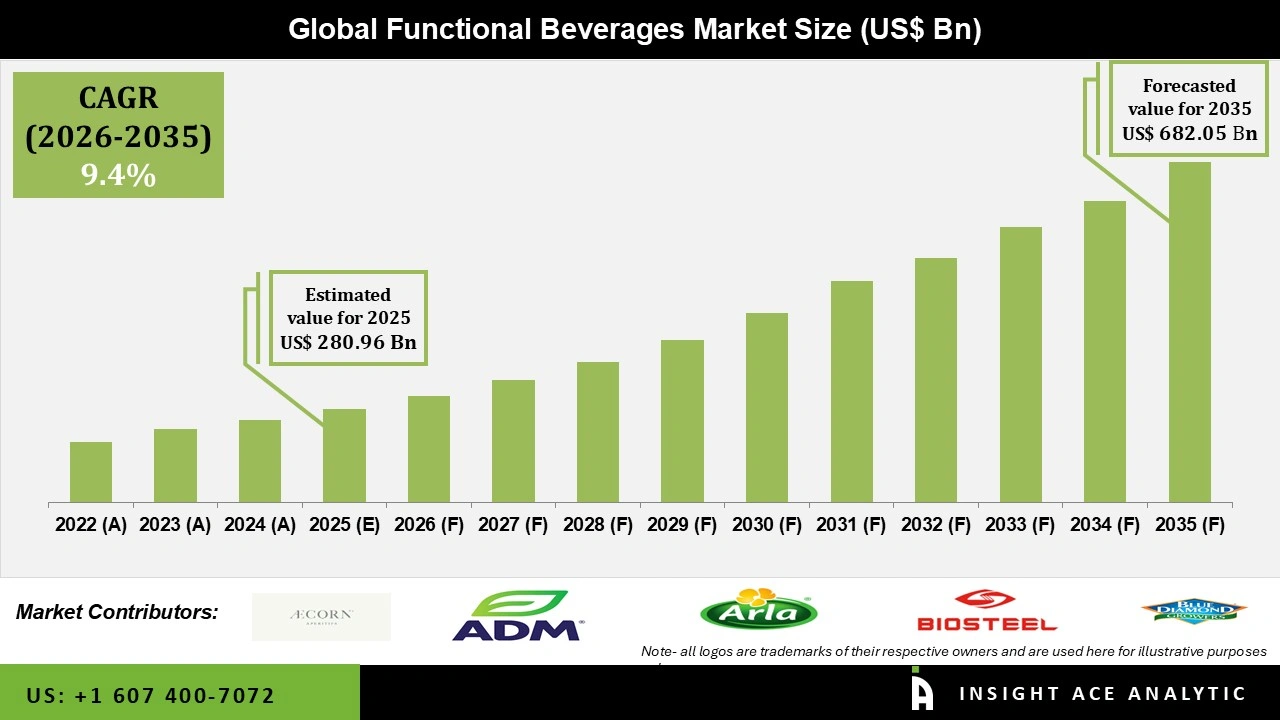

Global Functional Beverages Market Size is valued at USD 280.96 Billion in 2025 and is predicted to reach USD 682.05 Billion by the year 2035 at a 9.4% CAGR during the forecast period for 2026 to 2035.

