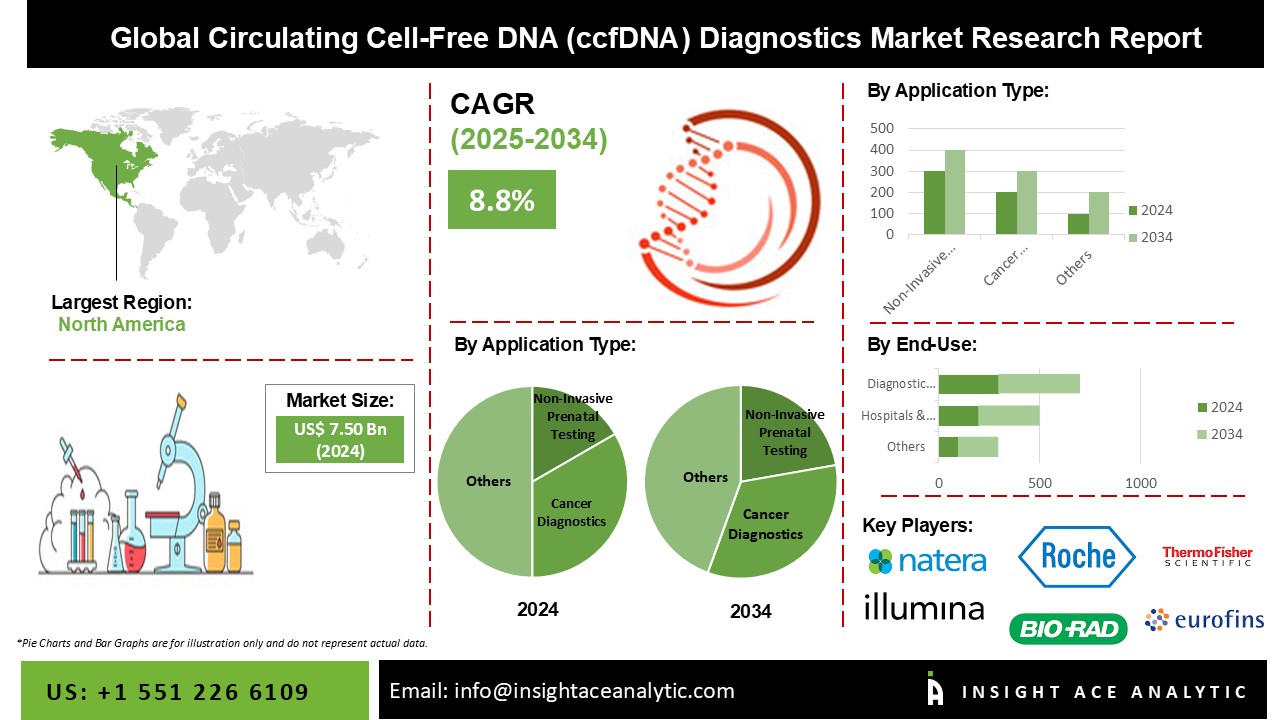

Circulating Cell-Free DNA (ccfDNA) Diagnostics Market Size is valued at 7.50 Billion in 2024 and is predicted to reach 17.19 Billion by the year 2034 at an 8.8% CAGR during the forecast period for 2025-2034.

Circulating cell-free DNA is defined as DNA fragments released in the bloodstream for essential and chronic disorders. ccfDNA, also known as circulating DNA (ctDNA), has recently gained popularity as a non-invasive illness biomarker. The scientific community's interest in therapeutic applications of ctDNA continues to grow at an exponential rate, fueling its attractiveness as a viable target in a wide range of study domains. One of the primary drivers of the Global Circulating Cell-Free DNA (ccfDNA) Diagnostics Market is the growing concern for early cancer detection. Other drivers include the success of NIPTs, increased cancer prevalence, and an increase in research and development initiatives to investigate the usefulness of circulating biomarkers in disease diagnosis. Furthermore, advances in molecular technology are promoting the exploration of cfDNA as a possible tool for the creation of minimally invasive diagnostics. The use of cfDNA-based diagnostics enhances both informed clinical decision-making and patient outcomes.

However, lack of standardization, poor reimbursement policies, and legal and regulatory restrictions are among the factors impeding market expansion. The dearth of awareness among people in underdeveloped nations is also hindering market expansion.

