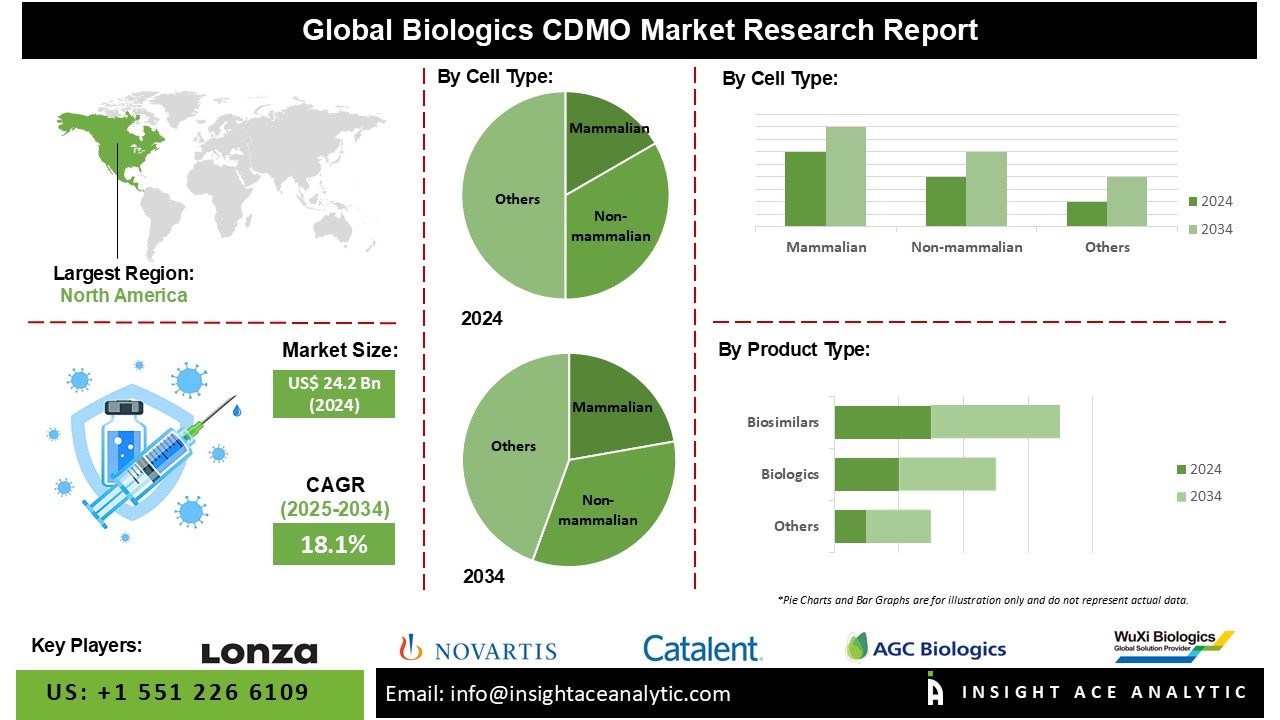

Biologics CDMO Market Size is valued at USD 24.2 Bn in 2024 and is predicted to reach USD 125.5 Bn by the year 2034 at a 18.1% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the report:

Biologics Contract Development and Manufacturing Organisations (CDMOs) are essential in developing and manufacturing biopharmaceuticals, also known as biologics. These organisations provide specialised services to biopharmaceutical businesses, assisting them from the early stages of drug discovery to commercial manufacturing. Several variables influence the Biologics Contract Development and Manufacturing Organisation (CDMO) market's growth and development. These factors represent rising biologics demand, advances in biopharmaceutical technology, and the changing landscape of the pharmaceutical and biotechnology industry. The rising prevalence of complicated disorders, combined with the efficacy of biologics in treating various ailments, has increased the demand for biopharmaceuticals.

However, the COVID-19 pandemic has already had an impact on the pharmaceutical and biopharmaceutical industries, especially the Biologics CDMO (Contract Development and Manufacturing Organisation) market. The epidemic disrupted global supply chains, affecting raw materials and essential components used in biologics development. CDMOs encountered logistical, transportation, and procurement problems that hampered their ability to sustain flawless operations.

The Biologics CDMO Market is segmented on the basis of cell type and product type. According to cell type, the market is segmented as Mammalian and Non-mammalian. The product type segment includes Biologics and Biosimilars. By biologics, the market is segmented into monoclonal antibodies, recombinant proteins, antioxidant and molecular therapy, vaccines, and other biologics.

The Mammalian category is expected to hold a major share of the global Biologics CDMO Market in 2024. Various variables influence the Biologics Contract Development and Manufacturing Organisation (CDMO) market for mammalian cell-based processes, reflecting the increasing demand for biologics manufactured utilising mammalian cell cultures. Mammalian cells are frequently utilised to produce complicated biopharmaceuticals (monoclonal antibodies and recombinant proteins).

The growing pipeline of biopharmaceuticals, particularly those involving large and complicated compounds, needs synthesis in mammalian cell cultures. CDMOs that specialise in mammalian cell-based processes are well-positioned to help with the development and production of these sophisticated therapies.

The monoclonal antibodies segment is likely to grow rapidly in the global Biologics CDMO Market. Several factors influence the Biologics Contract Development and Manufacturing Organisation (CDMO) market, focusing on monoclonal antibodies (mAbs), reflecting the increasing need for mAb-based therapeutics. Monoclonal antibodies are commonly utilised to treat cancer, autoimmune disorders, and infectious diseases and other similar diseases. The development of several monoclonal antibody platforms, including classic and next-generation formats, broadens therapeutic intervention choices.

The North American Biologics CDMO Market is expected to record the maximum market share in revenue in the near future due to the existence of two major economies, notably the United States and Canada. The United States has one of the world's largest pharmaceutical sectors, accounting for a sizable portion of market sales. The increasing prevalence of chronic diseases, population ageing, and the increased requirement for evidence-based practice are all factors that have contributed to the strong need for clinical trials in the United States.

In recent years, the location of clinical trials has migrated from academic medical centres to community-based practises to worldwide venues in various countries. Moreover, the Asia Pacific biopharmaceutical sector is expanding rapidly, owing to rising healthcare costs, the frequency of chronic diseases, and scientific developments. This expansion presents the potential for Biologics CDMOs to support biologics development and manufacture.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 24.2 Bn |

|

Revenue Forecast In 2034 |

USD 125.5 Bn |

|

Growth Rate CAGR |

CAGR of 18.1% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Cell Type, Product Type |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

|

Competitive Landscape |

Boehringer Ingelheim Group, Lonza Group, Samsung Biologics, NOVARTIS AG, Toyobo Co. Limited, Parexel International Corporation, Catalent Inc., Binex Co. Limited, AGC Biologics, AbbVie Contract Manufacturing, JRS Pharma, Fujifilm Diosynth Biotechnologies USA Inc., Wuxi Biologics and Others. |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Biologics CDMO Market By Cell Type-

Biologics CDMO Market By Product Type-

Biologics CDMO Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.