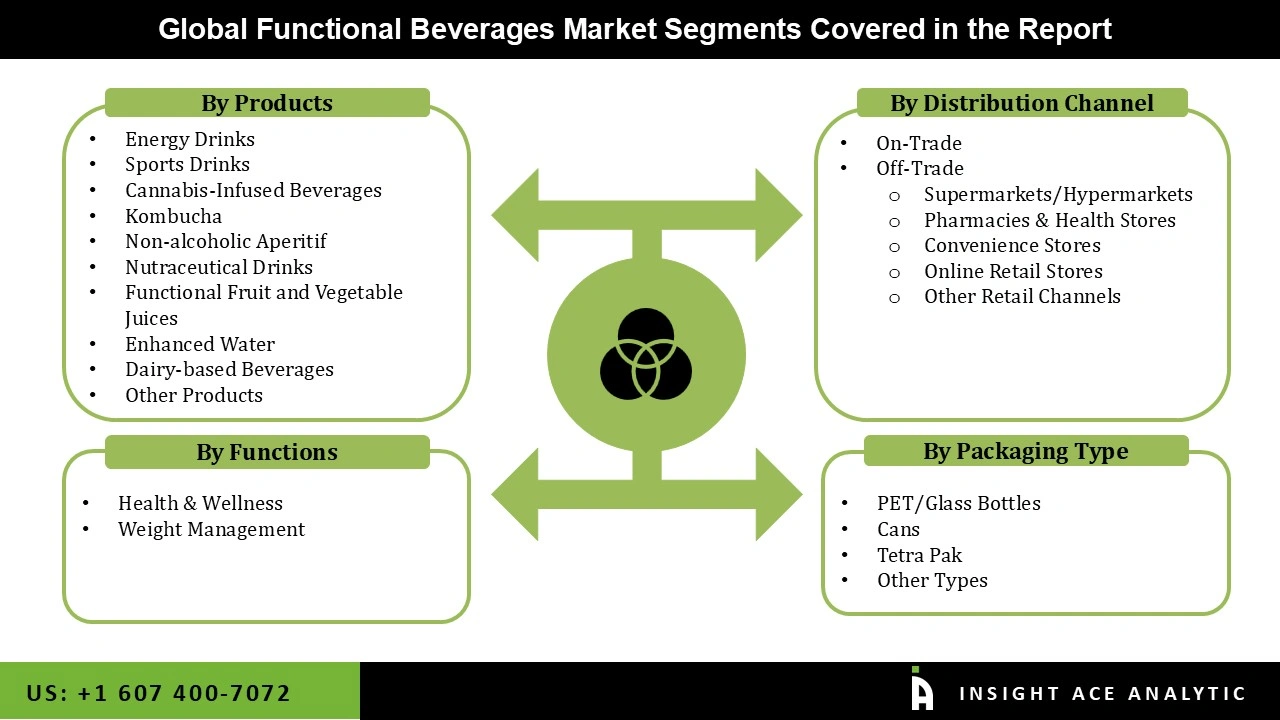

Functional Beverages Market Size, Share & Trends Analysis Report By Products, By Functions (Health & Wellness, Weight Management), By Packaging Type, By Distribution Channel (Convenience Stores, Online Retail, Pharmacies, Supermarket/Hypermarket), By Region, and By Segment Forecasts, 2026 to 2035.

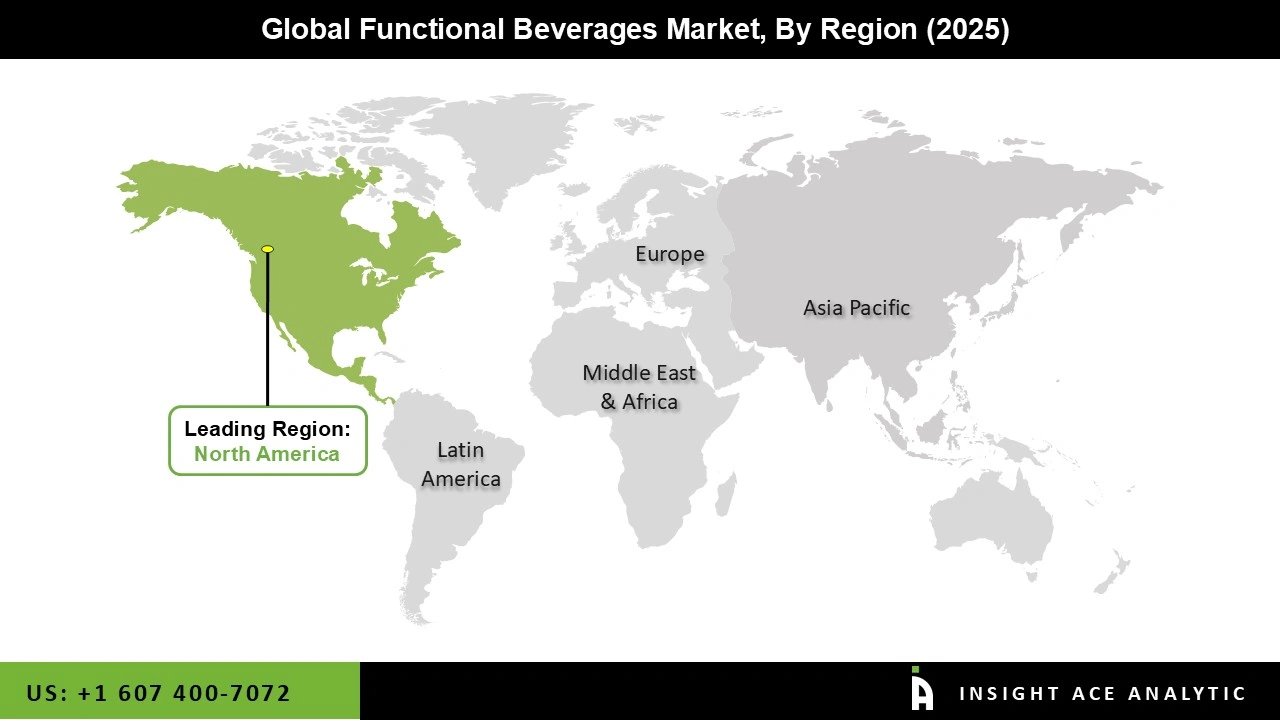

A Functional Beverage is a non-alcoholic drink product. It contains essential nutrients and bioactive compounds, including minerals, vitamins, antioxidants, amino acids, herbs, raw fruits, or vegetables. They help boost the immune system and improve the physical and mental health of the body. These beverages include energy drinks, dairy beverages, ready-to-drink tea and coffee, sports drinks, plant milk, fortified fruit drinks, and enhanced water. By region, North America controlled the global market with a share of 42 % in 2021.

