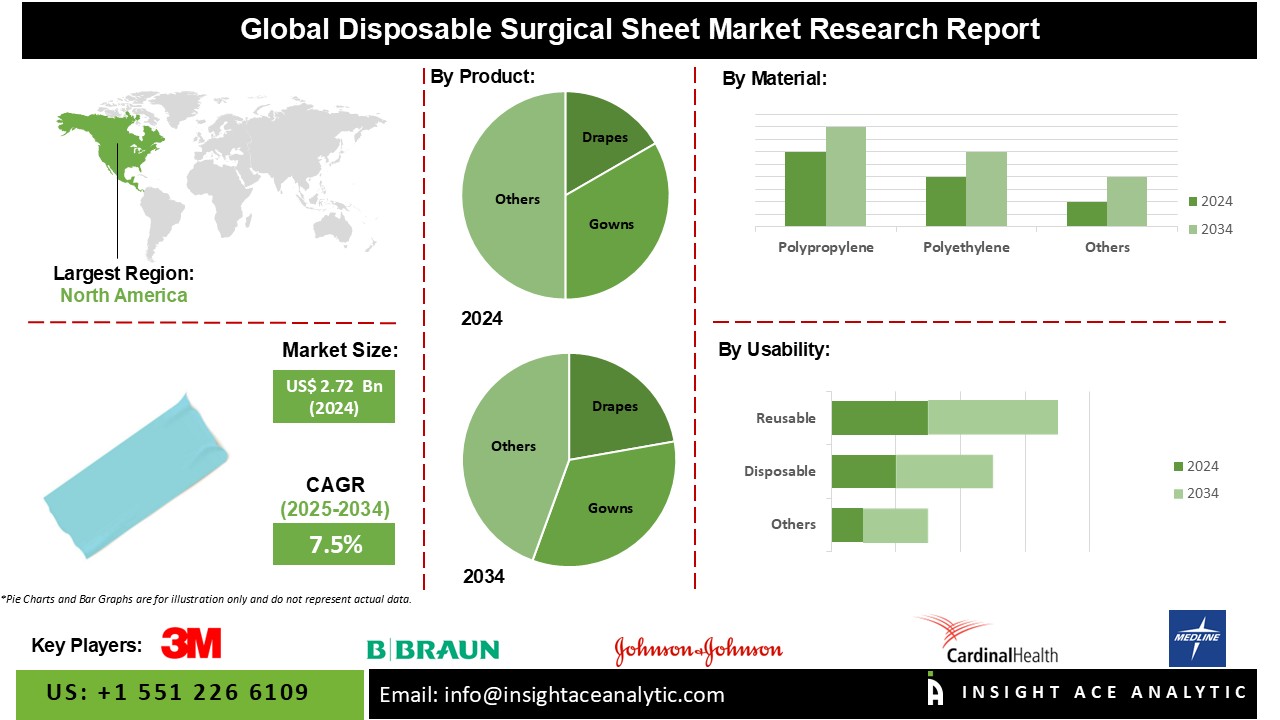

Disposable Surgical Sheet Market Size is valued at USD 2.72 Billion in 2024 and is predicted to reach USD 5.57 Billion by the year 2034 at a 7.5% CAGR during the forecast period for 2025-2034.

A disposable surgical sheet is a sterile and single-use covering composed of materials such as non-woven fabric or plastic. It serves as a protective barrier during surgical procedures, safeguarding patients and equipment from pollutants. These sheets come in many sizes and forms, meet infection control standards, are easy to use once, and typically repel fluids. They help maintain sterile conditions in the operating room and are discarded after each surgical procedure.

The rise in surgical procedures globally is a significant factor fueling the demand for disposable surgical sheets. Healthcare providers, guided by stringent regulations and guidelines, are increasingly incorporating these single-use products to ensure compliance with industry standards. Advancements in material technology play a crucial role in enhancing the performance of disposable sheets, with ongoing innovations improving properties such as barrier protection and comfort. While posing certain challenges, sustainability considerations also act as a market driver. Some disposable surgical sheets are designed with eco-friendly materials, aligning with the broader trend of environmentally conscious healthcare practices. Cost-effectiveness contributes to adopting disposable sheets, especially in more economical scenarios than traditional reusable options.

