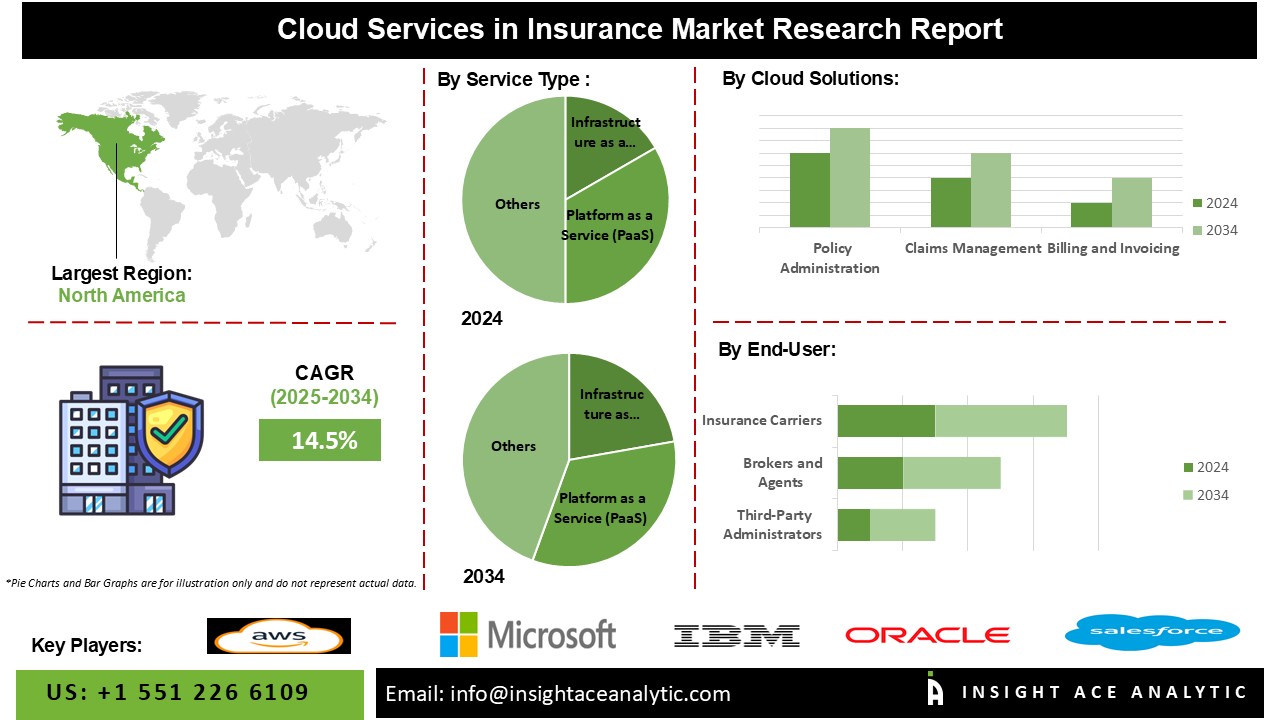

Cloud Services in Insurance Market Size is predicted to witness a 14.5% CAGR during the forecast period for 2025-2034.

Scalable, effective, and adaptable computer solutions that facilitate data administration, analytics, customer relationship management, and other functions are provided by cloud services to the insurance sector. By utilizing cloud computing, insurance companies may effectively manage substantial data sets, boost risk evaluation, improve customer support, and guarantee regulatory compliance by implementing strong security protocols. Furthermore, by eliminating the need for on-premises infrastructure, cloud computing lowers costs, promotes quick product development and innovation, and guarantees business continuity with dependable disaster recovery solutions. All things considered, cloud services help insurance businesses work more nimbly, concentrate on the demands of their clients, and react swiftly to market developments.

The key factors driving the industry ahead are the rise of digital transformation and the need for cloud services, which boost disaster recovery and business continuity, provide scalable storage solutions, enable better data analysis, and offer advanced analytics. Furthermore, modernization and international trade agreements might open new business prospects worldwide, further promoting market expansion. In addition, the market is anticipated to be propelled by increased government investments in research and development to optimize services and a growing demand for personalized experiences. These factors have fueled the insurance sector's growing embrace of cloud services, enabling businesses to improve customer happiness, streamline operations, and maintain competitiveness in a changing market.

However, the market growth is hindered by data privacy concerns, high installation costs, a lack of qualified professionals, and issues with regulation and compliance, weighing on the sector's expansion. Global markets expanded in the coming years due to technological developments, widespread adoption of digital platforms, and the ever-increasing consumer desire for novel cloud services.

