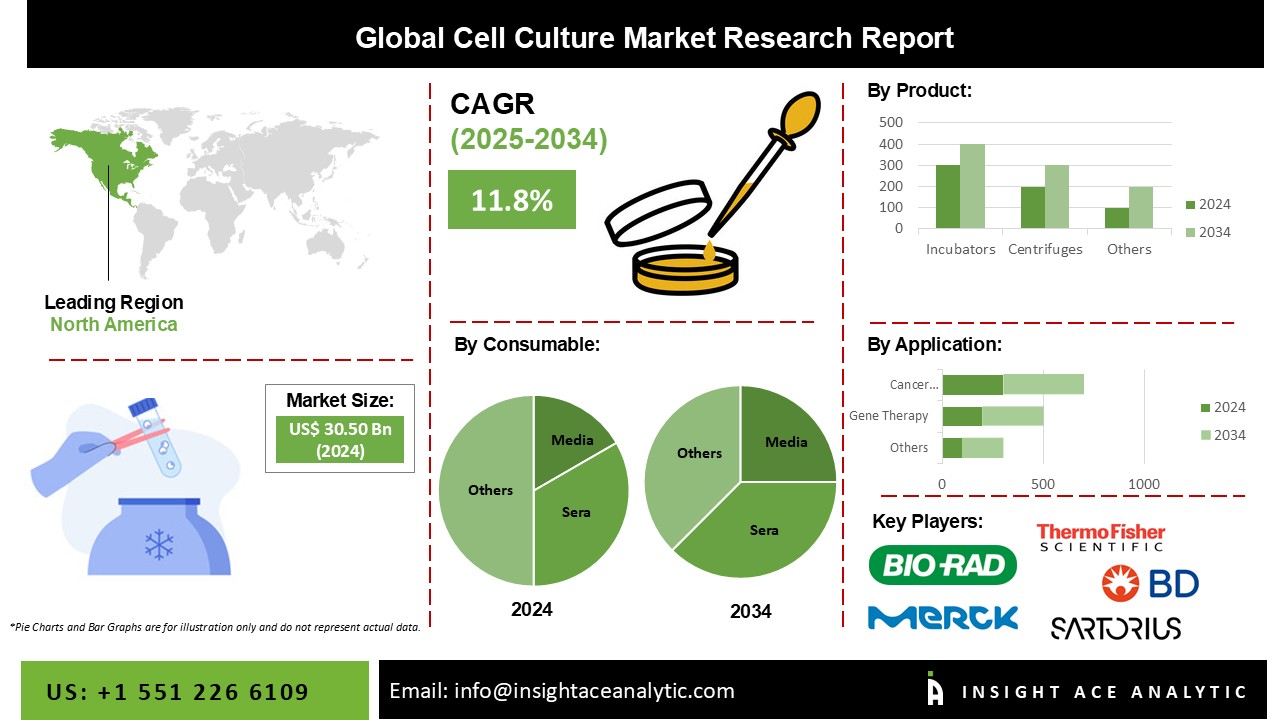

Cell Culture Market Size is valued at USD 30.50 billion in 2024 and is predicted to reach USD 92.35 billion by the year 2034 at a 11.8% CAGR during the forecast period for 2025-2034

Key Industry Insights & Findings from the Report:

The cell culture industry is expected to rise due to improvements in 3D culture technologies and their expanding use in biopharmaceutical manufacturing, drug discovery, and tissue engineering applications. The manufacture of innovative vaccines and biopharmaceuticals has been made possible by recent advancements in gene expression technology, expanding the research & development applications of cell culture techniques. Moreover, the market is anticipated to be driven by increased cancer research programs and an expanding range of gene therapy applications.

Due to the enormous contribution of cell culture technology to developing new diagnostic and treatment options for the COVID-19 pandemic, the demand for items derived from cell culture has increased. Examples of research applications of cell lines that are anticipated to favor market expansion include high-throughput COVID-19 drug screening for discovering new drug candidates and studies aiming at understanding the mechanism of viral entry into host cells. The growth prospects in this field are also increased because culturing techniques provide crucial instruments for creating viral particles for vaccine development.

The Cell Culture market is segregated into consumables, products, and applications. Based on consumables, the market is segmented as Media, Minimum Essential Media (MEM), RPMI 1640 Media, MEM/F-12 Media, F-10 Serum-Free Media, BME Media, Insect Media, Other Media, Sera, Fetal Bovine Serum, Other AnimalSerum, Reagents, Albumin, and Other. The product segment includes Culture Systems, Incubators, Centrifuges, Cryostorage Equipment, Biosafety Equipment, and Pipetting Instruments. By application, the market is segmented into Biopharmaceuticals, Tissue Culture & Engineering, Vaccine Production, Drug Development, Gene Therapy, Toxicity Testing, Cancer Research, and Others.

