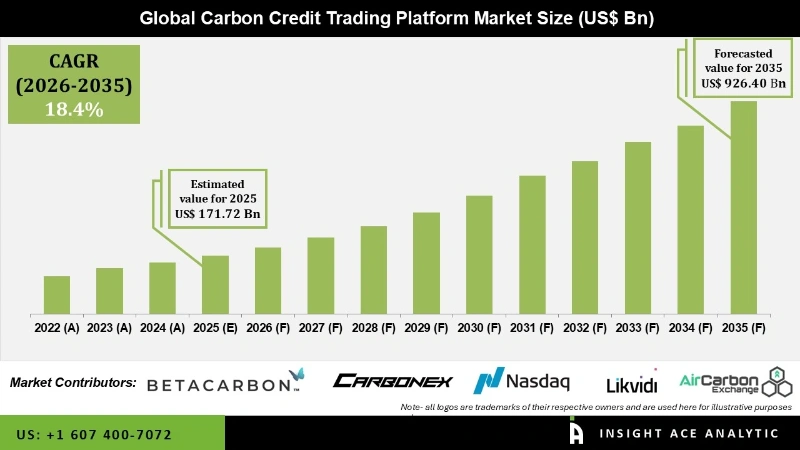

Global Carbon Credit Trading Platform Market Size is valued at USD 171.72 Billion in 2025 and is predicted to reach USD 926.40 Billion by the year 2035 at a 18.4% CAGR during the forecast period for 2026 to 2035.

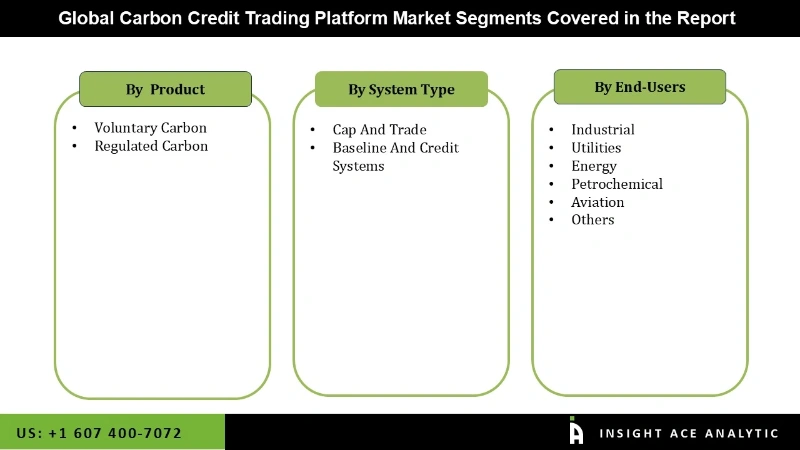

Carbon Credit Trading Platform Market Size, Share & Trends Analysis Report By Type (Voluntary Carbon Market And Regulated Carbon), System Type (Cap, Trade, Baseline, And Credit Systems) And End Users (Industrial, Utilities, Energy, Petrochemical, Aviation), Region And Segment Forecasts, 2026 to 2035.

The global market for carbon credit trading platforms makes buying and selling carbon credits possible, providing businesses and organizations with a platform to reduce greenhouse gas emissions. Its main goal is to combat climate change and reduce greenhouse gas emissions. By allowing the trading of carbon credits, these platforms encourage investment in emission reduction projects and support international sustainability initiatives.

The need for enterprises to reduce their carbon footprints, more vital environmental rules, and growing awareness of climate change have all contributed to the market for carbon credit trading platforms experiencing significant development in recent years. However, prospective emission reduction targets and the overall demand for carbon credits could impact the market's stability.

Moreover, participants in the market may experience difficulties as the market expands due to the need for more regularity and uniformity in the methods used to trade carbon credits. Producers must reduce and reverse their carbon emissions by putting money into renewable energy, finding new markets for CO2, implementing carbon capture technologies, and deploying carbon offsets and credits. Additionally, the increase in the exchange and selling of these carbon credits will drive the market for trading platforms for carbon credits.

The carbon credit trading platform market is segmented based on product, system type and end users. Based on type, the carbon credit trading platform market is segmented as voluntary carbon market and regulated carbon. The carbon credit trading platform market is segmented by system type into cap, trade, baseline, and credit systems. End users segment the market into industrial, utilities, energy, petrochemical, aviation, etc.

The cap & trade category will hold a major share of the global Carbon Credit Trading Platform market in 2022. The cap and trade system regulates carbon emissions and limits overall emissions while allowing for flexible usage by different types of enterprises. Additionally, it generates a strong financial incentive for spending money on cleaner, more effective technologies that propel the market. The word "trade" provides businesses flexibility. This sector's expansion is also attributable to rising investments in clean energy projects and decarbonization ambitions.

The utility segment is projected to grow rapidly in the global market. The utilities are committed to decarbonization programs to combat climate change, fueling demand for carbon credit trading systems. Utility companies must reduce carbon footprints and slow climate change because they are major greenhouse gas emitters. Utility companies can use carbon credit trading systems to purchase carbon credits from other companies that have lowered their emissions to offset their emissions.

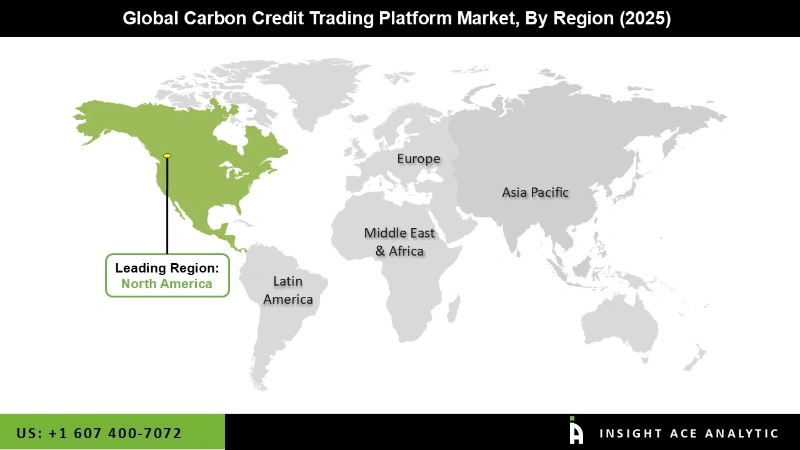

The North America carbon credit trading platform market is expected to register at the highest market share because there are more people working to fight climate change and cut greenhouse gas emissions. Many organizations in North America are committing to reducing their carbon footprints as part of their ambitious sustainability targets. By enabling businesses to buy carbon credits to offset their emissions, which promotes market growth, carbon credit trading systems provide a means of achieving these objectives.

In addition, the Europe region is projected to grow rapidly in the global carbon credit trading platform market. The region is strongly focused on achieving net zero targets, as seen by compliance and voluntary carbon market growth. Therefore, the decarbonization goal offers this region a great opportunity as it works to cut greenhouse gas emissions and make the transition to a more sustainable future.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 171.72 Billion |

| Revenue forecast in 2035 | USD 926.40 Billion |

| Growth rate CAGR | CAGR of 18.4% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product, System Type And End Users |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Nasdaq Inc., European Energy Exchange AG., Carbon Trade Exchange, Xpansiv Data Systems Inc., CME Group Inc., Climate Impact X, Carbonplace, Likvidi Technologies Ltd., BetaCarbon Pty Ltd., Carbonex Ltd., Intercontinental Exchange Inc., AirCarbon Pte Ltd., Planetly and Toucan. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product-

By System Type-

By End Users

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.