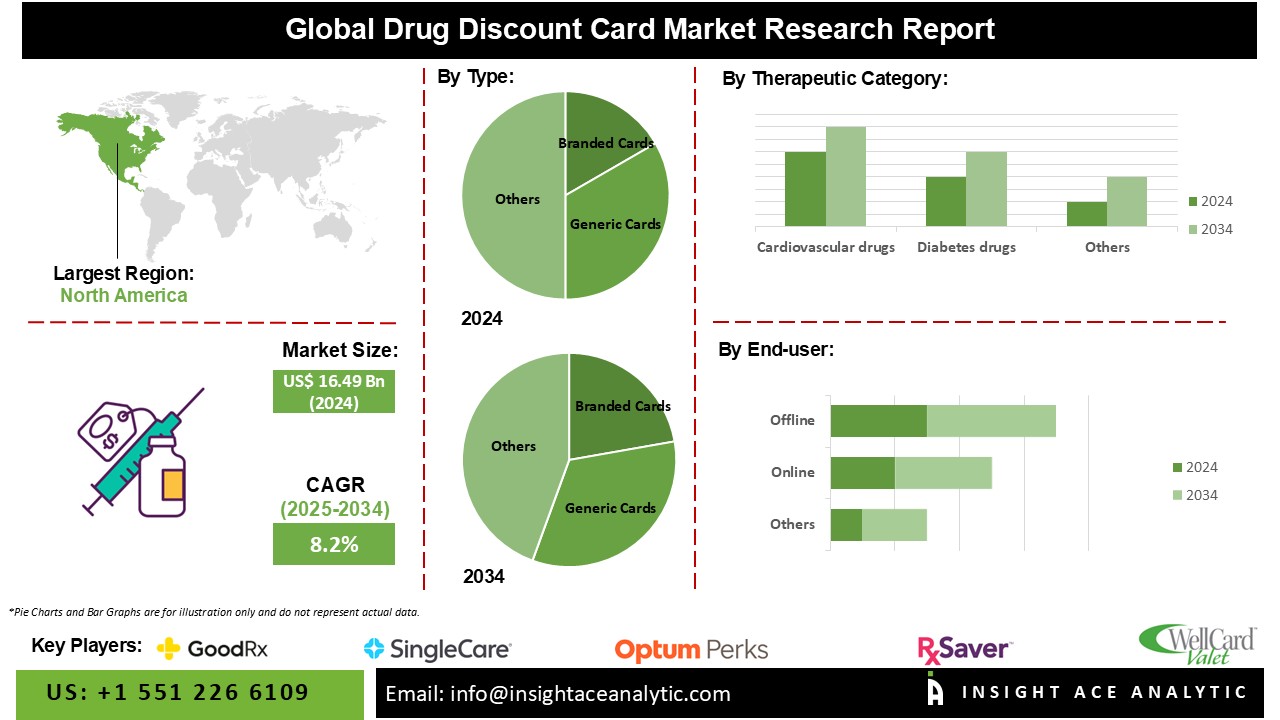

Drug Discount Card Market Size is valued at USD 16.49 Billion in 2024 and is predicted to reach USD 35.92 Billion by the year 2034 at an 8.2% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

A drug discount card is a card that allows people to save money on prescription prescriptions. Various organizations, including pharmaceutical firms, charity organizations, and pharmacy chains, frequently issue these cards. When filling a prescription at a pharmacy, individuals display the drug discount card. The chemist then applies the discount, and the individual pays the lower sum out of pocket. Consumers are looking for ways to decrease their out-of-pocket spending as the cost of healthcare, particularly prescription pharmaceuticals, grows. Drug discount cards enable patients to obtain prescriptions at a lesser cost, reducing the financial burden of healthcare.

However, the COVID-19 pandemic has substantially influenced various industries, including healthcare and the pharmacy discount card business. The pandemic's economic impact has heightened concerns about healthcare affordability. With many people experiencing financial difficulties, there has been a greater emphasis on minimizing the cost of vital healthcare services, such as prescription pharmaceuticals.

The Drug Discount Card Market is segmented on the basis of type, therapeutic category, and sales channel. Based on type, the market is segmented into Branded Cards and Generic Cards. The therapeutic category segment includes Cardiovascular drugs, Diabetes drugs, Pain medications, Mental health medications, Cancer drugs, and Others. The sales channel segment consists of online and offline sales.

The Generic Cards category is expected to hold a major share of the global Drug Discount Card Market in 2022. In recent years, the generic card section of the pharmacy savings card market has grown dramatically. This increase can be ascribed to a number of important variables. The growing preference for low-cost alternatives has increased the need for generic pharmaceuticals, which are generally less expensive than brand-name versions. Generic medicine discount cards are designed expressly for this booming industry, providing significant savings on a wide range of generic prescription drugs.

The offline segment is expected to grow at a rapid rate in the global Drug Discount Card Market. Hospitals, retail stores, clinics, and other businesses fall within this category. Despite technological developments in healthcare, a sizable portion of the population prefers traditional, face-to-face contact regarding their pharmaceutical needs. Physical pharmacies, sometimes known as brick-and-mortar stores, continue to play an important role in the process of distributing pharmaceuticals and offering vital patient counselling.

The North America Drug Discount Card Market is expected to record the highest market revenue share in the near future. The sector market's expansion can be attributable mostly to rising healthcare costs. As medical costs rise, people seek more economical access to prescription prescriptions, fueling the demand for pharmacy discount cards. Furthermore, the region's well-established pharmaceutical sector and excellent healthcare infrastructure create an ideal environment for market expansion. The Asia-Pacific region is expected to be a significant growing region. The Asia-Pacific region's growing middle-class population, combined with increased healthcare knowledge, has accelerated the use of prescription discount cards. A thriving pharmaceutical industry and a rapidly expanding healthcare infrastructure further support this growth.

In Dec 2021, Express Scripts introduced a novel method that seeks to incorporate the cost of prescription discount cards into the current advantages of its members. Upon the implementation of the new Right Price program, qualified members who possessed a discount card would have observed the automatic application of their savings at the pharmacy counter.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 16.49 Billion |

| Revenue Forecast In 2034 | USD 35.92 Billion |

| Growth Rate CAGR | CAGR of 8.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Therapeutic Category, sales Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | GoodRx, SingleCare, WellCard Savings, RxSaver, Optum Perks, Kroger Prescription Savings Club, ScriptSave, Walmart Rx Savings Program, Prescription Hope, FamilyWize, NeedyMeds, Humana, AARP Prescription Discounts (UnitedHealth Group), Blink Health, Coast2Coast Rx, HealthWarehouse.com, Inc., Inside Rx (Express Scripts), Simple Savings Card, United Networks of America, USA Rx, Watertree Health and others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Drug Discount Card Market By Type-

Drug Discount Card Market By Therapeutic Category-

Drug Discount Card Market By Sales Channel-

Drug Discount Card Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.