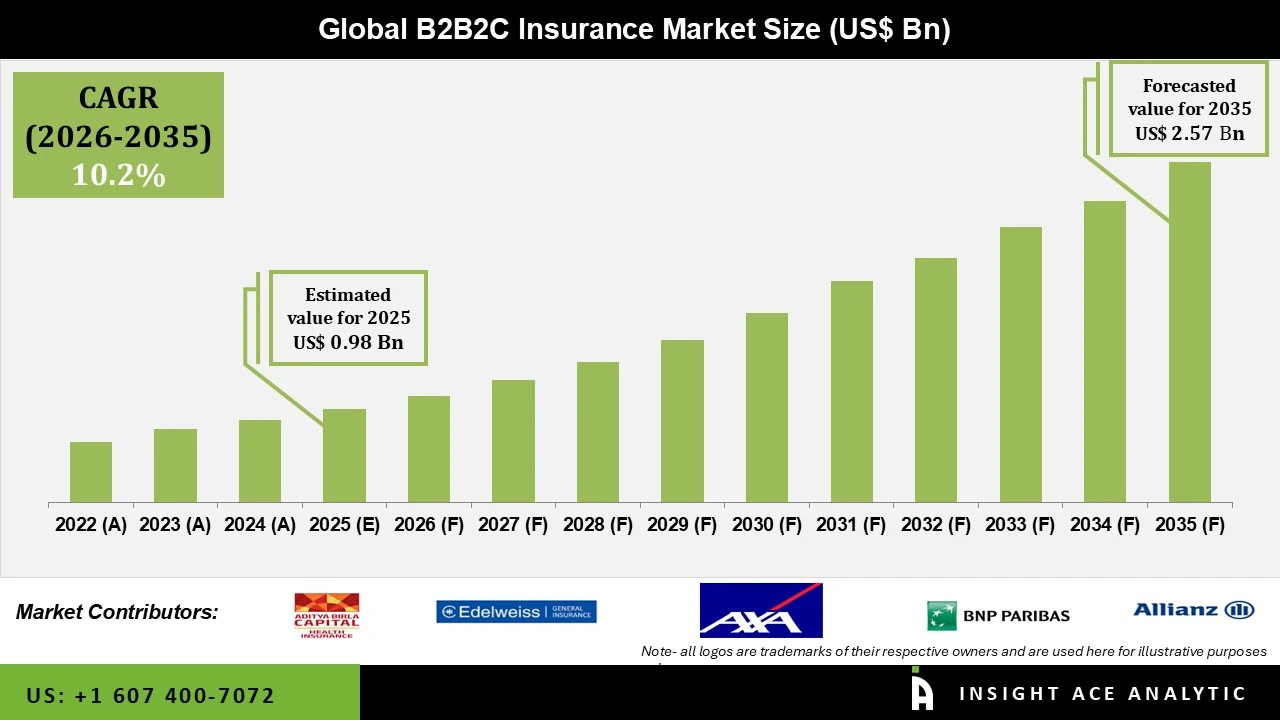

B2B2C Insurance Market Size is valued at USD 0.98 Bn in 2025 and is predicted to reach USD 2.57 Bn by the year 2035 at a 10.2% CAGR during the forecast period for 2026 to 2035.