The rising health awareness among the population and heavy investments by significant food and beverage companies are the primary driver of the functional beverage market. Additionally, the advances in scientific research, low consumption of convenience foods, rising demand for sports & performance drinks, availability of wide varieties of energy drinks and fruit juices, easy product distribution and storage, increasing consciousness about fitness and diets, and changing lifestyle patterns further increasing the demand for functional beverage products, thereby driving the market growth.

Consumers' preference is shifting toward more healthy and nutritious food and drink products due to the increasing awareness about fitness, diet, and health. So, the manufacturers are focusing more on research and development of new products, such as vegan, probiotic, and plant-based drinks. Such advances in beverage products are expected to enhance the global functional beverage market over the forecast years (2020-2030). Furthermore, the current COVID-19 outbreak has accelerated the demand for functional beverages that support the immune system.On the other hand, food safety problems, strict government regulations, and a lack of awareness about the benefits of functional beverages are expected to restrain the market growth over the forecast period.

The functional beverages market is segmented into products, functions, distribution channels, and region. The products segment is classified into energy drinks, sports drinks, cannabis-infused beverages, kombucha, non-alcoholic aperitif, nutraceutical drinks, functional fruit and vegetable juices, enhanced water, dairy-based beverages, and other products. The energy drinks segment is expected to hold the largest share of the global market over the forecast years due to the increasing demand for energy beverages. The sports drinks segment is also growing pidly due to the rising awareness about fitness.

By Functions, the market is divided into health & wellness and weight management. By distribution channel, the market is grouped into convenience stores, online retail, pharmacies, and supermarket/hypermarket. The online retail segment dominated the functional beverages market in 2020 and is expected to continue the trend over the forecast period due to the increasing customer preference towards online shopping. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America region is anticipated to dominate this market over the forecast years.

• Æcorn Aperitifs

• Archer Daniels Midland Company

• Arla foods

• BioSteel Sports Nutrition Inc.

• Blue Diamond Growers

• Campbell Soup Co.

• Celsius Holdings Inc.

• CENTR Brands Corporation

• Clif Bar & Company (Mondelēz International)

• Danone S.A.

• Domaines Pierre Chavin

• DuPont Nutrition & Health

• Flow Beverage Corp. (Flow)

• Fonterra Co-operative Group Limited

• General Mills, Inc.

• Glanbia PLC

• Hint Inc.

• Keurig Dr Pepper Inc.

• Kraft Foods Group, Inc.

• LycoRed Ltd.

• Monster Beverage Corp.

• National Beverage Corp

• Nestle SA

• Oatly Group AB

• Otsuka Holdings Co. Ltd

• Pepper SnappleGroup

• PepsiCo Inc.

• Red Bull GmbH

• Seedlip

• Suntory Holdings Limited

• Tata Global Beverages

• The Coca-Cola Company

• The Kraft Foods Group

• Thomson &Scott Ltd.

• Vita Coco Company Inc.

• Vitamin Well

• VOSS Water Global

• Yakult Honsha Co. Ltd

• Others

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 280.96 Billion |

| Revenue Forecast In 2035 | USD 682.05 Billion |

| Growth Rate CAGR | CAGR of 9.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Products, By Functions, By Distribution Channel, By Packaging Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Archer Daniels Midland Company (US) , Arla foods (Denmark), Æcorn Aperitifs (UK), Campbell Soup Co. (US), Clif Bar & Company (US), Danone S.A. (France), DuPont Nutrition & Health (Denmark), Fonterra Co-operative Group Limited (New Zealand), General Mills, Inc. (US), Glanbia PLC, Kraft Foods Group, Inc. (Ireland), LycoRed Ltd. (Israel), Monster Energy Company (US), Dr. Pepper SnappleGroup (US), National Beverage Corp (US), Nestlé S.A. (Switzerland), PepsiCo, Inc. (US), Red Bull Gmbh (Austria), Suntory Holdings Limited (Japan), Tata Global Beverages (Bengaluru), The Coca-Cola Company (US), The Kraft Foods Group (US), Thomson &Scott Ltd. (UK), Seedlip (Australia), Domaines Pierre Chavin (France), and others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.