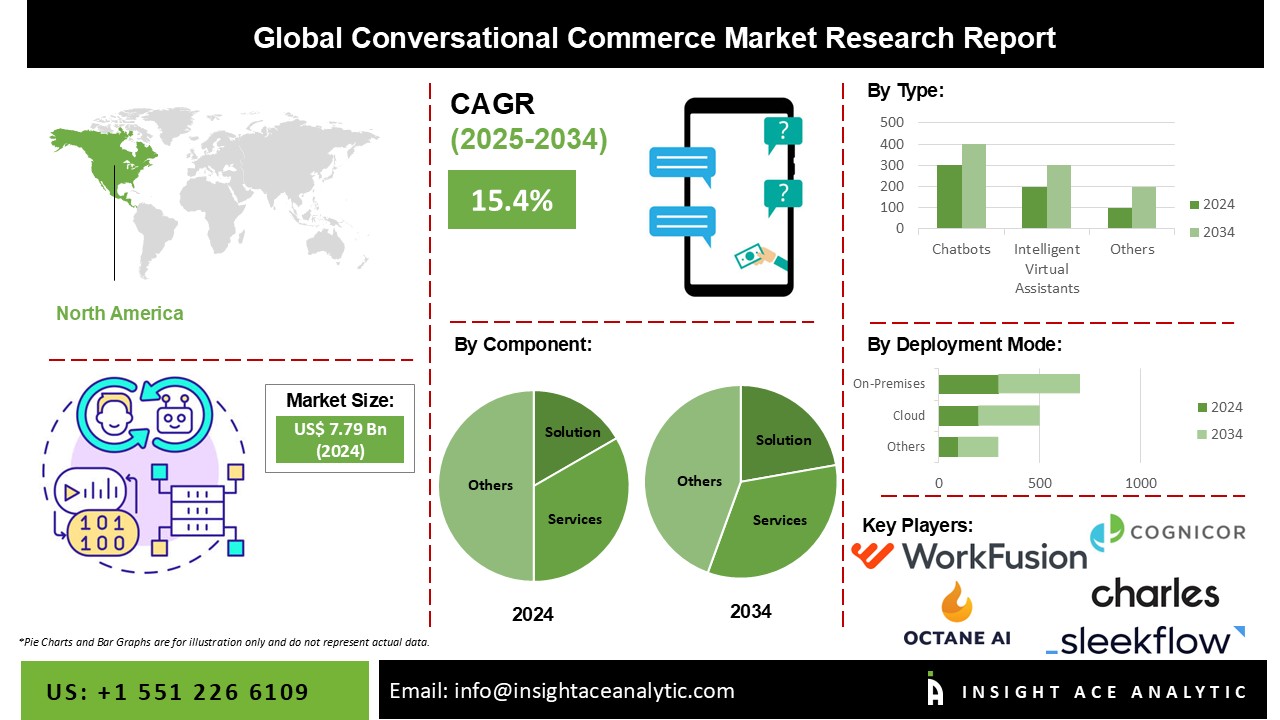

Conversational Commerce Market Size is valued at 7.79 billion in 2024 and is predicted to reach 32.40 billion by the year 2034 at a 15.4% CAGR during the forecast period for 2025-2034.

E-commerce, or any business with a web and social media presence, includes conversational commerce. It deals with client engagement through messaging applications, social media, and other online platforms like business websites. This type of discussion uses voice assistants, messaging apps, and chatbots. It enables businesses to comprehend their current and potential clients' wants, expectations, and questions. Conversational commerce is expanding as a result of increased innovation in the market. Companies are now able to develop more complex chatbots that can comprehend and respond to clients' wants because of the development of artificial intelligence and machine learning.

Additionally, these technologies can assist companies in providing quicker and more accurate customer support, as well as personalized product recommendations and promotional offers. The fiercely competitive environment in which firms operate is a further element fostering the expansion of conversational commerce. Businesses need to develop fresh ways to stand out from the competition and give customers a more enjoyable buying experience considering the proliferation of e-commerce platforms and the expansion of online marketplaces. By providing a more individualized and interactive experience, businesses may differentiate themselves from their rivals and draw in more clients thanks to conversational commerce.

The conversational commerce market is segmented based on component, type, deployment mode, enterprise size, business function and industry. The components segment includes solutions, services, training and consulting services, system integration and implementation services, and support and maintenance services. The market is segmented based on type as chatbots and intelligent virtual assistants. Based on deployment mode, the market is segmented as cloud and on-premises.

Enterprise size segment includes into small and mid-sized enterprises (SMEs) and large enterprises. The market is segmented as sales, finance, HR, operation, and IT service management based on business function. Based on industry, the market is segmented as BFSI, healthcare and life sciences, IT & telecom, retail and e-commerce, travel and hospitality, media and entertainment, automotive and others.

The cloud category is expected to hold a major share of the global Conversational Commerce market in 2022. By utilizing the cloud, businesses may eliminate wasteful spending and quickly and cheaply access the required resources. Growth would be aided by Al's incorporation and the continued development of numerous cloud technologies. Additionally, organizations are frequently integrating chatbots, voice assistants, and other technologies to expand their operations.

The Chatbot segment is projected to grow at a rapid rate in the global conversational commerce market. One of the most often used forms of communication is chatbot. Customers may instantly get responses through the retailer's website, and it is easy to use. It has a significant edge over email and phone due to this feature. With a chatbot, one employee may converse with two or three consumers at once, which allows brands to shorten wait times and increase customer satisfaction. Chatbots have enormous e-commerce potential.

North America region is one of the fastest-growing conversational commerce markets globally. In North America, the United States has largely adopted conversational systems. The nation has incorporated deep learning, machine learning, and AI technology into its current business procedures to maintain a competitive edge. The Asia Pacific region is also expected to experience robust expansion, driven mainly by China.

Growing economies like China and India may be to blame for the rise since they use technology more regularly. Rising smartphone demand in the area will likely present market development opportunities. Several small and medium-sized enterprises in the region have begun integrating conversational technology into their everyday operations to engage clients and help them generate more leads efficiently.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 7.79 Bn |

| Revenue Forecast In 2034 | USD 32.40 Bn |

| Growth Rate CAGR | CAGR of 15.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Component, Type, Deployment Mode, Enterprise Size, Business Function And Industry |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada.; Germany; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; South Korea; South East Asia |

| Competitive Landscape | Charles GmbH, Octane AI, WorkFusion, Quiq, SleekFlow, Cognicor, Recart, Via, lia, Action.AI, Inbenta, Wizard Commerce |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Conversational Commerce Market By Component

Conversational Commerce Market By Type

Conversational Commerce Market By Deployment Mode

Conversational Commerce Market By Enterprise Size

Conversational Commerce Market By Business Function

Conversational Commerce Market By Industry

Conversational Commerce Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.