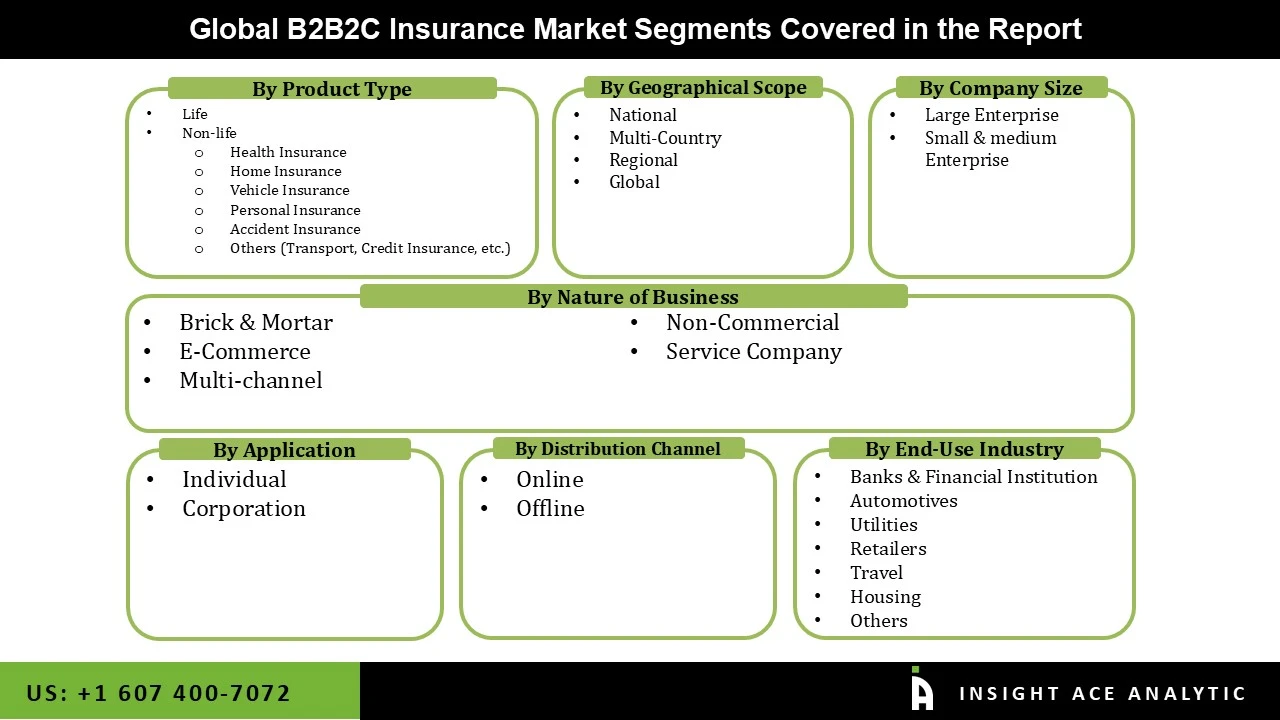

B2B2C Insurance Market Size, Share & Trends Analysis Report By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others, By Geographical scope, By Company size, By Nature of business, By End Use Industry, By Distributional Channel, By Application, By Region, And By Segment Forecasts, 2026 to 2035

The B2B2C models facilitate collaboration between businesses and insurance providers to create tailor-made insurance products, ultimately increasing customer satisfaction and loyalty. A notable technological shift, characterized by the emergence of AI, telematics, and chatbots, has played a pivotal role in the global expansion of this market. The growing adoption of insurance-related devices is set further to amplify the market's size in the near future. Businesses now have the opportunity to adapt insurance products to suit the unique requirements of their customers, resulting in more individualized and relevant offerings. This, in turn, has the potential to elevate customer satisfaction and nurture customer loyalty.

However, implementing and integrating new technologies to support B2B2C operations can be a challenging endeavour. It often entails bridging legacy systems with modern digital platforms, which can be time-consuming and costly, impeding market growth. Furthermore, the increasing adoption of insurance-related devices is expected to contribute to the continued expansion of the global market in the foreseeable future. Businesses still retain the opportunity to tailor insurance products to align with their customer's specific needs, which can lead to more personalized and pertinent offerings, ultimately enhancing customer satisfaction and fostering customer loyalty.

The B2B2C Insurance market is segmented on the basis of product and application. As per the product, the market is segmented as life and non-life. By geographical type, the market is segmented into national, multi-country, regional and global. According to company size, the market is segmented into large enterprises and small & medium enterprises. By applications, the market is segmented into brick-and-mortar, E-Commerce, Multi-channel, Non-Commercial and Service Companies. By end users, the market is segmented into banks and financial institutions, automobiles, utilities, retailers, travel, housing and others. The distributional channel segment comprises online and offline. By application, the market is segmented into Individuals and Corporations.

The large enterprise category is expected to hold a major share of the global B2B2C Insurance market in 2024. Large enterprises can achieve economies of scale, leading to cost efficiencies. This allows to offer competitive pricing and a broader range of insurance products, which can attract both business clients and individual consumers. Large enterprises typically have extensive experience and expertise in risk management. This is a critical aspect of the insurance industry, as it allows them to assess, underwrite, and mitigate risks effectively for their clients, whether they are businesses or individual consumers.

The segment, non-life insurance, is estimated to grow at a rapid rate in the global B2B2C Insurance market. Due to the rising demand for this type of coverage from various sectors like retail and the automotive industry, this particular segment is experiencing a surge in its growth. This segment offers compensation for losses resulting from specific financial events related to assets, which has led to its widespread popularity among the public. The expansion of urban populations, combined with higher disposable incomes, is a major driver for this growth. Furthermore, the rapid increase in the middle-class population, characterized by an inclination towards value-added services and seamless experiences, further fuels the demand.