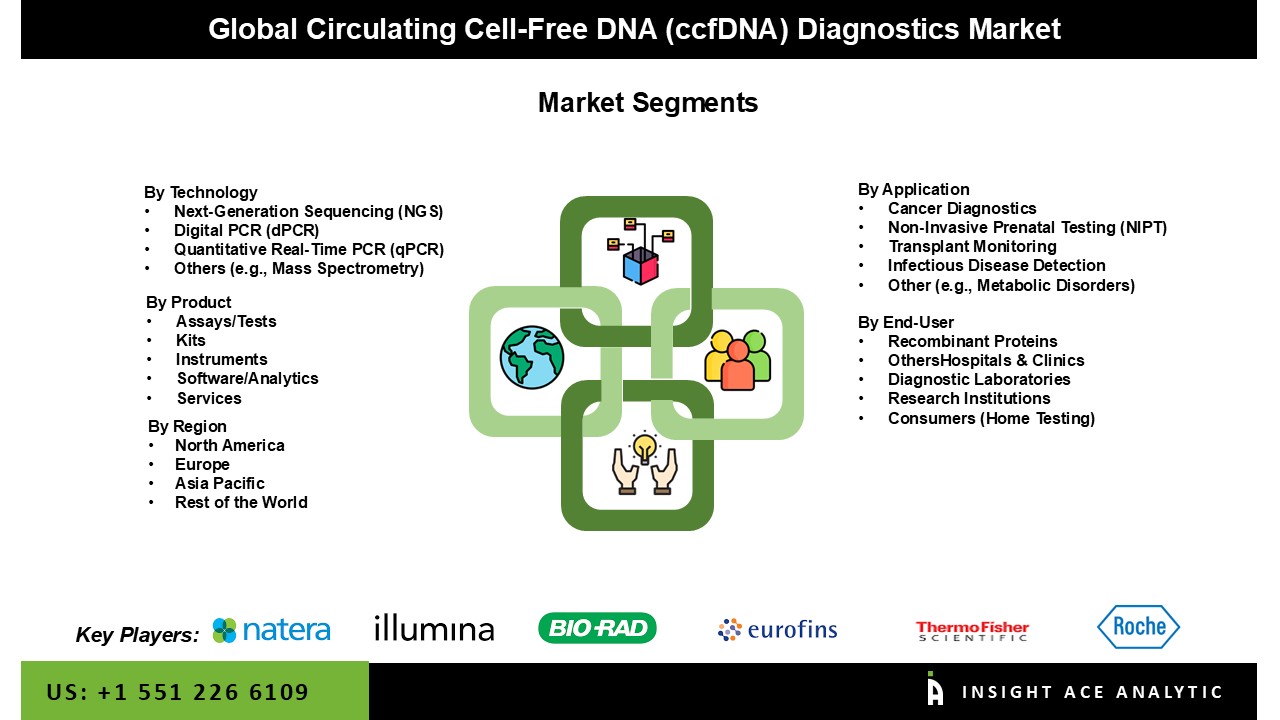

The circulating cell-free dna (ccfDNA) diagnostics market is segmented on the basis of application, technology, products and end-users. by application segment, the market is further segmented into cancer diagnostics, non-invasive prenatal testing (NIPT), transplant monitoring, infectious disease detection, other (e.g., metabolic disorders). whereas, by technology, the market comprises next-generation sequencing (NGS), digital PCR (dPCR), quantitative real-time PCR (qPCR), and others (e.g., mass spectrometry). as per the end-user category, the market includes hospitals & clinics, diagnostic laboratories, research institutions, consumers (home testing). the product segment consists of assays/tests, kits, instruments, software/analytics, and services.

The market for circulating cell-free DNA (ccfDNA) diagnostics is expected to be dominated by non-invasive prenatal testing in terms of revenue. The dominance of this market has been aided by the popularity of non-invasive tests based on cfDNA. Furthermore, the segment is being driven by increased medical coverage for NIPTs. A non-invasive DNA testing process without the hazards associated with amniocentesis or CVS (chorionic villus sample). One of the major aspects driving this segment's revenue growth is increasing knowledge of the procedure's benefits. On the other hand, the category for cancer diagnostics is anticipated to develop the fastest. The main engine of segment expansion is rising investment in the creation of liquid biopsies.

The hospitals & prenatal clinics segment is anticipated to gain the major share of the global circulating cell-free DNA (ccfDNA) diagnostics market in the forecast period. The public's understanding and acceptance of non-invasive prenatal DNA screening is growing, which has boosted this sector's income flow. Hospitals & prenatal clinics remain the leading end-users of the market due to the benefits of NIPTs, such as early risk diagnosis of chromosomal defects like down syndrome and trisomy utilizing NIPTs. However, the fastest expanding end-user of this industry is emerging to be the biotechnology and pharmaceutical industries. The primary driver of this category is the recent approval of companion diagnostics.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 7.50 Billion |

| Revenue forecast in 2034 | USD 17.19 Billion |

| Growth rate CAGR | CAGR of 8.8% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Application, Technology, Product and End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Hoffmann-La Roche, Natera Inc., Illumina Inc., Agena Bioscience, Paragon Genomics, Thermo Fisher Scientific, Bio-Rad Laboratories, Lucence Health, and Eurofins. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Application

By Technology

By Product

By End-User

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.