Global Food Hydrocolloids Market Size is valued at USD 9.1 Bn in 2024 and is predicted to reach USD 15.7 Bn by the year 2034 at a 5.7% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

In the food processing business, hydrocolloids are crucial because they are employed as gelling agents, thickeners, and stabilizing agents. Food hydrocolloids have been widely used in the food processing business for the past ten years, which is attributable to their practical qualities. The use of hydrocolloids has greatly expanded in response to the rising demand for ready-meal food products, which is encouraging the future growth of the worldwide food hydrocolloids market.

Hydrocolloids are essential in the food processing industry because they are used as gelling agents, thickeners, and stabilizing agents. Due to their useful characteristics, food hydrocolloids have been employed extensively in the food processing industry for the past few years. Due to the growing demand for ready-meal food products, the use of hydrocolloids has significantly increased, which is positive for the future global food hydrocolloids market expansion. The surge in demand for convenience foods including pasta, bread, beverages, gravies, cakes, and pastries and an increase in the world's population is driving food hydrocolloids market demand.

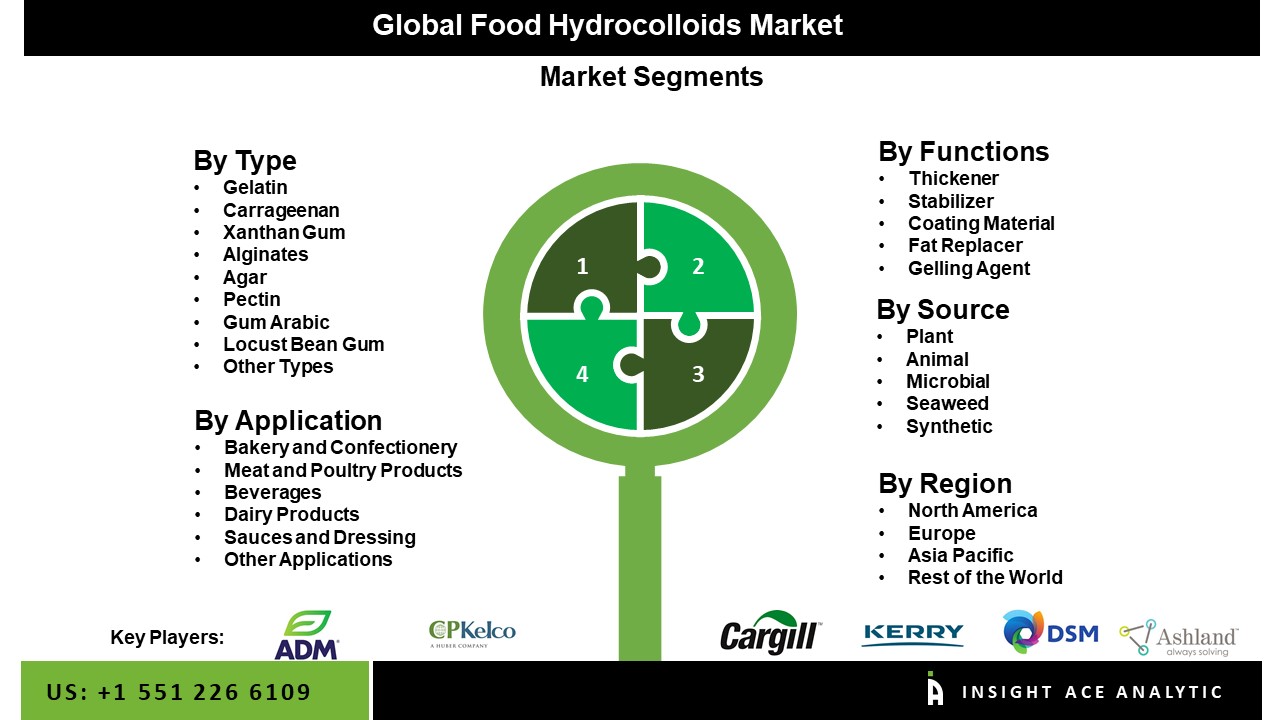

The food hydrocolloids market is segmented into type, application, source and function. Based on type, the market is segmented into gelatin, carrageenan, xanthan gum, alginates, agar, pectin, gum arabic, locust bean gum, and other types. Based on application, the market is further divided into bakery and confectionery, meat and poultry products, beverages, dairy products, sauces and dressing, and other applications. Based on source, the market is divided into plant, animal, microbial, seaweed, and synthetic. Based on function, the market is subdivided into thickener, stabilizer, coating material, fat replacer, and gelling agent.

The growing number of food and beverage manufacturing facilities and increased consumer spending on high-end and convenient food goods are primarily responsible for the segment's size. Because of their ability to change the flow characteristics of liquids, their capacity to gel, their ability to emulsify oil droplets, and their ability to prevent ice from recrystallizing, hydrocolloids are an essential component of the food industry.

In comparison to other hydrocolloids, gelatin is anticipated to generate a significant part of income. The diverse functional qualities of gelatin (such as its ability to gel and thicken, emulsify, foam and whip, and be non-toxic) and its capability to have special emulsifying and film-forming properties in the pharmaceutical sectors are primarily responsible for this segment's overall growth. The huge market demand for tablets, soft gels, and hard capsules made from gelatin drives up the price of gelatin on a global scale.

