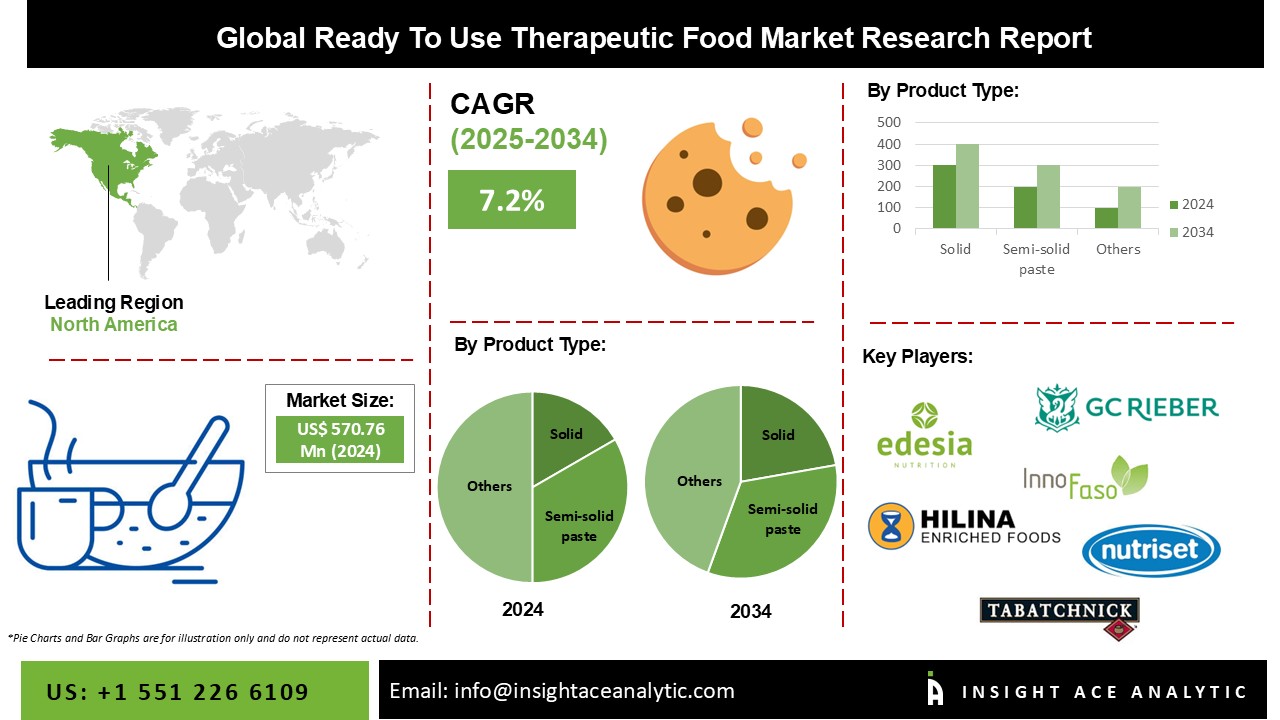

Ready-to-Use Therapeutic Food Market Size is valued at USD 570.76 Million in 2024 and is predicted to reach USD 1133.14 Million by the year 2034 at an 7.2% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Ready-to-use therapeutic food (RUTF) is convenient to consume, doesn't need to be refrigerated, is inexpensive, and has a long shelf life. This tool helps youngsters live healthier lives while also saving money. The market for ready-to-use therapeutic food is expected to rise as more cases of malnutrition are reported across the globe.

The market for ready-to-use therapeutic food is anticipated to expand due to increasing consumer demand for liquid RUTF products. Due to the difficulty of feeding newborns RUTF paste to treat malnutrition, the need for consumable RUTF products such as therapeutic milk is predicted to increase. Therefore, infants have a high demand for drinkable RUFT products, which in turn is boosting the market growth for ready-to-use therapeutics. The market for RUTF is anticipated to benefit from the increasing focus of manufacturers on introducing bars and biscuits RUTF products.

Furthermore, many producers are concentrating on manufacturing RUTF products in powder form, opening up a significant window of opportunity for producers to increase their market share. Uncertainty in RUTF milk products, the possibility of microbiological contamination, and the lack of precise commodity requirements in the Codex Alimentarius for therapeutic milk by UNICEF are all anticipated to restrain the market's expansion for RUFT.

The ready-to-use therapeutic food market is segmented on the product. Based on product, the market is segmented into solid products (powder or blends and biscuits or bars), semi-solid products or paste, and drinkable therapeutic food.

The market share that belongs to semi-solid paste products is the largest. Because semi-solid products don't need water to be blended with them, and that contaminated water is frequently found in remote areas and can cause some illnesses, they are in great demand. To address the demand for more undernourished youngsters, businesses are expanding their product ranges and developing semi-solid paste. Companies are working to create new, inexpensive goods that offer superior nutrition.

The Europe ready-to-use therapeutic food market is expected to register the highest market share in revenue soon due to the region's extensive production by reputable manufacturers who provide other regions with the goods. Several European regional businesses focus on increasing their production capacity while also delivering RUTF to UNICEF and other NGOs. Besides, the Asia Pacific is accounted to experience significant growth in the global market for therapeutic ready-to-eat foods. During this period, the regional market is anticipated to increase due to the government's escalating efforts to eradicate malnutrition in the countries.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 570.76 million |

| Revenue Forecast In 2034 | USD 1133.14 million |

| Growth rate CAGR | CAGR of 7.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | GC Rieber Compact AS, Diva Nutritional Products, Edesia USA, Hilina, InnoFaso, Insta Products, Mana Nutritive Aid Products, Nutriset SAS, NutriVita Foods, Power Foods Tanzania, and Tabatchnik Fine Foods. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product Type:

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.