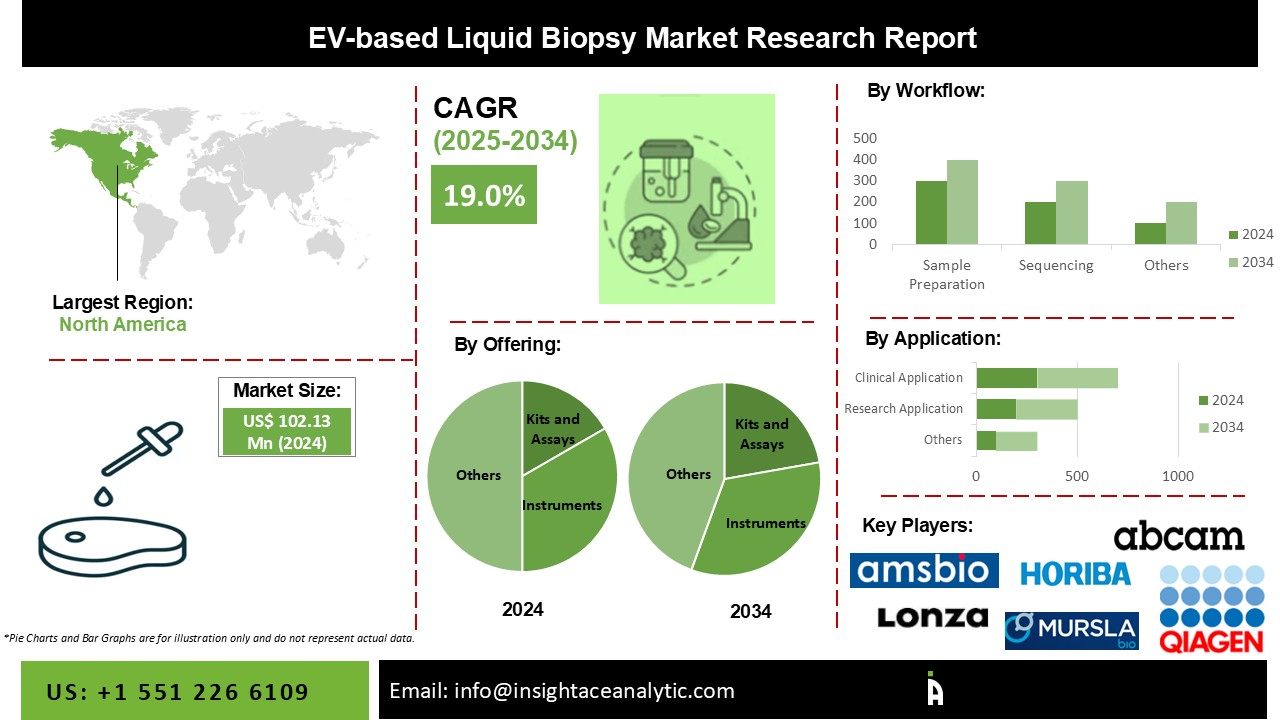

Global EV-based Liquid Biopsy Market Size is valued at USD 102.13 Million in 2024 and is predicted to reach USD 572.43 Million by the year 2034 at an 19.0% CAGR during the forecast period for 2025 to 2034.

EV-based Liquid Biopsy Market Size, Share & Trends Analysis Report By Offering (Kits & Assays, Instruments, Services), Workflow (Sample Preparation, Sequencing, Data Analysis), Technology (Isolation And Detection Technology), Sample Type, End User, Region, And Segment Forecasts, 2026 to 2035

EVs (Extracellular Vesicles) can be categorized based on their cellular origin or size. EVs derived from the intracellular endosomal system are called "exosomes", and vesicles from the plasma membrane are known as "ectosomes" or "microvesicles". Extracellular vesicles are present in all human biofluids and contain DNA, RNA, and proteins originating from their parent cells.

Several clinical research studies have highlighted extracellular vesicles (EVs) as a promising source of novel tumor biomarkers. Tumor EVs in body fluids such as blood have unique properties of cells of origin, making them ideal biomarker candidates for detecting, evaluating, and monitoring tumor growth in liquid biopsies. However, using EVs as cancer biomarkers in routine diagnosis is still hampered by a lack of standardization, data from large patient cohorts, and methodological challenges. Once these issues have been resolved, EVs alone or in combination with other body fluids have the potential to be useful tools in liquid biopsies.

Rising cancer awareness is driving the growth of the EV-based liquid biopsy industry, as liquid biopsy technology can detect cancer at an early stage, monitor tumors, and evaluate diagnosis. In addition, advanced technology development has increased the demand for non-invasive diagnosis and treatment, which is expected to boost the demand for EV-based liquid biopsy in the upcoming years.

The EV-based Liquid Biopsy Market is segmented into offering, workflow, technology, sample type, and end user. By offering, the market is categorized into kits & assays, instruments, and services. The workflow segment comprises sample preparation, sequencing, and data analysis. Based on technology, the market is bifurcated into isolation technologies and detection technologies. The sample type segment is classified into blood (plasma/serum), urine, saliva, other biofluids (CF- cerebrospinal fluid), cell culture. The end user segment consists of academic & research institutions, clinical laboratories, and pharmaceutical & biotechnology companies.

The Kits and Assays segment held the largest EV-based Liquid Biopsy Market share in 2022. The growth can be due to the rising demand for kits. The liquid biopsy market relies on the distance collection of samples by transporting the diagnostics kits to the patient.

In 2022, the Sequencing segment held the largest share of the EV-based Liquid Biopsy Market. The increasing adoption of sequencing, advancements & high efficiency of the Next Generation Sequencing technology to detect the lower frequency variants of cancer are responsible for market expansion.

Factors such as the increasing need for early disease detection and diagnosis, rising public healthcare awareness, and the demand for quick and real-time diagnostic results are expected to boost the demand for detection technologies and, ultimately, for the EV-based Liquid Biopsy Market.

In 2022, the clinical laboratories segment led the EV-based Liquid Biopsy Market and is expected to continue its trend over the projected period, followed by the Pharmaceutical and Biotechnology Companies segment. This is due to the high prevalence of cancer and rising clinical R&D efforts for improving liquid biopsy techniques.

The largest portion of the EV-based Liquid Biopsy Market was held by North America in 2022. The market in this region is being driven by the increasing demand for non-invasive treatments, surging awareness about the applications of liquid biopsies, and rising research efforts to improve early cancer detection. At the same time, the Asia Pacific regional market is expected to witness the fastest growth during the forecast period. Factors such as the escalating cancer cases, increasing adoption of advanced diagnosis techniques, and the increasing government investments in oncology research and treatment are responsible for the blooming of the EV-based Liquid Biopsy Market in Asia Pacific.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 102.13 Million |

| Revenue Forecast In 2034 | USD 572.43 Million |

| Growth Rate CAGR | CAGR of 19.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, By Workflow, By Technology, By Sample Type, By End User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Abcam plc, AMS Biotechnology Limited (AMSBIO), Bio-Techne Corporation, Horiba Ltd., Qiagen N.V., Thermo Fisher Scientific, Inc., Lonza Group AG, Malvern Panalytical Ltd, Revvity, Inc. (PerkinElmer, Inc.), Takara Bio Inc., Emerging Companies, Mursla Bio, Nanostics Inc., Mercy BioAnalytics, Inc., Clara Diagnostics, Inc. (Clara Biotech), and others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

EV-based Liquid Biopsy Market By Sample Type-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.