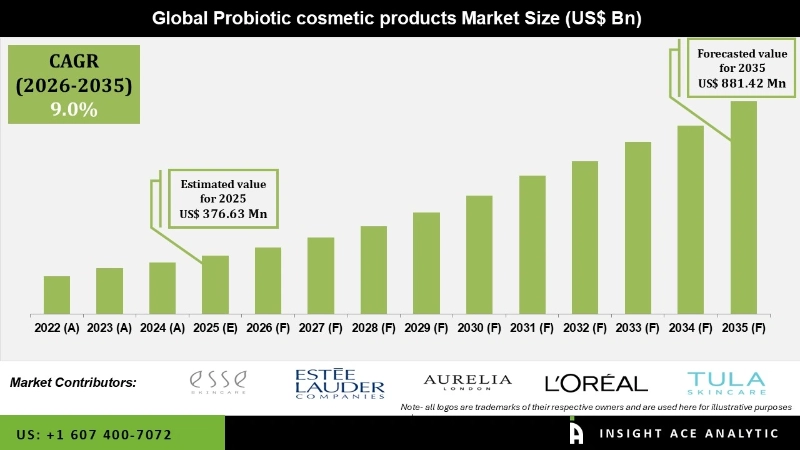

Global Probiotic Cosmetic Products Market Size is valued at USD 376.63 Mn in 2025 and is predicted to reach USD 881.42 Mn by the year 2035 at an 9.0% CAGR during the forecast period for 2026 to 2035.

Probiotic Cosmetic Products Market Size, Share & Trends Analysis Report By Products (Skin Care, Hair Care), By End-User (Hypermarket & Supermarket, Pharmacy & Drug Store, E-commerce, Others), By Region, And By Segment Forecasts, 2025-2034.

Key Industry Insights & Findings from the Report:

Probiotics have a strong demand in cosmetics, which is driving market expansion due to their expanding acceptability as a nutritional supplement. Consumer awareness of the benefits of microbes in cosmetics and skincare products, such as Lactobacillus and Bifidobacterium, is driving the demand for probiotic cosmetics. The probiotic cosmetics market is growing due to processing components such as Lactobacillus, Bifidobacterium, and other ferments in cosmetic and skincare products. Companies are investing in research and development to improve the quality of their products. Mergers and acquisitions are other common growth strategies that help significant players enhance their positions. The organic skincare industry's growth will also boost probiotic cosmetics sales.

Furthermore, due to a growing consciousness of physical appearance and skincare routine, customers are willing to spend a premium on product ingredients that are shown to function for skin nourishment. Microbiome cosmetics and sustainable skincare are in high demand. Furthermore, rising R&D efforts, government initiatives to employ sustainable components in manufacturing, and investments by major players are likely to provide lucrative revenue growth possibilities for participants in the global probiotic cosmetic products market. However, managing logistics for probiotic skin care cosmetics needs a high level of knowledge in a variety of areas, including managing large quantities of items and delivering them at a competitive price. As a result, the market for probiotic skin care cosmetics is constrained.

The probiotic cosmetic products market is segmented based on product and end-users. By product, the market is categorized as skincare and hair care. By end-users, the market is segmented into hypermarkets & supermarkets, Pharmacy & drugs store, E-commerce, and others.

The skin care category is expected to hold a significant share in the global probiotic cosmetic products market in 2021. The essential factor driving the segment growth is the usage of probiotics as a relief ingredient for skin disorders like acne, pimples, wrinkles, and others. Growing consumer knowledge of the efficacy of clinically tested goods and probiotic cosmetics contributes to the segment's growth. Furthermore, increased demand for products with few to no adverse effects is expected to drive product demand in the market over the upcoming years. Probiotics have been making their way into main counter shelves as manufacturers extend their product selection.

The e-commerce segment is projected to grow at a rapid rate in the global probiotic cosmetic products market. The growing popularity of e-commerce channels is expected to boost the market's growth potential. Factors like a larger distribution network, increased internet penetration, the availability of a wide selection of items, and inexpensive operational costs have enticed both existing and new businesses to use this channel of distribution. Amazon.com, Sephora.com, Nika, and skinstore.com are just a few of the prominent online retailers of probiotic cosmetics worldwide, especially in countries such as the US, Germany, UK, China, and India.

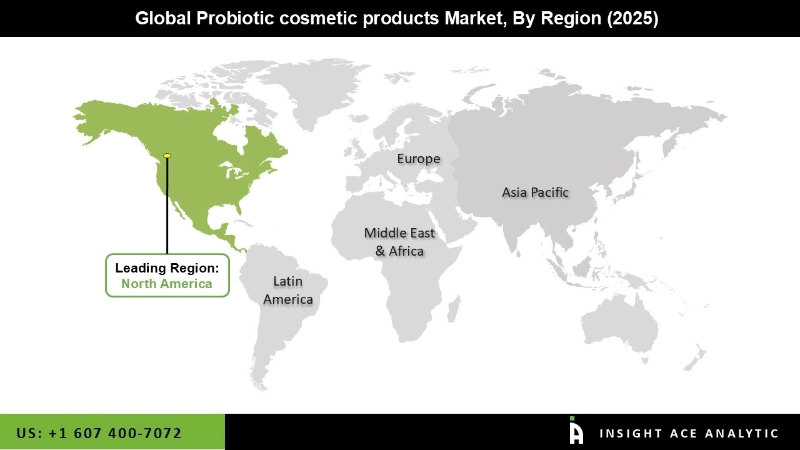

The North America probiotic cosmetic products market is expected to register the highest market share in terms of revenue soon. This can be attributed to the intense focus on the environment in the region, with the increasing adoption of probiotic cosmetic products in different industries, including food & beverages, personal care, packaging, automotive, and others. In addition, the region's chemical industry is focusing on producing probiotic cosmetic products to develop sustainable and environmentally friendly solutions. Growing demand for bio-based components across industries and widespread adoption of probiotic cosmetic products in the production of intermediate chemicals in the region are factors proliferating the growth of the target market in the region. In addition, Asia Pacific is projected to augment in the global probiotic cosmetic products market due to growing environmental concerns, rapid industrialization, government initiatives, and increasing funding in various industries.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 376.63 Mn |

| Revenue Forecast In 2035 | USD 881.42 Mn |

| Growth Rate CAGR | CAGR of 9.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Bottle Types, By Material Types, By Capacity |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Esse Skincare, Estee Lauder Companies, Inc., Aurelia Skincare Ltd., L’oreal S.A., Tula Life, Inc., Eminence Organic Skincare, Unilever, LaFlore Probiotic Skincare, Glowbiotics, Inc, The Clorox Co and Other Prominent Players. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Products

By End-Users

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.