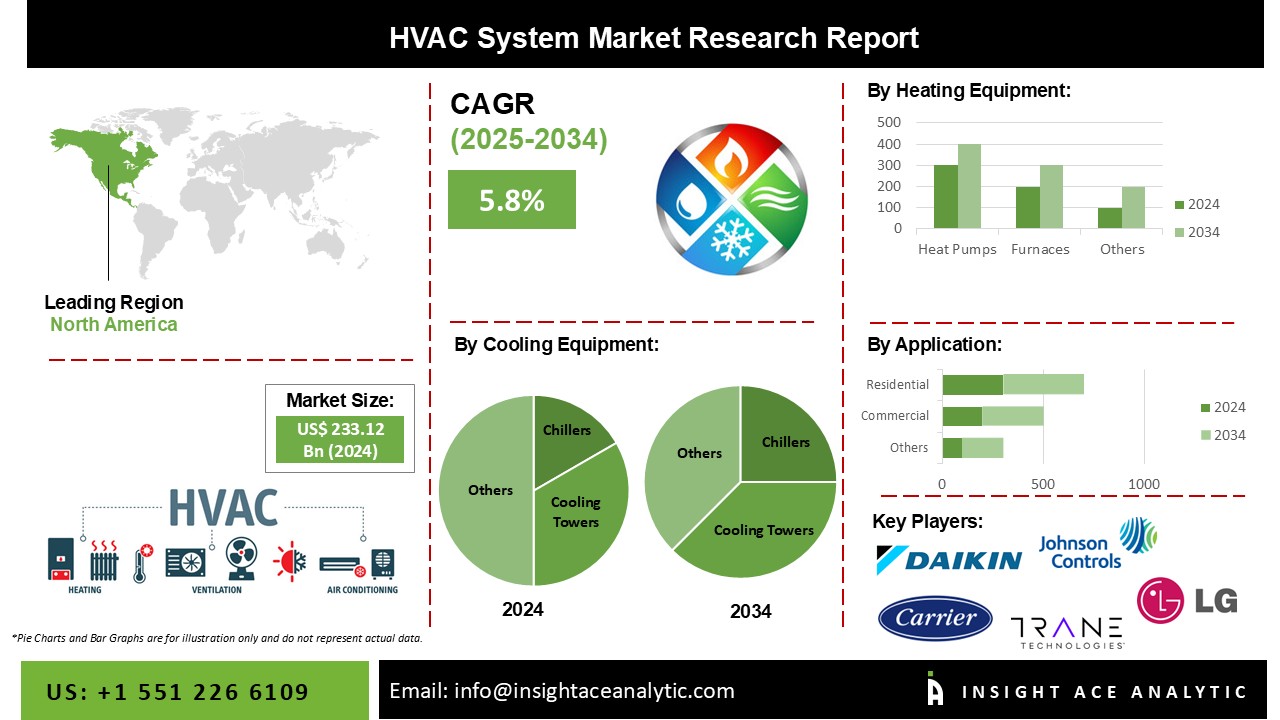

HVAC System Market Size is valued at 233.12 billion in 2024 and is predicted to reach 403.76 billion by the year 2034 at a 5.8% CAGR during the forecast period for 2025-2034.

Heating, ventilation, and cooling systems are used to transport air between indoor and outdoor spaces. They filter the interior air to keep the environment healthy and humidity comfortable. A key trend predicted to impact the market over the projected period is varying climatic conditions and the necessity to maintain an ambient climate in a building. Most customers have recently prioritized the availability of smart features and energy efficiency as essential purchase criteria, and this trend is projected to continue in the next years.

Furthermore, the increased building activity in the commercial and residential sectors and the demand from the food and beverage and telecommunications industries are expected to contribute considerably to market growth. Moreover, a shortage of competent professionals is projected to have a negative impact on market growth in the near future.

However, after the first occurrence of COVID-19 was revealed in December 2019, the global economy has seen tremendous disruption. The pandemic had a negative impact on global heating, ventilation, and cooling system market development in the first quarter of 2020. This is due to the lockdown effect that has occurred in nations such as Ireland, Germany, the United States, China, and others. The lockout interrupted production and diminished client demand for the equipment.