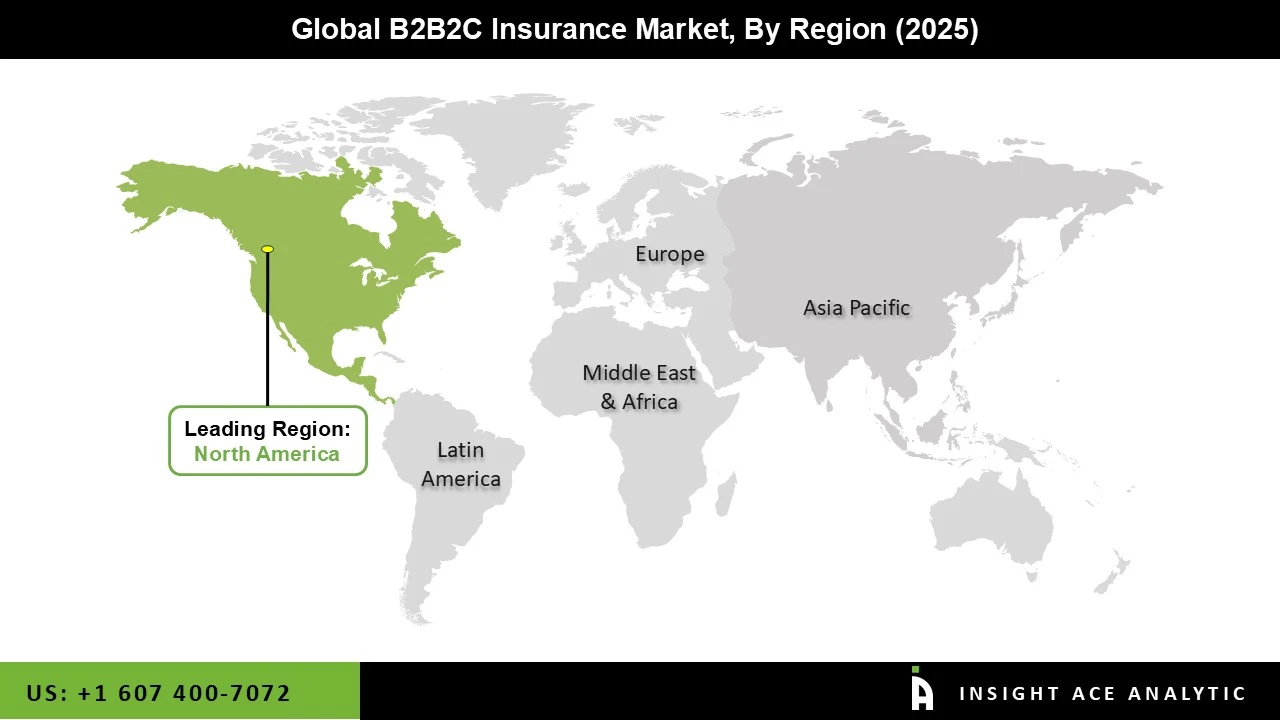

The Asia Pacific B2B2C Insurance market is expected to register the highest market share. The B2B2C insurance market in the American region is undergoing a digital transformation. Insurtech startups are playing a crucial role in driving innovation, offering digital solutions, and improving customer experiences. These technologies are helping insurers reach a broader customer base and streamline their operations. In addition, North America is estimated to grow at a rapid rate in the global B2B2C Insurance market. As the middle class expands and consumer awareness of insurance benefits increases, the demand for insurance products is expected to rise. Adopting digital technologies and partnerships will likely play a central role in shaping the market's future.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 0.98 Bn |

| Revenue Forecast In 2035 | USD 2.57 Bn |

| Growth Rate CAGR | CAGR of 10.2 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Geographical scope, By Company size, By Nature of business, By End Use Industry, By Distributional Channel, By Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Aditya Birla General Insurance, Edelweiss General Insurance Company Limited, AXA SA, BNP Paribas SA., Allianz S, Assicurazioni Generali S.p.A., Berkshire Hathaway Inc, ICICI Lombard, UnitedHealth Group Inc, Tata-AIG General Insurance Co. Ltd., Aviva plc, Berkshire Hathaway Inc., China Life Insurance Group, Japan Post Holdings Co., Ltd., Munich Re Group, Prudential plc, UnitedHealth Group Inc., Others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

B2B2C Insurance Market By Product-

B2B2C Insurance Market By Geographical scope

B2B2C Insurance Market By Company Size

B2B2C Insurance Market By Nature of business

B2B2C Insurance Market By End Use Industry

B2B2C Insurance Market By Distributional Channel

B2B2C Insurance Market By Application

B2B2C Insurance Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.