Furthermore, the market's growth is further supported by the prevalence of infectious diseases, including global events, underscoring the importance of robust infection prevention measures and the COVID-19 pandemic. Intense competition among manufacturers has spurred innovation, with companies striving to differentiate their products through features like improved adhesiveness and antimicrobial properties. Additionally, the ease of disposal associated with disposable surgical sheets aligns with evolving healthcare practices, including a shift toward outpatient procedures and minimally invasive surgeries. The well-developed infrastructure in the healthcare sector, coupled with the rising healthcare expenditure, acts as a solid foundation for the market's expansion.

The disposable surgical sheet market is segmented based on product, application, usability, and sterility. The market is segmented as drapes, gowns, sheets, and others based on product. The market is segmented by application into polypropylene, polyethylene, rayon, and others. By usability, the disposable surgical sheet market is segmented into disposable and reusable. By sterility, the market is segmented as sterile and non-sterile. The end-user segment comprises Hospitals, Clinics, Diagnostic Centers, Ambulatory Surgical Centers, and Others.

Drapes are essential for preserving sterility during surgical procedures as they establish a sterile environment around the operating area. Their demand is fueled by the increasing prevalence of operations worldwide.

The disposable category will hold a major share of the global Disposable Surgical Sheet market in 2022. The widespread use of disposable drapes and the increasing recognition of disposable surgical drapes are propelling the growth of the segment. Typically crafted from non-woven materials, these drapes are discarded after each surgical procedure. Non-woven fabric is favoured over woven fabric due to its superior protection against hospital-acquired diseases and surgical-site infections. It boasts lightweight nature, cost-effectiveness, straightforward recycling procedures, and reduced manufacturing expenses. Additionally, in comparison to reusable surgical drapes, disposable drapes exhibit resistance to liquids, abrasion, and tearing. Consequently, the benefits of non-woven fabric foster the demand for disposable surgical drapes.

The hospital segment is projected to develop at a rapid rate in the global disposable surgical sheet market. Hospitals are the initial consumers of surgical drapes, given that most surgeries worldwide occur within hospital settings. The escalating incidence of Surgical Site Infections (SSI) further amplifies hospitals' demand for surgical drapes. Additionally, the ongoing construction of new hospitals, supported by increased government investments, contributes significantly to this segment's expansion.

The North America Disposable Surgical Sheet market is expected to register a tremendous market share in revenue shortly. There is a growing awareness and learning of environmental sustainability in North America. This may influence the market, with some manufacturers developing eco-friendly disposable surgical sheets to address environmental concerns. North America has well-established and stringent healthcare regulations. Compliance with these regulations is a key driver for adopting disposable surgical sheets to meet infection control and patient safety standards. The healthcare industry in North America is competitive, and this competition can drive innovation and the development of high-quality disposable surgical sheets. In addition, Asia Pacific is estimated to grow rapidly in the global disposable surgical sheet market, a hub for medical technology innovations. Advancements in material technology and integrating features such as antimicrobial properties can influence the adoption of disposable surgical sheets.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.72 Billion |

| Revenue Forecast In 2034 | USD 5.57 Billion |

| Growth Rate CAGR | CAGR of 7.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Application, By Usability, By sterility, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Cardinal Health, Paul Hartmann AG, Standard Textile Co., Medline Industries Inc., Molnlycke Health Care AB, 3M Healthcare, Ahlstrom-Munksjo, Winner Medical Co. Ltd., Kimberly-Clark Health Care, DuPont Medical Fabrics, Johnson & Johnson, B. Braun Melsungen AG, Premier, Ansell Limited |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Disposable Surgical Sheet Market By Product-

Disposable Surgical Sheet Market By Material-

Disposable Surgical Sheet Market By Usability

Disposable Surgical Sheet Market By sterility

Disposable Surgical Sheet Market By End User

Disposable Surgical Sheet Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.