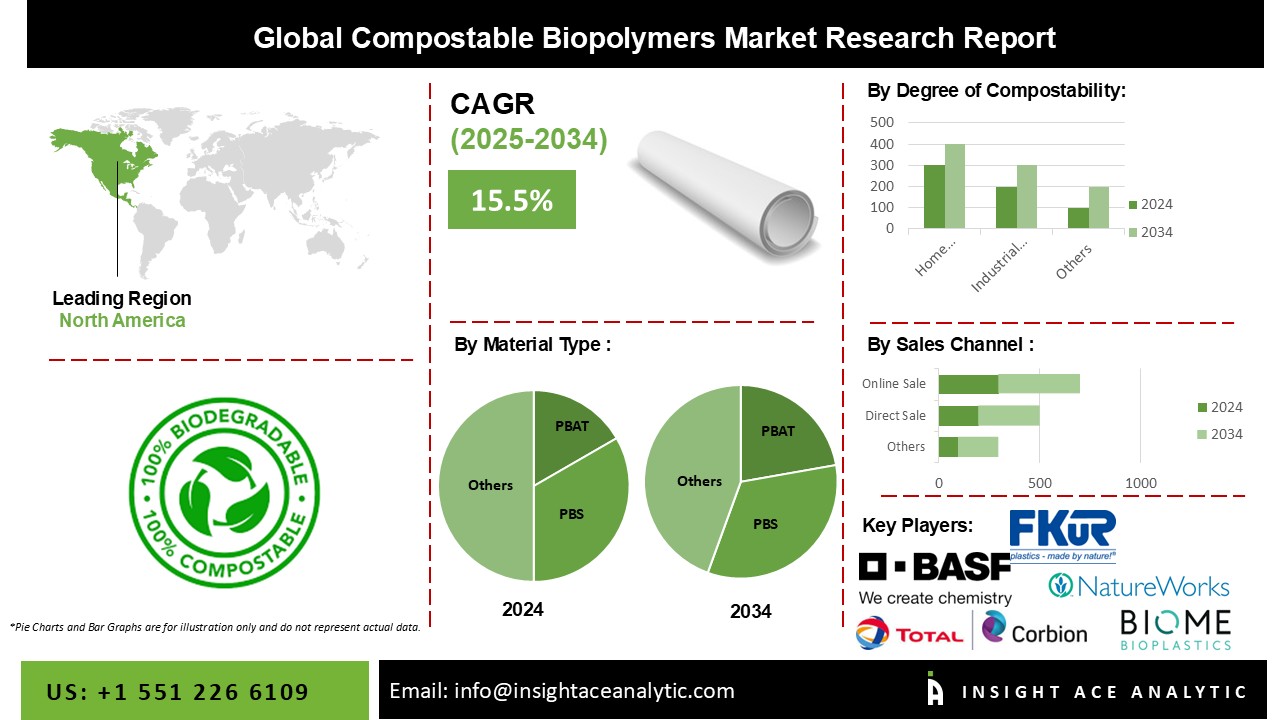

Compostable Biopolymers Market Size is predicted to witness a 15.5% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Compostable biopolymers are biodegradable plastics derived from natural sources such as corn starch, sugarcane, and potato starch. They are used to replace traditional plastics, which take years to degrade and frequently pollute the environment. The market for biodegradable biopolymers is a fast-expanding industry that is gaining popularity owing to its eco-friendliness and sustainability. Legislators are allowing the use of biodegradable polymers over traditional polymers to reduce carbon footprint. Several major automakers are now incorporating biopolymers into their vehicles; for example, Ford Motor Company is incorporating biopolymers for internal applications. Several factors are predicted to cause significant growth in the compostable biopolymers market in the coming years.

However, the COVID-19 pandemic has impacted the bioplastics and biopolymers market by disrupting supply chain and distribution networks, limiting industrial activities, and posing operational issues. Lockdown regulations all across the world hampered the transit of goods and the purchase of raw materials, and workforce shortages and restricted transport services hampered market growth even more.

The Compostable Biopolymers Market is segmented on the basis of material type, degree of compostability, sales channel, and end-use. Material type segment includes polybutylene adipate terephthalate, polybutylene succinate, polylactic acid, polyhydroxyalkanoate, starch blends, cellulose films, and others. The degree of compostability segment includes home compostable and industrial compostable. Sales channel segment includes direct sales, online sales, and distributors. The end-user segment includes food packaging, disposable cutlery, bags, mulch films, agricultural applications, and others.

The food packaging category is expected to hold a major share of the global Compostable Biopolymers Market in 2024. Packaging solutions based on bioplastics and biopolymers are increasingly being used to safeguard commodities during storage and transportation. These technologies provide better strength and durability while preventing breakage and contamination. They also have superior aesthetics and are utilized by brands for product branding and communicating product information to customers.

The food and beverage industries have boosted their use of bioplastics and biopolymers in packaging. Population expansion, rising consumer purchasing power, and a major increase in e-commerce are all factors driving this segment's growth. Businesses all around the world are taking steps to reduce packaging waste and control their carbon footprint by implementing ecologically friendly packaging solutions.

