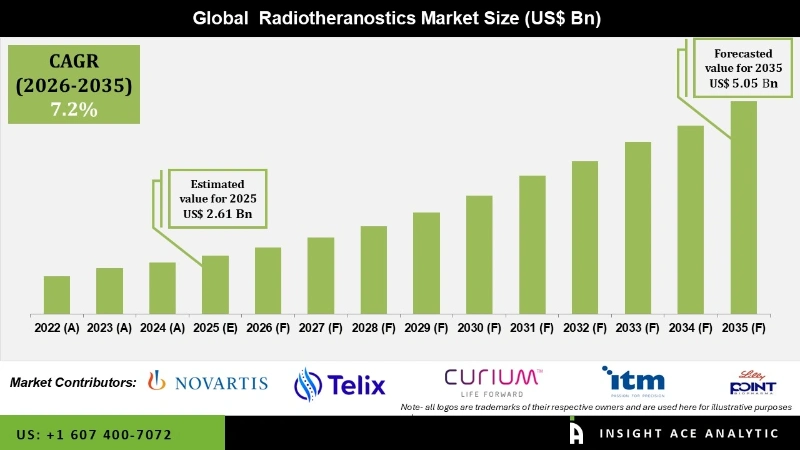

Global Radiotheranostics Market Size is valued at USD 2.61 billion in 2025 and is predicted to reach USD 5.05 billion by the year 2035 at an 7.2% CAGR during the forecast period for 2026 to 2035.

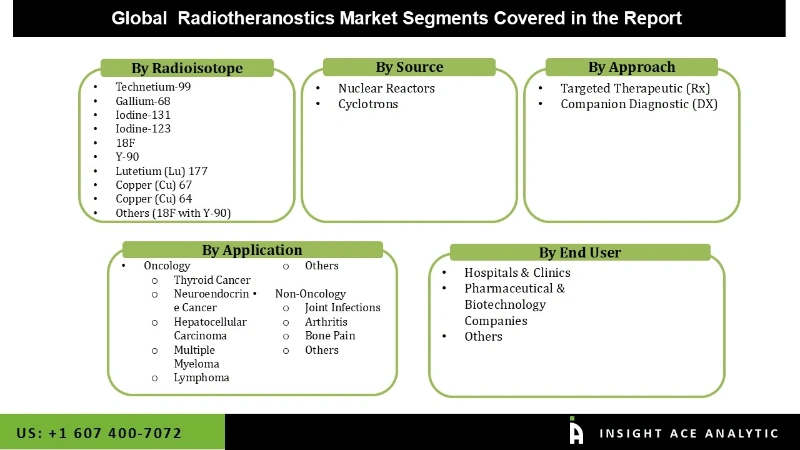

Radiotheranostics Market Size, Share & Trends Analysis Report By Radioisotope, By Source (Nuclear Reactors, Cyclotrons), By Approach, By Application(Oncology, Non-Oncology), By End-User, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Radiotheranostics is a division of radiology that combines molecular imaging (primarily PET and SPECT) with targeted radionuclide therapy, which involves the use of small molecules, peptides, and/or antibodies as carriers for therapeutic radionuclides, typically those emitting -, -, or auger-radiation. The approval of new radiotheranostic agents such as 177Lu-DOTATATE and 177Lu-PSMA-617, as well as the availability of companion diagnostic agents (such as 68Ga-DOTATATE and 68Ga-PSMA-11, respectively), has fueled a resurgence of interest in the field, fueling a slew of clinical trials testing novel radiotheranostics.

Increased public-private funding for target research initiatives, growing public awareness of the advantages of alpha radio immunotherapy-based targeted cancer treatment, and increased product innovations and development due to global technological advancements is expected to create lucrative opportunities for market participants during the forecast period. Hospital budget cuts, particularly during the pandemic, a lack of sufficient infrastructure in low- and middle-income nations, and an unfavorable reimbursement environment are all anticipated to pose challenges to the market throughout the projection period.

Increasing investment in R&D, particularly in developed and developing economies, for medical instruments and devices will further open up lucrative market expansion opportunities. The nuclear medical field's research and development capabilities also support the market growth rate. Growing numbers of strategic alliances and partnerships between public and private players are opening up lucrative new market opportunities for the funding and use of cutting-edge technology.