Due to the substantial demand for media products for use in research and development applications, media accounted for the greatest revenue share. The market penetration for media products has expanded as a result of the availability of a variety of serum- and animal-component-free and customised media alternatives. Also, the commercialization of specialised media for stem cell applications is escalating, which is anticipated to accelerate the segment's expansion. For instance, businesses like Sartorius AG and Thermo Fisher Scientific, Inc. provide media products designed for stem cell culture.

The segment with the highest revenue share was biopharmaceuticals. The use of cell culture techniques in the production of biopharmaceuticals is predicted to increase as a result of the use of mammalian cell lines, such as the Chinese hamster ovary, and the growing desire for alternative medicines. Furthermore, the recent development of a number of grafting methods and individualized treatment alternatives has increased the growth potential in the biopharmaceutical industry.

Due to major investments in R&D, the presence of an established scientific infrastructure, the high demand for media without animal components, and other considerations, North America held the biggest revenue share. In addition, it is anticipated that continued research and the growth of the biopharmaceutical sector in the U.S. will foster industry development in the area. Key firms like Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., and Becton, Dickinson, and Company can greatly influence the industry if they are present.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 30.50 Bn |

| Revenue forecast in 2034 | USD 92.35 Bn |

| Growth rate CAGR | CAGR of 11.8% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Consumables, Products, And Applications |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Cargill Inc., Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Becton, Dickinson and Company; Merck KGaA; Sartorius AG; VWR International, LLC; Eppendorf SE; PromoCell GmbH; Bio-Techne Corporation; BioSpherix, Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cell Culture Market By Consumable-

Cell Culture Market By Product-

Cell Culture Market By Application-

Cell Culture Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Cell Culture Market Snapshot

Chapter 4. Global Cell Culture Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Consumable Estimates & Trend Analysis

5.1. by Consumable & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Consumable:

5.2.1. Media

5.2.1.1. Minimum Essential Media (MEM)

5.2.1.2. RPMI 1640 Media

5.2.1.3. DMEM/F-12 Media

5.2.1.4. F-10 Serum Free Media

5.2.1.5. BME Media

5.2.1.6. Insect Media

5.2.1.7. Other Media

5.2.2. Sera

5.2.2.1. Fetal Bovine Serum

5.2.2.2. Other Animal Serum

5.2.3. Reagents

5.2.3.1. Albumin

5.2.3.2. Other

Chapter 6. Market Segmentation 2: by Product Estimates & Trend Analysis

6.1. by Product & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Product:

6.2.1. Culture Systems

6.2.2. Incubators

6.2.3. Centrifuges

6.2.4. Cryostorage Equipment

6.2.5. Biosafety Equipment

6.2.6. Pipetting Instruments

Chapter 7. Market Segmentation 3: by Application Estimates & Trend Analysis

7.1. by Application & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Application:

7.2.1. Biopharmaceuticals

7.2.2. Tissue Culture & Engineering

7.2.3. Vaccine Production

7.2.4. Drug Development

7.2.5. Gene Therapy

7.2.6. Toxicity Testing

7.2.7. Cancer Research

7.2.8. Others

Chapter 8. Cell Culture Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Consumable, 2021-2034

8.1.2. North America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Product, 2021-2034

8.1.3. North America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.1.4. North America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Consumable, 2021-2034

8.2.2. Europe Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Product, 2021-2034

8.2.3. Europe Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.2.4. Europe Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Consumable, 2021-2034

8.3.2. Asia Pacific Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Product, 2021-2034

8.3.3. Asia-Pacific Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.3.4. Asia Pacific Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Consumable, 2021-2034

8.4.2. Latin America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Product, 2021-2034

8.4.3. Latin America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.4.4. Latin America Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Consumable, 2021-2034

8.5.2. Middle East & Africa Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Product, 2021-2034

8.5.3. Middle East & Africa Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.5.4. Middle East & Africa Cell Culture Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Adolf Kühner AG

9.2.2. Agilent Technologies, Inc.

9.2.3. ANGUS Chemical Company

9.2.4. Becton, Dickinson and Company

9.2.5. Bio-Rad Laboratories, Inc.

9.2.6. Biospherix Ltd.

9.2.7. Bio-Techne Corporation

9.2.8. Caisson Laboratories Inc.

9.2.9. Cellexus

9.2.10. Corning Incorporated

9.2.11. Danaher Corporation

9.2.12. Eppendorf AG

9.2.13. FUJIFILM Irvine Scientific, Inc.

9.2.14. Getinge AB

9.2.15. HiMedia Laboratories

9.2.16. InvivoGen

9.2.17. Lonza Group AG

9.2.18. Meissner Filtration Products Inc.

9.2.19. Merck KGaA

9.2.20. Miltenyi Biotec

9.2.21. Pan-Biotech GmbH

9.2.22. PromoCell GmbH

9.2.23. Sartorius AG

9.2.24. SeraCare Life Sciences Inc.

9.2.25. Solida Biotech GmbH

9.2.26. STEMCELL Technologies Inc.

9.2.27. Thermo Fisher Scientific, Inc.

9.2.28. VWR International, LLC

9.2.29. Other Prominent Players