The HVAC System Market is segmented based on cooling equipment, heating equipment, ventilation equipment, implementation type and application. Based on cooling equipment, the market is segmented as unitary air conditioners, VRF systems, chillers, room air conditioners, coolers, and cooling towers. The heating equipment segment includes heat pumps, furnaces, unitary heaters, and boilers. By ventilation equipment, the market is segmented into air handling units, air filters, dehumidifiers, ventilation fans, humidifiers, and air purifiers. The implementation type segment includes new construction and retrofit. By application, the market is segmented into residential, commercial, and industrial.

The unitary air conditioners category is expected to hold a major share of the global HVAC system market in 2024. According to the International Energy Agency (IEA), cooling accounts for more than 10% of global electricity use. Increasing population and disposable incomes, particularly in hotter regions of the world, have encouraged the use of air conditioners, supporting the need for cooling equipment.

The residential segment is projected to grow rapidly in the global HVAC system market. The residential HVAC segment is expanding due to an increase in multi-family and single-family buildings. Residential HVAC (Heating, ventilation, and air conditioning) demand is predicted to remain more or less stagnant in developed areas of the world, but demand from emerging markets, particularly developing economies, is expected to be slightly higher. This is mostly due to the rising population in emerging economies and increased market maturity in mature markets.

The Asia Pacific HVAC system market is expected to register the highest market share in terms of revenue in the near future. Rising urbanization, population expansion, and rising consumer disposable income have contributed to the region's phenomenal progress. Currently, the corporate sector has been increasingly offering opportunities for future regional growth. North America was the second-largest customer of HVAC systems, closely followed by Europe. The market for HVAC systems as a whole has matured; however, replacement sales owing to aged infrastructure or retrofit projects are opening new revenue streams for OEMs in addition to expanding into the services and maintenance area.

|

Report Attribute |

Specifications |

|

Market size value in 2024 |

USD 233.12 Bn |

|

Revenue forecast in 2034 |

USD 403.76 Bn |

|

Growth rate CAGR |

CAGR of 5.8% from 2025 to 2034 |

|

Quantitative units |

Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report coverage |

The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments covered |

Cooling Equipment, Heating Equipment, Ventilation Equipment, Implementation Type And Application |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

|

Competitive Landscape |

Daikin Industries, Johnson Controls, Carrier, Trane Technologies plc., LG Electronics, Emersion Electronic Co., Honeywell International Inc., Mitsubishi Electric Corporation, Nortek Air Management, and Samsung Electronics. |

|

Customization scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and available payment methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global HVAC System Market Snapshot

Chapter 4. Global HVAC System Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Cooling Equipment Estimates & Trend Analysis

5.1. by Cooling Equipment & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Cooling Equipment:

5.2.1. Unitary Air Conditioners

5.2.1.1. Split Air Conditioners

5.2.1.2. Packaged Air Conditioners

5.2.2. Vrf Systems

5.2.3. Chillers

5.2.3.1. Scroll Chillers

5.2.3.2. Screw Chillers

5.2.3.3. Centrifugal Chillers

5.2.3.4. Reciprocating Chillers

5.2.3.5. Absorption Chillers

5.2.4. Room Air Conditioners

5.2.5. Coolers

5.2.5.1. Ducted Coolers

5.2.5.2. Window Coolers

5.2.6. Cooling Towers

5.2.6.1. Evaporative Cooling Towers

5.2.6.2. Dry Cooling Towers

5.2.6.3. Hybrid Cooling Towers

Chapter 6. Market Segmentation 2: by Heating Equipment Estimates & Trend Analysis

6.1. by Heating Equipment & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Heating Equipment:

6.2.1. Heat Pumps

6.2.1.1. Air-To-Air Heat Pumps

6.2.1.2. Air-To-Water Heat Pumps

6.2.1.3. Water-To-Water Heat Pumps

6.2.2. Furnaces

6.2.2.1. Oil Furnaces

6.2.2.2. Gas Furnaces

6.2.2.3. Electric Furnace

6.2.3. Unitary Heaters

6.2.3.1. Gas Unit Heaters

6.2.3.2. Oil-Fired Unit Heaters

6.2.3.3. Electric Unit Heaters

6.2.4. Boilers

6.2.4.1. Steam Boilers

6.2.4.2. Hot Water Boilers

Chapter 7. Market Segmentation 3: by Ventilation Equipment Estimates & Trend Analysis

7.1. by Ventilation Equipment & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Ventilation Equipment:

7.2.1. Air Handling Units

7.2.2. Air Filters

7.2.3. Dehumidifiers

7.2.3.1. Refrigeration Dehumidifiers

7.2.3.2. Absorption Dehumidifiers

7.2.4. Ventilation Fans

7.2.4.1. Crossflow Fans

7.2.4.2. Axial Fans

7.2.4.3. Centrifugal Fans

7.2.4.4. Domestic Fans

7.2.4.5. Range Hood Fans

7.2.4.6. Power Roof Fans

7.2.5. Humidifiers

7.2.5.1. Warm-Mist Humidifiers

7.2.5.2. Ultrasonic Humidifiers

7.2.5.3. Cool-Mist Humidifiers

7.2.6. Air Purifier

7.2.6.1. HEPA Air Purifiers

7.2.6.2. Activated Carbon Air Purifiers

7.2.6.3. Electrostatic Air Purifiers

7.2.6.4. Ionic Air Purifiers

Chapter 8. Market Segmentation 4: by Implementation Type Estimates & Trend Analysis

8.1. by Implementation Type & Market Share, 2024 & 2034

8.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Implementation Type:

8.2.1. New Construction

8.2.2. Retrofit

Chapter 9. Market Segmentation 5: by Application Estimates & Trend Analysis

9.1. by Application & Market Share, 2024 & 2034

9.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Application:

9.2.1. Residential

9.2.2. Commercial

9.2.2.1. Office

9.2.2.2. Government

9.2.2.3. Healthcare

9.2.2.4. Education

9.2.2.5. Retail

9.2.2.6. Airport

9.2.3. Industrial

Chapter 10. HVAC System Market Segmentation 6: Regional Estimates & Trend Analysis

10.1. North America

10.1.1. North America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Cooling Equipment, 2021-2034

10.1.2. North America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Heating Equipment, 2021-2034

10.1.3. North America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Ventilation Equipment, 2021-2034

10.1.4. North America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Implementation Type, 2021-2034

10.1.5. North America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

10.1.6. North America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

10.2. Europe

10.2.1. Europe HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Cooling Equipment, 2021-2034

10.2.2. Europe HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Heating Equipment, 2021-2034

10.2.3. Europe HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Ventilation Equipment, 2021-2034

10.2.4. Europe HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Implementation Type, 2021-2034

10.2.5. Europe HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

10.2.6. Europe HVAC System Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

10.3. Asia Pacific

10.3.1. Asia Pacific HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Cooling Equipment, 2021-2034

10.3.2. Asia Pacific HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Heating Equipment, 2021-2034

10.3.3. Asia-Pacific HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Ventilation Equipment, 2021-2034

10.3.4. Asia Pacific HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Implementation Type, 2021-2034

10.3.5. Asia Pacific HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

10.3.6. Asia Pacific HVAC System Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

10.4. Latin America

10.4.1. Latin America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Cooling Equipment, 2021-2034

10.4.2. Latin America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Heating Equipment, 2021-2034

10.4.3. Latin America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Ventilation Equipment, 2021-2034

10.4.4. Latin America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Implementation Type, 2021-2034

10.4.5. Latin America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

10.4.6. Latin America HVAC System Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

10.5. Middle East & Africa

10.5.1. Middle East & Africa HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Cooling Equipment, 2021-2034

10.5.2. Middle East & Africa HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Heating Equipment, 2021-2034

10.5.3. Middle East & Africa HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Ventilation Equipment, 2021-2034

10.5.4. Middle East & Africa HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Implementation Type, 2021-2034

10.5.5. Middle East & Africa HVAC System Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

10.5.6. Middle East & Africa HVAC System Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 11. Competitive Landscape

11.1. Major Mergers and Acquisitions/Strategic Alliances

11.2. Company Profiles

11.2.1. Carrier Corporation

11.2.2. Daikin Industries, Ltd. (Japan)

11.2.3. Emersion Electronic Co.

11.2.4. Hitachi Ltd.

11.2.5. Honeywell International Inc.

11.2.6. Johnson Controls International plc

11.2.7. Lennox International, Inc.

11.2.8. LG Electronics

11.2.9. Mitsubishi Electric Corporation

11.2.10. Nortek Air Management

11.2.11. Samsung Electronics

11.2.12. Trane Technologies plc.

11.2.13. Other Prominent Players

HVAC System Market By Cooling Equipment-

HVAC System Market By Heating Equipment-

HVAC System Market By Ventilation Equipment-

HVAC System Market By Implementation Type-

HVAC System Market By Application-

HVAC System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.