The radiotheranostics market is segmented on the radioisotope, source, approach, applications and end users. Based on radioisotope, the market is segmented into technetium-99, gallium-68, iodine-131, iodine-123, 18F, y-90, lutetium (lu) 177, copper (Cu) 67, copper (Cu) 64, others. Based on source, the market is segmented into Nuclear Reactors, Cyclotrons. Based on approach market is segmented into Targeted Therapeutic (Rx), Companion Diagnostic (DX). Based on application, the radiotheranostics market is segmented into oncology (thyroid cancer, neuroendocrine cancer, hepatocellular carcinoma, multiple myeloma, lymphoma, others) and non-oncology (joint infections, arthritis, bone pain, others). Based on end-use, the radiotheranostics market is segmented into hospitals & clinics, pharmaceutical & biotechnology companies and others.

177 Lu segment grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. The majority of radioisotopes are employed in oncology for radiation therapy or diagnosis. Theranostics frequently utilized in diagnosing and treating neuroendocrine tumors include 68 Ga DONATE and 177 Lu DOTATOC. The main causes of the intense interest in the clinical application of this radionuclide are its good nuclear properties and the simplicity of obtaining high activity levels of 177Lu.

Cyclotrons are fast evolving and will play an increasingly significant role in the pharmaceutical industry, particularly in advanced medical imaging techniques, since radiopharmaceuticals generated by cyclotrons are exceptionally effective at identifying various diseases.

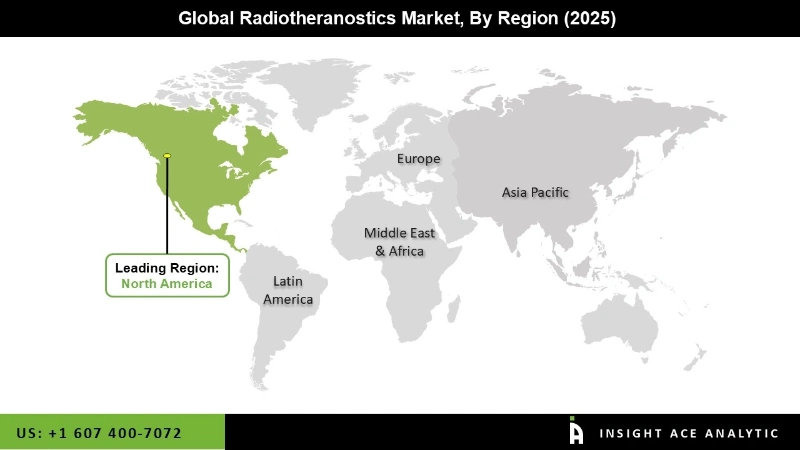

The North American radiotheranostics market is expected to register the highest market share in revenue soon because of the region's robust healthcare infrastructure, rising overweight population, large patient population suffering from chronic diseases like cancer, coronary artery disease, and strokes, and increased research activity. In addition, Asia Pacific is projected to grow rapidly in the global radiotheranostics market. However, this business is still expected to have substantial development potential due to the expanding number of clinical settings where flow cytometry is used.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.61 billion |

| Revenue Forecast In 2035 | USD 5.05 billion |

| Growth Rate CAGR | CAGR of 7.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Radioisotope, Source, Approach, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Novartis AG, Bayer AG, Telix Pharmaceuticals, ITM Isotope Technologies, Eli Lilly (via POINT Biopharma), AstraZeneca (via Fusion Pharmaceuticals), Radiopharm Theranostics, Nordic Nanovector, Y-mAbs Therapeutics, Ratio Therapeutics, Radionetics Oncology |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Radiotheranostics Market By Radioisotope:

Radiotheranostics Market By Source

Radiotheranostics Market By Approach

Radiotheranostics Market By Application:

Radiotheranostics Market By End User:

North America Radiotheranostics Market By Country,

Europe Radiotheranostics Market By Country,

Asia Pacific Radiotheranostics Market By Country,

Latin America Radiotheranostics Market By Country,

Middle East & Africa Radiotheranostics Market By Country,

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.