Due to the increasing demand for hydrocolloids in oil and fat reduction, North America will continue to be the largest market over the projection period. Consumers in developed regions are constantly looking for fresh and inventive food products. This element is predicted to increase the usage of food hydrocolloids in food products, supporting the market's expansion. Besides, in the Asia-Pacific area, the demand for processed goods and fast food is expected to increase. The product's use as a stabilizing and texturizing component and its adoption as an ingredient by many food and beverage producers can be attributed to its functional and clean-label standpoint.

|

Report Attribute |

Specifications |

|

Market size value in 2024 |

USD 9.1 Bn |

|

Revenue forecast in 2034 |

USD 15.7 Bn |

|

Growth rate CAGR |

CAGR of 5.7% from 2025 to 2034 |

|

Quantitative units |

Representation of revenue in US$ Bn, Volume (Tons) and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report coverage |

The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments covered |

Type, Application, Source And Function |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

|

Competitive Landscape |

Yara International ASA, Siemens Energy, Origin Energy Limited, Iberdrola, S.A., HY2GEN AG, Hive Energy,, Haldor Topsor A/S, H2U Technologies, Inc., Fusion-Fuel, Fertiglobe, Eneus Energy Limited, Enaex Energy, Dyno Nobel, CF Industries Holdings, Inc., Ballance Agri-Nutrients, Aker, Clean Hydrogen, Air Products Inc.and ACME Group. |

|

Customization scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and available payment methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Food Hydrocolloids Market Snapshot

Chapter 4. Global Food Hydrocolloids Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Type Estimates & Trend Analysis

5.1. by Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn) & Volume (Tons)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Type:

5.2.1. Gelatin

5.2.2. Carrageenan

5.2.3. Xanthan Gum

5.2.4. Alginates

5.2.5. Agar

5.2.6. Pectin

5.2.7. Gum Arabic

5.2.8. Locust Bean Gum

5.2.9. Other Types

Chapter 6. Market Segmentation 2: by Application Estimates & Trend Analysis

6.1. by Application & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn) & Volume (Tons)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Application:

6.2.1. Bakery and Confectionery

6.2.2. Meat and Poultry Products

6.2.3. Beverages

6.2.4. Dairy Products

6.2.5. Sauces and Dressing

6.2.6. Other Applications

Chapter 7. Market Segmentation 3: by Source Estimates & Trend Analysis

7.1. by Source & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn) & Volume (Tons)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Source:

7.2.1. Plant

7.2.2. Animal

7.2.3. Microbial

7.2.4. Seaweed

7.2.5. Synthetic

Chapter 8. Market Segmentation 4: by Function Estimates & Trend Analysis

8.1. by Function & Market Share, 2024 & 2034

8.2. Market Size (Value (US$ Mn) & Volume (Tons)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Function:

8.2.1. Thickener

8.2.2. Stabilizer

8.2.3. Coating Material

8.2.4. Fat Replacer

8.2.5. Gelling Agent

Chapter 9. Food Hydrocolloids Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. North America

9.1.1. North America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Type, 2021-2034

9.1.2. North America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Application, 2021-2034

9.1.3. North America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Source, 2021-2034

9.1.4. North America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Function, 2021-2034

9.1.5. North America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

9.2. Europe

9.2.1. Europe Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Type, 2021-2034

9.2.2. Europe Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Application, 2021-2034

9.2.3. Europe Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Source, 2021-2034

9.2.4. Europe Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Function, 2021-2034

9.2.5. Europe Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

9.3. Asia Pacific

9.3.1. Asia Pacific Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Type, 2021-2034

9.3.2. Asia Pacific Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Application, 2021-2034

9.3.3. Asia-Pacific Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Source, 2021-2034

9.3.4. Asia-Pacific Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Function, 2021-2034

9.3.5. Asia Pacific Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

9.4. Latin America

9.4.1. Latin America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Type, 2021-2034

9.4.2. Latin America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Application, 2021-2034

9.4.3. Latin America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Source, 2021-2034

9.4.4. Latin America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Function, 2021-2034

9.4.5. Latin America Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

9.5. Middle East & Africa

9.5.1. Middle East & Africa Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Type, 2021-2034

9.5.2. Middle East & Africa Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Application, 2021-2034

9.5.3. Middle East & Africa Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Source, 2021-2034

9.5.4. Middle East & Africa Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Function, 2021-2034

9.5.5. Middle East & Africa Food Hydrocolloids Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. Anderson Corporation

10.2.2. Archer Daniels Midland Company

10.2.3. Ashland Inc.

10.2.4. B&V SRL

10.2.5. Balfour Beatty PLC

10.2.6. BASF SE

10.2.7. Bayer Material Science AG

10.2.8. Bio-Kleen Products, Inc.

10.2.9. Biosciences

10.2.10. Calera Corporation

10.2.11. Cargill Incorporated

10.2.12. CP Kelco

10.2.13. Darling Ingredients

10.2.14. De Pont De Nemours & Company

10.2.15. Dryvit Systems, Inc.

10.2.16. Fiberstar, Inc.

10.2.17. FMC Corporation

10.2.18. Fuerst Day Lawson

10.2.19. Hispanagar

10.2.20. Huber Engineered Woods LLC

10.2.21. Ingredion Incorporated

10.2.22. Jungbunzlauer

10.2.23. Kerry Group plc

10.2.24. Kingspan Group

10.2.25. Koninklijke DSM NV

10.2.26. Lubrizol Corporation

10.2.27. Palmer Industries, Inc.

10.2.28. Plycem USA, Inc.

10.2.29. Rico Carrageenan

10.2.30. CEAMSA

10.2.31. Silver Line Building Products LLC

10.2.32. Tate & Lyle PLC

10.2.33. Thermafiber, Inc.

10.2.34. USG Corporation

10.2.35. Other Prominent Players

Food Hydrocolloids Market By Type-

Food Hydrocolloids Market By Application-

Food Hydrocolloids Market By Source-

Food Hydrocolloids Market By Function-

Food Hydrocolloids Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.