The polylactic acid segment is projected to grow at a rapid rate in the global compostable biopolymers market. The rising demand for biodegradable plastics has resulted in higher recycling and a reduction in waste production volume. Packaging, medical equipment, automotive, consumer products, construction, and textiles are key uses for the market, as are orthopedic devices, wound treatment, surgical sutures, and drug administration systems. These reasons are propelling market segment expansion.

Europe's Compostable Biopolymers Market is expected to register the most increased market share in terms of revenue in the near future. The increased use of bioplastics and biopolymers in automotive, packaging and consumer goods industries supports regional market growth. The rise in environmental concerns and the implementation of severe ecological legislation has increased customer preference for bio-based and biodegradable products.

The Asia Pacific region is expected to increase significantly during the predicted period. Economic expansion, urbanization, and industrialization have all raised demand for the region's sector. Increased population, increased consumer awareness, and growing demand for sustainable packaging solutions, particularly from the e-commerce industry, drive market growth.

|

Report Attribute |

Specifications |

|

Growth rate CAGR |

CAGR of 15.5% from 2025 to 2034 |

|

Quantitative units |

Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments Covered |

By Material Type, Degree Of Compostability, Sales Channel, And End-Use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

|

Competitive Landscape |

NatureWorks LLC, BASF SE, Total Corbion PLA, Biome Bioplastics, FKuR Kunstsoff GmbH, Novamont S.p.A., Green Dot Bioplastics, TIPA, Cardia Bioplastics, and Danimer Scientific. |

|

Customization scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and available payment methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Compostable Biopolymers Market Snapshot

Chapter 4. Global Compostable Biopolymers Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Material Type Estimates & Trend Analysis

5.1. by Material Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Material Type:

5.2.1. Polybutylene Adipate Terephthalate (PBAT)

5.2.2. Polybutylene Succinate (PBS)

5.2.3. Polylactic Acid (PLA)

5.2.4. Polyhydroxyalkanoate (PHA)

5.2.5. Starch Blends

5.2.6. Cellulose Films

5.2.7. Others

Chapter 6. Market Segmentation 2: by Degree of Compostability Estimates & Trend Analysis

6.1. by Degree of Compostability & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Degree of Compostability:

6.2.1. Home Compostable

6.2.2. Industrial Compostable

Chapter 7. Market Segmentation 3: by Sales Channel Estimates & Trend Analysis

7.1. by Sales Channel & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Sales Channel:

7.2.1. Direct Sales

7.2.2. Online Sales

7.2.3. Distributors

Chapter 8. Market Segmentation 4: by End-Use Estimates & Trend Analysis

8.1. by End-Use & Market Share, 2024 & 2034

8.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End-Use:

8.2.1. Food Packaging

8.2.2. Disposable Cutlery

8.2.3. Bags

8.2.4. Mulch Films

8.2.5. Agricultural Applications

8.2.6. Others

Chapter 9. Compostable Biopolymers Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. North America

9.1.1. North America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Material Type, 2021-2034

9.1.2. North America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Degree of Compostability, 2021-2034

9.1.3. North America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Sales Channel, 2021-2034

9.1.4. North America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

9.1.5. North America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.2. Europe

9.2.1. Europe Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Material Type, 2021-2034

9.2.2. Europe Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Degree of Compostability, 2021-2034

9.2.3. Europe Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Sales Channel, 2021-2034

9.2.4. Europe Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

9.2.5. Europe Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.3. Asia Pacific

9.3.1. Asia Pacific Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Material Type, 2021-2034

9.3.2. Asia Pacific Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Degree of Compostability, 2021-2034

9.3.3. Asia-Pacific Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Sales Channel, 2021-2034

9.3.4. Asia-Pacific Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

9.3.5. Asia Pacific Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.4. Latin America

9.4.1. Latin America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Material Type, 2021-2034

9.4.2. Latin America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Degree of Compostability, 2021-2034

9.4.3. Latin America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Sales Channel, 2021-2034

9.4.4. Latin America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

9.4.5. Latin America Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.5. Middle East & Africa

9.5.1. Middle East & Africa Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Material Type, 2021-2034

9.5.2. Middle East & Africa Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Degree of Compostability, 2021-2034

9.5.3. Middle East & Africa Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by Sales Channel, 2021-2034

9.5.4. Middle East & Africa Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

9.5.5. Middle East & Africa Compostable Biopolymers Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. NatureWorks LLC

10.2.2. BASF SE

10.2.3. Total Corbion PLA

10.2.4. Biome Bioplastics

10.2.5. FKuR Kunstsoff GmbH

10.2.6. Novamont S.p.A.

10.2.7. Green Dot Bioplastics

10.2.8. TIPA

10.2.9. Cardia Bioplastics

10.2.10. Danimer Scientific.

10.2.11. Other Prominent Players

Compostable Biopolymers Market By Material Type-

Compostable Biopolymers Market By Degree of Compostability-

Compostable Biopolymers Market By Sales Channel-

Compostable Biopolymers Market By End-Use

Compostable Biopolymers Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.