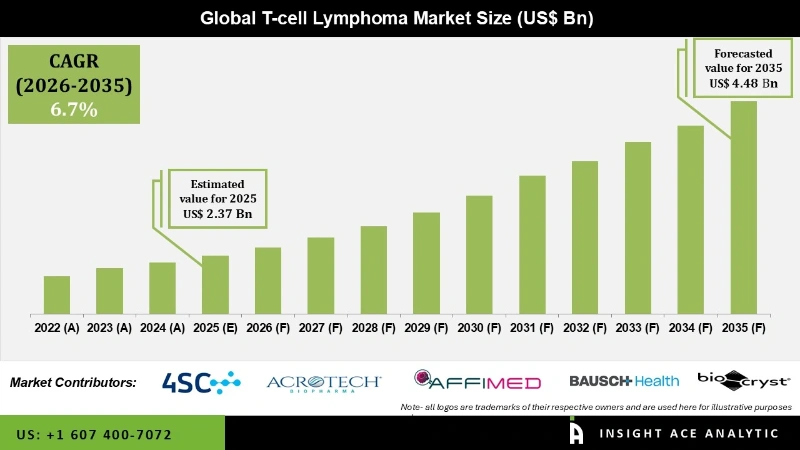

T-cell Lymphoma Market Size is valued at USD 2.37 Billion in 2025 and is predicted to reach USD 4.48 Billion by the year 2035 at a 6.7% CAGR during the forecast period for 2026 to 2035.

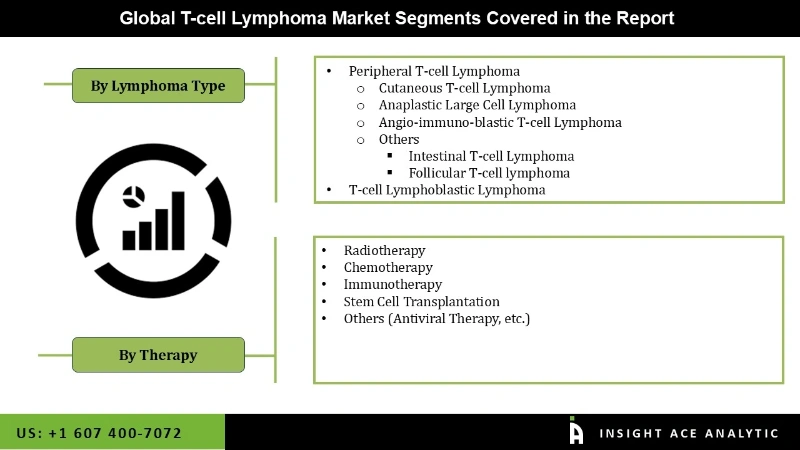

T-cell Lymphoma Market Size, Share & Trends Analysis Report By Lymphoma Type (Peripheral T-cell Lymphoma, T-cell Lymphoblastic Lymphoma), By Therapy, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

T-cell lymphoma is a rare type of cancerous lymphoma that begins in white blood cells (T cells). Lymphoma arises from the uncontrolled growth of mature T cells and can become cancerous. It can cause skin redness, scaly round patches on the skin, and skin tumors.

Several factors driving the growth of the T-cell Lymphoma Market include the rising lymphoma cancer cases, increasing technological advances in therapy techniques, increasing T-cell lymphoma-specific therapies, and increasing autoimmune disorders. Moreover, spreading awareness regarding the benefits of T-cell lymphoma therapeutics, surging demand for cost-efficient cancer treatments and boosting government funding for the R&D of innovative cancer therapies are further expected to deliver considerable market growth during the forecast period. According to Leukemia & Lymphoma Society 2020, around 85,720 new lymphoma cases were diagnosed in the United States in 2020. Additionally, the newly reported lymphoma cases include 8,480 cases of Hodgkin (HL) and 77,240 cases of Non-Hodgkin (NHL) Lymphoma, thereby upsurging the demand for this market.

However, the high cost of T-cell Lymphoma therapies, complicated production methods, and side effects of these therapies may restrict the market growth in the upcoming years.

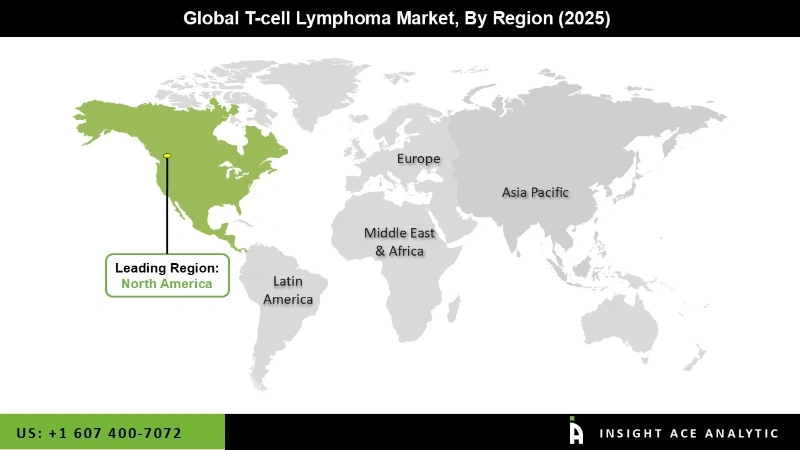

The T-cell Lymphoma Market is classified based on lymphoma type, therapy, and region. By lymphoma type, the market is segmented into peripheral T-cell lymphoma and T-cell lymphoblastic lymphoma. Peripheral T-cell lymphoma is further divided into cutaneous T-cell lymphoma, anaplastic large cell lymphoma, angio-immuno-blastic T-cell lymphoma, and others (intestinal T-cell lymphoma, follicular T-cell lymphoma). By therapy, the market is grouped into radiotherapy, chemotherapy, immunotherapy, stem cell transplantation, and others (antiviral treatment, etc.). The chemotherapy segment is expected to lead this market during the forecast years due to its increasing use for cancer treatments. Regionally, the market is segregated across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America is anticipated to dominate the T-cell lymphoma market over the forecast period (2020-2030), owing to the increasing R&D expenditure and rising incidences of lymphoma in this region.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.37 Billion |

| Revenue forecast in 2035 | USD 4.48 Billion |

| Growth rate CAGR | CAGR of 6.7% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Therapy, Lymphoma Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | 4SC AG, Acrotech Biopharma, Affimed, Bausch Health Companies Inc., Biocryst Pharmaceuticals Inc., Bristol-Myers Squibb Company, Chipscreen Biosciences, Citius Pharma, CSPC, CStone Pharmaceuticals, Daiichi-Sankyo, Dizal Pharma, Eisai, Elorac, F. Hoffmann-La Roche Ltd, Genmab A/S, Genor Biopharma, GlaxoSmithKline plc., Innate Pharma, Johnson and Johnson Private Limited, Kyowa Kirin Co., Ltd., Merck and Co. Inc., Novartis AG, Pfizer, Roche, Seagen Inc., Secura Bio, Shanghai Junshi Bio, SHIONOGI & Co., Ltd., Solasia, Spectrum Pharmaceuticals Inc., Takeda, Viracta, and Other Prominent Players. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global T-cell Lymphoma Market, by Lymphoma Type

Global T-cell Lymphoma Market, by Therapy

Global T-cell Lymphoma Market, by Region

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.