided into manufacturing, energy, oil & gas, metals & mining, healthcare, retail, transportation, and agriculture. Based on the connectivity technology, the market is divided into wired and wireless technologies.

The critical role of the infrastructure and the requirement for widespread deployment across multiple industrial settings motivate a substantial initial hardware investment. As a result, the hardware segment continues to dominate the IIoT industry. The foundation of the IIoT is made up of sensors that gather information on variables like motion, humidity, temperature, and pressure. In sectors including manufacturing, energy, and transportation, this data is crucial for process optimization, predictive maintenance, and real-time monitoring. AI-enabled sensors improve edge computing capabilities, precision, and downsizing. Sensors are becoming essential for contemporary IIoT installations, especially in smart factories, due to these developments. For instance, in June 2023, ABB and China Telecom established a joint laboratory in Hangzhou, China, to develop advanced IIoT sensor solutions for industrial applications. This partnership focuses on integrating sensors with digitalization technologies to enhance smart factory capabilities.

The Industrial IoT (IIoT) market is dominated by the manufacturing segment because of its strong need for automation, efficiency, and real-time operational insights. IIoT is essential to allowing smart factories, where consumers, machines, and systems are connected by a network of sensors, devices, and software, as manufacturers attempt to increase productivity and lower operating costs. Predictive maintenance is made possible by this connectivity, which helps to prolong equipment life and prevent unscheduled downtime.IIoT is also used by manufacturers to enhance supply chain visibility, streamline production procedures, and identify quality problems early. Real-time data collection and analysis from several lines or facilities facilitates quicker decision-making and better use of available resources. Furthermore, the manufacturing sector had a major advantage over other industries since it was one of the first to implement Industry 4.0 and digital transformation tactics. Manufacturing continues to dominate the IIoT industry in terms of adoption, investment, and overall impact due to the large number of deployed connected devices and the diverse variety of use cases, which include everything from automation and robotics to energy management and environmental monitoring.

North America's early adoption of IIoT solutions, sophisticated technological infrastructure, and favourable economic and regulatory conditions have all contributed to the region's dominance in the Industrial Internet of Things (IIoT) market. This is the outcome of the region's early adoption and deployment of industrial IoT technologies. Furthermore, during the forecast period, the industrial IoT industry is anticipated to grow due to a number of factors, including increased use of industrial IoT devices, strong government support for advancing digitalization throughout the industrial sector, and growing adoption of cutting-edge technologies like cloud computing and artificial intelligence. These companies drive innovation through significant investments in research and development (R&D), offering advanced IIoT platforms, sensors, and analytics tools.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 192.92 Bn |

| Revenue Forecast In 2034 | USD 445.96 Bn |

| Growth Rate CAGR | CAGR of 9.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Deployment, Offering, Vertical, Connectivity Technology |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Huawei Technologies Co., Ltd., Cisco Systems, Inc, ABB, Siemens, Intel Corporation, General Electric, Emerson Electric Co, Sap Se, Honeywell International Inc, Rockwell Automation, Arm Limited, PTC, Dassault Systemes, IBM, Robert Bosch GmbH, Nec Corporation, Ansys, Inc, Worldsensing, Arundo, Software Ag, Texas Instruments Incorporated, Kuka Ag, Dragos, Inc, Google LLC, Microsoft Corporation |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Industrial IoT Market - By Deployment

Global Industrial IoT Market – By Offering

Global Industrial IoT Market – By Vertical

Global Industrial IoT Market- By Connectivity Technology

Global Industrial IoT Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.