The cloud services in the insurance market are segmented based on service type, cloud solutions, and end-user. Based on service type, the market is segmented into, platform as a service, infrastructure as a service and software as a service (SaaS). With cloud solutions, the market is segmented into policy administration, claims management, billing and invoicing, customer relationship management (CRM), and risk management. By end-user, the market is segmented into insurance carriers, brokers and agents, and third-party administrators.

The Software as a Service (SaaS) cloud services in the insurance market are expected to hold a major global market share. A SaaS eliminates businesses the burden of installing, maintaining, and updating software locally by providing ready-to-use apps and software solutions hosted on the cloud. SaaS solutions have seen significant growth in this market due to their accessibility and ease, making them popular with companies of all sizes.

The insurance carrier segment is projected to grow rapidly in the global cloud services in the insurance market because insurance carriers are the primary providers of insurance goods and services to customers. They collect premiums, underwrite insurance, and resolve claims as necessary. Insurance companies typically hold the largest market share due to their direct client interaction and control over product offerings, especially in countries like the US, Germany, the UK, China, and India.

The North American cloud services in the insurance market are anticipated to have the largest revenue share in the near future. This can be attributed to several reasons, including a highly developed infrastructure, increased spending by market participants, and supportive government programs. In addition, Asia Pacific is anticipated to increase rapidly in the insurance markets because of the growing funding for cutting-edge research and development in this area and growth in the middle class, which drives up demand for cloud services in insurance. Insurance companies are increasingly adopting cloud services due to technological developments, and the move toward digitization would aid growth in the industry.

|

Report Attribute |

Specifications |

|

Growth Rate CAGR |

CAGR of 14.5% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Service Type, Cloud Solutions, And End-User |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

|

Competitive Landscape |

Amazon Web Services (AWS), Microsoft Corporation, IBM Corporation, Oracle Corporation, Salesforce, SAP SE, Cisco Systems, Inc., Dell Technologies Inc., Google Cloud, DataRobot Inc., Zest AI and Accenture plc. |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Cloud Services in Insurance Market Snapshot

Chapter 4. Global Cloud Services in Insurance Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Service Type Estimates & Trend Analysis

5.1. by Service Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Service Type:

5.2.1. Infrastructure as a Service (IaaS)

5.2.2. Platform as a Service (PaaS)

5.2.3. Software as a Service (SaaS))

Chapter 6. Market Segmentation 2: by Cloud Solutions Estimates & Trend Analysis

6.1. by Cloud Solutions & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Cloud Solutions:

6.2.1. Policy Administration

6.2.2. Claims Management

6.2.3. Billing and Invoicing

6.2.4. Customer Relationship Management (CRM)

6.2.5. and Risk Management

Chapter 7. Market Segmentation 3: by End-User Estimates & Trend Analysis

7.1. by End-User & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End-User:

7.2.1. Insurance Carriers

7.2.2. Brokers and Agents

7.2.3. Third-Party Administrators

Chapter 8. Cloud Services in Insurance Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

8.1.2. North America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Cloud Solutions, 2021-2034

8.1.3. North America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.1.4. North America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

8.2.2. Europe Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Cloud Solutions, 2021-2034

8.2.3. Europe Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.2.4. Europe Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

8.3.2. Asia Pacific Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Cloud Solutions, 2021-2034

8.3.3. Asia Pacific Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.3.4. Asia Pacific Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

8.4.2. Latin America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Cloud Solutions, 2021-2034

8.4.3. Latin America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.4.4. Latin America Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

8.5.2. Middle East & Africa Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by Cloud Solutions, 2021-2034

8.5.3. Middle East & Africa Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.5.4. Middle East & Africa Cloud Services in Insurance Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Amazon Web Services (AWS)

9.2.2. Microsoft Corporation

9.2.3. IBM Corporation

9.2.4. Oracle Corporation

9.2.5. Salesforce

9.2.6. SAP SE

9.2.7. Cisco Systems, Inc.

9.2.8. Dell Technologies Inc.

9.2.9. Google Cloud

9.2.10. Accenture plc

9.2.11. DataRobot Inc.

9.2.12. Zest AI

9.2.13. Other Prominent Players

Cloud Services in the Insurance Market By Service Type-

Cloud Services in the Insurance Market By Cloud Solutions-

Cloud Services in the Insurance Market By End-User-

Cloud Services in the Insurance Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.